Litecoin vs Bitcoin: What’s the Difference and Which Is Better in 2025

Quick Summary (TL;DR)

- Bitcoin (BTC) — the first and most valuable cryptocurrency, often called “digital gold.” It’s secure but slower and more expensive to use.

- Litecoin (LTC) — known as the “silver to Bitcoin’s gold.” It’s faster, cheaper, and better suited for smaller payments.

- Both use the Proof-of-Work mechanism, but Litecoin relies on the Scrypt algorithm, making mining more accessible.

Background and Philosophy

Bitcoin was created in 2009 by Satoshi Nakamoto as an alternative to traditional finance. Its goal was to establish a decentralized monetary system with a limited supply of 21 million coins.

Litecoin was launched in 2011 by former Google engineer Charlie Lee. He aimed to make Bitcoin lighter and faster — keeping its reliability while improving transaction speed and reducing fees. Hence the name “Lite-coin.”

Key Differences Between Bitcoin and Litecoin

1. Transaction Speed

Bitcoin produces a new block approximately every 10 minutes, while Litecoin does it every 2.5 minutes. As a result, Litecoin confirms transactions faster and can handle a higher number of them within the same period.

2. Transaction Fees

In 2025, the average Litecoin fee remains around $0.01–$0.03, while Bitcoin typically costs $1–$2 or more during network congestion. This makes Litecoin a practical choice for microtransactions and low-cost transfers.

3. Supply and Emission

Bitcoin has a capped supply of 21 million coins. Litecoin increases this limit to 84 million — four times higher — preserving the same scarcity ratio but offering more liquidity in circulation.

4. Mining Algorithm

Bitcoin uses SHA-256, requiring powerful ASIC miners. Litecoin applies Scrypt, initially allowing mining with GPUs and CPUs, although ASIC devices are now common. Litecoin mining remains slightly more decentralized and energy-efficient.

5. Technology and Upgrades

- SegWit and Lightning Network are available on both chains, improving transaction speed and scalability.

- Litecoin was the first to activate Taproot and MimbleWimble, enhancing privacy.

- Bitcoin focuses on institutional adoption and long-term stability, while Litecoin remains a testing ground for innovation.

Market Position and Adoption

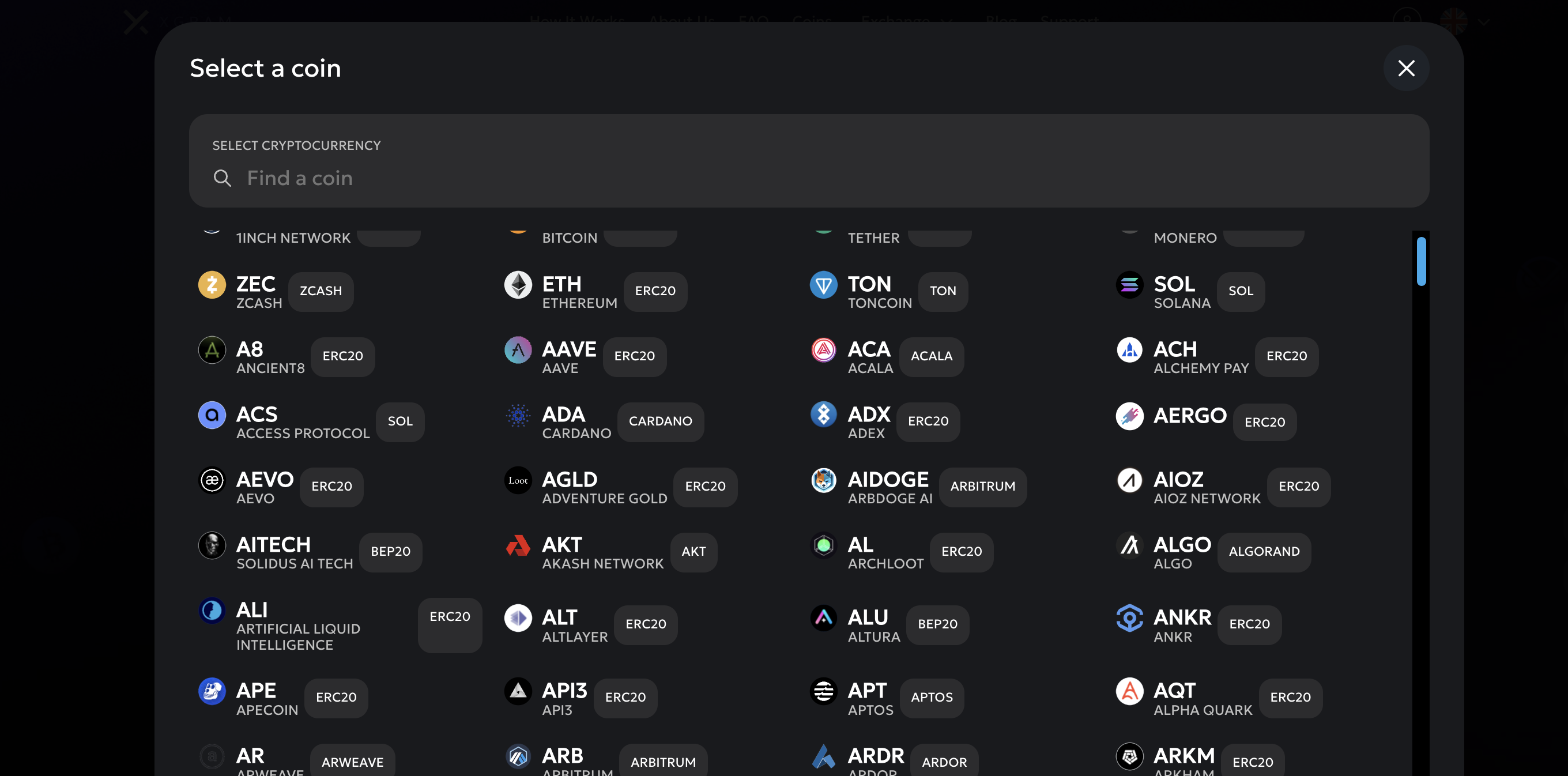

Bitcoin remains the dominant cryptocurrency with the highest market capitalization and trust. It’s accepted globally, supported by institutions, and serves as the base trading pair on nearly every exchange. Litecoin, while smaller, consistently ranks among the top 20 coins and is supported by most wallets and swap platforms, including Xgram.io.

How to Swap BTC and LTC via Xgram

If you want to quickly exchange Bitcoin for Litecoin (or vice versa), you can use Xgram.io — a no-KYC crypto swap service. It’s fast, transparent, and doesn’t require registration. Here’s how it works:

- Select the swap pair (BTC → LTC or LTC → BTC) on the main page.

- Enter your wallet address and the amount you want to exchange.

- Xgram shows the final rate and fees before confirming the trade — no hidden charges.

- Send your crypto, and after 1–2 confirmations, your exchanged coins arrive automatically.

This is one of the simplest and most private ways to convert between Bitcoin and Litecoin in 2025.

Which One Should You Choose in 2025?

- Bitcoin — ideal for long-term holding, large transfers, and as a hedge against inflation.

- Litecoin — perfect for fast, everyday transactions and smaller payments with minimal fees.

Many investors use both: Bitcoin as a store of value and Litecoin as a medium of exchange.

Final Thoughts

Bitcoin and Litecoin are not rivals but complements. Bitcoin leads in adoption and security, while Litecoin brings flexibility and speed to everyday use. In 2025, both continue to serve different but equally important purposes in the evolving crypto economy.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always research before investing in cryptocurrencies.