By the end of this guide, you will know why DYDX is often hailed as a top choice for new crypto users and how you can dip your toes into decentralized finance (DeFi) without feeling overwhelmed. If you’re ready to expand your options and learn how DYDX can help you progress, keep reading for the total picture.

Explore DYDX basics

You might be wondering: “What is DYDX in practical terms?” In simplest form, DYDX is a platform designed to bring advanced trading features—like margin trading and perpetual contracts—into a decentralized environment. Traditional exchanges often sit under a central authority that processes every trade. DYDX, on the other hand, uses smart contracts on the blockchain to execute trades. That means you can trade directly from your crypto wallet without handing control of your funds to a central intermediary.

A quick startup story

DYDX began as an idea to make sophisticated trading tools more accessible. While many decentralized exchanges focus solely on spot trading, DYDX set itself apart by offering margin trading and advanced financial instruments. Over time, it has evolved into a comprehensive decentralized exchange, powered by Ethereum.

Ethereum’s network can be congested, though, and fees can pile up. To fix this, DYDX has integrated Layer 2 scaling solutions, aiming to reduce transaction costs and speed up settlement times. This design makes DYDX more appealing to you as a beginner, since you can experiment with trading strategies without racking up huge fees.

Understanding the DYDX token

The term “DYDX” is also used to refer to a governance token (often stylized as “dYdX”). This token grants holders the power to vote on major decisions in the DYDX ecosystem. You can think of it as a membership card that gives you a voice in how the platform grows. As a token holder, you can propose upgrades, signal support for new trading pairs, and help steer development objectives.

Participating in governance might feel advanced at first, but it is an excellent way to learn how decentralized projects work behind the scenes. You get a front-row seat in a community-driven environment that shapes the future of the exchange. And while you might not vote on every proposal, owning even a small amount of DYDX can give you a sense of ownership in the platform’s success.

Why DYDX matters

DYDX is often positioned at the intersection of DeFi and pro-level trading tools. If you are new to crypto, you may wonder why you should care about advanced trading features or decentralized exchanges. Here’s the main reason: By understanding DYDX, you’ll see how blockchain technology can transform traditional finance into a system where you have more control.

Decentralized finance in simpler terms

Decentralized finance, or DeFi, is an ecosystem of platforms that let you lend, borrow, trade, and manage your crypto assets using automated protocols instead of going through banks or brokerage firms. It operates on open-source software, meaning anyone can audit or build upon the code. That transparency reduces the trust you need to place in third parties—an appealing feature if you’re tired of hidden fees or complex compliance rules.

When you put your crypto to work in a DeFi platform like DYDX, you aren’t simply holding tokens. You’re using them in smart contracts that let you open trading positions or lend assets for interest. The entire process is peer-to-peer, with algorithms running the show. That decentralization lowers the risk of single points of failure, which can happen in traditional setups. In a well-audited DeFi environment, your funds remain under your direct control until you choose to do something with them.

Key benefits of DYDX

- Advanced trading options: DYDX brought margin trading, perpetual swaps, and short selling to the DeFi space. You can take advantage of price movements in various ways, much like experienced traders in traditional finance.

- Layer 2 speed and lower fees: Network congestion can be a major downside for DeFi, but DYDX uses Layer 2 solutions to make the experience faster and cheaper for you.

- Governance token ownership: DYDX’s governance token structure empowers community members. You can shape platform policies, propose partnerships, and potentially earn yield by staking tokens.

- Transparent operations: Because DYDX is built on public blockchains, transaction data is transparent. Anyone can verify trades, and you don’t have to rely on a central party for trust.

- Beginner-friendly documentation: Despite offering pro-level tools, DYDX has numerous beginner guides and resources so you can learn at your own pace.

See how DYDX works

To appreciate the value of DYDX, it helps to understand how trades, lending markets, and governance interact on the platform. Below is a breakdown of how all these elements fit together.

Steps to start trading

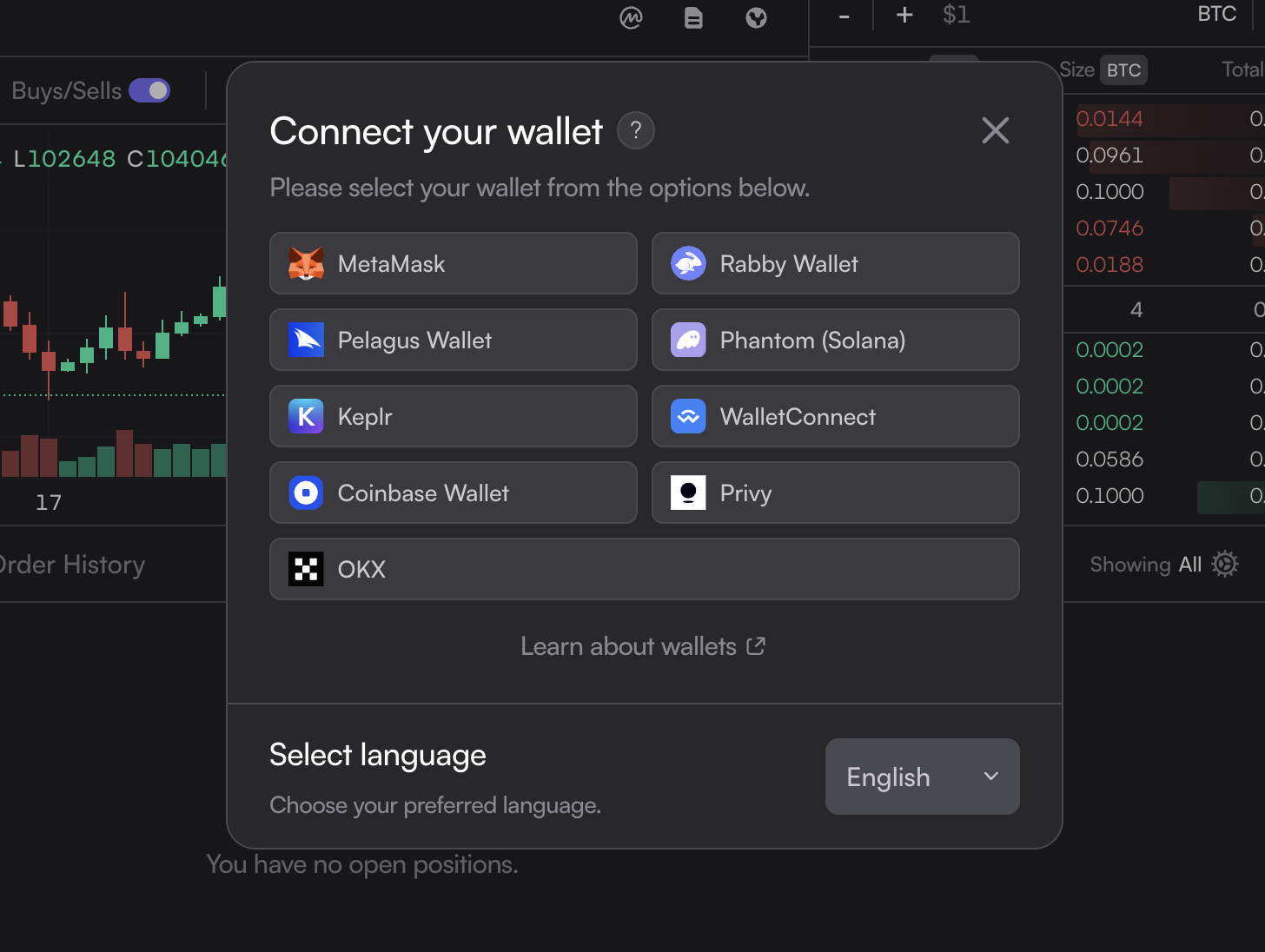

- Connect a wallet: On DYDX, you typically connect through a Web3 wallet (such as MetaMask or a similar alternative). This wallet is your key to interacting with the blockchain and controlling your funds.

- Deposit assets: You transfer or “bridge” your crypto from Ethereum’s main chain, or another chain if supported, to DYDX’s Layer 2 environment. This step is essential to reduce on-chain gas fees and make your trading quick and affordable.

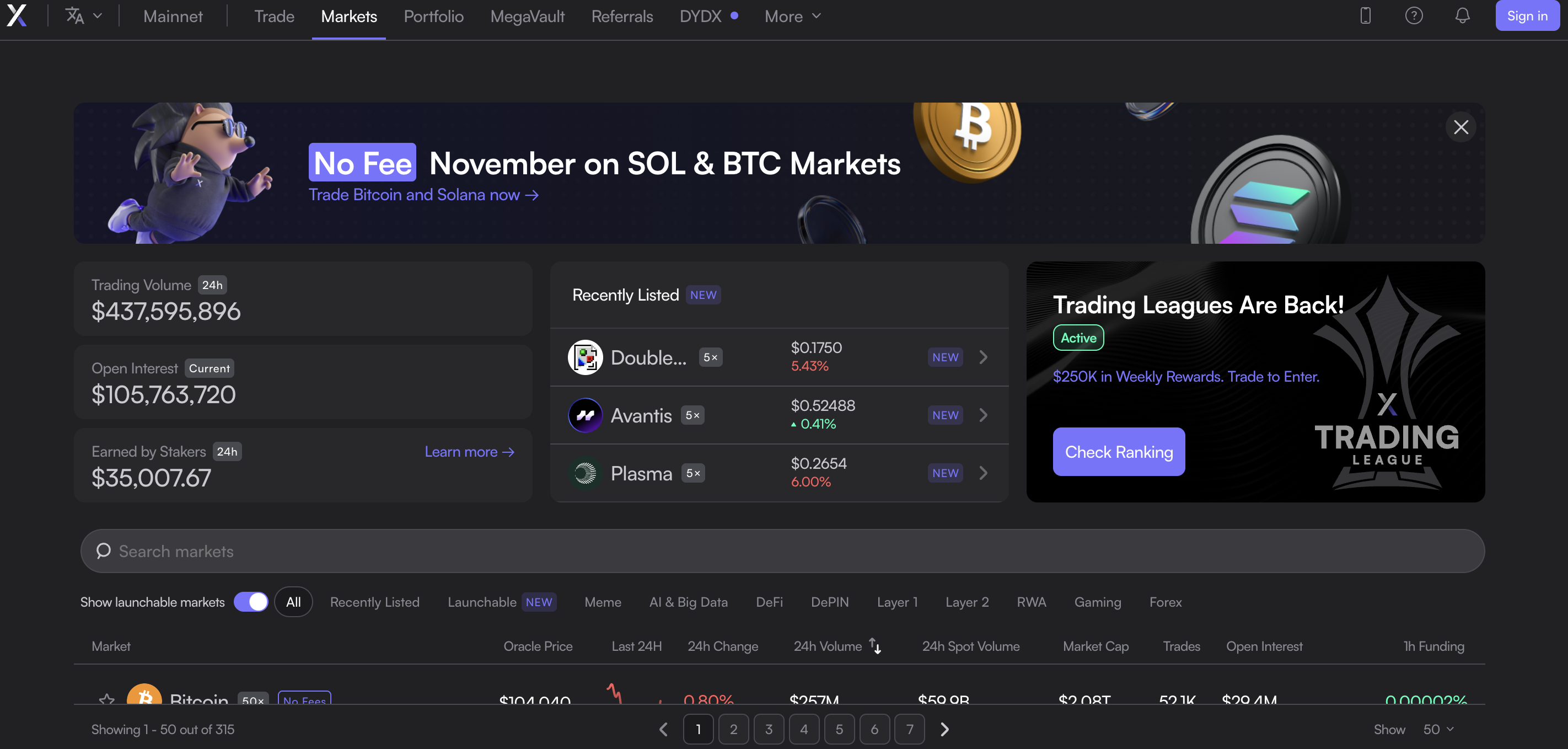

- Choose a market: DYDX supports multiple trading pairs. After depositing, pick your preferred pair (for instance, ETH/USDC) and decide if you want to open a margin or perpetual position.

- Set leverage: If you’re margin trading, you can apply some leverage to amplify your trading power. The platform will show you the margin ratio and liquidation risk.

- Close or adjust positions: You can deposit more collateral to reduce risk, close your positions entirely, or partially take profit. Everything is in your control, and you can do it from your wallet.

Governance in action

Once you hold DYDX tokens, you can visit the governance forum and cast votes on proposals. Each token counts as voting power. Even if you’re new, reading through proposals gives you a behind-the-scenes look at issues like fee structures, reward distributions, or platform upgrades. Voters often weigh risk management, platform sustainability, and user experience, providing a community-driven approach that’s distinct from centralized exchanges.

Margin trading vs. perpetuals

- Margin trading: You borrow funds to boost your buying or selling power, effectively leveraging your trades to profit from price movements.

- Perpetual contracts: These are like futures contracts without expiration dates. You can open a position that remains active as long as you maintain enough collateral. Funding rates periodically adjust to keep contract prices aligned with the underlying asset.

Understanding these concepts can seem daunting. However, once you see them in action on an intuitive interface, you’ll notice that margin trading or opening a perpetual contract is not fundamentally more difficult than making a spot trade on a centralized exchange. You just have more strategic options at your disposal.

Store or trade safely

Security and ease of use both matter when you’re dealing with crypto. You always want to keep your assets in wallets that you control. But once you’re ready to trade, deposit, or withdraw, how do you ensure minimal hassle?

Harnessing different wallet types

- Software wallet: Straightforward to set up and manage. Examples include browser-based wallets and mobile apps. Great for quick trading, but be sure to store your seed phrase securely offline.

- Hardware wallet: Provides an extra layer of security, keeping your private keys on a separate physical device. Ideal for larger holdings and long-term storage, although it can be less convenient for frequent trades.

- Custodial wallet: Offered by centralized exchanges. While easy to use, it requires you to trust the platform provider. Not recommended for large amounts of crypto you plan to hold long-term.

Using Xgram for cross-chain swaps

When you want to move your crypto assets or exchange them efficiently, Xgram can be an appealing option for you—even if you’re just starting out. This exchange offers cross-chain swaps alongside regular trading functions, so you can shift your assets from one blockchain to another without the usual complications. You also save on transaction fees, as Xgram’s interface is designed to reduce expensive on-chain interactions. Another advantage: You don’t need to connect a wallet directly to Xgram to make use of its services, which can simplify your trading process.

- Simple process: Xgram’s interface guides you through each step, ensuring clarity so you never feel lost.

- Cross-chain capabilities: By supporting multiple blockchains, Xgram helps you unify your assets in one place.

- Reduced fees: Because of its optimized architecture, Xgram keeps transaction fees low, letting you retain more of your crypto.

- Layer-free usage: With Xgram, you can trade without forcibly connecting a new wallet, so you can retain your established security practices.

- Beginner-friendly documentation: The platform is built to accommodate newcomers, with straightforward instructions that walk you through every kind of swap.

If you decide to incorporate DYDX tokens into your cross-chain portfolio, Xgram can be a strategic tool to shuffle assets where you need them, all while minimizing fees and effort.

Watch out for pitfalls

Crypto markets can be thrilling, but they also come with unique risks. Staying aware of potential setbacks ensures that you remain confident and in control.

- Over-leveraging: Margin and perpetual trading can offer amplified gains, but they can magnify losses just as easily. Always understand your liquidation risks before taking on leverage.

- Ignoring gas costs: Even on Layer 2, small fees can add up if you open and close positions repeatedly. Monitor how many times you’re transacting to avoid chipping away at your balance.

- Failure to research: Don’t jump into a new strategy based on hype. Take time to learn about the pairs you plan to trade, how funding rates work, and whether your collateral is at risk.

- Phishing attacks: Keep an eye on the site’s URL, always lock your wallet after each session, and never share your private keys or seed phrases. Scenes of “urgent requests” and suspicious links are common traps.

- Relying solely on governance tokens: Holding DYDX tokens is beneficial for governance, but the token price can fluctuate significantly. Consider your risk tolerance before buying large amounts.

Keeping these points in mind helps you build healthy habits for the long term. DYDX and similar DeFi platforms can be fantastic avenues for growth, provided you don’t blindside yourself by ignoring core security measures.

Frequently asked questions

How do I acquire DYDX in the first place?

You can buy DYDX on many popular exchanges or swap it on certain DeFi platforms. Once you have ETH or stablecoins such as USDC, you can swap for DYDX. Alternatively, you can earn DYDX through liquidity mining or trading rewards when you actively use the dYdX platform.Is DYDX only for expert traders?

No. DYDX may have advanced features like margin trading and perpetual contracts, but it also offers simpler spot trading. If you’re starting out, you can ease into basic trades first, then explore margin or perps when you feel more confident.Do I need a huge budget to trade on DYDX?

Not necessarily. While some people use DYDX for large positions, you can start small. Just keep trade sizes reasonable, especially as you get a feel for the platform’s mechanics. The main cost is usually network or Layer 2 fees, which are lower than Ethereum’s main chain but can still impact smaller trades.What’s the difference between DYDX and other decentralized exchanges?

DYDX specializes in margin trading, perpetual contracts, and advanced tools—making it distinct from DEXs that only offer spot trades. Its governance token also grants decision-making power to the community, which is a core part of how the project evolves. Moreover, DYDX’s Layer 2 solution aims for fast, low-fee trading compared to many on-chain competitors.What wallets work best with DYDX?

Popular Web3 wallets like MetaMask are frequently used. Hardware wallets like Ledger or Trezor can also integrate via MetaMask for added security. Always confirm that you’re connecting to the official DYDX site before approving any wallet transactions.

When you step into the blockchain economy, it’s easy to feel overwhelmed. But DYDX aims to simplify advanced trading so you can get more from your crypto journey. By leveraging the platform’s DeFi mechanics, governance system, and user-centric approach, you’re not just passively holding assets, but actively engaging in a financial ecosystem where you have genuine influence.

As a beginner, you have plenty of resources that can help you navigate your first trades. A single well-researched move can teach you more about DeFi than hours of abstract reading. If you take it step by step—starting with basic spot trades, moving into margin features, and finally exploring governance—DYDX can be a solid platform for your journey into decentralized finance.

You’re now equipped with the basics of what DYDX is all about. If you’re looking to diversify, take advantage of advanced trading tools, or simply learn the ropes of DeFi in a user-driven environment, DYDX could be a great fit. And when you’re ready to expand your strategy across multiple chains or assets, keep platforms like Xgram in mind to ease cross-chain exchanges and cut down on fees.

By staying curious, managing your risk, and retaining control of your tokens, you set yourself up for steady progress in the world of crypto. After all, having the right knowledge is half the battle. With DYDX, you get tangible ways to put that knowledge into action. Go forward, and decide how you want to use DYDX to your advantage.