Understanding the basics: What does HODL mean?

If you have noticed people asking, “What does HODL mean?” you are not alone. In the cryptocurrency world, HODL stands for “Hold On for Dear Life,” but its origin actually comes from a simple misspelling of “hold.” Over time, it took on a meaning all its own. Rather than panic-selling when crypto prices dip, you keep your assets in your wallet, hopefully reaping rewards as market value recovers. HODLing is a mindset. It is about resisting the urge to trade impulsively and instead focusing on the long-term potential of your chosen coins or tokens.

For beginners, HODLing can provide a sense of direction in a landscape that often feels unpredictable. This strategy does not guarantee profits, but it can help you avoid emotional decisions fueled by FOMO (fear of missing out) or panic. By committing to HODL, you aim to benefit from the gradual, long-term adoption of crypto. Over the years, plenty of early Bitcoin holders discovered that clinging to their assets through ups and downs paid off when prices soared.

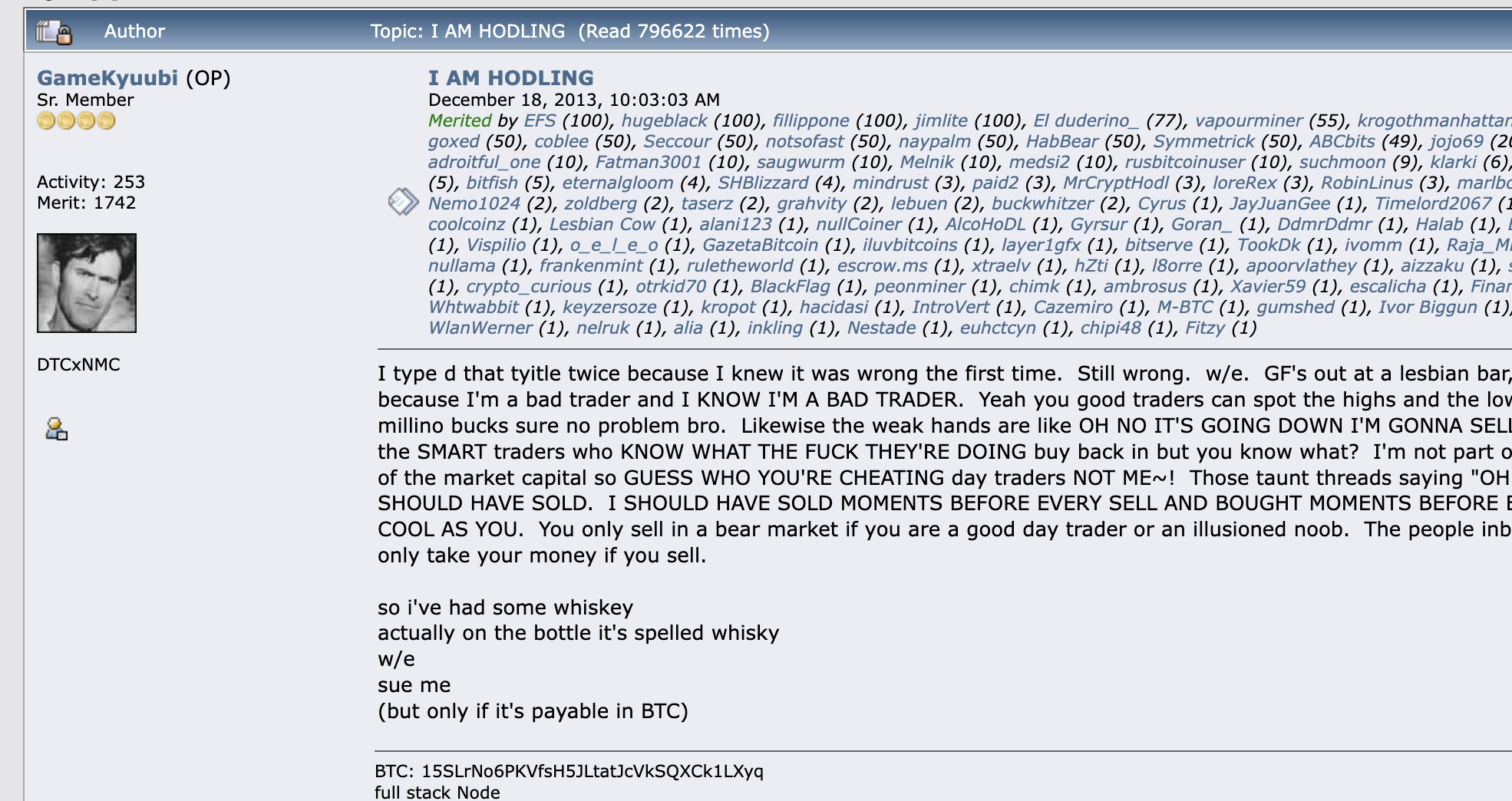

Where did the term “HODL” come from?

Like many internet trends, “HODL” first appeared on an online forum post. In 2013, a user misspelled the word “hold” in a rant about refusing to sell Bitcoin during a price crash. The spelling error quickly went viral. Because cryptocurrency conversations often happen in chatrooms filled with memes and jargon, HODL blended seamlessly into the culture. Soon enough, people were associating it with the idea of clinging to your crypto no matter how the market fluctuates.

It may seem odd that a single typo grew into a widely recognized catchphrase. However, slang in the crypto space spreads quickly. As new users came on board, they embraced the playful spirit of the term. Now, HODL is more than a meme. It signals a particular investment approach: do not let short-term price action dictate your behavior. Stay calm, stay invested, and let time work in your favor.

Why do people HODL in crypto?

Choosing to HODL is not just about waiting for a coin to hit a new all-time high. It is also about:

- Avoiding knee-jerk decisions: By declaring that you will HODL, you shield yourself from anxiously checking prices every second and selling in a panic.

- Saving on fees: Every time you trade, you might pay transaction fees or battle slippage. Holding long term can reduce these repetitive costs.

- Simplifying your strategy: Traders often stumble into losses by overcomplicating their plans. By HODLing, you focus on fewer coins that you truly believe in.

- Emotional relief: Constantly timing the market can be stressful. HODLing can help you maintain your peace of mind while the market does its thing.

Additionally, major cryptocurrencies like Bitcoin and Ethereum have historically shown long-term upward trends, despite wild short-term swings. Many who adopt a HODL philosophy do so based on the belief that crypto technology will become an integral part of global finance, business, and daily life.

The psychology behind HODLing

Emotions can run high in the cryptocurrency marketplace. One moment you might see a token’s price skyrocketing, and the next, it could plummet. This roller coaster ride often traps newcomers in a cycle of emotional buying and panic selling.

- FOMO (fear of missing out) pushes you to jump into a rapidly rising coin, hoping not to miss further gains.

- When the price corrects, anxiety kicks in, leading to a sudden sell that might lock in a loss.

HODLing attempts to short-circuit that emotional cycle. By deciding in advance that you will hold your assets for a specific period, you remove some of the guesswork. You can still keep track of market developments, but you put less pressure on yourself to act in response to every price swing. Of course, staying disciplined takes practice. The key is to do thorough research about each crypto asset you hold so that you feel confident in the technology’s long-term feasibility.

Practical ways to HODL effectively

Simply declaring you will “HODL forever” may not be enough. To make the most of this strategy, you want to be organized, stay informed, and secure your holdings properly. Consider these practical tips:

1. Choose the right crypto assets

Not all coins or tokens are created equal. Some have strong communities, proven use cases, and active development teams. Others are purely speculative with little real-world utility. By focusing on well-known projects, you reduce the risk of your investment evaporating if a poorly managed token fails.

2. Set realistic goals

Ask yourself why you are investing. Do you want to hold crypto for a few months, a few years, or even longer? Having clear goals helps you measure whether HODLing is working for you. If your time horizon is short, a buy-and-hold approach might not align perfectly with your expectations. If you decide on a longer timeframe, you may be better prepared for the inevitable dips.

3. Stay updated with market news

While you should not panic with every headline, staying informed is still important. Follow reputable cryptocurrency news sources to keep track of major developments. Changes in regulation, technology updates, or new partnerships can significantly affect a coin’s prospects. By having a sense of where the industry is headed, you also gain confidence in your decision to keep HODLing.

4. Secure your holdings

A huge part of HODLing is safeguarding your digital assets. If you plan to hold coins for months or years, look into hardware wallets or other reliable storage methods. Hot wallets, like those on exchanges, could be vulnerable to hacks if you are not protected by strong security practices. A hardware wallet helps keep your private keys offline.

5. Plan for the long term

Crypto markets can experience massive fluctuations in a single day. If you are HODLing, that means riding out both the highs and the lows. Thinking in terms of years rather than hours helps you maintain perspective. Keep in mind that deciding to hold for a long time does not mean you can ignore your investments. Regularly review your portfolio to confirm it still aligns with your broader financial goals.

What is P2P trading?

When you first step into the crypto world, you might see references to P2P (peer-to-peer) trading. On many crypto exchanges, especially larger ones, you can trade coins directly with other users using P2P features. For example, you could buy Bitcoin from someone by sending them a payment via bank transfer or e-wallet, and they release the Bitcoin to you when the payment is confirmed.

- P2P can be more flexible, letting you negotiate specific payment methods.

- You often bypass some of the standard fees you see in centralized order books.

- P2P markets are popular in regions where traditional banking solutions for crypto trading might be restricted.

- You also have an escrow service on most major platforms. This adds a layer of protection so each party receives what’s promised.

For HODLers, P2P trading means you might have more options to acquire (or eventually sell) your crypto at rates you are comfortable with. This freedom can be beneficial if you live in a region with limited conventional exchange services or if you just like the idea of direct user-to-user transactions.

Exploring xgram to save on fees

You can also consider platforms like Xgram to streamline your crypto operations. Here are five convenient aspects you might appreciate:

- Cross-chain swapping: xgram allows you to exchange tokens across different blockchain networks, making it a flexible solution if you want to move assets around without juggling multiple wallets.

- Cost-efficiency: Because gas fees can add up fast, the platform aims to help you save on transaction costs by bundling or optimizing transfers.

- User-friendly interface: xgram’s user experience is designed so that even newcomers can figure out how to swap tokens quickly.

- Broad token support: The platform accommodates a variety of cryptocurrencies, giving you room to diversify.

- Future-ready approach: xgram is continuously updating features to stay relevant in the evolving crypto space, so you benefit from new functionality without hassle.

If you intend to hold multiple coins over a long period but occasionally need to rebalance, a cross-chain service like Xgram could simplify the process. Just remember, the same rule applies here as anywhere else: do your research. Make sure you trust the technology and the team behind it before funneling large amounts of your portfolio into any one platform.

Common pitfalls of HODLing

HODLing is not foolproof. The benefits often come hand in hand with challenges you need to watch out for:

- Overconfidence: It is easy to become emotionally attached to a particular coin. If you never evaluate its fundamentals, or if the project deteriorates, blind confidence can lead to losses.

- Missing legitimate sell opportunities: HODLing encourages a steady approach, but sometimes taking profits is not a bad idea. If a coin experiences an enormous surge, you might consider selling a portion to lock in gains.

- Ignoring new innovations: The crypto world changes quickly. By solely focusing on your current holdings, you might miss out on emerging technologies or projects that align even better with your goals.

- Inadequate security: Holding long term is only half the equation. You need robust security to ensure your investments remain safe over time.

- Regulatory changes: Rules vary across countries. A shift in regulations can affect the accessibility or even legality of certain coins and platforms.

Ultimately, you must weigh both the positives and the potential risks before committing to a HODL strategy. This is especially true if you are new to crypto, since the marketplace has many unknowns.

Balancing HODLing with active participation

While HODLing can form a strong anchor for your crypto journey, there are times you may want to blend in other strategies:

- Dollar-cost averaging (DCA): You regularly invest a set amount of money into your chosen crypto. Over time, DCA helps average out your purchase price, reducing the impact of market volatility.

- Staking or yield farming: Some projects reward you for holding and securing the network by staking your tokens. These rewards might be additional tokens, which could bolster your long-term holdings.

- Strategic portfolio diversification: You might hold various coins or tokens from different sectors (DeFi, NFTs, layer-1 blockchains) so you do not rely exclusively on one asset’s performance.

These options can help you contribute to the crypto ecosystem, gather rewards, and still adhere to the overall principle of HODLing.

Reviewing your strategy over time

It is one thing to decide you will hold a token for five years, and another to verify halfway through that your assumptions still hold up. Every investor’s situation evolves, and the crypto market rarely remains static for more than a moment. You may need to pivot based on personal circumstances or major industry shifts.

Stay open-minded. HODLing does not have to mean stubbornly ignoring glaring red flags. If a token’s development team disappears, or if regulations in your area drastically change, what seemed like a good plan a year ago might need revisiting. You can be flexible while still championing the essence of HODLing: thinking long term and not letting panic define your trades.

Final thoughts on the HODL mindset

HODLing in crypto represents far more than a silly internet meme. It is a strategy fueled by trust in the potential of blockchain technology. By resisting the temptation to capitulate during dips or chase quick gains during rallies, you give your investments room to mature. Of course, not every cryptocurrency will stand the test of time. That is why thorough research, consistent monitoring, and secure storage remain crucial to success.

If you ask yourself “What does HODL mean for me?” the answer likely involves setting realistic goals, staying calm through market turbulence, and making decisions grounded in logic rather than fear. As you progress in your crypto journey, your approach will evolve alongside your expanding knowledge. Whether you become a dedicated HODLer or incorporate more active trading strategies, your mindset—and how you manage your emotions—often proves as critical as any price chart.

Frequently asked questions

How long should I HODL my crypto?

There is no fixed timeframe for HODLing. It really depends on your investment goals and risk tolerance. Some people plan to hold for months, while others think in terms of years or even decades. Know why you are investing to help guide how long you hold your assets.Can I still make money if I just HODL and never trade?

Yes, you can. Cryptocurrencies like Bitcoin and Ethereum have tended to grow over the long run. That said, there is no guarantee of profit, and not every coin will appreciate. Perform due diligence before committing to a purely HODL strategy.Isn’t it risky to leave my crypto on an exchange while I HODL?

Storing crypto on an exchange can be more convenient, but it also poses security risks. Many people prefer hardware wallets or other offline methods because they retain full control of their private keys. If you do leave funds on an exchange, enable two-factor authentication and practice good password hygiene.What if I regret holding during a major price drop?

The risk of price drops is part of the crypto experience, and no one can predict market movements perfectly. If you have researched a project’s fundamentals and remain confident, short-term price fluctuations may be less concerning. However, if your outlook changes significantly, it can be appropriate to reevaluate your holdings.Does HODLing require me to ignore the market entirely?

Not at all. You can still stay informed about your chosen projects, read updates on emerging trends, and evaluate whether your original reasons for investing are valid. The difference is that you do not jump to sell just because of a dip or buy impulsively during a spike.

By focusing on your long-term vision, regularly reviewing the fundamentals of each asset, and keeping your crypto secure, you can adopt a HODLing mindset that suits your unique financial goals. It is all about patience, research, and understanding cryptocurrency’s underlying potential. Ultimately, you want to chart a course that gives you confidence—even when price swings make headlines.