TL;DR quick overview

- “Copium” is an internet slang term combining “cope” and “opium.” It describes a situation where people hold onto unfounded optimism in the face of losses or negative news.

- In crypto communities, copium often shows up when a token’s price crashes and investors look for excuses to stay hopeful.

- While a little optimism is healthy, relying too heavily on copium may cloud your judgment, pushing you into risky trades or decisions.

- Stay levelheaded by researching, diversifying your assets, and having a plan for various market scenarios.

Below, we’ll break down exactly how copium began, why it’s so prevalent in crypto, and what you can do to keep your feet on the ground.

Origins of copium

Copium has its roots in internet culture, as a playful, tongue-in-cheek portmanteau that blends “cope” and “opium.” The concept of “coping” is about dealing with difficulties, disappointments, or stress in a way that allows you to continue functioning. “Opium,” in a slang sense, can refer to an addictive substance that offers a temporary high but may carry negative consequences in the long run.

In the early days, copium was mainly found in gaming forums and social media memes to describe the lengths people might go to feel better after losing a match or facing a setback. Over time, the term expanded beyond these circles, eventually making its way into crypto contexts. With the inherent volatility and drama surrounding digital assets, the idea of using “copium” to manage emotional reactions just made sense.

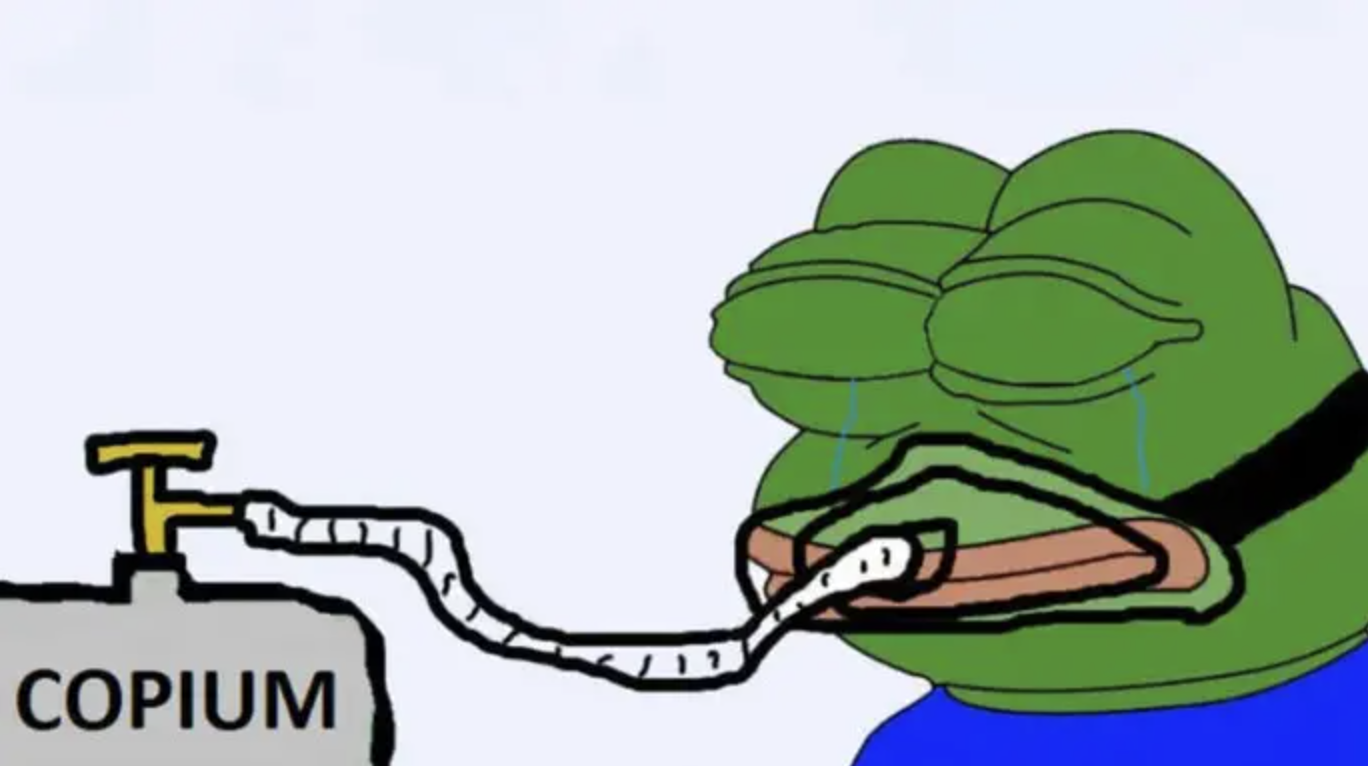

Certain online communities use copium ironically. They’ll share memes of “inhalers” or “gas tanks” symbolizing imaginary doses of hope for a faltering crypto project. However, beneath the humor lies a very real phenomenon: the emotional struggle investors face when markets don’t go as expected. You’ll often see folks rationalize their losses or keep doubling down on a failing project, simply because it’s easier to believe in a magical recovery than to confront a tough reality.

By understanding the origins of copium, you gain insight into how this playful internet creation became a tool—albeit sometimes a misleading one—for dealing with disappointment. It’s vital to recognize its comedic undertones while also acknowledging the risk it carries when it becomes a substitute for facts or a defensible strategy.

Why people use copium

Copium’s appeal is universal because setbacks are common in both life and crypto. When your portfolio takes a hard hit, it’s instinctive to look for reassurance. Nobody wants to feel like they’ve made a terrible financial decision. Sometimes, the easiest mental fix is to inflate small positive developments into signs of a massive turnaround.

Emotional cushion: Copium gives you a brief emotional boost. It might help you catch your breath when confronted with sudden drops or negative headlines about your favorite token.

Avoiding regret: A part of you might believe it’s better to cling to illusions of hope rather than admitting that an investment just isn’t working out. Recognizing you’ve made a mistake can be painful, especially when real money is on the line.

Groupthink dynamics: Crypto groups often feed into each other’s positivity. If a handful of influential voices on social media remain bullish, it’s tempting to adopt their outlook without considering the facts.

Fear of missing out (FOMO): Exiting a project might be the correct move but can also trigger FOMO if the coin rallies right after you sell. Copium lulls you into staying put, sometimes leading you to hold assets much longer than you should.

Keep in mind that staying genuinely informed demands looking beyond hype or hopeful speculation. Copium can feel therapeutic in the short term, but it risks distorting your decision-making process.

Spotting copium in crypto

Learning to spot copium in the wild will help you make sounder choices. Here are a few common themes or signals:

Overemphasis on vague “partnerships”: If a project is crashing while community leaders keep hinting at “huge partners” without providing details, you might encounter copium. Genuine collaborations usually come with tangible data or formal announcements.

Dismissing valid concerns: When critics raise well-researched points and the counter-argument is merely “FUD” (fear, uncertainty, doubt), the conversation may be driven by copium rather than logical reasoning.

Eternal optimism in the face of hard data: If a project has missed deadlines or lacks a coherent roadmap, unwavering optimism could be copium. A healthy community remains open to critique and is willing to adapt.

Excessive reliance on “this has to go up eventually”: While it’s comforting to believe your investment will bounce back, indefinite positivity with no fundamental backing is a clear sign of wishful thinking.

Meme overload: Memes can be fun, but if you see an entire forum constantly posting inhaler memes or “hopium” references without discussing tokenomics or development milestones, that’s a strong tip-off.

Spotting copium often comes down to recognizing the difference between data-driven optimism and blind hope. If you find yourself nodding along with big claims that lack substance, pause for a moment to see if you’re falling into the copium trap.

Real-world copium examples

While copium is most noticeable in online banter, it can manifest in the real world as well:

“They’ve got to come back!”: Suppose a major crypto project faces huge regulatory hurdles, but you keep telling yourself that regulatory clarity is just around the corner. You might spend months waiting, ignoring all evidence that the project isn’t actually meeting compliance requirements.

“The whales are just testing our patience!”: You might hear this if a token’s price is repeatedly dropping. Investors sometimes rationalize big dumps by attributing them to market manipulation, rather than acknowledging there might be a fundamental flaw in the token’s strategy.

“We’re just in the accumulation phase”: This phrase can be perfectly legitimate when analyzing market cycles, but it can also become copium if the “accumulation phase” extends indefinitely with no upward trend in sight.

“All altcoins crash in bear markets, we’ll rebound soon”: It’s true that altcoins are more volatile, but it’s also true that not every altcoin recovers. Some vanish altogether.

“The dev team is stealthy, that’s why we have no updates”: A dedicated dev team usually shares roadmaps, progress reports, or testnet milestones. If a team has gone silent, you might be dealing with either a dormant or failing project—and hoping otherwise could be copium.

All of these illustrate how copium can mask hard truths. Reality might be telling you one thing, but the comfort of “maybe things will improve” feels safer than seeing the mechanics for what they are. Staying informed and focusing on fundamentals keeps you aligned with real opportunities, not illusions.

Manage your copium use

It’s natural to seek emotional relief when your investments don’t pan out. The key is finding balance. You don’t want to crush your optimism, but you also don’t want to let misplaced hope sabotage your portfolio.

Acknowledge emotional reactions: The crypto market can be intense, so recognize that your feelings are valid. Draw a line between acknowledging those emotions and letting them run the show.

Examine fundamentals: Before you label negative news as mere “FUD,” take time to analyze whether there’s a genuine problem. Review the project’s roadmap, team credentials, code audits, and overall market reception.

Set exit strategies: One of the best ways to guard against copium is to define clear sell targets or stop losses. Decide in advance how much risk you’re willing to shoulder. That way, you won’t rely on blind optimism when prices dip below your comfort level.

Diversify: Rather than sinking all your capital into one token—or ignoring significant red flags because of your emotional attachment—spread out your investments to reduce risk. If one coin flops, you won’t be left with an empty bag and no plan.

Share and listen: Talk to other traders you trust, and be open to hearing criticisms of your favorite projects. Fresh perspectives might be uncomfortable, but they can also prevent you from making big mistakes.

By blending a healthy dose of hope with research-driven strategies, you safeguard yourself from the pitfalls of excessive copium. Optimism is an asset in a growing industry, but it shouldn’t blind you to warning signs.

Tips to avoid pitfalls

You need practical strategies to ensure you’re not drifting away on copium clouds. Here are some tips:

Keep a trading journal: Document your logic for entering and exiting trades. If you look back and see that you tended to ignore warning signals—or that you relied only on vague “good feeling” instincts—you’ll know it’s time to tighten your strategy.

Monitor your emotional triggers: Are you more susceptible to copium when everyone else on social media is bullish? Understanding what sets off your bias can help you pump the brakes on emotional decisions.

Follow a range of sources: Avoid echo chambers by following a variety of influencers, analysts, and developers. Be open to reading bearish viewpoints, even when they create discomfort.

Focus on risk management: Consider your portfolio’s overall risk profile. If you’re in projects that require leaps of faith and endless disclaimers of “It’ll be big next month,” that can be a red flag.

Learn the basics of market psychology: Understanding the common psychological pitfalls—like confirmation bias, sunk cost fallacy, or FOMO—helps you add logic to your decisions.

These steps can keep you grounded, ensuring that you remain a rational investor rather than one who jumps from one hopeful rumor to another.

Consider using Xgram

If you’re looking to expand your options while minimizing costs, consider a platform like Xgram. Xgram stands out as a versatile exchange where you can perform cross-chain transactions seamlessly, giving you room to move your assets across different blockchains without the usual hassles. By bundling multiple transfers into a streamlined process, it often reduces your overall transaction fees. That’s especially helpful if you’re moving smaller amounts and don’t want to sacrifice half your gains to network fees. It’s also designed with user experience in mind, so you don’t have to spend hours learning an overly complex interface. If you’re stepping outside your comfort zone and exploring multiple tokens, Xgram can simplify what might otherwise be a confusing process.

FAQs about copium

What is copium exactly?

Copium is a tongue-in-cheek term that fuses “cope” and “opium” to describe unwarranted optimism, particularly when faced with a losing position. In crypto, it might surface when investors cling to unrealistic hopes instead of looking at a project’s real performance and fundamentals.Why do I hear it so often in crypto?

Because the crypto market is so volatile, emotional highs and lows are the norm. Copium provides a playful way for people to soothe their nerves and rationalize losses. However, if you rely on it too much, you risk misreading critical signals and missing solid exit strategies.Is copium always bad?

Not always. Sometimes, a bit of optimism helps you stay calm and prevent knee-jerk reactions. But you want that optimism backed by facts—if it’s purely emotional without any data, it becomes more destructive than helpful.How do I avoid falling into the copium trap?

One method is to set clear goals, risk tolerance, and exit points before you even enter a trade. Regularly review your positions, follow diverse opinions, and don’t ignore negative news when it’s credible. Staying informed is a powerful antidote to wishful thinking.Can xgram help reduce copium?

Indirectly, yes. Using an efficient platform like xgram can lower transaction fees and streamline swapping between chains, giving you more flexibility. Rather than feeling stuck in a losing position because you’re worried about excessive fees or complicated bridging, you can make well-timed moves that align with your research.

When you put these insights into practice, you give yourself room to approach the crypto market with both optimism and caution. Although memes like copium can provide comic relief, they shouldn’t replace critical thinking and real information. Aim for an informed balance—an approach that respects both the excitement of the crypto world and the seriousness of your financial decisions. By recognizing when copium enters the conversation, you equip yourself to make clearer, more resilient moves in a volatile market.