Understand Solana basics

Before diving into how to sell Solana, it pays to cover a few fundamentals. Solana is a high-performance blockchain known for its ability to process thousands of transactions per second at a low cost. By design, it uses a proof-of-stake and proof-of-history combination, making transactions faster than many other networks. Its token, SOL, is traded on most major cryptocurrency markets, reflecting a broad interest in the project.

So why might you want to sell? There are countless reasons. Maybe you want to cash out some gains, rebalance your investment portfolio, or simply test how the selling process works. Regardless of the reason, understanding Solana’s speed and fees helps you gauge the best possible route to sell.

Pick your selling method

Once you decide to sell your Solana, the next step is to figure out which method is right for you. Each option has its own advantages and trade-offs in terms of convenience, cost, and security.

Centralized exchanges

A centralized exchange (CEX) is often the first choice for new sellers. These services act like digital marketplaces where you create an account, deposit your SOL, and then place a sell order. Many well-known platforms let you sell Solana for fiat currencies such as USD, EUR, or GBP. Others may require you to swap SOL for a stablecoin or another cryptocurrency first.

The benefits? Centralized exchanges are often user-friendly and come with features like limit orders and quick buy/sell tools. Some provide added support or insurance to protect your assets. However, you will typically need to go through an identity verification process, known as KYC (Know Your Customer), which can take time. Also, keep in mind that CEXs hold your funds in their own wallets, so you have to place a certain level of trust in the platform’s security.

P2P (peer-to-peer) platforms

If privacy is more of a priority, or you want to cut out the middleman, you can opt for a P2P platform. These platforms allow buyers and sellers to interact directly. You list your SOL, specify your price, and wait for a match. Payments can range from bank transfers to e-wallets and even cash (though that last one is less common for Solana trades).

P2P trading can offer better rates, particularly if you find a buyer willing to pay a premium. But watch out for potential scams. Some users could try to defraud you through fake receipts or chargebacks. Reputable P2P platforms offer escrow services that hold your SOL until payment is confirmed, which keeps everyone honest in the transaction.

Instant swap services

Instant swap services let you trade Solana for other cryptocurrencies in a snap. You simply enter how much SOL you want to sell, select the crypto you want in return, and send your tokens to the swap address. The platform will then transfer your chosen crypto to your specified address. This is quick and convenient, making it a popular option for converting SOL to stablecoins or other altcoins without much fuss.

While instant swaps often charge slightly higher fees than a typical exchange order, the difference is worth the time saved for some users. You also get to skip the requirement of creating a dedicated account on a centralized exchange. For people who value minimal steps, it’s a strong choice.

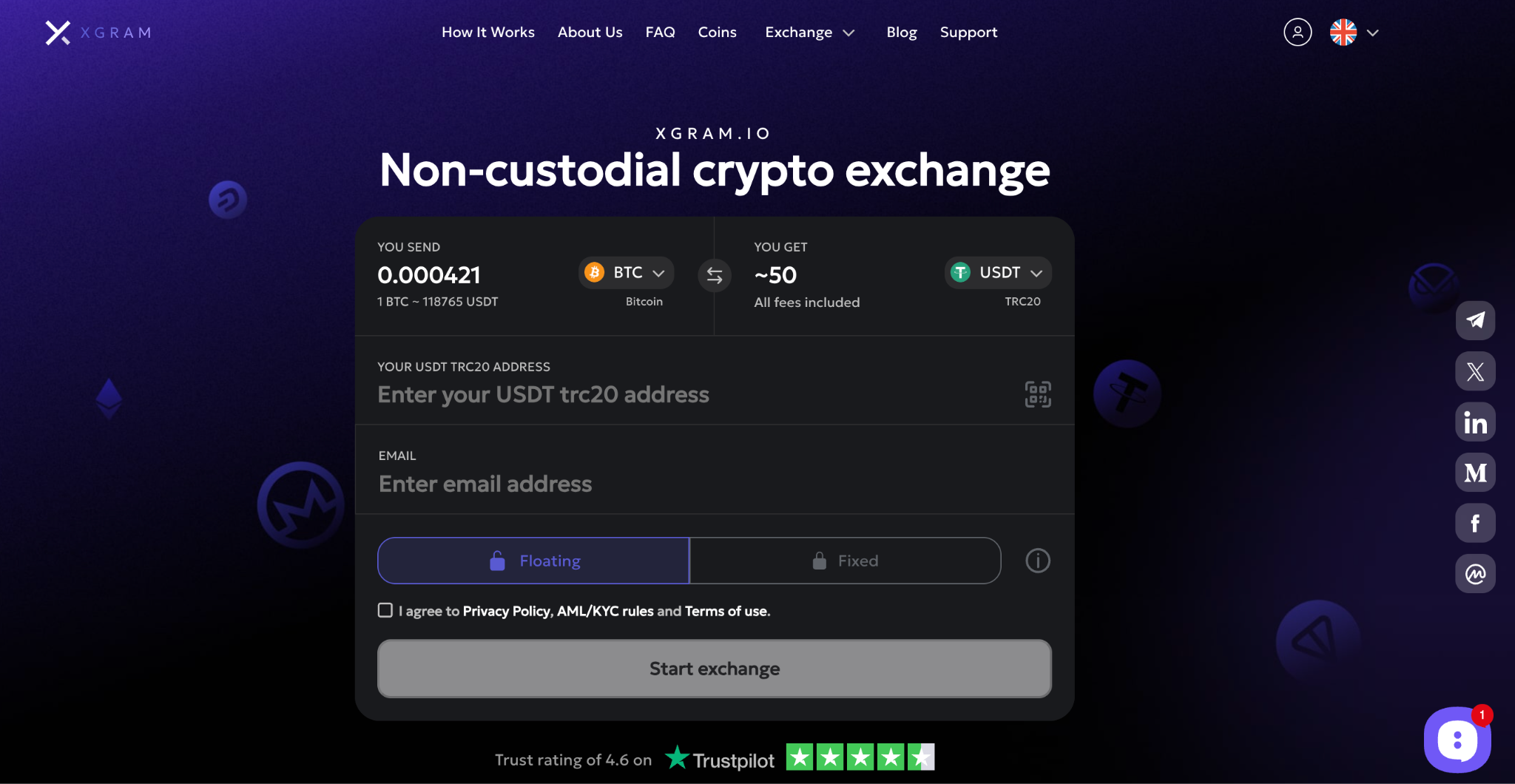

Xgram as a cross-chain solution

Another useful method to sell or convert Solana is through a cross-chain service like Xgram. Xgram stands out for letting you swap between different blockchains, which can be helpful if you want to convert SOL to tokens on other networks without juggling multiple transfer steps. You do not need to connect an existing wallet to use it. Instead, you can simply provide your destination addresses. This structure can reduce friction if you are switching networks often.

Using Xgram can also minimize fees, since you can avoid double conversions or multiple withdrawal costs. It can be a straightforward approach if you want to sell Solana indirectly by swapping to a better-known coin and then selling on a secondary platform. Because it requires little setup, Xgram can be ideal for quick cross-chain exchanges, and it provides a smooth user experience that helps you avoid typical multi-step procedures.

Prepare your Solana wallet

If you plan to sell Solana, you first need to ensure your wallet is ready for the transaction. This involves confirming where your SOL is currently stored, checking wallet compatibility, and making sure you have any required passphrases or hardware keys at hand.

- Verify your wallet type: Some exchanges or services have specific wallet compatibility requirements. Make sure your wallet works well with the platform you plan to use.

- Check your token availability: Look at your balance to confirm you indeed have enough SOL to meet selling minimums.

- Secure your private keys: Keep your private keys and essential credentials safe, especially if you are dealing with a hardware or paper wallet.

- Consider network fees: Selling Solana requires a small transaction fee. Make sure you have some spare SOL left in your wallet to cover that cost.

This preparation helps you avoid last-minute surprises. Having everything lined up early means you can focus on the actual transaction process rather than juggling new account logins or rummaging for passwords.

Follow step-by-step instructions

Let’s walk through the basic steps involved in selling your Solana. Although exact steps vary depending on the platform, there is a general procedure you can follow.

1. Move SOL to your chosen platform (if needed)

If you use a centralized exchange, log in to your account and find the deposit page. Select Solana, copy the deposit address, and send your SOL from your wallet. The deposit might take a few minutes depending on network congestion, so be patient. For P2P platforms, check their instructions on how to list your SOL. Typically, you do not need to deposit into the platform’s wallet — you can keep your coins in your own address until a buyer is found, as long as escrow processes are in place.

2. Choose your trading pair or method

If you are on an exchange, you might see pairs like SOL/USDT, SOL/BTC, or SOL/USD. Pick the pair that matches the currency you want to receive. On P2P platforms, look for relevant listings or create your own, detailing the payment method you accept. With instant swaps, simply state how much SOL you want to swap and select the coin or stablecoin you want back.

3. Place your sell order or initiate the swap

For centralized exchanges, your interface might let you pick a market sell, limit, or stop-limit order. Market sells are immediate but might not get you the best price. Limit orders let you set a specific selling price, but the trade only goes through when the market hits that rate. If you are using P2P, confirm your escrow deposit or platform instructions before proceeding. For instant swaps, click the confirm button once you have checked the details of your transaction.

4. Confirm transaction completion

After the sale, check your account balance or wallet to ensure you have received the correct amount. For a centralized exchange, you will then see the traded currency in your account. If you used P2P, confirm you have received the buyer’s payment before releasing your SOL out of escrow. For instant swaps, look at the deposit address you provided; the new coin should be there.

5. Withdraw funds if desired

If you want to cash out to your bank or digital wallet, you can typically do so directly from your exchange balance. Different platforms have various withdrawal methods, from direct bank transfers to PayPal or third-party payment processors. Keep in mind that withdrawal fees vary widely, so check for the best rates before you finalize.

Stay safe when selling

Because digital assets can be vulnerable to hacking or scams, do not overlook safety measures. Even if you are just selling a small amount of SOL, you will want to keep everything above board.

- Use reputable services: Whether it is a recognizable CEX or a P2P platform with robust escrow, the platform’s reputation matters.

- Watch out for phishing: Keep an eye on URLs and double-check any messages you receive related to your transaction. Scammers often imitate exchange support teams.

- Secure your account: Use strong passwords and two-factor authentication (2FA) on any platform you choose.

- Be patient: Haste leads to mistakes. Always double-check wallet addresses, the amount you are sending, and other transaction details.

- Stick to official sources: Whether you are using a cross-chain service like Xgram or a top exchange, always type the URL yourself rather than clicking random links.

Frequently asked questions

What if I cannot find a buyer right away?

If you are using a P2P platform, it might take time to get matched with a buyer. You can lower your asking price or explore a different selling method, such as a centralized exchange or instant swap service.Do I need to verify my identity to sell Solana?

It depends on the platform. Most centralized exchanges require KYC for regulatory compliance. However, P2P platforms and instant swap services might let you sell without extensive personal documents, though limits could apply.How quickly can I sell my Solana?

In many cases, you can sell your SOL within minutes, especially on a liquid exchange or via an instant swap. P2P trades might take longer if you have to wait for a buyer or confirm external payments.Can I sell just a fraction of my Solana holdings?

Yes. Most platforms support fractional transactions. Just keep in mind trading and withdrawal fees can eat into your profits if your transactions are too small.What is the best way to reduce fees?

Look for platforms with competitive fee structures or volume-based discounts. Cross-chain solutions like Xgram can help you skip multiple transition fees by doing a direct swap to your preferred blockchain, which can cut down on extra conversion costs.

Final thoughts

Mastering how to sell Solana safely and easily is a matter of practice. After choosing the platform that aligns with your preferences, always remember to verify addresses, keep your private keys secure, and confirm that each step of your transaction is correct. Solana’s speed advantage may help you complete your trades faster than on other networks, but that is no reason to rush your decisions. By staying aware of potential pitfalls, verifying each step, and selecting the right platform, you can exit your SOL position with minimal friction. You have all you need to get started, so go ahead, optimize your selling strategy, and protect your hard-earned crypto gains.