In 2025, the crypto market has soared beyond a $4 trillion total market cap, with Bitcoin hitting an all-time high of over $126,000. The number of crypto users ranges between 40–70 million active participants worldwide, and countless others hold at least some form of digital asset. As the landscape grows, you need a trustworthy and feature-rich exchange for buying, selling, and trading your assets safely. Below are eight standout platforms, each excelling in different areas, followed by actionable guidance to help you choose wisely.

Xgram.io: best overall pick

If you’re looking for a crypto exchange service that fits nearly every trading scenario — fast swaps, privacy, and a broad range of coins — Xgram.io delivers an all-in-one experience. The interface is straightforward for beginners yet efficient enough for experienced users who value speed and flexibility.

Key highlights:

- Instant crypto swaps without complex registration steps or mandatory KYC for most trades

- Over 500 supported cryptocurrencies and hundreds of available pairs

- Competitive exchange rates and low fees starting around 0.1%

- Strong focus on privacy and transaction security through encrypted protocols

- Seamless experience across web and Telegram mini-app, ideal for trading on the go

What makes Xgram.io stand out is how it blends speed, convenience, and privacy. Most exchanges either sacrifice ease of use for advanced features or compromise on security — Xgram balances all three. Transactions are typically completed in under 10 minutes, and users can manage everything directly from their phone.

If you don’t need margin trading, futures, or advanced order types, Xgram.io is one of the most practical and user-friendly swap platforms for 2025 — combining simplicity, reliability, and modern design in one place.

1. Binance: global trading volume

Binance quickly emerged as a leading global exchange, surpassing USD 36 billion in trade volume by early 2021. It continues to dominate in 2025, especially if you are an active trader seeking high liquidity. More liquidity generally means better price fills, minimal slippage, and a faster experience for frequent trades.

- Hosts around 400 cryptocurrencies, from major players like Bitcoin and Ether to smaller altcoins

- Allows for high-frequency trading strategies thanks to high liquidity and advanced charting

- Encourages staking and yield products for passive income generation

While Binance stands out for its depth of markets and impressive trade volume, be mindful of its regulatory hurdles in different regions. If you live in a jurisdiction with strict regulations, verify your eligibility and available services under Binance’s terms.

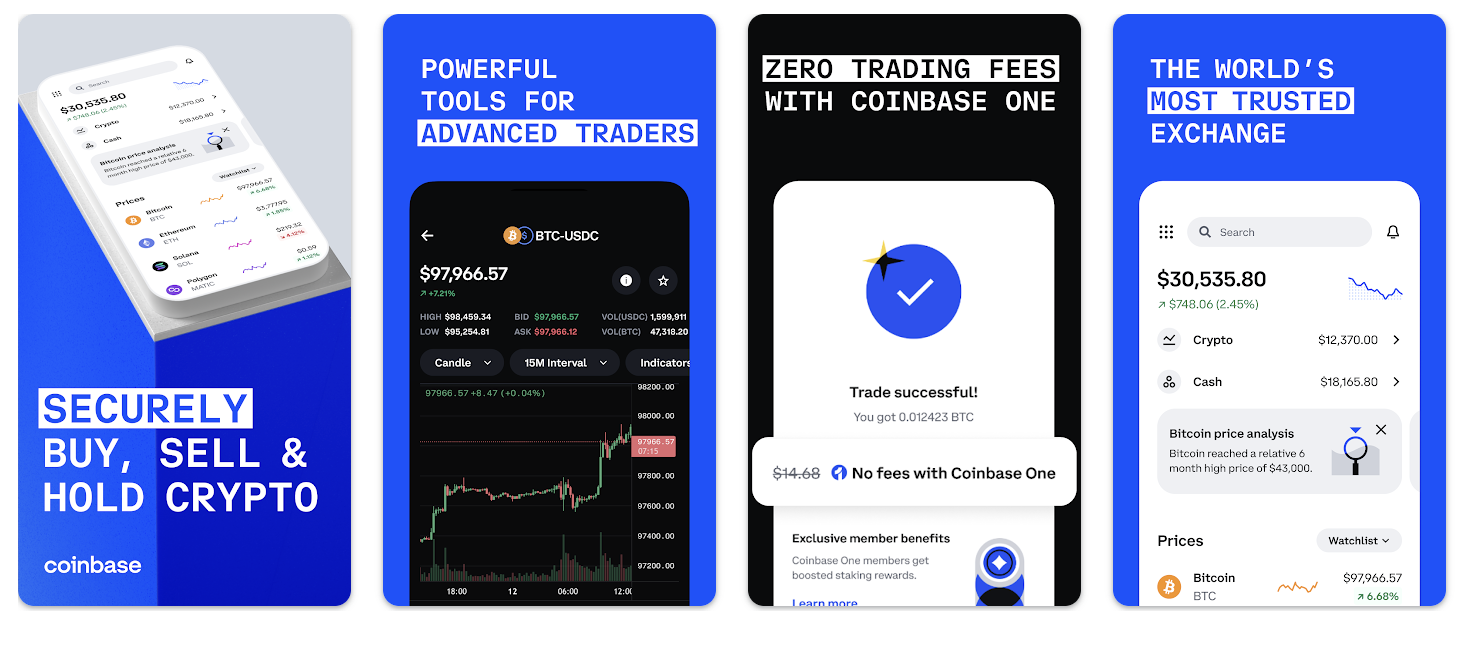

2. Coinbase: straightforward for beginners

Coinbase remains a top pick for first-time buyers, boasting a user-friendly interface and a strong presence in the United States. It initially made waves in 2012 and has since gained the trust of millions, processing over USD 2 billion in trading volume at the start of 2021. By 2025, Coinbase continues to innovate with new products and improved educational resources.

- Designed for simplicity, guiding new users through each step of buying or selling

- Maintains compliance with U.S. Securities and Exchange Commission regulations, adding a layer of transparency

- Features a comprehensive library of tutorials and tips for those new to crypto

With Coinbase, you get a secure environment and intuitive mobile apps. Fees might be slightly higher than on some competitor platforms, but the reliability and ease of onboarding are significant advantages if you are just getting into digital assets.

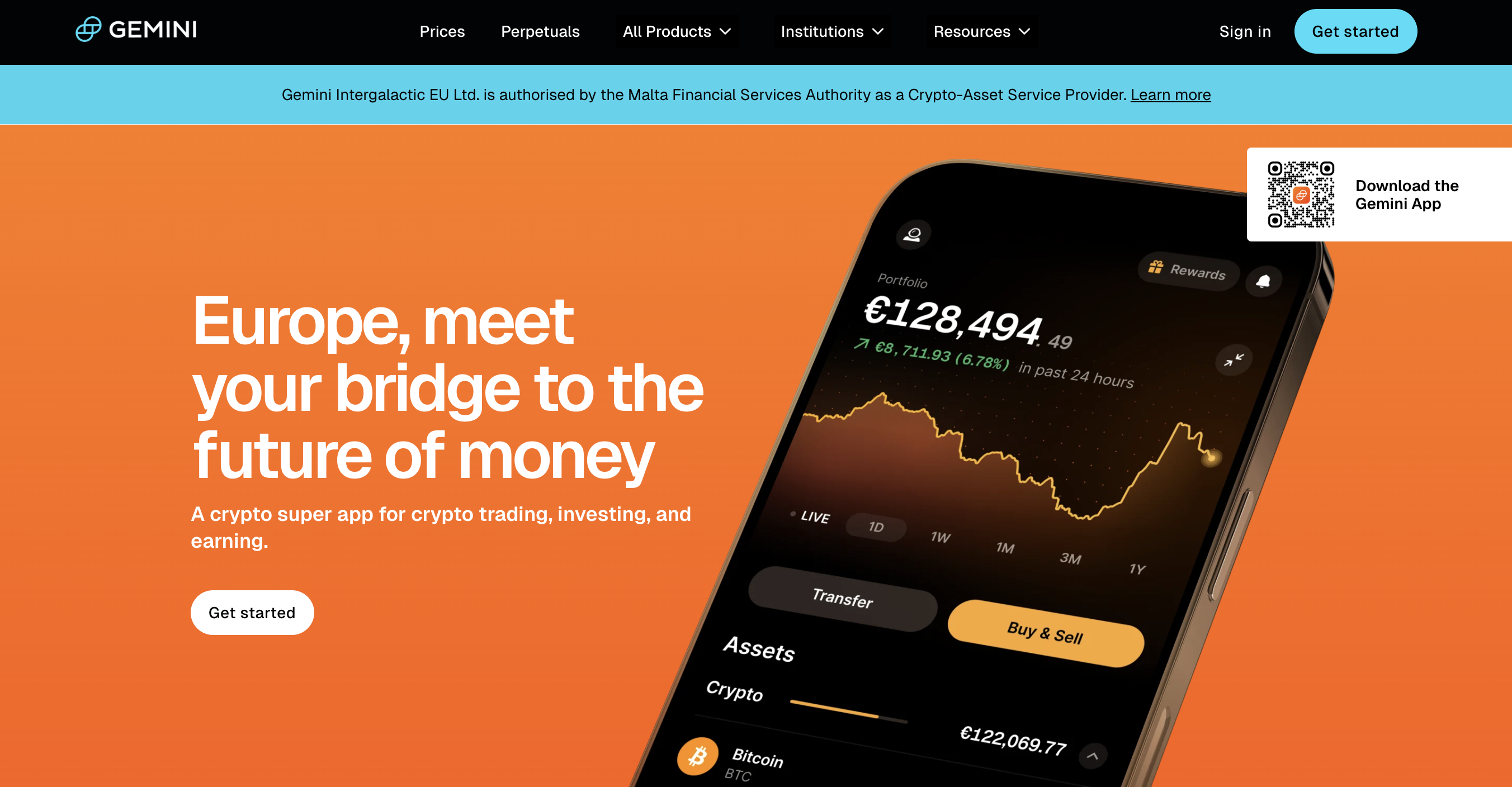

3. Gemini: robust security measures

Founded in 2014 by the Winklevoss twins, Gemini carved out a name as one of the most secure exchanges in the crypto space. If you prioritize safeguarding your funds, Gemini’s stringent protocols and FDIC insurance on USD deposits make it a compelling option in 2025.

- Above-average security with cold storage solutions, two-factor authentication, and thorough regulatory compliance

- Offers over 70 cryptocurrencies, suitable for expanding your portfolio

- Features the Gemini Dollar (GUSD), a stablecoin that further anchors its ecosystem

While Gemini is known for robust security, its transaction fees can be higher than on other major exchanges. Nevertheless, you may find the added security worth the cost, especially if you trade large volumes or hold assets for the long term.

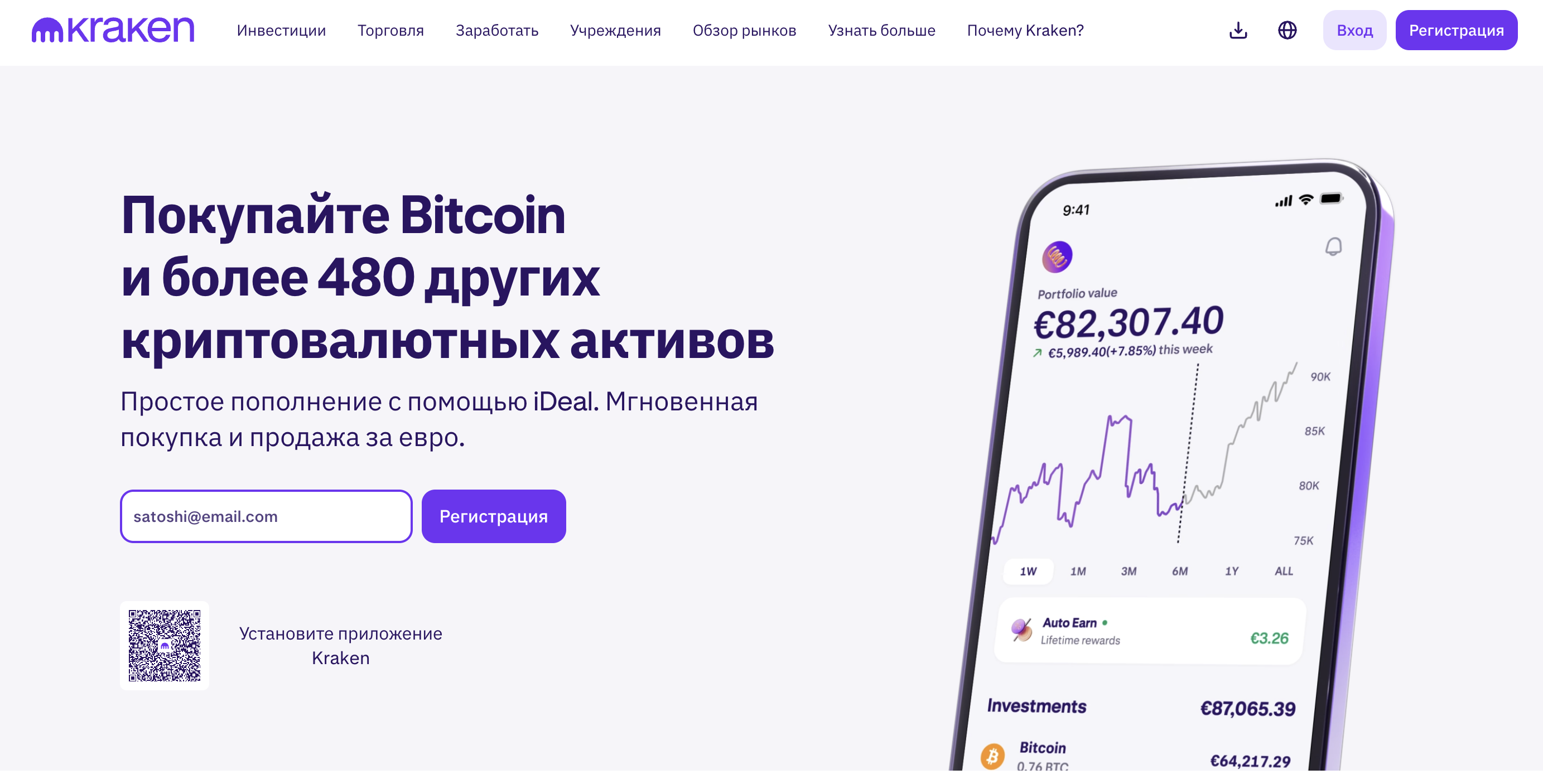

4. Kraken: low fee structure

Kraken is one of the longer-standing exchanges, operational since 2011, and has never experienced a hack leading to the loss of customer funds. It is also popular for offering competitive fees. If you make frequent trades, the cost savings on fees can quickly add up.

- Charges a 1% trading fee on the basic platform, with maker-taker fees between 0.00% and 0.25% on Kraken Pro

- Provides support for over 450 digital assets and more than 800 trading pairs

- Emphasizes best-in-class security, which has served it well over the years

Kraken’s advanced interface might be a bit steeper to learn if you are new to crypto, but once you familiarize yourself, you can execute trades efficiently. The platform’s longevity and consistent reliability instill trust among seasoned traders.

5. Huobi: derivatives trading hub

Huobi Global stands out if you want specialized derivatives features. Founded in 2013, it sailed through regulatory challenges in China and has expanded to Japan, Singapore, and beyond. In 2025, it remains one of the top choices for derivatives, thanks to competitive fees and a broad selection of futures, options, and perpetual swaps.

- Taker fee of around 0.04% on derivatives, with similarly attractive maker fees

- International network of exchanges for users in multiple regions

- Expansive product offerings ranging from spot trading to margin lending

Note that Huobi’s user experience might feel more advanced if you’re primarily used to spot trading. However, if you aim to leverage complex trading strategies, Huobi’s robust derivative ecosystem provides numerous pathways to diversify and hedge.

6. Crypto.com: mobile user focus

If you plan to trade primarily on your phone or tablet, Crypto.com emerges as a strong candidate. Established with a mobile-first approach, it has steadily grown into a diverse platform with over 400 cryptocurrencies. Beyond standard spot trading, it supports Bitcoin trading pairs, staking, cashbackVisa cards, and a wide range of in-app services.

- Provides a sleek mobile application with advanced charting, multiple order types, and 24/7 customer support

- Includes a user-friendly rewards system through its native token, Cronos (CRO)

- Offers competitive fees and incentives for staking CRO

By 2025, Crypto.com has improved its interface and expanded its educational resources, appealing to both new and experienced users. However, ensure you research the specific staking commitments if you plan to access fee discounts or bonus perks.

Conclusion and next steps

There is no single “one-size-fits-all” exchange. Your choice should match your trading style, security expectations, fee preferences, and regional regulations. If you are scaling up your crypto activities, weigh liquidity, derivatives options, and user experience carefully. For those seeking the best all-rounder, xgram.io stands out due to its cohesive design, high-level security, and particularly accessible interface.

Before you open any account, compare each platform’s user agreements and verify the available features in your country. Once you find a match, start with small trades as you gain confidence in the platform’s reliability. As the crypto market grows beyond $4 trillion in 2025, having a trustworthy exchange can be a critical advantage for both short-term speculation and long-term investment strategies.

Frequently asked questions

Which exchange is best for beginners?

If you are completely new to crypto, Coinbase is often the easiest to navigate, thanks to its intuitive interface and clear tutorials.How do I choose a secure exchange?

Look for robust security protocols such as cold storage, two-factor authentication, and compliance with regulations. Exchanges like Gemini and Kraken have a strong track record of protecting user funds.Can I trade derivatives on every platform?

Not all exchanges offer derivatives. You would look to platforms like Huobi, FTX, or Binance to trade futures, options, or leveraged tokens.Do I need multiple exchange accounts?

You do not have to, but many traders diversify by using more than one platform to access unique coins, different fee structures, or specialized products like staking or derivatives.What is the most versatile exchange in 2025?

For an all-in-one experience in 2025, xgram.io edges ahead due to its wide assortment of trading tools, user-friendly interface, and consistently updated security measures.