Entenda os fundamentos do Litecoin

Antes de iniciar o processo de venda, vale entender o que é o Litecoin e por que as pessoas compram e vendem esse ativo.

Litecoin foi lançado em 2011 como uma versão “leve” do Bitcoin. Assim como o BTC, é descentralizado e não controlado por uma única entidade. Porém, muitos investidores veem o Litecoin como uma rede mais rápida para transações do dia a dia, com taxas mais baixas em média.

Você pode ter adquirido LTC como investimento de longo prazo, por meio de trading ativo ou como forma de pagamento. Com o tempo, o Litecoin passou a ser listado na maioria das grandes exchanges, o que facilita sua conversão para moedas fiduciárias ou outras criptos.

Ao planejar a venda, é inteligente considerar o mercado. O preço do Litecoin, assim como de qualquer cripto, é afetado por oferta, demanda e condições macroeconômicas. Momentos de alta demanda podem render preços melhores. Porém, acertar o timing perfeito é difícil, então é melhor manter expectativas realistas.

Alguns conceitos importantes:

- Volatilidade: os preços podem subir e cair rapidamente.

- Liquidez: quanto mais liquidez, mais fácil vender LTC sem impacto negativo no preço. As grandes exchanges normalmente oferecem boa liquidez.

- Gestão de carteira: é essencial acompanhar endereços, depósitos e saídas.

Com esses fundamentos, você estará mais preparado para decidir como e quando vender LTC.

Compare suas opções de venda

Ao vender Litecoin, você tem alguns caminhos. Cada um tem vantagens e desvantagens — escolha o que combina com seu nível de experiência, prazo e tolerância a taxas.

Exchanges centralizadas

São plataformas como Coinbase, Binance e outras. Elas armazenam seu LTC em carteiras custodiadas. Após a verificação KYC, você pode usar ferramentas de negociação como ordens limit e market. A liquidez costuma ser alta, permitindo vendas rápidas. O ponto negativo é a necessidade de verificação e as taxas de saque para bancos.Serviços descentralizados ou trocas instantâneas

DEXs permitem negociar criptos sem controle centralizado. Mas nem todas suportam LTC. Alternativamente, serviços de troca instantânea não exigem conta e permitem conversões rápidas — porém, geralmente com taxas ou taxas de câmbio menos favoráveis.Plataformas P2P

Marketplaces P2P conectam compradores e vendedores diretamente. Você escolhe o método de pagamento (transferência bancária, PayPal, dinheiro) e negocia o preço. O escrow mantém o LTC bloqueado até que você confirme o recebimento do pagamento. É uma opção mais privada, mas que exige atenção à reputação dos usuários.

Quanto às taxas, cada plataforma tem seu modelo. Algumas cobram taxa fixa; outras, porcentagem. Compare também os prazos de saque. Se a prioridade for velocidade, uma exchange ou serviço instantâneo pode ser melhor. Se for privacidade ou métodos específicos de pagamento, o P2P faz mais sentido.

Siga o processo padrão de uma exchange

Se você prefere um ambiente estruturado, as exchanges centralizadas oferecem um fluxo de venda claro e organizado.

Crie e verifique sua conta

Cadastre-se em uma exchange que suporte pares LTC–fiat ou LTC–cripto. A maioria das plataformas populares aceita Litecoin. Após o cadastro, faça a verificação KYC enviando seus documentos (passaporte, identidade etc.). A aprovação pode levar de minutos a alguns dias.

Deposite seu Litecoin

Para vender LTC, primeiro transfira-o de sua carteira pessoal para o endereço de depósito da exchange. Acesse a área de depósitos, copie o endereço e envie o LTC. Dependendo das confirmações da rede, o saldo pode levar alguns minutos para aparecer. Algumas exchanges não cobram taxa de depósito, outras sim.

Faça sua ordem de venda

Com o LTC na conta, você pode criar uma ordem de venda. Normalmente existem dois tipos:

- Ordem a mercado (Market): vende imediatamente pelo preço atual.

- Ordem limitada (Limit): você define o preço desejado; a venda ocorre somente quando o mercado atinge esse nível.

A ordem a mercado é mais rápida; a limitada dá mais controle sobre o preço. Confira o livro de ordens para entender a liquidez e o spread.

Saque seus fundos

Depois que a venda for concluída, o saldo será convertido na moeda escolhida — fiat ou outra cripto. Se for fiat, vá até a seção de saques, insira sua conta bancária e confirme. O prazo pode variar de horas a dias, dependendo da plataforma e do banco. Verifique sempre as taxas antes de finalizar.

Explore a venda P2P

Se você prefere uma conexão mais direta com compradores ou precisa de um método de pagamento que exchanges não suportam, plataformas P2P podem ser uma boa solução. Apesar de mais pessoais, exigem cautela extra.

Escolhendo uma plataforma P2P

Busque plataformas com um sistema sólido de escrow e boa reputação. O escrow segura seu Litecoin até que o comprador confirme o pagamento. Depois que você verificar que o dinheiro chegou, o LTC é liberado. Leia avaliações de usuários e investigue sinais de alerta, como contas suspeitas ou disputas frequentes.

Criando seu anúncio

Na maioria dos marketplaces P2P, você pode criar um anúncio definindo:

- Quantidade de LTC que deseja vender

- Moeda que quer receber (USD, EUR, BRL etc.)

- Métodos de pagamento aceitos

- Taxa de câmbio desejada

O anúncio aparece para compradores potenciais. Alguns vendedores preferem preços competitivos para vender rápido; outros colocam um valor acima do mercado para maximizar lucro, mesmo que a venda leve mais tempo.

Realizando a negociação

Quando um comprador aceita sua oferta, o LTC é movido para o escrow. Comunique-se pelo chat da plataforma, confirme o método de pagamento e peça para ser avisado quando o pagamento for enviado. Sempre verifique se o valor caiu na sua conta bancária ou carteira digital antes de liberar o LTC.

Fique seguro

- Siga as regras da plataforma para resolver disputas.

- Evite conversar fora da plataforma — isso remove sua proteção.

- Perfis bem avaliados tendem a ter taxas menores ou destaque nas buscas.

Com atenção, vender Litecoin via P2P pode ser eficiente e mais flexível.

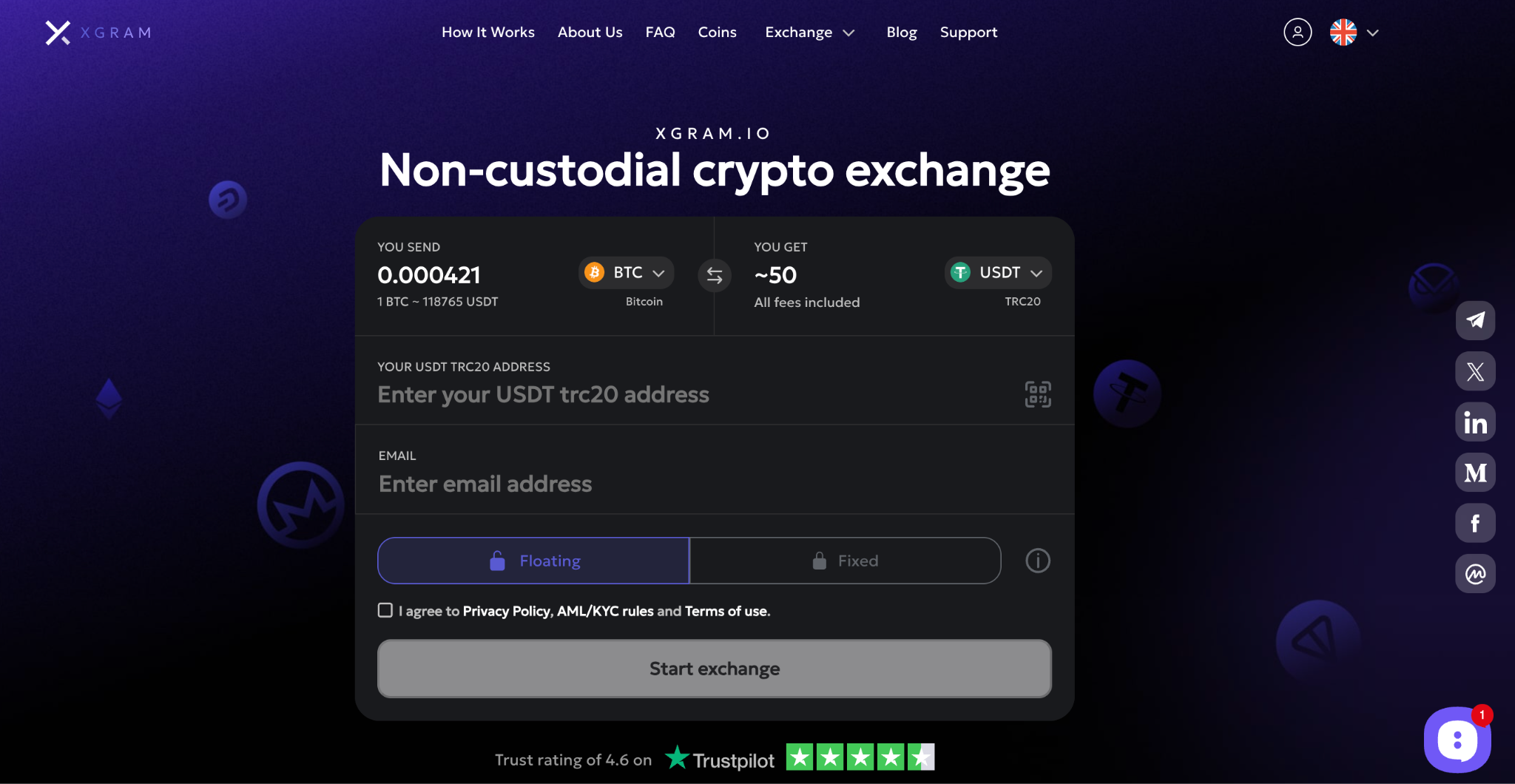

Experimente swaps com Xgram

Além dos métodos tradicionais, você talvez queira uma troca mais rápida e com menos taxas. O Xgram permite não só swaps comuns, mas também conversões cross-chain sem conectar carteira externa. Isso facilita trocar LTC para outra blockchain sem usar bridges complexas.

- O Xgram não exige integração de carteira externa, simplificando o processo.

- As taxas tendem a ser menores, especialmente em operações cross-chain.

- A interface é fácil de entender e mostra a quantia final antes da troca.

- Até iniciantes conseguem usar sem dificuldades.

- Evita etapas extras como conectar várias carteiras ou configurar bridges.

Se você quer converter LTC de forma rápida e sem complicações, o Xgram pode ser a opção ideal.

Evite erros comuns

Para proteger seus fundos e sua tranquilidade, fique atento a estes erros frequentes:

Endereço incorreto

Copie e cole com cuidado. Um caractere errado pode fazer você perder LTC para sempre.Phishing e sites falsos

Golpistas criam clones de exchanges ou enviam e-mails falsos. Verifique URLs e evite clicar em links aleatórios.Ignorar taxas

Venda de LTC envolve tarifas de rede, taxas de negociação, saques e até escrow no P2P. Sempre calcule o valor líquido final.Regulamentações locais

Algumas plataformas não funcionam em certos países. Confira as regras antes para evitar congelamento de contas.Pressa na transação

P2P exige atenção. Só libere LTC após confirmar o pagamento real.Negligenciar segurança

Use 2FA, senhas fortes e mantenha backups dos dados importantes.Falta de pesquisa

Fique atento ao preço do LTC e evite vender em momentos emocionalmente críticos.

Perguntas frequentes (FAQ)

Posso vender Litecoin por dinheiro vivo?

Sim. Algumas exchanges permitem saque em conta bancária após converter LTC para fiat. Plataformas P2P também possibilitam vendas presenciais, mas sempre se encontre em locais seguros e use escrow.Qual é o valor mínimo de LTC que posso vender?

Depende da plataforma. Exchanges têm volumes mínimos, mas geralmente baixos. No P2P, depende do comprador.Posso vender LTC armazenado em carteira hardware?

Sim. É só enviar seu LTC da hardware wallet para o endereço da exchange ou do comprador. Você pagará apenas a taxa de rede.Como reduzir taxas ao vender LTC?

Compare várias plataformas, escolha horários de baixa congestão da rede e avalie instant swaps cuidadosamente.Posso vender LTC por outras criptomoedas como BTC ou ETH?

Claro. Exchanges oferecem pares como LTC/BTC e LTC/ETH. Cross-chain swaps como Xgram também tornam isso ainda mais rápido.

Seus próximos passos

Agora que você entende como vender Litecoin, escolha o método que combina com seu perfil. Exchanges oferecem estrutura; P2P oferece privacidade; swaps instantâneos oferecem velocidade. Plataformas como Xgram fornecem conversões cross-chain rápidas sem precisar conectar carteiras.

Verifique taxas, confirme endereços e permaneça atento a possíveis golpes. Com um plano claro e precauções adequadas, você consegue vender LTC sem dor de cabeça e gerenciar seus fundos com mais confiança.