How to Swap Bitcoin to Monero: A Step-by-Step BTC to XMR Guide

Understanding BTC to XMR Swaps: Why People Do It

Bitcoin's blockchain is fully public: every transaction, address balance, and history is visible forever. Monero, by contrast, hides sender, receiver, and amount by default. Converting BTC to XMR is a common way to:

- Break the traceability chain (move funds from a transparent ledger to a private one)

- Enhance financial privacy for personal or commercial use

- Participate in DeFi or other protocols where anonymity is valued

- Prepare for real-world spending in privacy-sensitive contexts

In 2026, with increasing regulatory pressure (MiCA in Europe, enhanced AML rules globally), the demand for such swaps has grown. However, many large centralized exchanges have either delisted XMR or require full KYC for trading/withdrawals, pushing users toward no-KYC and privacy-preserving alternatives.

Preparation Before Any BTC to XMR Swap

Before starting any swap, set up proper tools to maintain privacy and security.

Choose a Monero Wallet

Monero requires a wallet that supports its privacy features. Options in 2026 include:

- Official Monero GUI / CLI Wallet — open-source, full-featured, runs a local node (most private but requires ~150 GB storage and sync time).

- Feather Wallet — lightweight, fast-syncing, open-source, excellent privacy defaults.

- Cake Wallet — mobile-friendly (iOS/Android), supports XMR + BTC, built-in swap features.

- Ledger (hardware) — supports XMR via official app, ideal for cold storage.

Best practice: generate a fresh subaddress for each incoming transaction to avoid address reuse. Never use an exchange deposit address as your primary wallet.

Secure Your BTC Wallet

Use a non-custodial BTC wallet for the swap:

- Sparrow Wallet — advanced privacy features (CoinJoin, PayNym)

- Electrum — lightweight, supports hardware wallets

- BlueWallet or Phoenix — mobile-friendly Lightning support

- Hardware (Ledger, Trezor, Coldcard) — highest security for large amounts

Avoid leaving BTC on exchanges before swapping — withdraw to your own wallet first.

Privacy Tools

Use Tor Browser or a trusted VPN (Mullvad, ProtonVPN) when accessing platforms. For maximum anonymity, route everything through Tor. Never use your real IP or link wallets to personal accounts.

Method 1: Non-Custodial Instant Swaps (Fastest & Most Private)

Non-custodial swap aggregators let you exchange BTC directly from your wallet to XMR without depositing funds or creating an account. The process is instant or near-instant, and your BTC never touches a third-party server.

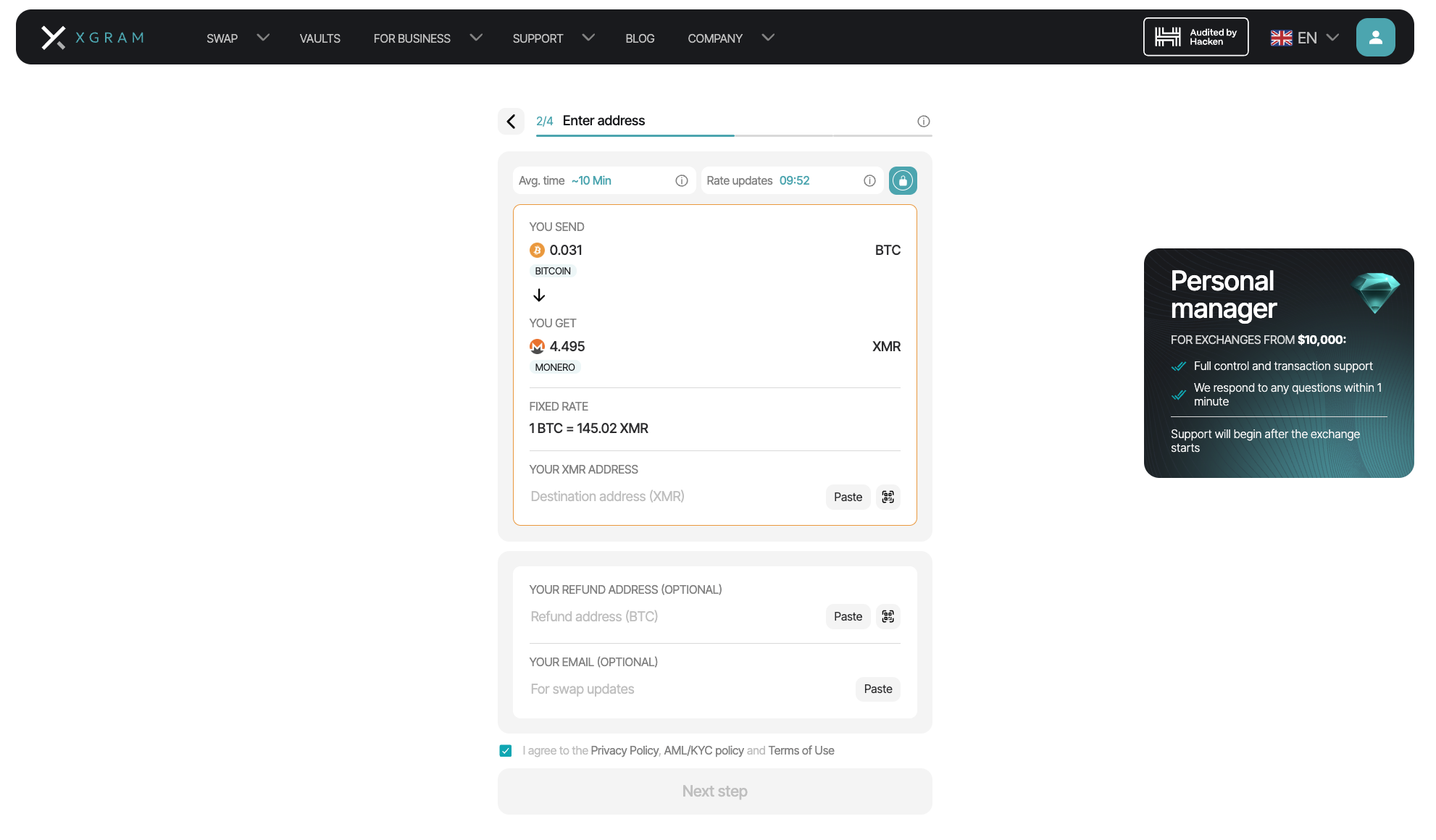

Step-by-Step with Xgram.io (Example)

- Go to https://xgram.io/coins/btc/xmr.

- Select BTC as “You send” and XMR as “You get”.

- Enter the amount of BTC you want to swap (or desired XMR amount — calculator auto-fills).

- Provide your Monero receiving address (generate a fresh subaddress in your wallet).

- Review the quoted rate, fees (usually 0.5–1.5% total), and estimated arrival time.

- Send the exact BTC amount to the one-time deposit address shown (copy carefully — QR code available).

- Wait for BTC confirmations (typically 1–3 for BTC, faster on Lightning if supported).

- XMR arrives directly in your wallet (usually 5–30 minutes depending on network load).

Xgram.io is non-custodial: funds go straight from your wallet to the swap engine and then to your XMR address without holding them. It supports high limits (often $10k–$100k+ per swap without verification), multi-chain BTC (on-chain & Lightning), and competitive rates via aggregated liquidity. Similar platforms include ChangeNOW, SimpleSwap, FixedFloat, Godex, and StealthEX — all still active in 2026 with no mandatory KYC for standard BTC → XMR swaps (limits usually $1k–$10k per transaction).

Pros & Cons of Non-Custodial Swaps

Pros: maximum privacy (no account, no IP tied to identity if using Tor), fast (minutes), no custody risk, supports large amounts.

Cons: slightly higher fees than CEX (0.5–2%), potential slippage on very large orders, occasional rate locks expire if BTC confirmations are slow.

Method 2: Decentralized Exchanges & Atomic Swaps (Maximum Trustlessness)

For users who want zero trust in any operator, decentralized and trustless methods are available.

Haveno — Leading Monero DEX

Haveno is the most mature decentralized P2P exchange focused on XMR. It works like Bisq but optimized for Monero as the base currency.

Step-by-Step with Haveno

- Download and install Haveno from the official site (haveno.exchange) or GitHub.

- Run the software and connect to the network (Tor built-in for anonymity).

- Create or restore a wallet (Haveno has built-in XMR wallet).

- Go to “Buy XMR” or “Sell BTC” section → browse offers.

- Select a BTC → XMR offer (fiat or crypto payment methods: bank transfer, cash, gift cards, etc.).

- Take the offer → deposit BTC into 2-of-3 multisig escrow (Haveno handles this securely).

- Seller confirms BTC receipt → releases XMR from escrow to your wallet.

- Dispute resolution available via arbitrators if needed (rare).

Haveno is fully non-custodial: funds are locked in multisig until both parties confirm. In 2026, it supports a wide range of payment methods and has active community nodes. Liquidity is lower than CEX, but privacy is maximal.

Atomic Swaps

Atomic swaps enable direct, trustless BTC ↔ XMR trades using hash-time-locked contracts (HTLC).

Tools in 2026

- Farcaster / COMIT — cross-chain atomic swap protocols (BTC ↔ XMR supported)

- Liquality — wallet with built-in atomic swap support

- Manual CLI swaps (via Monero and Bitcoin core tools) — advanced but fully trustless

Pros: no third party at all. Cons: slower (hours), technical setup required, lower liquidity.

Method 3: P2P Marketplaces

Peer-to-peer platforms connect buyers and sellers directly.

- AgoraDesk — successor to LocalMonero, still active in 2026. XMR ↔ fiat/crypto, cash-by-mail, bank transfers, gift cards. No mandatory KYC (depends on seller).

- Monero.market — XMR-focused P2P, reputation system, escrow, multiple payment methods.

- Local Telegram / regional groups — high-risk, in-person cash meets (use extreme caution).

P2P offers fiat ramps (cash, bank, Revolut, etc.) but requires trust in counterparties. Always use escrow and public meeting spots.

Method 4: Low/No-KYC Centralized Exchanges

Some mid-tier CEX still allow limited no-KYC activity:

- MEXC — no KYC for certain withdrawal limits (~$10k–$30k/day, policy changes possible)

- TradeOgre — classic no-KYC exchange, XMR/BTC pairs still active

- NonKYC.io — dedicated no-KYC platform, supports XMR

These are convenient but carry platform risk (exit scams, policy changes). Withdraw immediately after purchase.

Step-by-Step General Process (Any Method)

- Install a secure Monero wallet (Feather, Cake, official GUI, Ledger) and generate a fresh subaddress.

- Prepare BTC in a non-custodial wallet (Sparrow, Electrum, hardware).

- Choose method (swap aggregator, Haveno, P2P, CEX).

- Provide XMR address and BTC amount (or follow platform instructions).

- Send BTC to the provided deposit address (double-check!).

- Wait for confirmations and XMR receipt (5 min to several hours depending on method).

- Verify transaction on block explorer (use private view key for XMR privacy).

- Move XMR to cold storage if long-term hold.

Fees, Times, Limits & Privacy Comparison

| Method | Typical Fee | Time | Max Limit (no KYC) | Privacy Level | Risk Level |

|---|---|---|---|---|---|

| Non-Custodial Swaps (Xgram.io etc.) | 0.5–2% | 5–30 min | $10k–$100k+ | Very High | Low |

| Haveno (DEX) | 0.2–1% + payment fees | 30 min – hours | Depends on offer | Highest | Low |

| Atomic Swaps | Network fees only | Hours | Technical limits | Highest | Low |

| P2P (AgoraDesk) | 0–5% (negotiable) | Minutes – days | Offer-dependent | High (with precautions) | Medium-High |

| Low-KYC CEX (MEXC etc.) | 0.1–0.5% | Instant – minutes | $10k–$30k/day | Medium | Medium |

Risks & Best Practices in 2026

- Platform risk — even no-KYC sites can exit-scam or change policies; stick to established names.

- Address linking — never reuse XMR addresses; use subaddresses.

- IP exposure — always use Tor/VPN (Mullvad/ProtonVPN recommended).

- Exit scams — high risk in P2P; use escrow and check reputation.

- Regulatory risk — no-KYC activity may be flagged in some jurisdictions.

- Best practice: test small amounts first, use fresh wallets, avoid linking to KYC accounts.

Conclusion

Acquiring Monero anonymously in 2026 is still achievable through non-custodial swaps (like Xgram.io), decentralized platforms (Haveno), P2P marketplaces (AgoraDesk), and select low-KYC CEXes. Each method balances convenience, privacy, speed, and risk differently. Non-custodial aggregators offer the best mix for most users, while Haveno provides maximum trustlessness. Always prioritize self-custody, use Tor/VPN, and verify platform status before use. Privacy is an ongoing practice — not a one-time step.