Understanding KYC vs. no-KYC

You may have heard the term “KYC” or “Know Your Customer” in crypto circles. It generally means you must provide personal documents to verify your identity on an exchange before you sell or trade Bitcoin. Many mainstream exchanges use KYC to comply with regulations, but this can feel cumbersome if you prefer more privacy and efficiency.

Opting for no-KYC methods typically involves working with platforms or individuals who do not require extensive ID checks. This approach can save you time if you need instant liquidity. However, you should still exercise caution, as the idea of skipping verification can come with its own set of risks. Always decide on a reputable channel to protect your funds.

Why sell Bitcoin in Dubai

Dubai has built a strong reputation as a global hub for finance and innovation, including the growing crypto market. Here are a few reasons why you might find it worthwhile to sell your Bitcoin in Dubai without KYC:

Economic vitality

Rapid growth in trade and business means plenty of buyers and sellers are active in the city. With more participants, your chance of finding favorable deals often increases.Crypto-friendly attitude

Authorities have shown a relatively open approach to blockchain initiatives. You will find specialized meetups, coworking spaces, and a variety of services dedicated to crypto enthusiasts.Large expatriate community

Dubai is home to individuals from many countries, and many need fast ways to move funds or convert digital assets. This demand can make your Bitcoin a hot commodity.Diverse trading methods

Dubai has a growing range of OTC desks, P2P platforms, and even physical offices for in-person transactions. You can select from multiple avenues to fit your comfort level.Privacy-minded culture

Many locals value discretion in financial affairs. If maintaining anonymity is important to you, Dubai has several structures that keep transactions low-profile.

Step-by-step guide to selling Bitcoin in Dubai without KYC

When you decide to sell your Bitcoin without KYC in Dubai, you have multiple pathways. Below is a step-by-step layout to help you navigate the process.

1. Choose your selling method

No single solution works for everyone, so pick the one that fits your timeline, privacy needs, and transaction size.

Peer-to-peer platforms

P2P marketplaces connect you directly with individual buyers. Some allow trades by simply creating an account with minimal or no ID checks. You typically coordinate a payment method (bank transfer, cash, e-wallet) and arrange the deal privately.

- Pros: Direct negotiation often means better price control. You can choose from various local payment methods.

- Cons: You must vet the buyer’s credibility, and there can be a higher risk of fraud without an intermediary.

Crypto ATMs

Crypto ATMs are kiosks where you can sell Bitcoin or other cryptos in exchange for local currency. While some ATMs do require phone verification or an ID scan, there are models in certain locations that skip that step for smaller amounts.

- Pros: Quick turnaround, usually in minutes. Ideal if you want physical cash.

- Cons: Fees can be high, and limits are sometimes lower. Locations may not always be convenient.

OTC shops

Over-the-counter shops in Dubai cater to clients who want to buy or sell large amounts of crypto quickly. Many of these shops do not insist on full KYC for smaller trades. You can walk in, hand over your Bitcoin, and walk out with cash.

- Pros: Convenient for higher-volume trades. You often get personalized service and immediate settlement.

- Cons: You must travel in person, and fees may vary by location and transaction size.

2. Secure your Bitcoin

Before initiating the trade, make sure that your Bitcoin is stored in a wallet you control, such as a hardware wallet or a non-custodial software wallet. This ensures you can transfer your BTC at a moment’s notice if you find a great deal.

- Double-check wallet addresses: Mistyping the recipient address is one of the easiest ways to lose your crypto.

- Guard your private keys: Keep these offline and never share them with anyone, especially when trying to sell your Bitcoin.

- Use two-factor authentication: If available, enable 2FA or other security measures for added protection.

3. Confirm transaction details

If you are finalizing the sale through a P2P platform, confirm each step with the buyer:

- Agree on the final price in AED (United Arab Emirates Dirham) or another currency you prefer.

- Decide which payment method is used (cash in person, local bank transfer, e-wallet).

- Wait for the buyer to confirm they are ready, and only then proceed to transfer your Bitcoin.

- Ensure you receive the payment in full before you release the BTC from escrow (if available) or from your wallet.

For OTC shops or crypto ATMs, double-check their hours, fees, and proof of transaction. Some shops will handle the entire process step-by-step and guide you through.

4. Cash out

Once you have reached an agreement and verified payment, the final step is to cash out or, in some cases, receive another digital asset. If you prefer the local currency, make sure you have physically counted the cash or confirmed the bank deposit. For stablecoins, confirm the correct wallet address and network before you complete the sale.

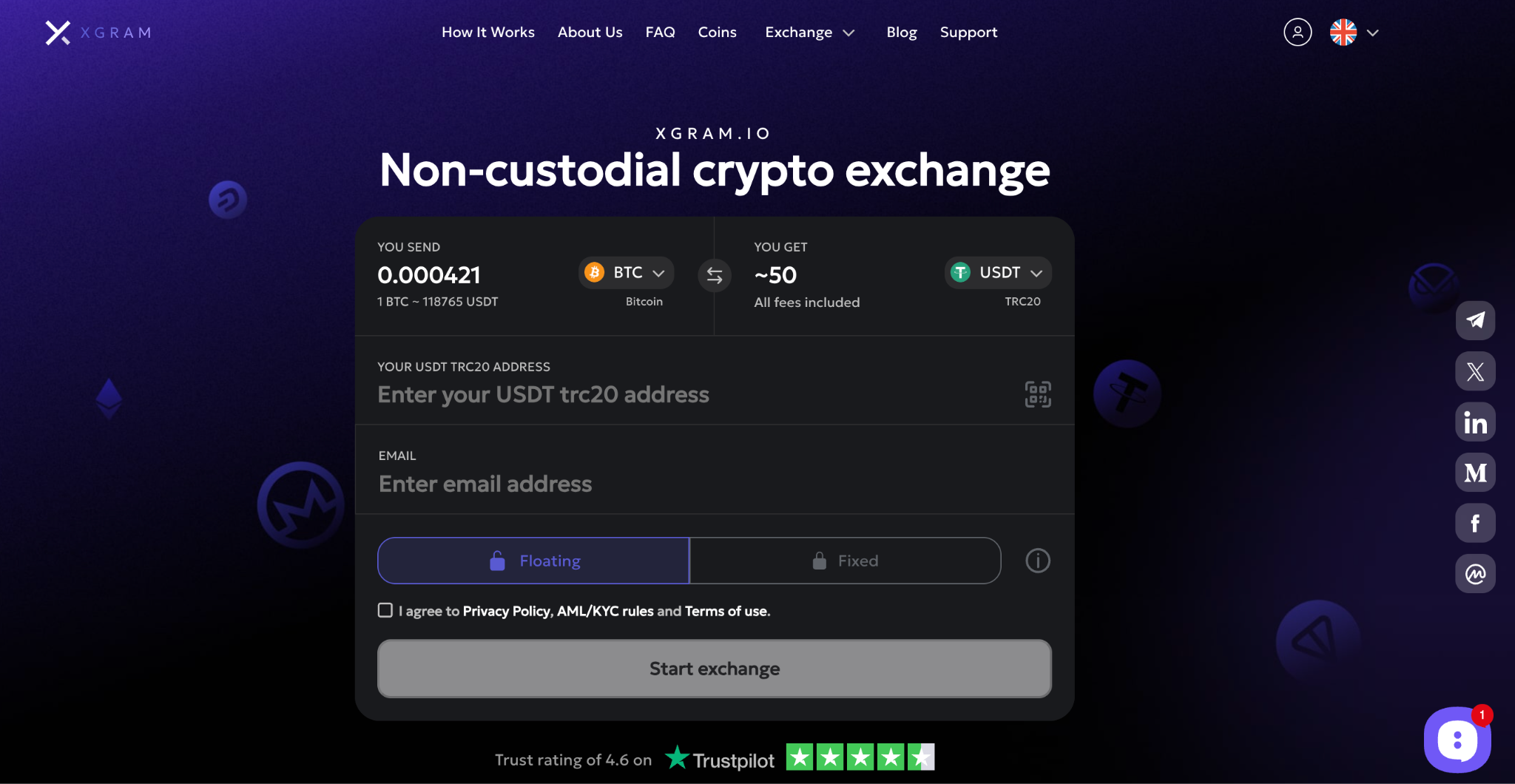

Xgram as a flexible exchange

When you are looking for a versatile, no-KYC option to exchange Bitcoin or altcoins while minimizing fees, Xgram can be an appealing platform. It requires no connected crypto wallet, so you retain more control over your funds and personal data. The system allows you to carry out both standard crypto swaps and more direct trades without tedious verification steps. The interface is streamlined, making it easy to set up a transaction at any time. With its user-friendly design, Xgram positions itself as a convenient choice for converting crypto into local or digital currencies without the usual friction.

Tips for secure and fast transactions

You can accelerate your Bitcoin sales in Dubai while staying safe when you adopt a few best practices along the way:

Check reputations

If you use a P2P platform or engage with an OTC shop, do some background research. Look for user reviews, discussion boards, or personal recommendations that confirm reliability.Stick to smaller test trades

If you are uncertain about a platform or a buyer, start with a small test transaction. This can help you confirm the process without risking large sums.Watch out for price fluctuations

The crypto market can swing significantly in a short span. Keep an eye on live market rates and consider setting a limit price if you are dealing with a buyer directly.Use secure communication channels

If you are discussing deals online, do so through encrypted apps (if possible). Avoid sharing sensitive wallet details over unencrypted channels like social media DMs.Maintain personal safety

For in-person meetings, try to pick public places with cameras or choose official OTC counters in known business areas. Do not reveal details about how much cryptocurrency you hold.

Potential fees and hidden costs

Selling Bitcoin without KYC often carries unique fees. Some are explicit, while others may be baked into the exchange rate. Here are common charges to keep on your radar:

- Market spread: Platforms might not charge a fixed fee but quote lower buy prices or higher sell prices to generate profit.

- Withdrawal fees: Even if a sale is quick, you might pay a network fee when sending Bitcoin from your wallet to a buyer or business.

- Platform fees: P2P platforms, OTC providers, or ATM operators may charge a flat percentage.

- Currency conversion fees: If you receive a different currency (like USD) instead of AED, you might need to convert it again.

Ask for a breakdown of any fees before you finalize a transaction. By knowing the total cost, you can compare offers and choose the best route.

Frequently asked questions

How fast can I sell Bitcoin in Dubai without KYC?

The speed depends on which method you pick. An OTC shop or a crypto ATM could complete the sale within minutes, while a P2P deal could take a few hours if the buyer needs time to fund their account or meet in person. Generally, you can wrap up the entire process quickly if you choose a well-established channel.Do I need any ID at all when selling Bitcoin without KYC?

Many OTC providers and P2P platforms do not ask for formal IDs if your trade size stays below a certain threshold. Still, you may be asked for minimal information like a phone number or an email address for communication. Always read the platform’s terms, as some require partial verification even if they label themselves “no-KYC.”Is it legal to sell my Bitcoin in Dubai without KYC?

Dubai is known for its favorable stance on crypto, but you remain responsible for following local rules. The concept of “no-KYC” typically reflects a platform’s own process. It does not mean you can ignore all regulations. If you are concerned about your obligations, consult legal advice based on your situation.What payment methods are common in Dubai for selling Bitcoin?

Bank transfers, cash, and e-wallets (like Payit or cash-based solutions) are popular. For minimal friction, many people prefer direct cash transactions in a safe, public location. Bank transfers are also common but might require more coordination with the buyer to clarify bank details.How can I ensure I get a fair price for my Bitcoin?

Compare different options before you commit. Look at price quotes on P2P platforms, check the rates at well-known OTC desks, or verify the exchange rate on popular crypto price trackers. By staying informed, you can gauge which parties offer fair deals and which ones simply push a lower buy price.

Conclusion

Selling your Bitcoin in Dubai without KYC can be a straightforward and efficient process once you know where to go. By exploring P2P platforms, crypto ATMs, OTC shops, or versatile exchanges like Xgram, you have numerous ways to leverage the strong market demand. Just remember to stay alert to fees and carefully confirm each step of the transaction. With a bit of planning and diligence, you can convert your crypto to cash or stablecoins in one of the Middle East’s most dynamic financial centers — all while maintaining a level of privacy and speed that matches your goals.