How to Sell Crypto Instantly

TL;DR: You want to learn how to sell crypto instantly without the usual headaches. The key is to pick a reliable platform, understand any fees or liquidity issues, and make sure your steps are fully secure. By choosing the right solution and timing your transactions, you can avoid the most common mistakes and convert your coins in just a few steps.

Selling crypto on the spot appeals to many, especially when prices move fast and you need quick liquidity. Yet rushing to sell can lead to hidden fees, slow transaction times, or even potential security gaps. In this guide, you will discover exactly how to sell crypto instantly, covering the main pitfalls, comparing different platform types, and locking down your transaction safety.

Know the basics of instant selling

Before you jump into any transaction, it helps to clarify what it really means to sell crypto “instantly.” In most cases, you are looking for the ability to convert your cryptocurrency of choice into your preferred fiat currency (like USD or EUR) in a matter of minutes. That usually happens on platforms or tools that have enough liquidity to process buy and sell orders right away.

- Liquidity: The platform or exchange needs enough liquidity, meaning there is a steady flow of buyers ready to snap up your crypto at the price you want. Without it, you could wait much longer or settle for a less favorable price.

- User-friendly mechanism: An instant selling tool should be straightforward enough that you can deposit, execute your sell order, and withdraw funds without reading a complex manual. Beginners often prefer simpler platforms that guide you step by step.

- Security standards: Instant does not mean careless. A reliable platform still requires you to pass basic security checks. Completing identity verification (KYC) or enabling additional authentication factors might feel like an extra step, but it often protects both you and the platform from scams or misuse.

The “instant” label can be a bit confusing if you are new to crypto. For many, “instant” means your trade order fills quickly at a steady rate, and your funds become available to withdraw without long delays. However, the actual speed can vary because cryptocurrencies ride on networks that might have occasional congestion, and not every exchange or swap service is created equal.

If your chosen exchange has plenty of liquidity and minimal friction, you can typically see your converted funds arrive in your account balance in minutes. Just keep an eye on any deposit or withdrawal times, as certain payment methods (like wire transfers) can add hours or days to the process even if your crypto itself was sold in seconds.

Understand why speed matters

Volatility defines the crypto world. Coins and tokens can swing by double-digit percentages within hours, sometimes even within minutes. If you find yourself needing immediate cash—maybe because you need to cover an expense or you spot a better investment opportunity—the speed at which you can convert your crypto becomes critical.

Safeguarding gains

Speed can be the difference between locking in your gains or seeing them evaporate. When your coin of choice hits a favorable price, you do not want to run into roadblocks trying to sell. A slow platform or inefficient process could mean extra steps that let the market shift before you can complete the trade. In a fast-paced market, those minutes matter.

Avoiding deeper losses

The same logic applies to downward market movements. If a coin starts plunging and you aim to cut your losses, an instant selling process helps you exit quickly. Delaying can cause sleepless nights, especially if you see your balance shrink by the second. By reducing the time between deciding to sell and completing the order, you keep a firmer grip on your funds.

Giving you flexibility

Even if you are not reacting to big profit spikes or sudden drops, being able to sell quickly adds a layer of convenience. You can respond on short notice to real-life events—like medical bills or rent payments—without waiting days for your funds to clear. Since the crypto market never sleeps, you can grab those opportunities or shield yourself from risks, day or night.

Spot the biggest mistakes

Selling crypto instantly sounds like a dream scenario, yet there are many pitfalls to watch for. Rushing into a transaction without reading the fine print or verifying key security details can cost you time and money. Below are the most common errors people make when they first learn how to sell crypto instantly.

Overlooking hidden fees

It is easy to fixate on “instant” and forget that speed can come at a premium. Some instant swap services or quick-sell features charge higher fees. This might be a flat rate or a percentage that sneaks up on you once you finalize your transaction. A few exchanges only display your final total after you check out, so read carefully.

Keep an eye on:

- Trading fees: Usually displayed as a percentage of the transaction amount.

- Withdrawal fees: Separate costs for withdrawing fiat or crypto.

- Spread: The difference between buy and sell prices that could be bigger than on more traditional exchanges.

Picking the wrong exchange type

Different exchange types cater to different user needs. If you are trading on a peer-to-peer (P2P) platform, for example, you rely on matching with an individual buyer. That can introduce delays if no one wants to trade at your desired price. On a centralized exchange, you might get better liquidity, but you trade convenience for more complex user interfaces and potential verification requirements.

Forgetting about liquidity

High liquidity is crucial for getting a fair price. Even if a platform claims to be “instant,” it might not have enough buyers or sellers for your specific coin. When you submit a sell order on a low-liquidity platform, you risk partial fills—only a portion of your order is sold quickly, with the rest waiting in the queue. During that wait, prices could shift, causing you to lose out on potential profit or face bigger losses.

Falling victim to scams

Beginners can be easy targets for social engineering or fraudulent services. Scammers often promise “fast track” conversions or incredible rates that are too good to be true. Always confirm that the site or platform you use is trustworthy. Double-check if the exchange is regulated or has a verifiable track record, and never share your private keys or recovery phrases with anyone—not even a customer service agent.

Ignoring security measures

In the rush to sell, some people skip basic security steps. Logging onto public Wi-Fi or ignoring the suggestion to enable two-factor authentication can open the door to hackers. Being cautious might add an extra step, but the trade-off is well worth it to keep your funds out of the wrong hands.

Compare exchange types

You can sell crypto instantly through various channels. Understanding each platform’s structure, advantages, and drawbacks helps you pick the one that best suits your needs. Below are the three main options to compare.

Centralized exchanges

These platforms usually hold user funds in custodial wallets, meaning you deposit your crypto into an account under the exchange’s management. This can streamline trading. Centralized exchanges typically have high liquidity, making them a popular pick for anyone looking to sell crypto quickly. Many major centralized exchanges also offer instant-sell features, allowing you to convert to a fiat balance in a few clicks.

Pros:

Often have large user bases and plenty of liquidity.

Provide user-friendly dashboards that simplify trading.

May support multiple payment methods for withdrawals.

Cons:

Require verification (KYC), adding to sign-up time.

You rely on the exchange to securely store your funds.

Could freeze withdrawals during high market volatility or maintenance.

Peer-to-peer platforms

P2P platforms match you directly with interested buyers. You set your asking price, and the platform acts as an escrow to ensure both parties honor their end of the deal. This system can be cost-effective and flexible for people who want to avoid typical exchange fees. However, “instant” depends on how quickly you find a buyer.

Pros:

Greater control over your selling price and payment methods.

Potential for lower fees, since you skip the typical exchange overhead.

Semi-private, allowing direct negotiation with buyers.

Cons:

May take longer to finalize a deal without enough available buyers.

Requires extra vigilance to avoid fraud.

Payment times vary based on the buyer’s chosen method.

Instant swap services

Instant swap services do not follow a standard order-book model. Instead, they partner with different liquidity providers behind the scenes to execute trades at the best possible rate. You do not typically need to open an account or hold funds on the platform. You simply indicate how many coins you want to sell, confirm the rate, and the service will process your swap into a destination address.

Pros:

Simple interface that is beginner-friendly.

No need to store funds on the platform.

Typically quick, as they aggregate multiple sources of liquidity.

Cons:

Rates may be less favorable if the service charges a bigger spread.

Limited range of supported coins on some instant swap sites.

If network fees rise, you end up paying more for each transaction.

Learn how to sell instantly

Now that you know what “instant selling” means, why speed matters, and the main platforms available, here is a step-by-step guide on how to sell crypto instantly. These steps are general enough that you can adapt them to whichever method or site you prefer.

Identify a trustworthy service

Start by choosing a centralized exchange, a P2P marketplace, or an instant swap service. Look for reviews, security certifications, and user feedback to verify the platform’s legitimacy. Steer clear of unknown sites that offer suspiciously great deals.Prepare your wallet

If you need to deposit crypto onto a platform, move your coins from your personal wallet. Confirm you have the correct deposit address. Copying an address incorrectly can lead to irreversible loss of funds. Double-check the network you are using—some coins can be sent via multiple blockchains, and choosing the wrong one can cause delays or lost transactions.Complete verification (if required)

Many platforms require some form of KYC to unlock all features, including instant cash-out or higher withdrawal limits. Verification can involve providing a valid photo ID and proof of address. You might also need to enable two-factor authentication for your account security.Execute your trade

Once your crypto is on the platform and your account is verified, look for the “Sell” or “Instant Sell” option. Some platforms let you pick a specific price, while others set a real-time rate for immediate fulfilment. Verify the details of your trade before confirming.Withdraw your funds

After you convert the crypto to fiat currency, you can usually withdraw money to your bank account, credit card, or alternative payment method, depending on the platform. Check withdrawal times, fees, and any minimum withdrawal amounts. Once the transaction is complete, confirm that the funds have actually hit your destination account.

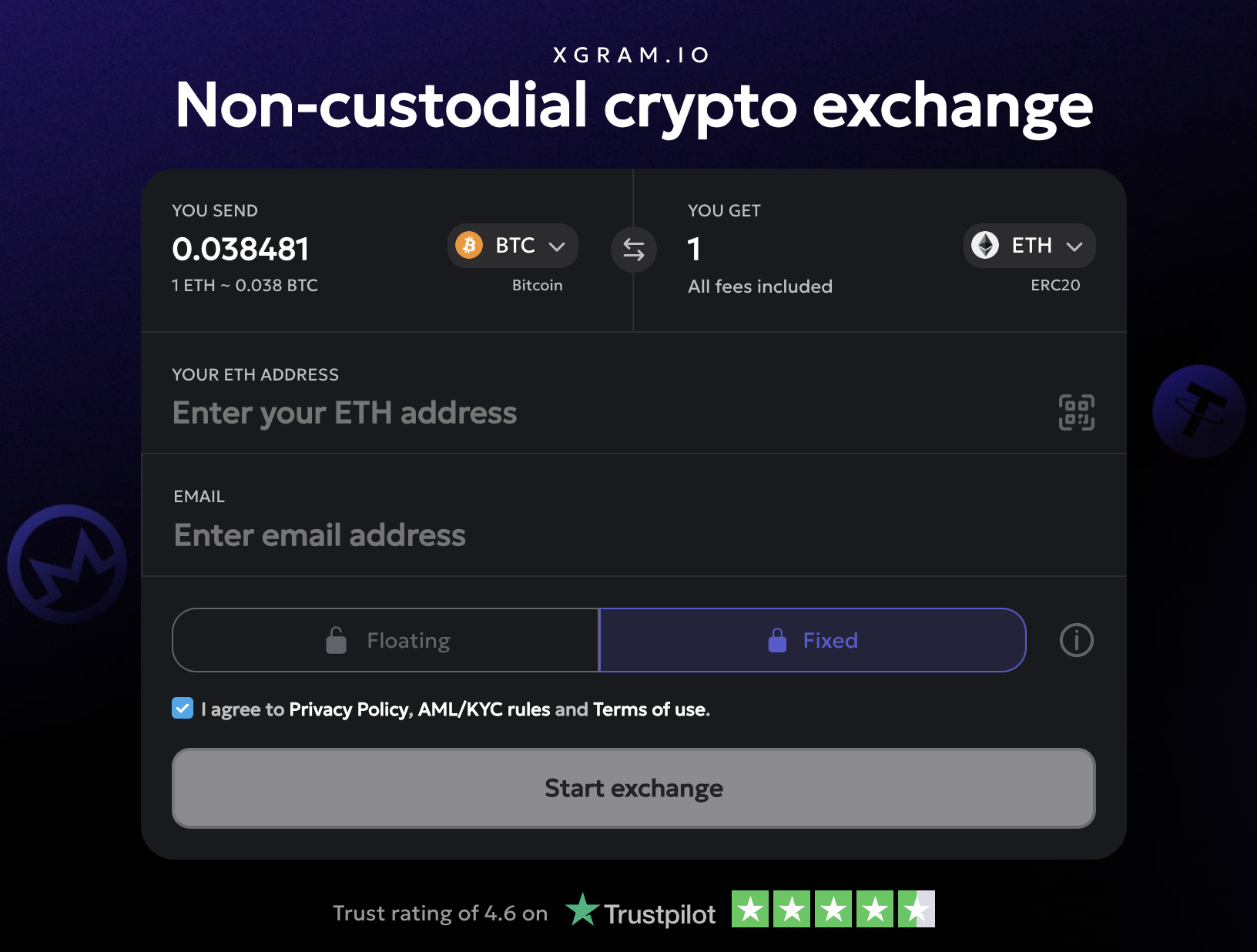

Use a real-world option: Xgram

Sometimes, you need a real example of a platform that balances speed, convenience, and security. Xgram is one such exchange service that lets you trade crypto instantly without connecting an external wallet. In other words, you start an exchange, choose the crypto you want to sell, and Xgram manages the process in the background, saving you from extra transfer steps.

Xgram stands out because it includes typical swaps and more advanced options for people looking to cut down on fees. Not needing to plug in your own wallet can reduce your exposure to phishing attacks. It also streamlines the entire process of going from crypto to fiat, which is essential for beginners who prefer a simple, straightforward interface.

You will find that Xgram’s approach deals heavily with user-related security. Since the platform does not require you to connect your wallet, you avoid the risk of pasting mislabeled addresses or juggling multiple transaction confirmations. Instead, the service provides a guided flow, helping you finalize your sale in a few steps.

Even for advanced users, Xgram can be a handy alternative to massive exchanges that sometimes freeze or lock accounts when things get volatile. By diversifying your selling sources—maybe combining a well-known centralized exchange with a platform like Xgram—you lessen your reliance on a single solution.

If you are just starting out, try a small test transaction on Xgram. This not only helps you get familiar with the interface but also lets you monitor fees and transaction times. That way, you get a clearer picture of how quickly your funds reach your bank or chosen payment method, and you keep control of the process from start to finish.

Protect your assets

Whether you sell crypto once a month or a few times a year, security should remain a top priority. Losing your digital assets is far more painful than dealing with an extra verification step. Consider these key measures:

- Use strong authentication: Always enable two-factor authentication on both your exchange and email accounts. If possible, opt for an authenticator app rather than SMS, which can be hijacked via SIM swapping.

- Keep your software updated: Outdated apps or operating systems create vulnerabilities hackers love to exploit. Consistently update your phone, computer, and wallet software to patch security holes.

- Separate trading from storage: Keep only what you plan to trade on an exchange. For long-term holdings, it is usually safer to store your crypto in a personal wallet, especially a hardware one.

- Be mindful of phishing: Scammers often create fake websites or send emails that look nearly identical to legitimate exchanges. Check the URL carefully, and do not click on random links from suspicious emails or messages.

- Limit your public Wi-Fi usage: Selling crypto while connected to public Wi-Fi invites eavesdropping. If you must trade on the go, consider using a VPN to encrypt your connection.

Frequently asked questions

How quick is “instant” really?

Instant usually means your trade executes within seconds to a few minutes. The exact speed depends on platform liquidity, network congestion, and whether you need to wait for any deposit transactions to confirm. Once your crypto is on a high-liquidity exchange, a sell order can fill almost immediately at the current market price.Do I need an ID to sell crypto instantly?

Many centralized exchanges require identity verification for security and regulatory reasons, but some instant swap services or P2P platforms may not need extensive documents. Keep in mind, though, that unverified accounts often have strict withdrawal limits or restricted features. Gradually completing verification raises those limits and generally provides smoother transactions.Can I sell crypto instantly without paying high fees?

Fees vary widely between platforms. Some add a noticeable markup in exchange for simplicity, while others keep spreads tight but charge separate transaction fees. If you want the best possible deal, compare multiple services. You may find that the fee difference adds up if you are selling larger amounts of crypto.Which payment methods are fastest to withdraw?

Debit cards and digital wallets usually provide the quickest turnaround. In many regions, bank transfers can take several business days, even if your crypto transaction was instant. Check the withdrawal processing times for the platform you use, as some allow near-instant fiat withdrawals to certain banks and e-wallets.Is it safe to sell large amounts instantly?

Large transactions are often more scrutinized. Some exchanges might freeze or delay big trades to confirm they are legitimate. If this concerns you, contact your chosen platform’s support team and verify any transaction limits in advance. Splitting your sale into smaller batches can sometimes help if you worry about liquidity or sudden price shifts.

Wrap up

You now have a clearer picture of how to sell crypto instantly without falling victim to hidden fees, slow approvals, or security loopholes. By choosing the right platform (or combination of platforms), keeping an eye on liquidity, and following a secure process, you can convert crypto into fiat in mere minutes. Always do your homework, from verifying platforms to double-checking addresses, to make sure your transaction goes smoothly.

Whether you choose a full-scale centralized exchange, a P2P marketplace, or an instant swap service, the key is to balance speed with safety. Having a quick solution at hand is valuable in a dynamic crypto market, but so is keeping your assets secure. Pick one or two reliable options—like Xgram or a well-known exchange—and stick to best practices. By avoiding rookie mistakes and staying vigilant, you can sell crypto smoothly and confidently every time.