Best Decentralized Swap Platforms in 2026 (Xgram vs KuCoin)

Introduction

What Are Decentralized Swap Platforms?

Decentralized swap platforms are services and protocols that enable direct peer-to-peer exchanges of cryptocurrencies across various blockchains, all while keeping users in full control of their funds through non-custodial models. These platforms aggregate liquidity from multiple decentralized exchanges (DEXs), utilize cross-chain bridges, or employ hybrid mechanisms to facilitate instant trades straight from personal wallets. In 2026, they stand out for delivering enhanced privacy, reduced intermediary risks, and true self-custody in non-custodial swaps.

Why Decentralized Swaps Are Gaining Traction in 2026

As of January 2026, decentralized swaps are experiencing sustained growth driven by increasing regulatory oversight on centralized platforms, persistent privacy concerns, and the rapid expansion of multi-chain DeFi ecosystems. Users increasingly favor intermediary-free solutions for cross-chain operations, quick portfolio adjustments, and hedging in volatile conditions. These platforms serve as a vital link between traditional crypto trading and full DeFi participation, especially with tokenized assets and interoperability becoming mainstream.

Decentralized vs. Centralized Exchanges: Key Differences

Decentralized platforms prioritize self-custody, on-chain transparency, and often no mandatory KYC, whereas centralized exchanges (CEXs) deliver superior speed, fiat gateways, and advanced order types but require users to trust the platform with funds. DEXs shine in privacy and cross-chain flexibility; CEXs dominate in liquidity depth and user support. With ongoing regulatory pressures in 2026, many are shifting toward decentralized or hybrid models to minimize counterparty exposure.

Overview of Top Options: Focus on Xgram and KuCoin as Market Leaders

In the evolving landscape of decentralized swap platforms in 2026, Xgram.io emerges as a leader in pure non-custodial, instant cross-chain swaps with a strong emphasis on privacy. KuCoin, through its Web3 Wallet and integrated DEX aggregator, provides robust multi-chain capabilities combined with DeFi tools and CEX connectivity. Both platforms enable secure, efficient asset swapping, but they cater to distinct needs: Xgram for speed and anonymity, KuCoin for comprehensive ecosystem access.

How Decentralized Swap Platforms Work

The Swapping Mechanism: How Platforms Facilitate Cross-Chain Trades

These platforms scan hundreds of liquidity sources—including DEX pools, bridges, and aggregated reserves—to identify the most efficient route. Trades can execute atomically, via intermediate pools, or through specialized bridges, ensuring funds move wallet-to-wallet without custody handover.

Liquidity and Pooling Process

Liquidity is sourced from diverse DEXs, partner providers, or hybrid reserves. Providers earn portions of transaction fees, with dynamic routing helping to reduce slippage and volatility exposure. In 2026, advanced aggregators prioritize capital efficiency and protection against market swings.

Blockchain Integration and Standards

Leading platforms cover major networks like Bitcoin, Ethereum, Solana, Tron, TON, BNB Chain, and Arbitrum, supporting standards such as ERC-20, BEP-20, and SPL, plus adapters for native assets including privacy coins.

Audits and Transparency: Importance of Regular Independent Audits and On-Chain Verifications

Independent audits of infrastructure, AML screening for clean funds, and on-chain transparency reports have become industry standards. Users routinely review recent audits and platform reputation before engaging in significant transactions.

Step-by-Step: How to Use and Integrate Decentralized Swaps

Connect a compatible wallet (e.g., MetaMask, Trust Wallet, Phantom).

Select source and target assets plus networks.

Input amount and recipient address.

Review quoted rate, fees, and slippage.

Confirm the transaction—assets arrive directly in the destination wallet.

Decentralized vs. Centralized Exchanges: In-Depth Comparison

Core Differences: Custody Model and Security

Non-custodial decentralized swaps eliminate single-point failures by keeping keys with the user, contrasting with CEXs' centralized custody that introduces recovery options but also hack or freeze risks.

Fee and Speed Behavior

Decentralized: Network gas + aggregator fees (~0.1–0.6%), with speed tied to chain congestion and routing.

Centralized: Fixed low fees and near-instant internal execution, though withdrawals may involve delays.

Use Cases: Privacy-Focused Trades vs. High-Volume Trading

Decentralized platforms excel in anonymous transfers, cross-chain moves, and privacy coins. Centralized ones handle high-volume spot/futures, fiat ramps, and margin trading.

Pros and Cons for Each Type

Decentralized Exchanges Pros:

Complete self-custody and strong privacy.

No mandatory KYC in many cases.

Global, censorship-resistant access.

Cons:

Variable network fees and slippage.

Bridge-related vulnerabilities.

Steeper learning curve.

Centralized Exchanges Pros:

Deep liquidity and advanced features.

Fiat integration and customer support.

Faster execution for most trades.

Cons:

Custodial risks and potential account freezes.

KYC/regulatory restrictions.

Reduced privacy.

Why Choose Decentralized in 2026?

Regulatory tightening on CEXs, combined with booming multi-chain DeFi and privacy demand, positions decentralized swaps as a preferred choice for users seeking autonomy and reduced exposure.

Top Decentralized Swap Platforms in 2026: Xgram vs KuCoin Detailed Review

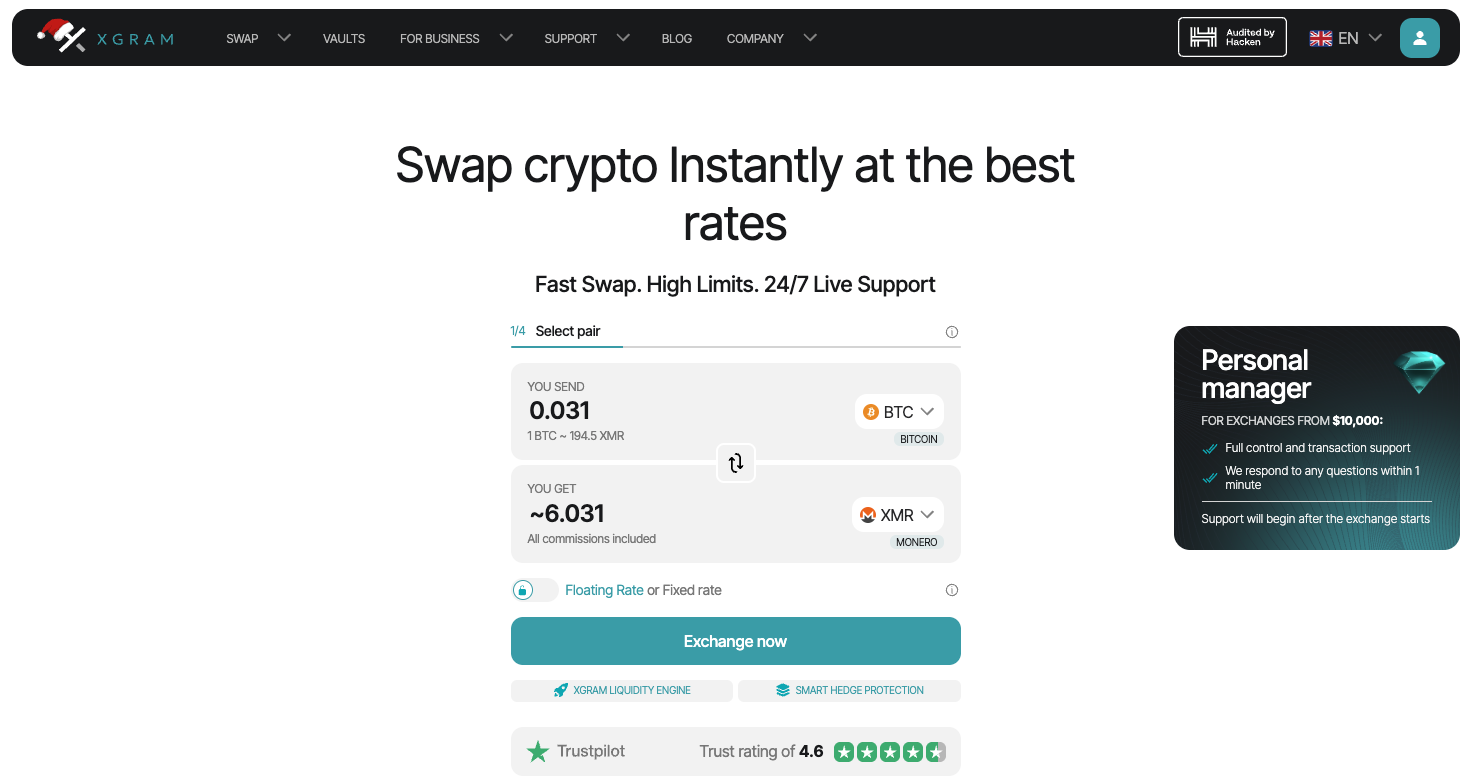

Xgram (Xgram.io): Features, Security, Liquidity, Fees, User Experience, Market Position in 2026

Xgram.io operates as a fully non-custodial multichain platform focused on instant swaps, supporting Bitcoin, Ethereum, Solana, Tron, TON, and privacy-focused coins like Monero and Zcash. It employs a hybrid liquidity engine combining proprietary reserves and aggregated depth, plus features such as Smart Hedge Protection for volatility mitigation, high transaction limits, and dedicated support for large swaps. Independent audits confirm robust architecture. Fees are embedded in rates (~0.1–0.5%), with swaps typically completing in minutes. In 2026, Xgram has solidified its position as a go-to for privacy-centric and high-volume swaps, surpassing $10 million in monthly BTC/XMR volumes.

KuCoin: Protocol Details, Audits, Multi-Chain Support, Fees, 2026 Updates

KuCoin's Web3 Wallet delivers a non-custodial experience with a built-in cross-chain DEX aggregator, supporting over 17 networks including Ethereum, Solana, BNB Chain, Polygon, and Arbitrum. It integrates asset management, token swaps, Web3 Earn for staking/yield, dApp connectivity, NFT support, and Convert for low-spread trades. Security aligns with platform-wide standards, including local key encryption. Fees hover around ~0.1% plus network costs. In 2026, expansions include broader chain coverage and enhanced on-chain tools, making it a seamless bridge to DeFi for existing KuCoin users.

Head-to-Head Comparison Table

Metric | Xgram.io | KuCoin Web3 Wallet / DEX Aggregator |

|---|---|---|

Supported Chains | BTC, ETH, Solana, Tron, TON + privacy coins | ETH, Solana, BNB, Polygon, Arbitrum + 17+ |

Custody Model | Fully non-custodial | Non-custodial (Web3) + CEX-linked options |

Fees | 0.1–0.5% embedded in rate | ~0.1% + network; Convert uses spread |

Swap Speed | 2–10 minutes | 1–15 minutes (route-dependent) |

Privacy Focus | High (Monero, Zcash support) | Moderate (possible KYC on main platform) |

Limits | Very high + personal manager for large trades | High, tiered by VIP level |

Extra Features | Smart Hedge, AML screening | DeFi Earn, NFT, dApp browser |

Best For | Privacy-driven, large anonymous swaps | All-in-one DeFi + CEX access |

Other Mentions

Aggregators like 1inch and ChangeNOW provide strong routing, while protocols such as THORChain excel in native cross-chain. Focus remains on Xgram for privacy/instant execution and KuCoin for integrated versatility.

2026 Outlook: Performance Tied to DeFi Growth, Adoption Trends, Potential Innovations

DeFi's multi-chain surge and privacy emphasis propel both platforms. Xgram benefits from rising demand for anonymous high-volume tools, while KuCoin gains from hybrid expansions. Innovations in aggregators, bridges, and compliance-friendly features will drive broader adoption amid clearer regulations.

Using Decentralized Swap Platforms: Integration, and Best Practices

How to Swap/Trade on Xgram and KuCoin

Xgram: Enter recipient address and amount for near-instant processing. KuCoin Web3: Connect wallet, select pair, and execute via aggregator or Convert tool.

Benefits of Non-Custodial Platforms for Secure Swaps

Non-custodial setups ensure ongoing control over funds, even for substantial transfers. For seamless cross-chain swaps via USDT, explore pairs such as USDT to BTC on https://xgram.io/coins/usdt/btc.

Integration with Wallets, DeFi Protocols, and Yield Opportunities

Compatible with MetaMask, Trust Wallet, Phantom, and others. KuCoin enables direct staking/yield farming; Xgram facilitates rapid rebalancing into DeFi positions.

Common Mistakes: Impermanent Loss, High Gas Fees, Unverified Pools

Steer clear of peak-hour network congestion, always verify routing paths, and double-check recipient addresses to prevent errors.

Risks, Challenges, and Best Practices for Users

Key Risks: Smart Contract Exploits, Bridge Vulnerabilities, Regulatory Changes, Market Volatility

Potential threats include bridge exploits, smart contract bugs, evolving regulations, and sudden price swings affecting routes.

Importance of Verification: Checking Audits, On-Chain Data, Community Governance

Always examine recent audits, monitor on-chain activity via explorers, and stay informed on platform updates.

Security and Wallet Practices: Hardware Wallets, Best Practices

Employ hardware wallets for significant holdings, enable 2FA, avoid phishing links, and verify URLs meticulously.

Regulatory Landscape in 2026: Global Trends, Compliance in DeFi

MiCA is fully implemented in Europe, with the US and Asia tightening CEX rules. Non-custodial platforms with transparent AML practices hold advantages in compliant environments.

Frequently Asked Questions (FAQ)

What is the main difference between Xgram and KuCoin?

Xgram delivers pure non-custodial instant swaps with heavy privacy emphasis and no registration. KuCoin provides a hybrid Web3 wallet with DEX aggregation, DeFi tools, and ties to its centralized ecosystem.

How secure are decentralized swaps compared to centralized ones?

Decentralized reduces custodial risks but requires vigilance against bridges and contracts. Centralized offers easier recovery but exposes users to platform-level vulnerabilities.

How do they perform in high-volatility markets?

Both support rapid hedging; aggregators help limit slippage, with Xgram's Smart Hedge adding extra protection.

How integrated are these platforms with major blockchains?

Xgram excels with BTC and privacy networks; KuCoin covers extensive EVM, Solana, and multi-chain support via Web3.

Conclusion

Recap: Why Decentralized Swap Platforms (Especially Xgram and KuCoin) Are Strong 2026 Choices

Xgram and KuCoin address core 2026 demands: instant privacy without intermediaries (Xgram) and unified multi-chain access blending DeFi with CEX convenience (KuCoin).