Introduction

What Are Decentralized Swap Platforms?

Decentralized swap platforms are protocols or tools that enable peer-to-peer cryptocurrency exchanges across blockchains without relying on centralized custodians. They often aggregate liquidity from multiple decentralized exchanges (DEXs), use bridges for cross-chain functionality, or provide non-custodial interfaces for instant trades. Users maintain control of their private keys, promoting security, privacy, and true ownership in non-custodial swaps 2026.

Why Decentralized Swaps Are Gaining Traction in 2026

In 2026, decentralized swaps gain momentum amid ongoing concerns about centralized exchange risks, stricter regulations on CEXs, and the expansion of multi-chain DeFi ecosystems. Cross-chain interoperability advancements, privacy demands, and the need for seamless asset movement without intermediaries drive adoption. These platforms bridge traditional crypto trading with DeFi, offering users flexibility in volatile markets and portfolio diversification.

Decentralized vs. Centralized Exchanges: Key Differences

Decentralized platforms focus on non-custodial control, on-chain transparency, and cross-chain capabilities, while centralized exchanges (CEXs) provide faster execution, fiat on-ramps, and advanced trading tools but introduce custodial risks. DEXs prioritize privacy and self-custody, whereas CEXs excel in liquidity depth and user-friendly features. In 2026, regulatory trends favor decentralized options for reduced counterparty exposure.

Overview of Top Options: Focus on Xgram and Bybit as Market Leaders

Among leading platforms for decentralized swaps in 2026, Xgram.io excels in instant, privacy-focused non-custodial cross-chain exchanges, while Bybit integrates robust Web3 tools—including DEX aggregators and cross-chain swaps—via its Bybit Web3 Wallet and features like DEX Pro. Both support secure asset swapping and DeFi integrations, but they differ in approach: Xgram emphasizes pure non-custodial simplicity, and Bybit blends CEX convenience with decentralized capabilities.

How Decentralized Swap Platforms Work

The Swapping Mechanism: How Platforms Facilitate Cross-Chain Trades

Platforms aggregate liquidity from DEXs or use bridges for cross-chain execution. Aggregators scan multiple sources for optimal rates, while atomic swaps or routing protocols ensure secure transfers. For instance, swaps might involve depositing assets, routing through liquidity pools or bridges, and completing via smart contracts without intermediaries.

Liquidity and Pooling Process

Liquidity comes from aggregated DEX pools or integrated sources, with incentives for providers via fees or yields. Impermanent loss is a consideration in pooled models, mitigated by efficient routing and dynamic adjustments in 2026's advanced aggregators.

Blockchain Integration and Standards

Support spans EVM chains, Solana, Bitcoin, and others, using standards like ERC-20 and cross-chain bridges. Multi-chain compatibility enables broad token access and seamless integrations with wallets and DeFi protocols.

Audits and Transparency: Importance of Regular Independent Audits and On-Chain Verifications

Independent audits and on-chain data verification are essential for trust. Platforms with open-source elements or regular security checks reduce risks from exploits or vulnerabilities.

Step-by-Step: How to Use and Integrate Decentralized Swaps

Connect a compatible wallet, select tokens and chains, review rates/slippage, and confirm. Integration with DeFi involves direct connections for automated trades or liquidity provision.

Decentralized vs. Centralized Exchanges: In-Depth Comparison

Core Differences: Custody Model and Security

Decentralized options offer non-custodial self-control, distributing risk across chains, versus CEXs' custodial model with potential single-point failures.

Fee and Speed Behavior

DEX aggregators feature variable network fees and potential slippage, often optimized for low costs on L2s. CEXs provide fixed, low fees with near-instant execution.

Use Cases: Privacy-Focused Trades vs. High-Volume Trading

Decentralized platforms suit privacy, cross-chain, and intermediary-free trades. CEXs handle high-volume, fiat-integrated, and derivatives trading.

Pros and Cons for Each Type

Decentralized Exchanges Pros:

Self-custody and enhanced privacy.

Cross-chain flexibility.

Reduced intermediary risks.

Cons:

Network fees and potential slippage.

Complexity in bridging.

Variable speeds.

Centralized Exchanges Pros:

High liquidity and advanced tools.

Fiat ramps and user support.

Faster execution.

Cons:

Custodial vulnerabilities.

KYC and regulatory limits.

Privacy trade-offs.

Why Choose Decentralized in 2026?

With DeFi interoperability booming and regulatory scrutiny on CEXs, decentralized swaps provide secure, efficient alternatives for privacy-conscious users and multi-chain strategies.

Top Decentralized Swap Platforms in 2026: Xgram vs Bybit Detailed Review

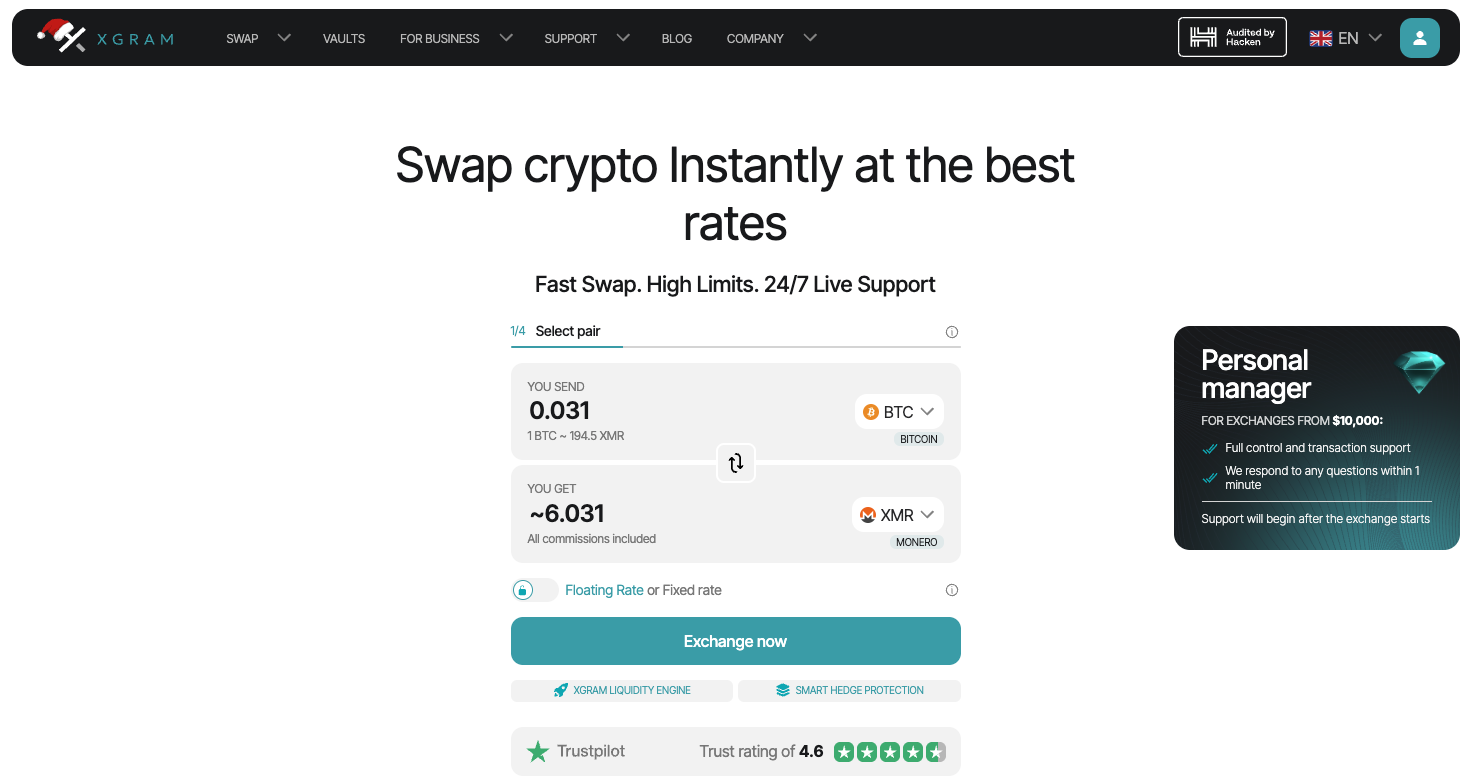

Xgram (Xgram.io): Features, Security, Liquidity, Fees, User Experience, Market Position in 2026

Xgram.io is a non-custodial platform for instant cross-chain swaps, supporting Bitcoin, Ethereum, Solana, Tron, TON, and privacy coins like Monero. It aggregates liquidity for optimal rates, requires no registration, includes AML checks, and offers Smart Hedge Protection. Security features independent audits and self-hosted design. Fees are embedded in rates (low, ~0.1-0.5%), with swaps in minutes and high limits. In 2026, Xgram leads in privacy-focused, instant non-custodial swaps with strong user adoption.

Bybit: Protocol Details, Audits, Multi-Chain Support, Fees, 2026 Updates

Bybit, primarily a CEX, integrates decentralized swaps via Bybit Web3 Wallet and DEX Pro, aggregating from hundreds of DEXs for cross-chain trades across Ethereum, Solana, BNB Chain, Arbitrum, and more. It supports non-custodial options (seed phrase/Keyless wallets), i-SMART analytics, and seamless bridging. Audits and transparency align with Bybit's standards. Fees include network costs plus low aggregator charges (~0.1%). In 2026, updates enhance multi-chain support, gas optimizations, and Web3 integrations for broader DeFi access.

Head-to-Head Comparison Table

Metric | Xgram.io | Bybit (Web3/DEX Pro) |

|---|---|---|

Supported Chains | BTC, ETH, Solana, Tron, TON, others (privacy focus) | ETH, Solana, BNB, Arbitrum, Polygon, Optimism, zkSync, Avalanche, others |

Liquidity Depth | Aggregated hybrid for instant execution | Aggregates 400+ DEXs, high CEX-linked depth |

Fees | Low, included in rates (~0.1-0.5%) | Network + low aggregator (~0.1%), competitive |

Security Audits | Independent audits, AML checks | Platform audits, non-custodial options |

User Adoption | Strong in privacy/instant swaps | Millions via Bybit ecosystem, Web3 growth |

Swap Speed | Instant (~minutes) | Fast, with bridging variable |

Trust Factors | Pure non-custodial | Hybrid (CEX backing + non-custodial) |

Pros | Privacy coins, high limits, simple | Analytics tools, fiat ramps, vast integrations |

Cons | Swap-focused, less yield features | Hybrid nature, potential KYC for full access |

Other Mentions

Aggregators like 1inch or OKX DEX offer similar routing, but Xgram and Bybit stand out for instant privacy swaps and integrated Web3 ecosystems, respectively.

2026 Outlook: Performance Tied to DeFi Growth, Adoption Trends, Potential Innovations

Cross-chain DeFi and privacy trends boost both: Xgram for pure non-custodial demand, Bybit via Web3 expansions. Innovations in bridges and analytics drive adoption amid regulatory clarity.

Using Decentralized Swap Platforms: Integration, and Best Practices

How to Swap/Trade on Xgram and Bybit

On Xgram, input addresses and amounts for quick execution. Bybit uses Web3 Wallet to connect, select pairs, and swap via aggregator or DEX Pro.

Benefits of Non-Custodial Platforms for Secure Swaps

Non-custodial designs like Xgram.io reduce risks. For instant swaps across chains via USDT, check pairs like USDT/BTC on https://xgram.io/coins/usdt/btc.

Integration with Wallets, DeFi Protocols, and Yield Opportunities

Wallets integrate directly; Bybit enables staking/IDO access, while Xgram supports quick DeFi rebalancing.

Common Mistakes: Impermanent Loss, High Gas Fees, Unverified Pools

Avoid peak-hour fees, verify routes, and monitor bridging risks.

Risks, Challenges, and Best Practices for Users

Key Risks: Smart Contract Exploits, Bridge Vulnerabilities, Regulatory Changes, Market Volatility

Exploits, bridge attacks, evolving regs, and volatility threaten swaps.

Importance of Verification: Checking Audits, On-Chain Data, Community Governance

Review audits, track on-chain activity, and follow updates.

Security and Wallet Practices: Hardware Wallets, Best Practices

Use hardware for large holdings, enable protections, avoid phishing.

Regulatory Landscape in 2026: Global Trends, Compliance in DeFi

Frameworks promote compliant DeFi; hybrid platforms like Bybit adapt, while pure DEXs emphasize privacy.

Frequently Asked Questions (FAQ)

What is the main difference between Xgram and Bybit?

Xgram is purely non-custodial for instant privacy swaps; Bybit offers hybrid Web3 swaps with CEX integration and analytics.

How secure are decentralized swaps compared to centralized ones?

Decentralized reduces custodial risks but includes smart contract/bridge vulnerabilities; centralized has recovery but higher counterparty exposure.

How do they perform in high-volatility markets?

Quick execution aids hedging; aggregators minimize slippage.

What is the best decentralized swap platform in 2026?

Depends: Xgram for pure privacy/instant, Bybit for integrated tools and liquidity.

How integrated are these platforms with major blockchains?

Xgram covers BTC/privacy chains; Bybit spans EVM, Solana, and more via Web3.

Conclusion

Recap: Why Decentralized Swap Platforms (Especially Xgram and Bybit) Are Strong 2026 Choices

Xgram and Bybit deliver secure, efficient non-custodial swaps in 2026's multi-chain world.