TL;DR (3–4 sentences) Selling Bitcoin fast usually means choosing a reputable service that completes trades quickly, like instant swap sites or well-known exchanges. P2P platforms can also be fast if you choose high-rated buyers or sellers. Be sure to factor in fees, security measures, and local regulations that might affect your transaction. With some preparation, you can have funds in hand in minutes or hours, rather than days.

Understand the basics

You have probably come across countless options to sell Bitcoin. Each option comes with different fees, speeds, and steps. To decide which approach fits you best, it helps to first explore the reasons you may need a fast sale and how those needs shape your strategy.

Why speed matters

- Market volatility: Crypto prices can swing dramatically in a single day. If you see a favorable price, you might not want to wait.

- Urgent liquidity: Sometimes you need cash right away, so a multi-day withdrawal is not ideal.

- Time-sensitive opportunities: Perhaps you plan to reinvest in something else. A quick sale can help you take advantage of fast-moving market events.

Key factors that affect your selling strategy

- Verification requirements: Some platforms need ID checks or KYC before trading. Although this can be quick, it still adds a step.

- Accepted payment methods: PayPal, wire transfers, credit cards, and other methods vary in speed and cost.

- Fees and spreads: A low visible fee might come with a poor exchange rate, so compare total costs.

- Local regulations: In some regions, certain methods may be limited or take longer due to compliance rules.

Popular ways to sell bitcoin fast

When it comes to how to sell Bitcoin fast 2025, you have three primary paths. Each path has strengths and best-use scenarios. Check which one feels right for your comfort level and transaction speed goals.

Centralized exchanges

Centralized exchanges (CEXs) are the most common route for converting Bitcoin to fiat or other assets. Examples include large global platforms that handle millions of transactions daily.

Advantages:

Typically offer high liquidity.

Provide a straightforward interface with charts and order books.

Often have multiple withdrawal methods, including direct bank deposits.

Considerations:

Some require lengthy ID verification if you are a new user.

Withdrawal can take a few business days, depending on your bank.

Fees vary depending on trading volume, withdrawal options, or your country.

If you decide a CEX is for you, always keep an eye on how quickly they process bank transfers or instant cash-out features. Some might deliver same-day transfers, while others can stretch to several days.

P2P platforms

Peer-to-peer (P2P) platforms connect you directly with buyers or sellers. These sites use escrow services to protect both sides until the transaction is complete.

Advantages:

Flexible payment terms and many methods (bank transfer, gift cards, cash in person, PayPal, etc.).

Potentially better rates if you shop around.

Some require less formal identification, though guidelines differ by platform.

Considerations:

You rely heavily on user reputation. Always check the ratings and reviews of the person you want to trade with.

Scammer risk is higher if you do not follow recommended escrow procedures.

Speed depends on how quickly your chosen partner responds or releases the funds.

Despite the potential for a fast transaction, your biggest time factor is finding a reputable buyer or seller with an attractive rate who is online at the same time. Once you make the connection, a P2P trade can finalize in a matter of minutes if all goes well.

Instant swap services

Instant swap services focus on quick crypto-to-crypto or crypto-to-fiat conversions. You might see these integrated in wallets or standalone sites that let you input the amount to sell and the currency you want in return.

Advantages:

Extremely quick if you already hold Bitcoin in a wallet.

Usually skip advanced trading interfaces.

Some do not require a formal account, although they might have transaction limits.

Considerations:

Rates may be slightly higher than on large exchanges, so compare the overall cost.

Depending on the service, you could have fewer payout options (e.g., only certain currencies).

If your top priority is speed, these services give you near-instant conversions with minimal steps. You might pay a small premium for convenience, but the time you save could be worth it.

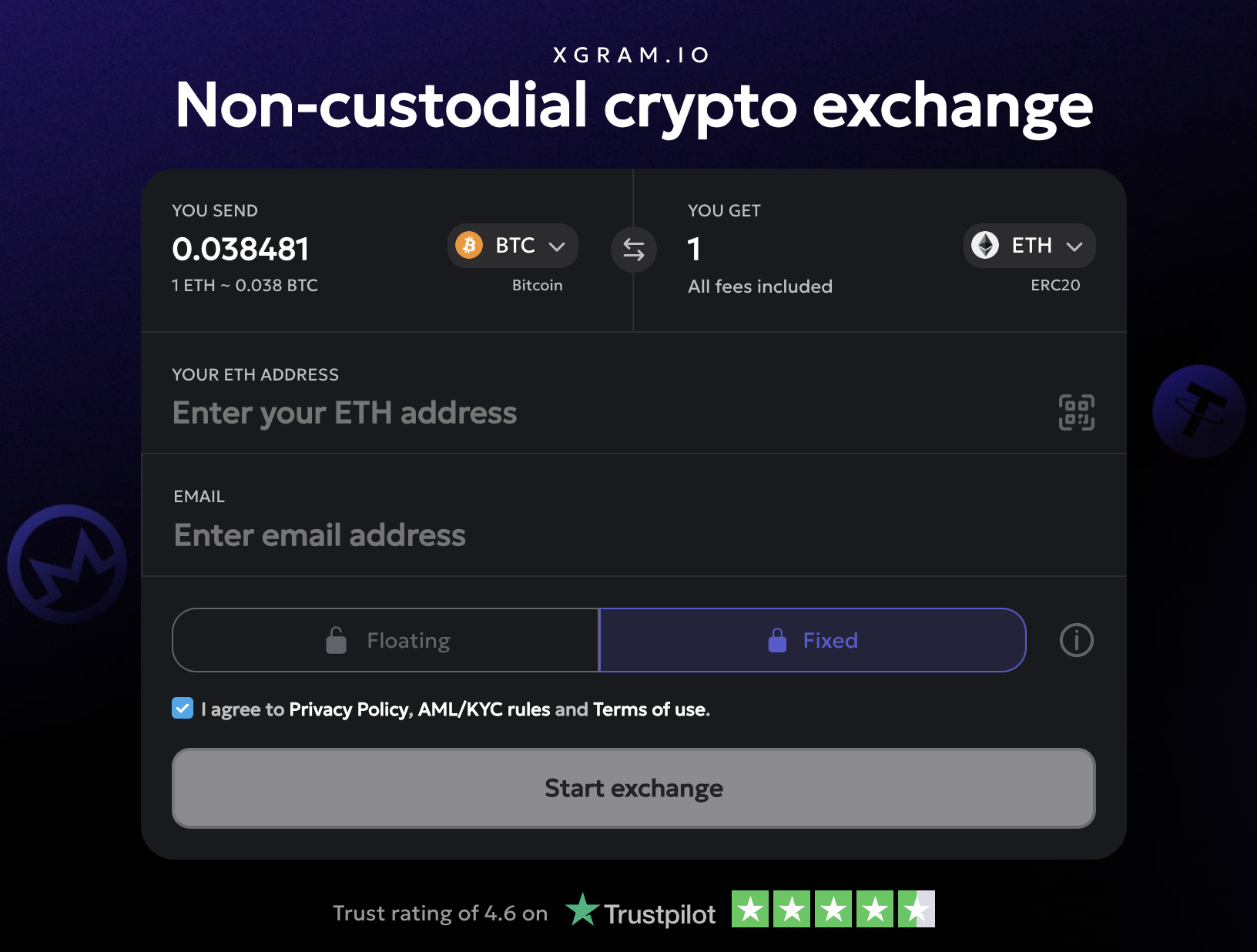

Introducing Xgram

Xgram is a platform you may not have heard of before. It offers both traditional swaps and advanced options to reduce fees. You do not need to connect a wallet to use Xgram, which makes the onboarding experience straightforward for beginners. The interface focuses on simplicity: you select what you want to sell, pick how you want to be paid, and confirm the swap. Many users praise Xgram for offering relatively competitive rates without hidden costs. If you are looking to test a new service that emphasizes quick transactions, Xgram is one to consider exploring.

Safe and secure selling tips

You care about speed, but security matters just as much. A fast sale is worthless if you end up losing funds or exposing personal data. Here are steps you can follow to protect your money and your privacy:

Use reputable providers

- Check online reviews of the exchange or platform you plan to use.

- Ask friends or crypto communities for referrals.

Enable two-factor authentication (2FA)

- Always enable 2FA on any account that handles your Bitcoin.

- SMS verification is better than no 2FA, but apps or hardware keys are more secure.

Verify withdrawal addresses

- When sending Bitcoin to a platform, double-check the destination address.

- Before releasing your payment, confirm the receiving address matches your record.

Watch out for scams

- Do not trust unsolicited messages offering unbeatable rates.

- Stick to official channels for support or verification.

Keep an eye on fees and total cost

- Calculate the total you will actually receive after fees.

- Compare that net amount across at least two or three platforms.

Combining these steps can reduce the chance of errors and ensure you get your funds quickly and safely.

Step-by-step example

Below is a general flow you might follow if you want to sell your Bitcoin on a fast-exchange platform. The exact process can differ depending on the site, but the main steps remain similar.

Create an account

- Provide your email address and choose a strong password.

- Depending on the platform, confirm your email to proceed.

Verify your identity

- If the platform requires KYC, be ready to provide an official ID or passport.

- Some services offer partial verification with lower limits, which might be enough for small trades.

Deposit your Bitcoin

- Copy the platform’s Bitcoin deposit address.

- In your wallet, select “send” and paste that address.

- Wait for the transaction confirmations to appear on the platform.

Choose your sell option

- Select the currency you want to receive (USD, EUR, or another crypto).

- Enter the amount of BTC you plan to sell.

- Check the real-time rate. This is where you confirm if it is acceptable.

Finalize the trade

- Review all details: price, fees, final amount you receive.

- Click “sell” or “confirm” to process the transaction.

Withdraw your funds

- Select your preferred payout method, like direct bank deposit.

- Enter your bank details or wallet address if you are getting another cryptocurrency.

Monitor and confirm completion

- Keep tabs on your bank account or receiving wallet.

- The time can range from a few minutes to a couple of days, depending on the platform and payment method.

If any point in the process seems off, do not hesitate to pause. It is better to revisit steps carefully than rush into potential mistakes.

Frequently asked questions

1. What is the fastest way to sell Bitcoin if I have it in my personal wallet?

Services like instant swap platforms often provide the fastest route. You simply paste your receiving address, send your Bitcoin, and receive the desired currency. Some allow near-instant transactions. However, speed can come with slightly higher fees. Always compare rates and read the platform’s guidelines carefully.

2. Do I need a lot of technical knowledge to sell Bitcoin?

Not necessarily. Many modern exchanges have user-friendly dashboards, and P2P platforms guide you through each step. The main technical parts are properly copying addresses and ensuring your device security (updating your antivirus, using 2FA, etc.). If you are completely new, try smaller test trades to build confidence.

3. How do fees work when selling Bitcoin?

Fees come in various forms: trading fees on the platform, network fees for sending your Bitcoin to the exchange, and withdrawal fees for receiving your money. Some platforms show a combined cost, while others break it down. Always confirm the net amount you will receive before finalizing the trade.

4. Can I use Xgram without connecting my personal crypto wallet?

Yes. That is one of Xgram’s main draws. You can deposit Bitcoin directly and manage your trades on their site. This helps beginners who worry about linking external wallets. Just remember to confirm the payout instructions and keep your account protected with strong security measures.

5. Are there any restrictions on how quickly I can withdraw my funds?

This depends on your chosen platform’s policies. Most will let you withdraw once the trade is confirmed, but some might lock funds for a short period, especially if you are a new user. Check payout times and minimum withdrawal thresholds. If you need money instantly, read the terms to ensure you can withdraw right away or use a method that guarantees near-real-time transactions.

Conclusion

Figuring out how to sell Bitcoin fast 2025 can be smoother than it looks at first glance. You have multiple options that balance speed, cost, and user experience. Centralized exchanges are often reliable if you are willing to complete verification steps, but P2P platforms can place you face-to-face—virtually speaking—with a buyer ready to pay quickly. Instant swaps excel at rapid transactions, though the fees can be higher.

Platforms such as Xgram add extra convenience by allowing trades without a linked wallet, so you can jump right into selling or swapping. Always watch out for security best practices: double-check your addresses, enable MFA, and make sure the platform you choose has good reviews. As soon as you see that first successful, fast sale, you will feel confident about managing your next crypto transaction. Whether you are seeking maximum speed or a simple, user-friendly process, the tips and methods here can point you to a quick, safe exchange. And now that you have the overview, it is time to pick your route and make your next move. Good luck with your sale!