Best No-KYC Monero (XMR) Swappers: Top Anonymous Sites 2026

Why No-KYC Monero Swappers Are Popular in 2026

Monero's privacy (ring signatures, stealth addresses, RingCT) is compromised if the entry point (purchase/swap) is KYC-linked — the receiving address can be tied to your identity via exchange records. No-KYC swappers preserve the chain's anonymity from the start:

- No account or personal data required

- Funds never sit on the platform (non-custodial/atomic swaps)

- IP hidden via Tor/VPN

- Direct wallet-to-wallet delivery

In 2026, with many CEXes (Binance, Coinbase, Kraken in regulated regions) restricting or delisting XMR, no-KYC swappers have become the primary on-ramp for privacy-conscious users.

Top No-KYC Monero Swappers in 2026

1. Non-Custodial Instant Swap Aggregators (Most Popular)

These platforms aggregate liquidity from multiple sources and execute direct wallet-to-wallet swaps without holding funds or requiring accounts/ID.

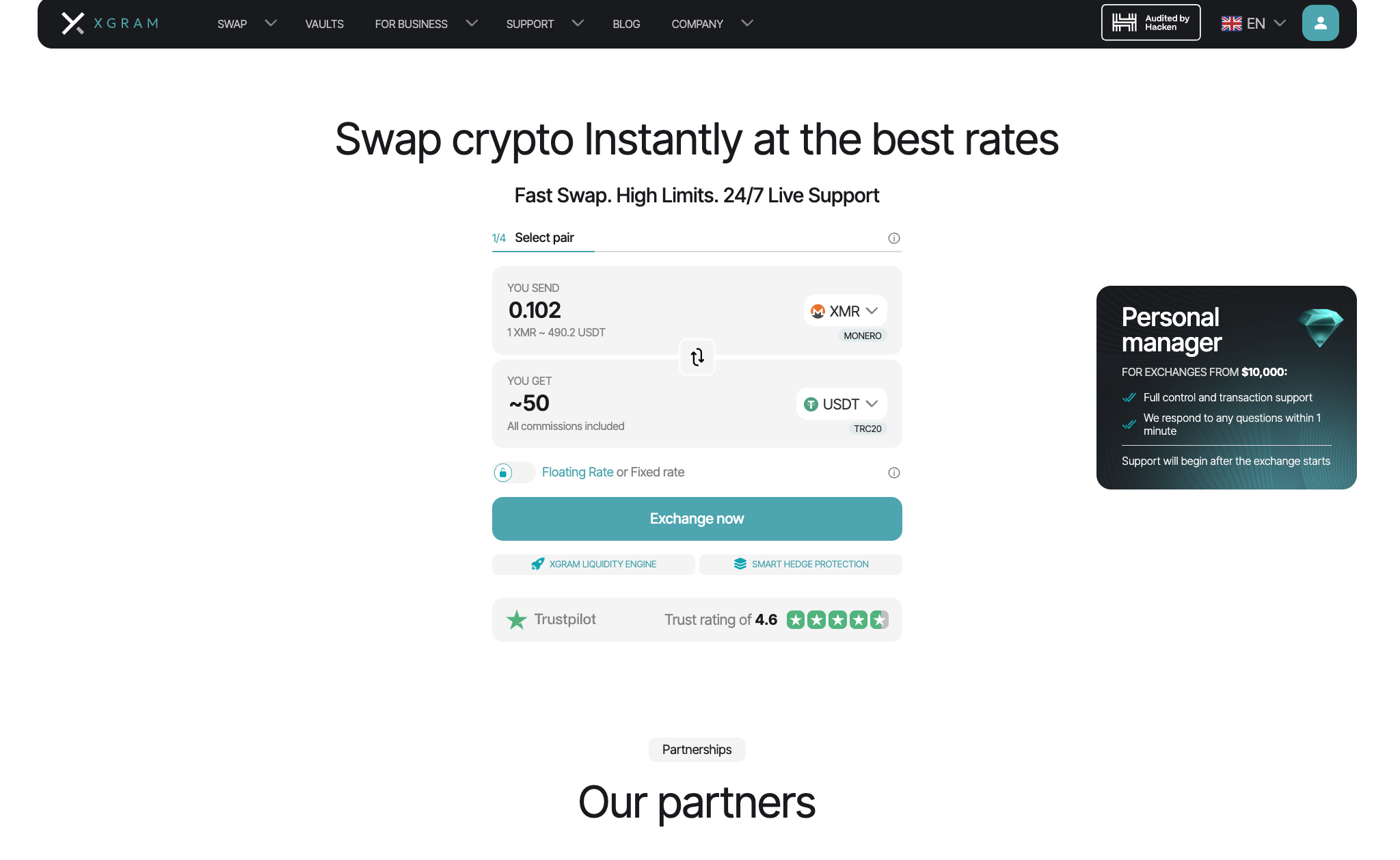

- Xgram.io — one of the leading non-custodial aggregators in 2026. Supports BTC → XMR, USDT → XMR, ETH → XMR and many other pairs. No KYC, no registration, low slippage on major pairs, multi-chain support. Frequently offers competitive rates for privacy coins like XMR. Ideal for fast, private swaps from your own wallet.

- ChangeNOW — still active, no KYC for standard swaps (limits ~$1,000–$10,000 per tx), good rates, supports XMR.

- SimpleSwap — no account required, fixed-rate swaps, XMR support, limits similar to ChangeNOW.

- FixedFloat — floating/fixed rate options, no KYC, reliable XMR pairs.

- Godex / StealthEX — no registration, privacy-focused, XMR available.

Typical process: select BTC/USDT → XMR, enter amount, provide fresh Monero subaddress, send crypto to one-time deposit address, receive XMR in your wallet (5–30 min).

2. Decentralized Exchanges (DEX) & P2P Platforms

True decentralized options with no central operator.

- Haveno — leading Monero DEX (Bisq-style). P2P order book, fiat/crypto pairs, multisig escrow, strong privacy. In 2026, Haveno is mature and widely used for no-KYC XMR trading.

- AgoraDesk — successor to LocalMonero. XMR ↔ fiat/crypto, cash-by-mail, bank transfers, gift cards. No mandatory KYC (vendor-dependent).

- Monero.market — XMR-focused P2P, reputation system, escrow, multiple payment methods.

Haveno and AgoraDesk support BTC → XMR and fiat ramps without KYC.

3. Atomic Swaps (Trustless Cross-Chain)

Direct BTC ↔ XMR swaps via hash-time-locked contracts (HTLC) — no intermediaries.

- Farcaster / COMIT — active protocols for BTC ↔ XMR

- Liquality — wallet with built-in atomic swap support

Steps: connect wallets, create/accept offer, lock funds, reveal preimage. Slower (hours) but maximum trustlessness.

4. Low/No-KYC Centralized Exchanges

- MEXC — withdrawal limits without KYC (~$10k–$30k/day, policy changes possible)

- TradeOgre — classic no-KYC exchange, XMR/BTC pairs active

- NonKYC.io — dedicated no-KYC platform, XMR support

These offer convenience but higher platform risk.

Step-by-Step General Process for No-KYC XMR Swaps

- Install a secure Monero wallet (Feather, Cake, official GUI, Ledger) and generate a fresh subaddress.

- Acquire BTC/USDT/ETH in a non-custodial wallet (Electrum, Sparrow, hardware).

- Choose a no-KYC method (swap aggregator, Haveno, atomic swap, P2P).

- Provide your XMR address and BTC/USDT/ETH amount (or follow platform instructions).

- Send funds to the provided deposit address (double-check).

- Wait for confirmations and XMR receipt (minutes to hours).

- Verify transaction in your Monero wallet (use private view key).

- Move XMR to cold storage for long-term holding.

Fees, Time, Limits & Privacy Comparison (2026)

| Method | Typical Fee | Time | Max Limit (no KYC) | Privacy Level | Risk Level |

|---|---|---|---|---|---|

| Non-Custodial Swaps (Xgram.io etc.) | 0.5–2% | 5–30 min | $10k–$100k+ | Very High | Low |

| Haveno (DEX) | 0.2–1% + payment fees | 30 min – hours | Offer-dependent | Highest | Low |

| Atomic Swaps | Network fees only | Hours | Technical limits | Highest | Low |

| P2P (AgoraDesk) | 0–5% (negotiable) | Minutes – days | Offer-dependent | High (with precautions) | Medium-High |

| Low-KYC CEX (MEXC etc.) | 0.1–0.5% | Instant – minutes | $10k–$30k/day | Medium | Medium |

Privacy & Safety Tips for No-KYC XMR Swaps in 2026

- Always use Tor Browser or a trusted VPN (Mullvad, ProtonVPN) when accessing platforms — especially CEX or aggregators.

- Never leave XMR on exchanges — withdraw immediately to your own wallet (official GUI/CLI, Feather, Cake, Ledger).

- Use fresh subaddresses for every incoming transaction to avoid address reuse/linkability.

- For P2P: meet in public places, use escrow, verify reputation.

- Avoid linking swap wallets to KYC'd services later — rotate addresses.

- Be cautious of exit scams on small platforms — stick to established names (Xgram.io, Haveno, AgoraDesk, MEXC, TradeOgre).

- Regulatory risk: no-KYC activity may be monitored more aggressively in some jurisdictions in 2026.

Conclusion

In 2026, buying or swapping into Monero anonymously is still feasible despite widespread KYC enforcement on major exchanges. Non-custodial instant swappers (like Xgram.io), decentralized platforms (Haveno), P2P marketplaces (AgoraDesk), atomic swaps, and select low-KYC CEXes remain the primary options. Each method balances convenience, privacy, speed, and risk differently. Non-custodial aggregators offer the best mix for most users, while Haveno provides maximum trustlessness. Always verify current platform status, use Tor/VPN, withdraw to self-custody immediately, and minimize shared information. Privacy is an ongoing process — not a one-time action.