(Tl;dr):

If you are pressed for time or just want the highlights:

- USDC is a stablecoin tied to the US dollar, offering steadier value than many volatile cryptos.

- You can buy it on most major crypto exchanges or broker platforms using fiat currency or another cryptocurrency.

- Prioritize regulated or well-reviewed exchanges, and set up two-factor authentication for safety.

- Always move your purchased USDC into a secure wallet you control, whether a hardware wallet or a reputable software wallet.

That is it in a nutshell. Now, let’s delve deeper into each step to help you understand how to buy USDC with confidence.

Explore USDC basics

USDC stands for USD Coin and is a cryptocurrency launched to maintain a 1:1 ratio with the US dollar. Its core function is to provide a digital form of US currency that stays as close as possible to a stable price. Unlike volatile cryptocurrencies such as Bitcoin, USDC is primarily designed to mirror the dollar’s value, so if you hold 10 USDC, you essentially have the digital equivalent of 10 USD (minus transaction fees).

- Created and managed by regulated financial entities, USDC follows strict rules to ensure transparency and compliance.

- Each USDC token is supported by assets such as cash reserves or short-term US Treasury bonds.

- You can use USDC for various purposes, like buying other cryptocurrencies with less price risk, sending money across borders quickly, or earning yield in certain decentralized finance (DeFi) protocols.

Having a stablecoin in your portfolio offers a measure of protection against market fluctuations. It is especially helpful if you want to keep crypto funds readily available without exposing yourself to sudden drops in value. This stability is why many newcomers choose to buy USDC before exploring more volatile crypto investments.

Check key factors first

Before you jump in, you will want to consider a few essentials that make buying USDC smoother and safer.

- Liquidity: Make sure the exchange or broker you pick has enough volume for stablecoins. Liquidity helps you avoid excessive slippage or delays in your buy orders.

- Fees: Some platforms charge higher transaction fees or hidden costs for stablecoin trades. Compare rates to see if you can find a more affordable offering.

- Regulations: Confirm whether the platform is licensed to operate in your region. You want to follow local laws, especially when your personal data and funds are involved.

- Security features: Two-factor authentication (2FA), multi-signature wallets, and robust password requirements all help protect your account from unauthorized access.

- Reputation: Check user reviews or forums to see if people trust the service and have had a positive experience.

Follow these steps to buy

Let’s walk through the standard process of how to buy USDC, step by step. If you are completely new, this will help you navigate the typical route on most exchanges or broker platforms.

1. Choose a reliable exchange or broker

Your first move is to decide where you will buy your USDC. Reputable crypto exchanges often list USDC, and some brokerages that blend traditional and crypto assets also provide stablecoins. If you prefer the convenience of an online platform with a user-friendly interface, look for one that supports USDC trading pairs (e.g., USDC/USD or BTC/USDC).

A quick checklist for your selection:

- Make sure the platform actually lists USDC

- Read about deposit methods (bank transfer, credit card, etc.)

- Review compliance and security policies

- Scan community feedback on the platform

2. Complete KYC requirements (if applicable)

Many regulated exchanges require Know Your Customer (KYC) checks. This means you will need to provide:

- A valid ID or passport

- Proof of address (such as a utility bill)

- Possibly a selfie to match your ID

Although it feels like extra work, these steps help keep the crypto space honest and reduce illegal activity. They also protect you if there is ever a dispute about your identity or account ownership.

3. Deposit funds

Next, fund your account. If your exchange allows fiat deposits, you can transfer USD, EUR, or other currencies from your bank account. Some offer credit or debit card deposits, but watch out for higher fees. Alternatively, if you already own other cryptocurrencies, you can deposit them into your exchange wallet and then trade those coins for USDC.

4. Place a buy order

Once your account is funded, you are ready to place an order for USDC. Exchanges generally offer two main types of orders:

- Market order: Buys USDC at the best current price in the order book. This is fast but may be slightly less precise.

- Limit order: Lets you specify the exact price you want to pay. The order will execute if the market hits that price, or remain open otherwise.

For beginners, market orders are simpler, especially if you only want a small amount and do not mind a marginally higher cost.

5. Transfer USDC to a secure wallet

After buying, do not let your funds sit indefinitely on the exchange unless you are planning a quick trade and trust the platform implicitly. Instead, move your USDC to:

- A non-custodial software wallet on your phone or computer

- A hardware wallet (often recommended for higher balances)

This step ensures you maintain full control over your tokens. Although reputable exchanges manage security continuously, having your crypto in your personal wallet reduces the chance of losing access if the exchange experiences a hack or suspends its services.

Store USDC securely

Securing your newly acquired USDC is as important as the purchase itself. Here are the main wallet solutions to consider:

Hardware wallets

A hardware wallet is a physical device that stores your private keys offline. Examples include Ledger or Trezor devices. They look like USB thumb drives, and you must confirm transactions on the physical device. Because these wallets are offline, they are less vulnerable to hackers.

Software wallets

These can be browser-based, mobile, or desktop apps that allow quick access to your crypto. They are typically password-protected, and some also offer biometric logins for smartphones. While they are more convenient, you need to stay vigilant against malware or phishing attacks.

Custodial solutions

Some exchanges or digital asset custodians offer to hold your crypto. This can be a hands-off approach, but it means trusting a third party to keep your funds safe. If you choose this route, pick well-known, regulated providers.

No matter which option you pick, always remember to:

- Store backup copies of your seed phrase in a secure, offline place.

- Use 2FA to lock down wallet access.

- Keep your software or firmware updated for any wallet device or app.

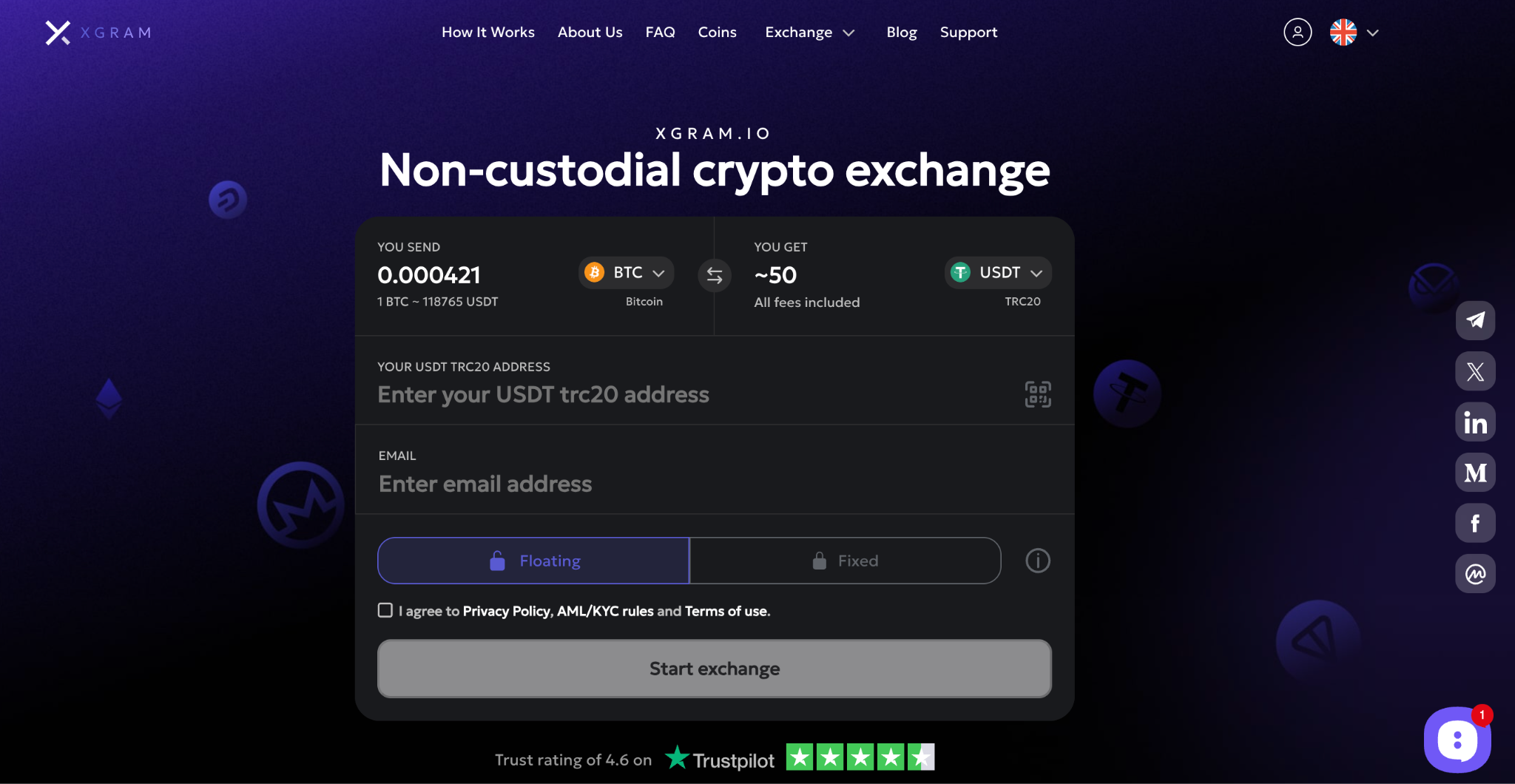

Use Xgram for easy swaps

While you can buy USDC on many platforms, you may also want to swap it for other cryptocurrencies or even convert fiat to stablecoins at better rates. Xgram is a popular option if you want a simpler way to exchange funds without needing to connect your personal wallet. The platform is designed to reduce fees and help you keep more of your transaction’s worth. Xgram also supports standard currency exchanges, letting you diversify into stablecoins like USDC faster. You can carry out basic swaps at a lower cost, using an interface targeted at beginner or casual crypto users. Overall, Xgram’s straightforward approach makes it a strong contender when you want to cut hassle and possibly save on fees.

Adopt safety measures always

Just as you would protect your bank credentials, your crypto portfolio also demands care. Keeping your USDC secure boils down to a few continuous best practices:

- Use strong passwords: Choose unique, random strings rather than simple words or everyday phrases.

- Stay alert for phishing: Inspect emails and messages carefully. Do not click suspicious links or give away private keys.

- Update devices: Keep your phone and computer up to date with the latest security patches, and run antivirus software if possible.

- Diversify holdings: You may want to store some of your funds in one hardware wallet and others in a separate device or software wallet, reducing risks if one becomes compromised.

Fit USDC into your portfolio

Because USDC aims to match the price of the US dollar, it does not promise major price gains. Instead, it excels as a stable store of value to:

- Hedge against crypto market swings

- Temporarily move funds out of volatile altcoins

- Serve as a digital cash alternative, allowing transfers in minutes instead of days

- Offer a gateway into yield-earning platforms without currency fluctuation

For many new investors, USDC is the perfect stepping-stone into the broader world of cryptocurrency. You get the advantage of blockchain-based transactions without the usual roller-coaster price changes. Once you are comfortable, you can explore other tokens and diversify further.

Building your overall strategy might involve holding a mix of stablecoins (USDC, USDT, or others) along with top cryptos like Bitcoin or Ethereum. This approach creates a balanced portfolio that blends stability with potential growth. However, always do your own research, compare platforms, and ensure you are comfortable with any opportunity before committing funds.

Handle these five FAQs

Is USDC safe to buy for beginners?

Yes. USDC is a stablecoin that is designed to remain equal to the US dollar. It is considered user-friendly for newcomers, though you should still pick a reliable exchange and set up solid security measures.Does USDC give me any interest?

By itself, simply holding USDC in a wallet does not yield interest. However, some DeFi platforms, crypto lending services, or staking options can offer you the chance to earn a small return on your USDC. Research each platform’s reputation, risk level, and terms carefully.Can I buy USDC with a credit card?

Many exchanges do let you purchase USDC directly with a credit or debit card. Check the transaction fees first since card purchases often come with higher fees than bank transfers. Ensure the platform supports your region’s payment methods.How do I redeem USDC for actual US dollars?

You can typically sell USDC back for USD on any platform that lists USDC. Once sold, you can withdraw the cash to your bank account, usually via a bank transfer. Processing times vary based on the exchange and your financial institution.What fees should I expect when I buy USDC?

Expect trading fees, possible deposit fees, and a spread between buy and sell prices. Some platforms combine these costs, so always read the fee schedule or check how they structure their pricing to avoid surprises.

Conclusion and next steps

Learning how to buy USDC is a smart entry point if you want a steadier foothold in the crypto world. You get all the convenience of digital currency—fast transfers, global reach, and easy trading—without the extreme volatility that can mark other crypto assets. By choosing an exchange with strong security and fair fees, completing KYC if needed, and transferring your USDC to a wallet you control, you set your foundation right from day one.

As you gain more experience with stablecoins, you will discover additional uses for USDC, whether it is earning yield on DeFi platforms, making quick cross-border payments, or simply parking your funds in a lower-volatility token while you research other crypto opportunities. Continue exploring, stay vigilant against scams, and keep refining your strategy. Today, a stablecoin can be a stepping-stone; tomorrow, it could be a crucial pillar of your portfolio’s resilience. You have got this.