Effortless Ways to Sell Toncoin Without KYC Checks

Understand Toncoin and KYC

Before diving into how to sell Toncoin without KYC, it helps to know what Toncoin is and why many traders want to avoid identity checks. Toncoin powers The Open Network (TON), a blockchain platform originally initiated by the Telegram team. It’s designed for quick transactions and easy integration with messaging and social apps, which makes it appealing if you favor speed and scalability.

When you hear “KYC” (short for Know Your Customer), this refers to verifying your identity before you can trade crypto or perform certain financial transactions. Some people value KYC measures because they reduce the risk of fraud and money laundering. Others want to avoid them because they prefer anonymity or they simply dislike sharing personal information online. Selling Toncoin without KYC can be straightforward, but it requires some background knowledge, careful platform selection, and a good handle on security.

Use peer-to-peer (P2P) exchanges

P2P exchanges connect individual buyers and sellers directly. They usually work as online marketplaces, allowing you to name your price or accept existing offers for various cryptocurrencies, including Toncoin. In many P2P scenarios, you can sell your holdings privately without extensive verification, although policies can vary by platform.

Create a listing or respond to an offer.

- Look for an order that matches your target price.

- Review the buyer’s trading history and feedback.

Agree on a payment method.

- Common payment options include bank transfers, PayPal, or third-party payment apps.

- If the buyer is open to face-to-face meetups, be sure to pick a public, safe location.

Complete the trade using the platform’s escrow.

- The site typically locks your Toncoin in an escrow wallet.

- Once you confirm the buyer has paid, the escrow releases your Toncoin to them.

Why it can work

- You can often skip the usual identity verification steps.

- You have flexibility in payment methods, letting you pick what suits you best.

What to watch for

- P2P trades can be slower than automated exchanges if there aren’t many buyers at your chosen price point.

- Some platforms still require partial KYC if your total trading volume crosses a certain threshold.

Because peer-to-peer trades are direct between individuals, it’s wise to research your prospective buyer. Check reputation scores and transaction history. Be cautious of newly registered accounts with no feedback. You’re responsible for double-checking the legitimacy of the buyer’s payment, since once you release your Toncoin, reversing the process can be tricky if something goes wrong.

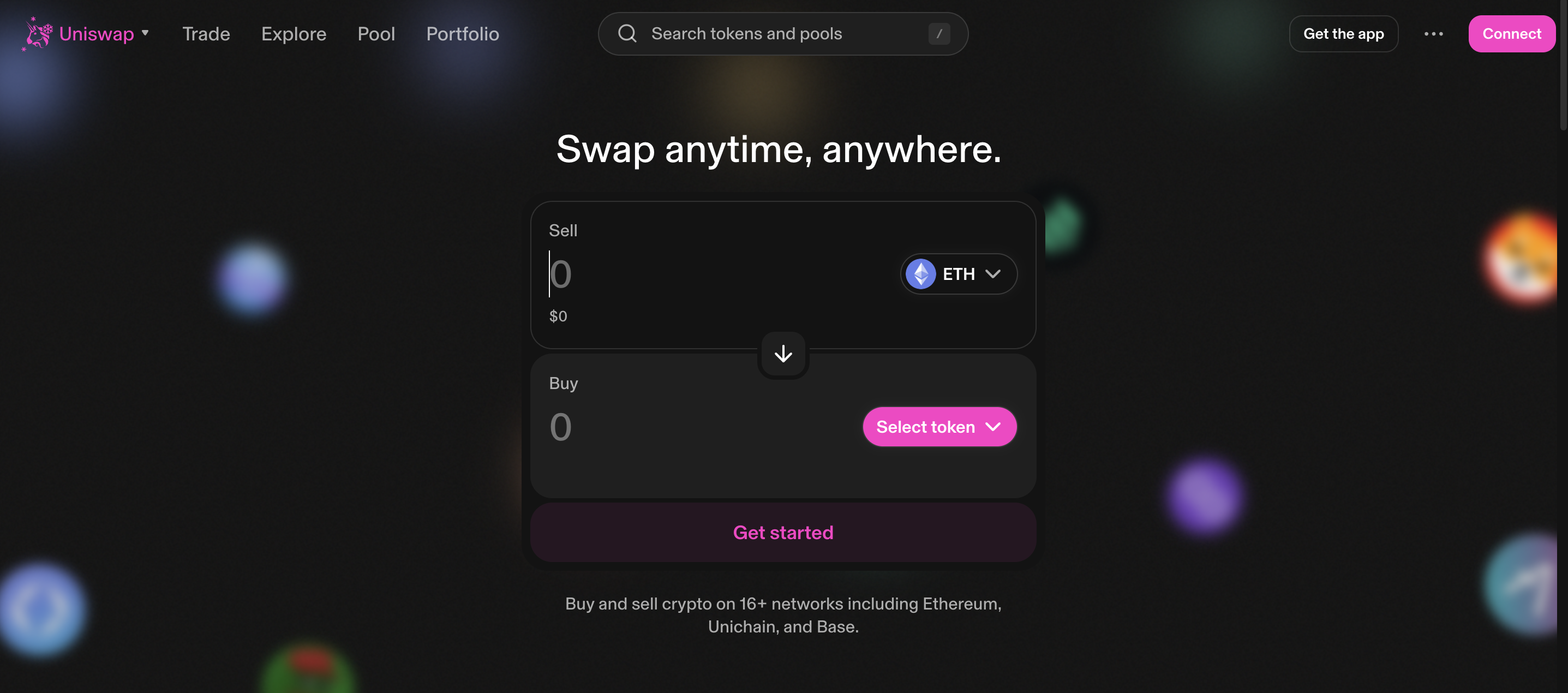

Try decentralized exchanges (DEXs)

Decentralized exchanges operate as distributed networks of smart contracts without a central authority. Many DEXs let you swap Toncoin for other crypto instantly, letting you then convert that crypto to fiat on a separate platform or hold it. The big draw is that most DEXs don’t collect personal information, so you can trade freely with your wallet address.

How decentralized exchanges work

- You connect your external wallet (e.g., MetaMask or a TON-compatible wallet) to the exchange interface.

- You select the pair you want to swap, such as TON/USDT or TON/ETH.

- The DEX calculates the rate and estimated fees.

- You confirm the transaction in your wallet, and the smart contract handles the trade.

Pros of going DEX

- Typically no mandatory KYC.

- Often quick and automated.

- Full custody of your funds because you hold your private keys.

Possible downsides

- Liquidity can be low for certain tokens, sometimes leading to big price slippage.

- Smart contract bugs are rare but can pose risks.

- You might still need a follow-up method to convert crypto to fiat if you want actual cash in your account.

Still, if your priority is speed and anonymity, decentralized exchanges can do the job. Once you swap Toncoin for a more widely traded token, you can move that token to any other service you choose. Just make sure you research each DEX’s reputation, confirm they support Toncoin, and be alert for scam tokens or copycat sites.

Explore Xgram for easy trades

Xgram is another option you can try if you want to sell Toncoin without connecting a wallet or completing a KYC procedure. It helps you directly exchange digital currencies, often providing standard trades and sometimes letting you save on fees. Here are five sentences to sum it up:

Xgram is a platform that allows you to swap Toncoin and other cryptocurrencies with minimal fuss. You don’t have to connect a wallet because the site uses its own interface and temporary addresses for deposits. Many users prefer Xgram for its quick trade times and wide selection of supported cryptos. You simply choose your trading pair, initiate the swap, and wait for a confirmation. By leveraging Xgram’s built-in exchange logic, you often get a competitive rate and lower fees than on some larger, more complicated platforms.

If you value simple user interfaces and want an option that removes the typical KYC bottleneck, Xgram might be a solid starting point. You deposit your Toncoin, specify what you want in exchange, confirm the trade, and withdraw your new currency. From there, you can convert it to cash if you have a local exchange that handles fiat. Always remember to use strong account security measures like complex passwords. And, as with any non-KYC exchange, remain vigilant for phishing links that impersonate the real site.

Opt for OTC deals

Over-the-counter (OTC) deals give you the option to sell Toncoin for fiat or other cryptos without necessarily handing over personal data to a large public exchange. Traditionally used for big block trades, OTC is also a path to skip KYC measures in some scenarios, though policies can vary.

What happens in an OTC deal

- You and the buyer set the terms.

- An OTC desk or broker helps you negotiate price.

- You deposit your Toncoin with the broker.

- They act as an intermediary, verifying the buyer’s payment before finalizing the trade.

Why people like OTC

- Deals can be large, so if you have a considerable amount of Toncoin, you might secure a better rate.

- Some OTC brokers will let you skip KYC for lower-volume transactions.

- Negotiation might help you score a better price if there’s high demand for Toncoin at the moment.

Points to consider

- OTC desks are unregulated in many regions, which poses some risk.

- You must be sure the broker is reputable and not a scam.

- OTC fees can be higher than standard exchange fees, depending on the service.

OTC deals can be ideal if you want to move large sums swiftly. But if your primary reason for avoiding KYC is to maintain privacy, do your homework. Certain OTC brokers have started requiring some form of verification to comply with evolving regulations. Always clarify the requirements upfront to avoid unwelcome surprises mid-trade.

Check out crypto ATMs

Crypto ATMs let you exchange cryptocurrencies for cash quickly by scanning a QR code, inserting bills, or combining both methods. The idea is to mimic the convenience of a bank ATM for digital assets. While not all machines support Toncoin, you might find one that does if TON adoption spreads in your region.

Selling process at a crypto ATM

- Select “Sell” on the machine’s interface and choose Toncoin.

- Enter the amount you want to sell.

- Scan the QR code from your wallet.

- The machine calculates the rate and fee.

- You transfer your Toncoin to the provided address.

- After confirmation, you receive cash from the ATM dispenser.

Pros

- Instant cash in hand without revealing much personal info.

- Straightforward user interface for quick transactions.

Cons

- ATM fees can be steep.

- Machine availability may be limited, especially for Toncoin.

- Certain ATMs still ask for a phone number or ID scan for larger transactions.

If your region has a minimal or no-KYC crypto ATM that includes Toncoin, hopping over to a kiosk can be a fast fix. However, always confirm the fees in advance. Some machines charge double-digit percentages, which can significantly eat into your returns. It’s also wise to check if the machine has a daily limit, so you don’t end up stuck with half your Toncoin sold and half still in your wallet.

Evaluate risks and best practices

When it comes to how to sell Toncoin without official identity checks, not all methods are risk-free. Here are some best practices to keep your trades secure and your stress levels low.

- Always research the privacy policy and terms of any platform you use. Even if they say “no KYC,” read the fine print to see if they require verification for larger trades or certain currencies.

- Watch out for phishing. Scammers often create copycat sites or impersonate well-known exchanges on social media.

- Check your local regulations. Some jurisdictions don’t allow unregistered crypto transactions, and you may face legal issues if you bypass these laws.

- Use escrow services whenever possible. They add a layer of safety by holding funds while each party confirms payment.

- Keep records of your transactions. Even if you don’t hand over personal info, having a record of who you traded with and how much you transferred can be helpful down the line for your own bookkeeping.

Balancing speed, convenience, and privacy can be tricky. If your prime focus is anonymity, it might be wise to split up trades or rely on well-reputed decentralized services. Remember that skipping KYC doesn’t mean skipping personal responsibility. You’ll still want to do thorough due diligence, especially in an industry where hackers and scammers look for easy targets.

Conclusion

Selling Toncoin without going through KYC doesn’t have to be complicated. Once you know the major avenues—P2P marketplaces, DEXs, Xgram, OTC deals, or crypto ATMs—you can pick the route that meets your flexibility and privacy goals. Just remember that each approach has different fees, waiting times, and security considerations. If privacy is top priority for you, keep your guard up and never reveal sensitive data unless you’re certain it’s safe. When done correctly, your Toncoin-to-fiat or Toncoin-to-other-crypto trade can be quick and painless.

Frequently asked questions

How fast can I sell Toncoin on a no-KYC platform?

It depends on the method you choose. P2P exchanges might take anywhere from minutes to a few hours, depending on how fast a buyer is found. DEX trades can settle almost immediately if there’s enough liquidity. OTC deals and crypto ATMs vary widely, so you might want to check each option’s typical processing time before committing.Do I risk breaking any laws by not using a KYC service?

This depends entirely on your local jurisdiction. Some countries require you to declare all crypto transactions or use regulated exchanges for specific trading volumes. To stay on the right side of the law, familiarize yourself with your local regulations. If you’re unsure, consulting a legal expert might save you from complications down the road.Can I get a better rate selling Toncoin without KYC?

Sometimes you can, because no-KYC avenues often attract a wide user base that values anonymity. This can create competitive offers from buyers. On the flip side, you might face higher fees (for instance, with certain crypto ATMs or OTC deals), which could offset any favorable rate. Check ongoing market conditions to see if you’re getting a decent price.Is it safe to keep my Toncoin on a decentralized exchange?

Generally, the safest approach is to keep your coins in your own non-custodial wallet until you’re ready to trade. Decentralized exchanges let you connect a wallet and execute swaps without leaving your assets vulnerable on a centralized server. Still, avoid suspicious DEXs or websites that might attempt to steal your private keys through phishing.What if I need cash instead of more crypto?

Some no-KYC methods, such as specific P2P trades and crypto ATMs, let you cash out directly. If you use a DEX or Xgram and end up with a stablecoin or another crypto, you can send that to a trusted P2P marketplace to convert to fiat. The path you choose depends on availability in your region, the payment methods you prefer, and local regulations around cash transactions.

Selling Toncoin can be an efficient and private process when you take the right precautions. By balancing research, good security habits, and awareness of local rules, you’ll be well on your way to an effortless swap.