How to Use Monero Swaps for Cryptocurrency Privacy Protection

What Are Monero Swaps and Why They Matter for Privacy

Monero swaps refer to the exchange of other cryptocurrencies (or fiat) for XMR or vice versa. The primary appeal is privacy: Monero's blockchain hides sender, receiver, and amount by default, unlike Bitcoin where every transaction is publicly traceable. Swapping into XMR "breaks the chain" — funds from a traceable wallet can be moved to Monero, making subsequent transactions untraceable without private keys.

In 2026, with MiCA in the EU requiring CASPs (crypto asset service providers) to implement Travel Rule and AML checks, and US regulators (SEC, CFTC, FinCEN) increasing scrutiny, privacy tools like Monero have gained relevance. Chain analysis firms report that ~80–90% of BTC/ETH transactions can be linked to identities via KYC exchanges, but Monero's privacy resists this (Chainalysis estimates <10% success rate for de-anonymizing XMR). Swaps allow users to leverage Monero's features for various scenarios, such as private DeFi participation or confidential transfers.

Key reasons Monero swaps are used:

- Traceability break: BTC from a KYC exchange can be swapped to XMR, obscuring future use

- DeFi privacy: Use XMR in private pools or bridges without revealing balances

- Everyday confidentiality: Send/receive without exposing transaction history

- Censorship resistance: Monero harder to block/freeze than transparent coins

Monero's market position in 2026: ~$706–$710 price, $13B+ market cap, ~$200–$300M daily volume (CoinGecko data). Swaps are available on non-custodial platforms, DEXes, and P2P markets, but many centralized exchanges delisted XMR due to regulatory pressure.

Preparation: Setting Up for Safe Monero Swaps

Before any swap, prepare tools to maintain privacy and security.

Choose a Monero Wallet

Monero requires a wallet that supports its privacy tech. Top options in 2026:

- Official Monero GUI/CLI — full node for maximum privacy, open-source

- Feather Wallet — lightweight, fast, Tor integration, ideal for desktop

- Cake Wallet — mobile (iOS/Android), built-in swaps, user-friendly

- Stack Wallet — multi-coin, Tor support, mobile/desktop

- Ledger — hardware for cold storage, integrates with GUI/Feather

Generate a new subaddress for each incoming transaction to avoid linking. Avoid custodial wallets (exchange apps) for privacy reasons.

Select a Base Currency Wallet

For BTC/USDT/ETH → XMR swaps, use a non-custodial wallet:

- Sparrow or Electrum for BTC — privacy tools like CoinJoin

- MetaMask or Trust Wallet for ETH/USDT — multi-chain support

- Ledger/Trezor — hardware for secure signing

Withdraw from exchanges to your wallet first to break initial links.

Privacy Tools

Use Tor Browser for accessing platforms (hides IP). VPNs (Mullvad, ProtonVPN) add speed. Avoid WiFi networks with logging. For maximum anonymity, use Tails OS or Whonix.

Method 1: Non-Custodial Instant Swaps

Non-custodial aggregators allow direct wallet-to-wallet swaps without deposits or KYC.

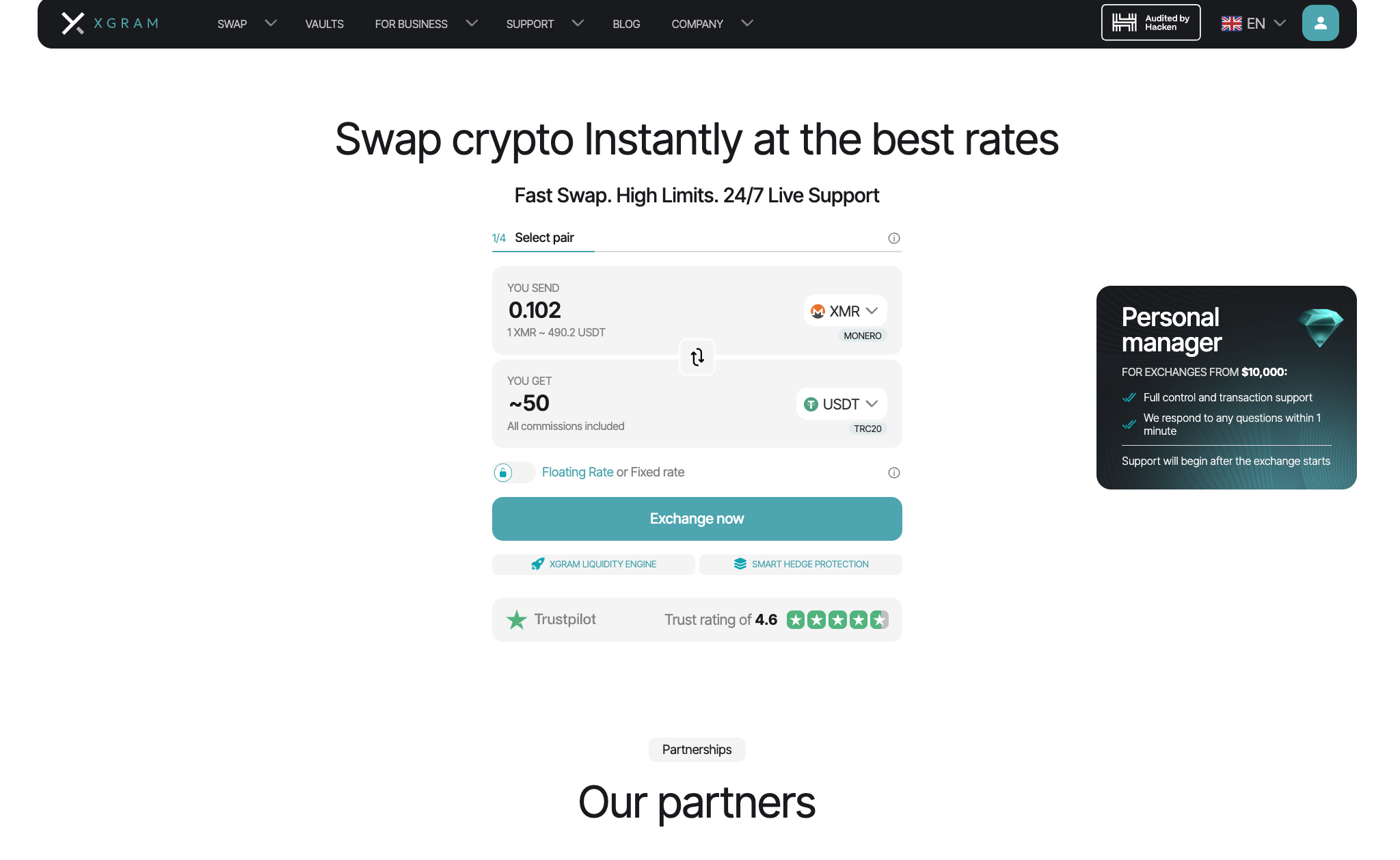

Step-by-Step with Xgram.io

- Visit https://xgram.io/coins via Tor/VPN.

- Select BTC/USDT/ETH as "Send" and XMR as "Receive".

- Enter amount, Monero receive address (fresh subaddress).

- Review rate and fees (0.5–1.5%).

- Send BTC/USDT to the deposit address.

- Wait for confirmations — XMR arrives in wallet (5–30 min).

Xgram.io is non-custodial — no fund holding. Similar: ChangeNOW, SimpleSwap, FixedFloat.

Pros/Cons

Pros: high privacy, fast, no custody.

Cons: fees slightly higher, slippage on large volumes.

Method 2: Decentralized Exchanges (DEX)

Haveno — P2P DEX for XMR with multisig escrow, no KYC.

Step-by-Step with Haveno

- Download Haveno from haveno.exchange.

- Run with Tor.

- Create wallet, browse BTC/USDT → XMR offers.

- Take offer, lock BTC in escrow.

- Seller confirms — receive XMR.

Haveno is non-custodial, supports fiat.

Method 3: Atomic Swaps

Trustless BTC ↔ XMR via HTLC.

Tools

- Farcaster / COMIT — cross-chain protocols

- Liquality — wallet with built-in swaps

Steps: install tool, connect wallets, create/accept offer, lock funds, reveal preimage.

Method 4: P2P Marketplaces

AgoraDesk, Monero.market — P2P for XMR without KYC, with fiat/crypto.

Method 5: Low-KYC Centralized Exchanges

MEXC, TradeOgre, NonKYC.io — limited trading without verification.

General Step-by-Step Process (Any Method)

- Install secure Monero wallet, generate fresh subaddress.

- Prepare BTC in non-custodial wallet.

- Choose method.

- Provide XMR address and BTC amount.

- Send BTC to deposit address.

- Wait for confirmations and XMR receipt.

- Verify transaction (private view key for XMR).

- Move to cold storage for long-term hold.

Fees, Time, Limits & Privacy Comparison

| Method | Typical Fee | Time | Max Limit (no KYC) | Privacy Level | Risk Level |

|---|---|---|---|---|---|

| Non-Custodial Swaps | 0.5–2% | 5–30 min | $10k–$100k+ | Very High | Low |

| Haveno (DEX) | 0.2–1% | 30 min – hours | Offer-dependent | Highest | Low |

| Atomic Swaps | Network only | Hours | Technical | Highest | Low |

| P2P | 0–5% | Minutes – days | Offer-dependent | High | Medium-High |

| Low-KYC CEX | 0.1–0.5% | Instant | $10k–$30k/day | Medium | Medium |

Risks and Best Practices in 2026

- Platform risk — verify status before use

- IP disclosure — use Tor/VPN

- Address linking — fresh subaddresses

- P2P scams — escrow and reputation

- Regulation — no-KYC may be monitored in some countries

- Practices: test small amounts, fresh wallets

Conclusion

Swapping Bitcoin to Monero in 2026 is accessible through non-custodial swaps (e.g., Xgram.io), decentralized platforms (Haveno), P2P marketplaces (AgoraDesk), and select low-KYC exchanges. Each method combines convenience, privacy, speed, and risks differently. Non-custodial aggregators offer the optimal balance for most users, while Haveno provides maximum trustlessness. Always verify platform status, use Tor/VPN, withdraw to self-custody immediately, and minimize shared information. Privacy is an ongoing process, not a one-time step.