TL;DR

- You can sell Avalanche through centralized exchanges, peer-to-peer platforms, and instant swap services.

- Each option offers different levels of control, fees, and speed.

- To sell AVAX, you typically create an account, transfer your coins, choose an order type, then confirm the sale.

- Always double-check wallet addresses and follow platform security guidelines to avoid mistakes.

Below, you will learn why people sell Avalanche, which pathways fit your needs, and a simple step-by-step guide to doing it safely. This resource also covers a unique platform called Xgram for streamlined trading. By the end, you will feel confident engaging in your very first AVAX-to-fiat or AVAX-to-other-crypto transaction.

Why sell Avalanche

Selling Avalanche can help you manage your portfolio, lock in gains, or free up funds for other opportunities. As a relatively new cryptocurrency, Avalanche has seen periods of rapid growth and evolving use cases. You could be interested in selling for any of these reasons:

- Realizing profits: If you have held AVAX for a while and seen its value grow, selling can allow you to convert your gains into stablecoins or cash.

- Rebalancing your portfolio: You might want to adjust how much risk you keep in crypto. Shifting a portion out of Avalanche gives you more balance across different assets.

- Funding expenses: In some cases, you may simply need funds for a personal expense or a new investment. Selling Avalanche can be a fast way to get liquidity.

- Trying new projects: The blockchain world is constantly evolving. If you want to move from Avalanche to another emerging network, selling AVAX and reinvesting could be part of your strategy.

Whether you are a complete beginner or have dabbled in other coins, selling Avalanche starts with knowing the platforms available to you and how they work. Each has advantages and trade-offs that might suit different goals or comfort levels.

Explore different selling options

When deciding how best to sell your Avalanche, it is essential to understand your marketplace options. Broadly, you can pick from centralized exchanges, peer-to-peer platforms, or instant swap services. Each route provides unique benefits in terms of price, control, speed, and fees.

Centralized exchanges

Centralized exchanges (CEXs) remain one of the most common and straightforward ways to sell Avalanche. These exchanges operate like traditional trading platforms for crypto assets and often let you trade hundreds of coins.

Advantages:

High liquidity, allowing you to find buyers quickly.

Competitive market prices, thanks to large user bases.

Added features such as advanced trading tools and order types.

Multiple withdrawal options (bank transfer, credit card, e-wallets).

Considerations:

Some require identity verification (KYC) before you can withdraw or trade large amounts.

The user interface might feel overwhelming if you are completely new to trading.

Centralized exchanges may hold custody of your AVAX unless you move it to your personal wallet.

That said, if your priority is a smooth, beginner-friendly experience, a well-known CEX is often a good pick. They typically provide easy steps to deposit AVAX, sell it for fiat (USD, EUR, etc.), and then withdraw accordingly.

Peer-to-peer platforms

Peer-to-peer (P2P) marketplaces let you sell directly to other individuals without an intermediary in charge of the entire transaction flow. In most cases, the P2P platform escrows your Avalanche, preventing fraud until both parties meet the agreed terms.

Advantages:

Freedom to negotiate price and payment methods.

Option to remain pseudonymous if the platform does not enforce strict ID checks.

Typically, more direct control over the transaction.

Considerations:

Transactions can be slower than instant trades, as you must coordinate with another person.

You need to stay vigilant about potential scams.

Liquidity might be lower compared to big centralized exchanges.

Beginners sometimes appreciate the directness of P2P, especially if they want to pick local payment channels. The key is to verify buyer reputation, follow platform guidelines, and release funds only when you see payment confirmed in your account.

Instant swap services

Instant swap services allow you to trade one cryptocurrency for another or for traditional currency in a few clicks, usually without creating a detailed trading account. Instead of managing order books, these services leverage existing exchange networks to find the best rate.

Advantages:

Rapid transactions with minimal steps.

User-friendly design, ideal for newcomers.

Transparent fees.

Considerations:

Higher exchange rates or extra fees in comparison to direct trades on a large exchange.

Potentially limited withdrawal methods if you want fiat currency.

Instant swaps can be attractive if convenience is your top priority. They suit users who are comfortable paying slightly more in fees for a hassle-free experience.

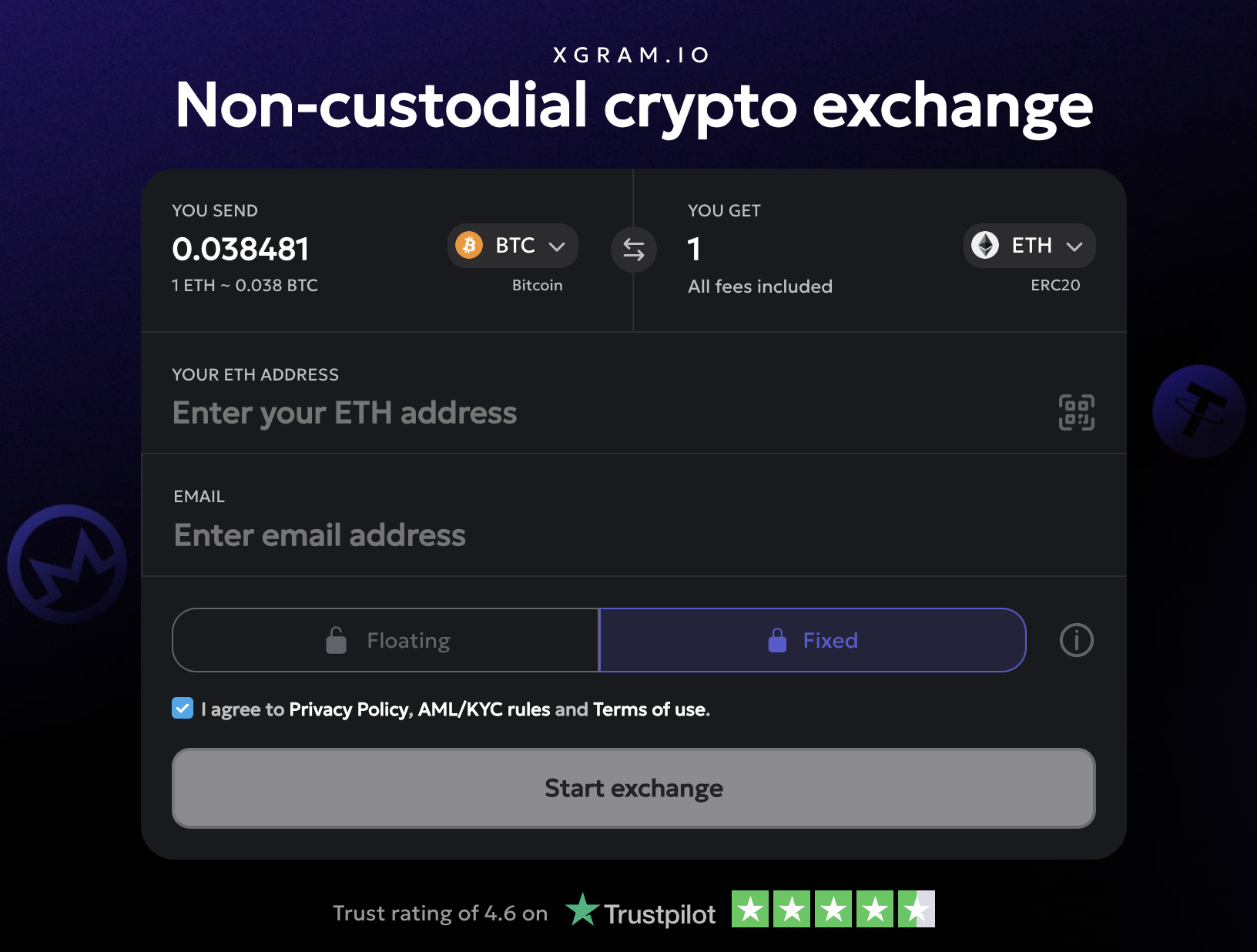

Xgram for streamlined trades

Xgram is a specialized exchange platform that focuses on simplicity and cost savings. You do not need to connect an external wallet to trade on Xgram, making it ideal if you are new to cryptocurrencies and want to avoid complicated setups. Here is how it fits in:

- Xgram does not require a wallet connection. That means you can stash your Avalanche in a platform-managed balance until you decide to trade.

- You save on transaction fees because Xgram uses efficient internal transfer mechanisms, often cheaper than on-chain transactions.

- Trades on Xgram happen quickly, letting you capture market movements without delays.

- The interface caters to newcomers, removing the clutter of advanced charts or complicated order types.

- You can manage your tokens on Xgram until you are ready to withdraw them as either crypto or fiat, depending on available methods.

This streamlined approach lets you focus on the essential part—buying and selling AVAX—rather than wrestling with complex tools or bridging networks. For a beginner or someone who wants to cut overhead costs, Xgram can be a convenient addition to your list of platforms to consider.

Step-by-step instructions

Regardless of whether you choose a centralized exchange, a P2P network, an instant swap service, or Xgram, you will follow a similar path from start to finish. Here is a general roadmap:

Step 1: Prepare your account

Your first move is to pick a platform that suits your needs. Maybe you prefer a large, reputable exchange for reliability and liquidity, or you want a simple interface like Xgram for fast trades.

- Create your account: Provide your email or phone number, choose a strong password, and store your login details securely.

- Complete verification (if required): Depending on the service, you may need to submit an ID document or proof of address. This process can take minutes or days, so prepare ahead if you want to sell quickly.

- Set up security: Enable two-factor authentication (2FA) to protect your account from unauthorized access. Most platforms will prompt you to do so.

A robust account setup is essential for peace of mind. By investing a few extra minutes in security, you reduce the risk of compromised passwords and fraudulent withdrawals.

Step 2: Transfer Avalanche

Now, you want to deposit AVAX into your chosen platform. If you already hold Avalanche on that platform, you can skip this step. Otherwise, transfer from your personal wallet or another exchange:

- Locate your deposit address: Look for the “Deposit” or “Receive” button and select Avalanche if multiple blockchains are listed.

- Copy the deposit address: This is usually a string of letters and numbers. Double-check that you are using the correct network if your platform supports multiple Avalanche chains.

- Initiate the transfer: In your external wallet or other exchange, paste the deposit address and confirm the transaction.

- Wait for confirmation: The speed can vary depending on network load. Once confirmed, your AVAX should appear in your account balance.

This process might feel a bit daunting on your first attempt. Always verify addresses carefully—simple typos can result in lost funds.

Step 3: Choose your order type

Platforms typically offer a few ways to sell:

- Market order: Instantly sell your Avalanche at the current market price. This is the fastest way, favored by beginners who prioritize speed over nabbing the absolute best price.

- Limit order: Set a target price to sell at. The trade occurs only when the market hits your specified rate. This approach offers more control over the final price but might not fill immediately.

- P2P negotiation: If you are using a P2P marketplace, you can browse buyer listings or create your own. Price and terms can be adjusted through direct communication, though it requires more time.

- Instant swap: For an instant swap service or Xgram, you often just pick the asset you want in return (like USDT or BTC) and see the quoted rate.

As a beginner, you might prefer a market order or an instant swap for simplicity. However, exploring limit orders could save you money in the long run if you find a price point you like.

Step 4: Confirm your sale

Finally, you will seal the deal by confirming the transaction details:

- Review the final price: Take a moment to verify the stated price is reasonable. If the asset’s value is swinging, you might see changes from second to second.

- Consider fees: Platforms charge fees for trading and withdrawals. Ensure you understand how these fees subtract from your final total.

- Execute the transaction: Click “Sell” or “Confirm” and wait. If you used a market order, the transaction often goes through in seconds.

- Withdraw your funds: Commonly, you can withdraw the proceeds as crypto or fiat. Each platform may handle this differently. For bank transfers, you might need extra verification or time for the deposit to clear.

With those steps, you have completed your Avalanche sale. Always keep records of your trades for tax or personal bookkeeping. If you decide to hold your funds on the platform, make sure you track potential fees or inactivity policies.

Stay safe and compliant

It is crucial to protect yourself and follow local regulations when selling Avalanche. Cryptocurrencies can be an exciting frontier, yet they come with risks:

- Verify official URLs: When accessing any exchange or P2P service, check that you are on the correct website. Scammers often create fake pages that mimic real ones to steal your credentials.

- Use strong security practices: Never share your passwords or 2FA codes. Keep them offline whenever possible to prevent hacking attempts.

- Avoid suspicious deals: If someone offers you a price that is far above the market rate, treat it as a red flag. This might be an attempt to lure you into a scam.

- Comply with legal requirements: Depending on your jurisdiction, you may need to declare profits or follow specific licensing rules. Staying compliant helps you avoid legal trouble later.

- Store leftover crypto safely: If you decide not to sell all your Avalanche, keep the remaining tokens in a wallet where you control the private keys, or at least in a secure, recognized platform with robust security measures.

When in doubt, consult up-to-date resources or financial professionals to guide you. If your goal is to trade large sums regularly, you might want to research exchange reputations, track record of hacks, and how they handle user funds.

Quick recap and next steps

If you have reached this point, you know the main paths and essential steps for how to sell Avalanche. Here is a quick rundown:

- Choose a platform type—centralized exchange, P2P, instant swap, or Xgram.

- Open an account, verify it if necessary, and enable added security.

- Deposit AVAX or verify that your Avalanche is already on the platform.

- Decide on an order type (market, limit, or direct negotiation).

- Confirm your sale, then withdraw your funds.

You are in control of your Avalanche assets. Selling them is simply one way to navigate the opportunities in cryptocurrency. If you plan to remain in the crypto space long term, keep exploring how different platforms handle fees, your local banking relationships, and advanced trading strategies that fit your goals. There is no one-size-fits-all method, but you will find your rhythm over time.

Frequently asked questions

Can I sell a small amount of Avalanche?

Yes. Most platforms let you sell fractional amounts of AVAX. You can even sell as little as a few dollars’ worth. Just check the platform’s minimum trading and withdrawal limits to confirm.What is the fastest way to sell AVAX?

A market order on a well-known centralized exchange or an instant swap service usually provides the fastest experience. These methods let you sell immediately at the current market rate, though fees might be slightly higher compared to limit orders.Why should I consider Xgram?

Xgram offers a streamlined approach without requiring a wallet connection. You can store and trade AVAX internally, often saving on transaction fees. If you are new to crypto, this simplicity helps you avoid the complexity of bridging wallets and dealing with excessive transaction costs.Is KYC mandatory for all selling methods?

It depends on the platform and your local regulations. Most centralized exchanges require ID verification for large withdrawals. P2P markets often have more relaxed requirements, although some forms of ID check can apply. Instant swap services and Xgram typically have fewer steps, but you should verify if there are specific local rules.What should I do if my withdrawal is delayed?

Cryptocurrency withdrawals can be delayed for several reasons—network congestion, security checks, or maintenance on the platform. If you notice an extended delay, contact your platform’s support team. Confirm that you have the correct wallet address or bank details, and follow up with any verification they request.

Selling Avalanche does not have to be technical or intimidating. Once you pick a method, follow the steps with care, and practice good security, you will feel confident navigating the world of crypto sales. Happy trading!