TL;DR:

If you want to learn how to sell crypto to credit card quickly and safely, focus on choosing the right platform, verifying your identity, and minimizing fees. Start by comparing centralized exchanges, peer-to-peer (P2P) marketplaces, and instant swap services. Protect yourself from hidden charges by examining fee schedules and transaction limits in advance. Once you confirm your payment details, execute the sale in just a few clicks and watch your credit card balance update.

Understand the basics of selling crypto to credit card

Selling your cryptocurrency directly to a credit card involves converting digital assets into fiat currency and loading that fiat onto your card. The transaction can happen on multiple types of platforms such as centralized exchanges, peer-to-peer (P2P) networks, or instant swap services. Before choosing a route, you want to understand the basic steps so you avoid costly errors.

- You select your crypto (e.g., Bitcoin, Ethereum, or any other supported coin).

- You initiate the sell order.

- The platform processes your exchange from crypto to fiat (usually USD, EUR, or another local currency).

- Funds appear on your credit card, sometimes immediately, sometimes after a short processing period.

One advantage of selling to a credit card is convenience. Once your account is set up and your card is verified, you can initiate a sale and receive funds fairly quickly. The main drawback is the potential for hidden fees or unfavorable exchange rates, so it’s important to review all costs before confirming a transaction.

Choose your platform

Deciding on the right platform is pivotal. While many claim to offer the best rates or the simplest experience, each carries unique pros and cons. Focus on transparency, user reviews, fee structures, and its overall liquidity.

1. Centralized exchanges

Major centralized exchanges are popular for their robust infrastructure and stable trading environment. They typically have large user bases, which helps maintain solid liquidity. You can easily list a sell order and withdraw your money to a credit card once your transaction is finalized.

- Pros: High liquidity, established reputation, added security features.

- Cons: Potentially longer verification time, varying transaction fees, and occasional withdrawal delays.

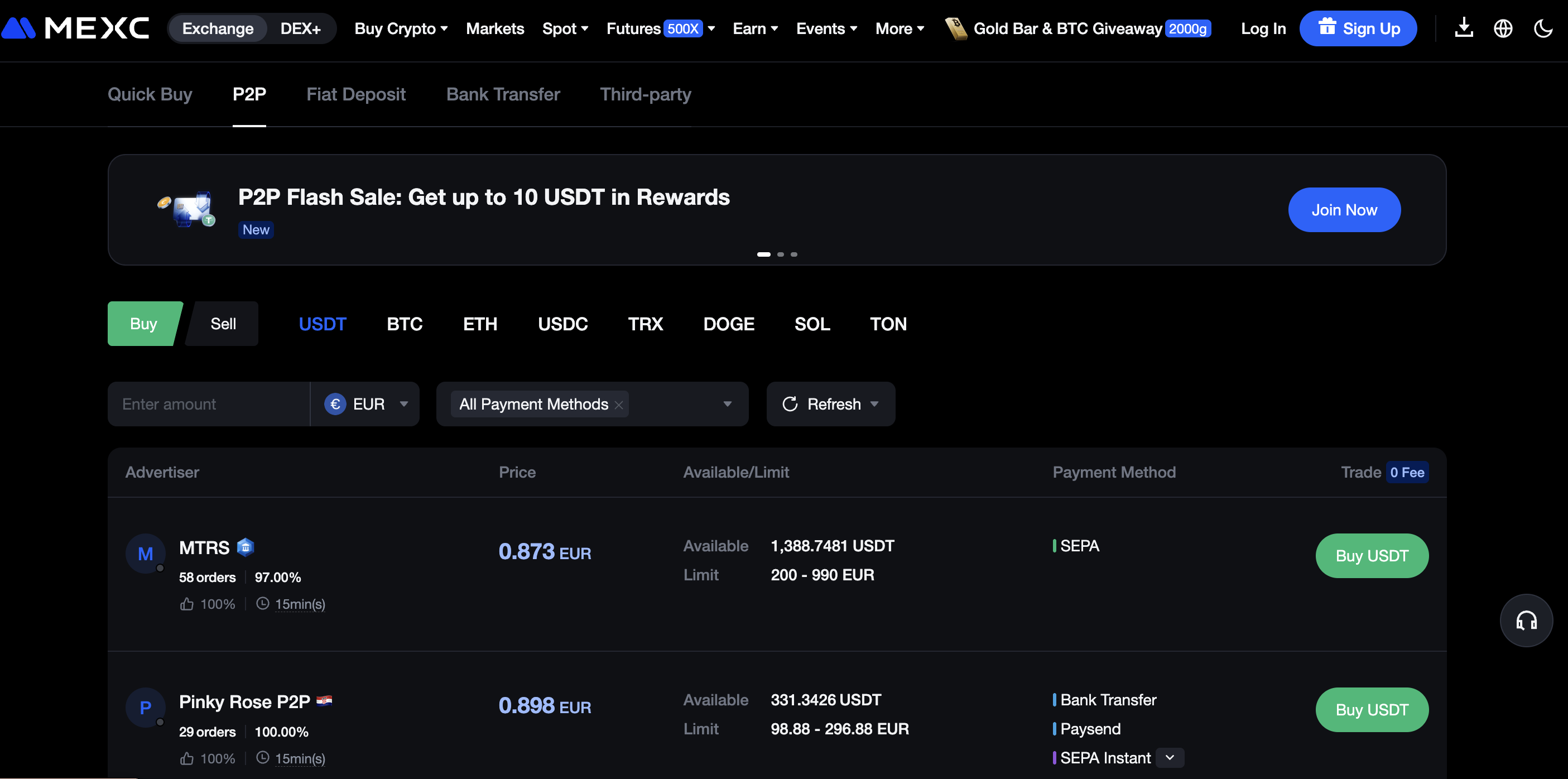

2. Peer-to-peer (P2P) marketplaces

P2P platforms match you directly with another individual who wants to buy your crypto. You set (or accept) a price, handle the exchange, and receive funds on your credit card or sometimes via other methods.

- Pros: Direct control over pricing, flexible payment options.

- Cons: Trust depends on verifying the buyer’s credibility, transaction speeds can vary.

3. Instant swap services

An instant swap service allows you to trade your Bitcoin, Ethereum, or other coins instantly for fiat, which then goes to your credit card. These services are typically designed for simplicity.

- Pros: Speed and intuitive interfaces, minimal steps.

- Cons: Exchange rates can be less favorable than on other networks, and fees might be higher for large transactions.

Weigh these options based on your experience level, desired speed, and fee sensitivity. If you’re new to crypto, it might be safer to use a well-known, centralized platform at first. If you’re comfortable reading reviews, verifying counterparties’ reputations, and carefully negotiating rates, you might love the freedom of P2P.

Set up your card for crypto transactions

Once you know which platform you will use, make sure your credit card is ready for crypto-related transactions. Different banks have varying policies, so you don’t want to get stuck mid-transaction because your card issuer flags the charge.

- Call your bank or log in to your account to confirm any restrictions for crypto transactions.

- Check your credit limit to ensure you don’t exceed daily or monthly purchase or withdrawal amounts.

- Keep track of any international transaction fees if you’re dealing with a platform based in another country.

- Verify if there are any additional steps required for your card issuer to allow deposits.

Proactive communication with your bank can save you from unexpected declines or blocked transactions. You might also get a clearer picture of the fees your bank charges, which you can add to your overall cost calculation.

Verify your identity

Identity verification is a basic requirement in most countries to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Even if you’re simply selling crypto to a credit card, many platforms will want documents verifying who you are, where you live, and possibly how you acquired your crypto.

- A typical process involves submitting a government-issued ID or passport, proof of address, and a selfie.

- Verification can take anywhere from a few minutes to several days.

- Once you’re verified, your daily transaction or withdrawal limits often increase, allowing you to move larger amounts in a single go.

If you foresee regular trades, you might want to complete the highest verification tier. This can prevent future delays when you’re in a hurry to convert crypto into fiat.

Execute the sale

After your identity is verified and your credit card is linked, you’re ready to sell. The exact steps vary from platform to platform, but the general workflow remains consistent.

1. Initiate the transaction

Go to the “Sell” or “Convert” section of your platform. Select which crypto you’re converting, how much you intend to sell, and choose credit card as your withdrawal or “deposit-to” method. The platform should display an estimated conversion price and may detail the transaction fee.

2. Confirm exchange details

Review all fees, exchange rates, and expected timelines. Some platforms quote a small fee but mark up the exchange rate, and others do the opposite. Double-check that you understand the true cost.

3. Wait for processing

For smaller payments on established exchanges or instant swap services, your crypto might convert to fiat and land on your card almost instantly. With P2P trades, you typically wait for the buyer to confirm payment. Once the transaction finalizes, you’ll see your updated credit card balance.

Consider potential fees and hidden costs

Fees can erode your profits if you’re not careful. Even if a platform advertises a low commission, the final cost of your transaction can be higher than expected.

- Platform fees: Some charge a flat fee, while others take a percentage.

- Blockchain network fees: Depending on congestion, sending crypto on-chain can be expensive, especially for coins like Ethereum.

- Currency conversion fees: If you’re receiving funds in a different currency than your card’s default, your bank can charge an additional exchange fee.

- Credit card provider fees: Some credit card companies classify crypto transactions as “cash advances,” which often trigger a higher interest rate and additional charges.

Study all these charges, so you don’t lose out on your well-earned gains. If the platform you’re using is transparent, it should clearly itemize each fee before finalizing your transaction. When in doubt, reach out to support or consult community forums to learn from other users’ experiences.

Avoid common pitfalls

When you’re learning how to sell crypto to credit card, it’s easy to slip up. Beginners often run into common snags that can cause delays, rejections, or extra charges.

Wrong blockchain network

Selecting the wrong blockchain network for your deposit or withdrawal can result in lost funds. Confirm that your sending and receiving addresses support the same network.Ignoring local regulations

Some regions place strict regulations on crypto transactions. Research your jurisdiction’s laws first, especially if you plan on moving large amounts in or out of your accounts.Overlooking processing time

Even credit card instant transfers can be subject to daily transaction cutoffs, meaning your funds might appear the next business day. If you need immediate access to money, check the platform’s published timelines.Falling for phishing

Malicious sites mimic legitimate platforms to steal your credentials. Always verify the website’s URL and consider bookmarking it. Use two-factor authentication to protect your account from unauthorized access.Not tracking fees

If you forget to tally up blockchain fees, platform commissions, and card charges, you might end up with a smaller payout than planned. Keep a running total of these costs so there are no surprises.

Where Xgram helps you save

Xgram is a user-friendly exchange that supports multiple crypto conversions, including the ability to sell to a credit card. You don’t need to connect a personal wallet to get started, making the onboarding process simpler. Xgram features clear fee breakdowns, so you see exactly what you’ll pay from the start. Transaction times are typically short, and you can initiate trades almost instantly. With no complicated wallet integrations, you cut down on time spent understanding address formats and network fees. Additionally, Xgram regularly runs promotions that waive certain transaction costs, enabling you to maximize your profits when selling your crypto to a credit card.

FAQs

Can I sell only Bitcoin or can I convert other cryptocurrencies too?

Yes, you can sell various cryptocurrencies like Ethereum, Litecoin, or XRP to a credit card if the platform you choose supports them. Check the list of supported coins before you sign up.How quickly do funds appear on my credit card?

Processing times depend on the platform, your card issuer, and your region. Some exchanges or swap services provide nearly instant conversions. Others can take a few hours or even a day.Do I have to pay taxes when I sell crypto to my credit card?

Tax obligations differ by country. Generally, selling crypto is considered a taxable event, so consult your local regulations or a tax professional to ensure you’re meeting your reporting requirements.What if my card transaction gets declined?

First, contact your bank or credit card provider to see if there’s a restriction on crypto transactions. If the bank confirms everything is allowed, you might need to check the platform’s settings or your daily transaction limits.Is it safe to store my credit card information on a crypto exchange?

Reputable platforms take precautions such as encryption and robust security practices, but it’s always wise to use unique passwords, enable two-factor authentication, and monitor your statements for any unusual charges. If you’re unsure, consider removing your card after each transaction or keeping to smaller trades.

Selling cryptocurrency to a credit card doesn’t have to be complex or costly. By choosing a reputable platform, verifying your identity, and understanding all fees, you reduce the chance of confusion or big mistakes. Keep an eye on every stage of your transaction from selecting your crypto type to confirming the deposit on your card so you can enjoy smooth, quick payouts and optimize your earnings.