How to Buy Gold-Backed Crypto in 2026 (5-Minute Beginner’s Guide)

Why Invest in Gold-Backed Crypto in 2026?

Tokenized gold bridges traditional precious metals and digital finance. Each token is backed 1:1 by audited physical gold in secure vaults (e.g., LBMA-certified Brink’s for PAXG, Swiss vaults for XAUT). Unlike volatile cryptos like Bitcoin, these offer low correlation with stocks/crypto and act as an inflation/geopolitical hedge.

Key advantages in 2026:

- Fractional access: Buy 0.01 oz (~$46) instead of full bars.

- No custody/storage fees (zero for most issuers).

- Instant settlement vs. T+2 for ETFs/physical gold.

- DeFi integration: Lend tokens for yields (3–8% APY on platforms like Aave).

- Redemption option: Convert to physical gold (institutional min ~430 oz, ~$2M+).

Risks include issuer counterparty (trust in Paxos/Tether), minor de-pegging during extreme volatility, regulatory changes (MiCA in EU, SEC oversight), and gold price drops if rates fall or risk-on sentiment returns.

Top Gold-Backed Tokens to Consider in 2026

| Token | Issuer | Backing Ratio | Market Cap (Jan 13, 2026) | 24h Volume | Key Strengths | Best For |

|---|---|---|---|---|---|---|

| PAXG | Paxos | 1 troy oz | ~$1.77B | ~$213M | NYDFS regulated, monthly KPMG audits, LBMA London vaults | Compliance-focused, institutional investors |

| XAUT | Tether | 1 troy oz | ~$1.88B | ~$220–231M | Multi-chain (ETH/TRON/TON), high liquidity, Swiss vaults | Active traders, DeFi users |

| KAU | Kinesis | 1 gram | Lower (~$300–400M) | Moderate | Spendable via debit card, low fees | Everyday utility, smaller positions |

PAXG and XAUT dominate (>90% market share) due to liquidity and trust. Start with these unless you need gram-level granularity (KAU).

Preparation Before Buying

1. Research & Due Diligence

Verify backing: Check issuer audits (Paxos monthly reports, Tether attestations). Use CoinMarketCap/CoinGecko for live data, official sites (paxos.com/pax-gold, gold.tether.to) for reserves. Read recent Chainalysis/Messari reports on RWA/tokenized assets growth.

2. Set Up a Secure Wallet

Choose based on chain: MetaMask/Trust Wallet (software, multi-chain), Ledger Nano X/Trezor (hardware for long-term). For multi-chain XAUT, ensure wallet supports TRON/TON bridges. Always:

- Enable 2FA/hardware keys.

- Never share seed phrase.

- Test small transfers first.

3. Choose Funding Method

Fiat on-ramps: Bank transfer/SEPA (Europe), ACH (US), card (higher fees). Crypto: USDT/USDC (stable), BTC/ETH. Start with $100–$1,000 to minimize risk.

Detailed Step-by-Step Buying Guide

Method 1: Centralized Exchanges (Easiest & Most Liquid)

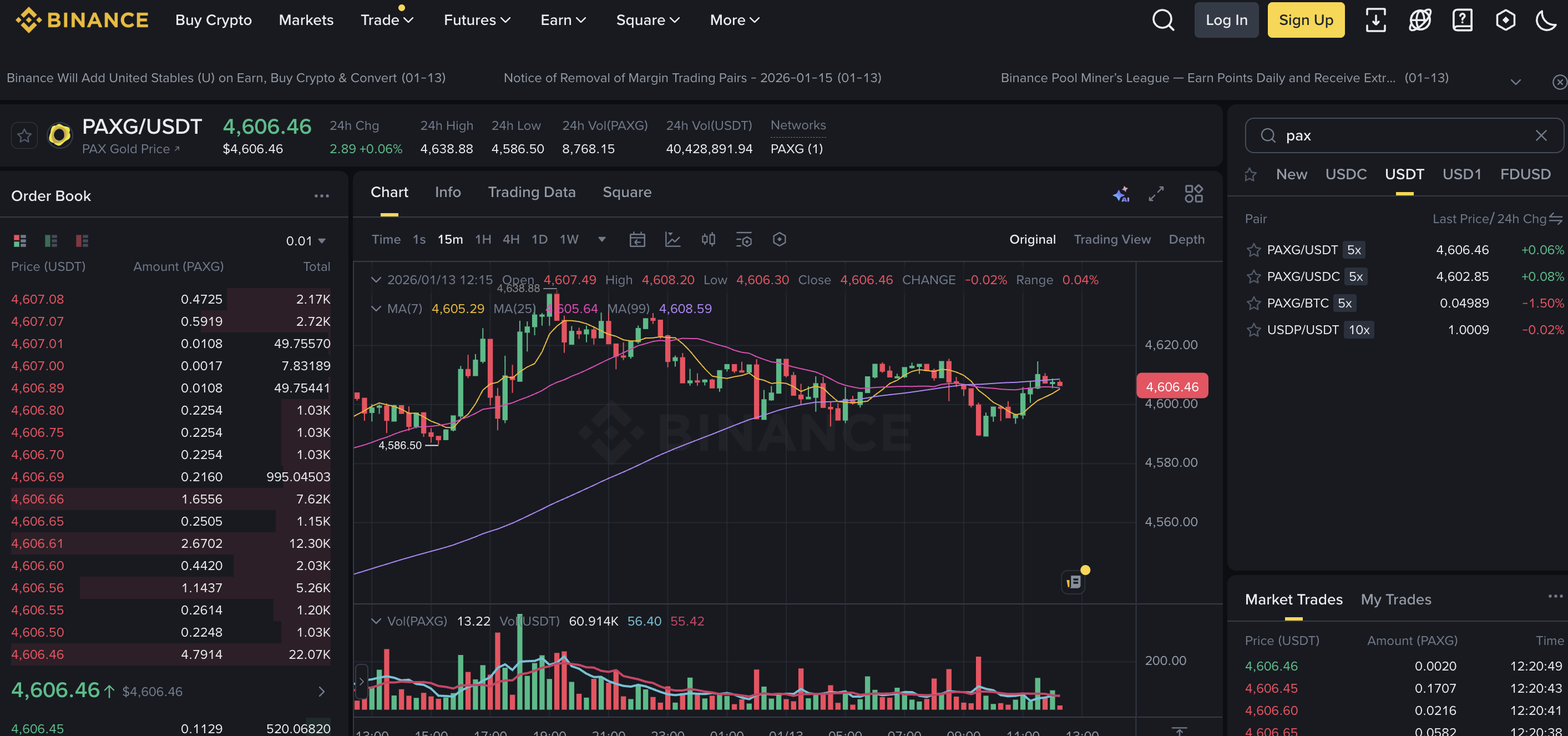

- Sign up on Binance, Kraken, Bybit, BingX, or Coinbase (KYC required for fiat).

- Verify identity (passport/ID + selfie; 1–3 days).

- Deposit fiat/crypto (e.g., SEPA transfer free on Kraken, card ~2–4% fee).

- Go to Spot trading → Search PAXG/USDT or XAUT/USDT.

- Place order: Market (instant at current price) or Limit (set your price).

- Withdraw to personal wallet (avoid leaving on exchange long-term).

Pros: High liquidity, fiat ramps, mobile apps. Cons: Custodial until withdrawal, KYC.

Method 2: Non-Custodial Swaps (Privacy & Control)

- Fund wallet with USDT/USDC/ETH (from exchange or P2P).

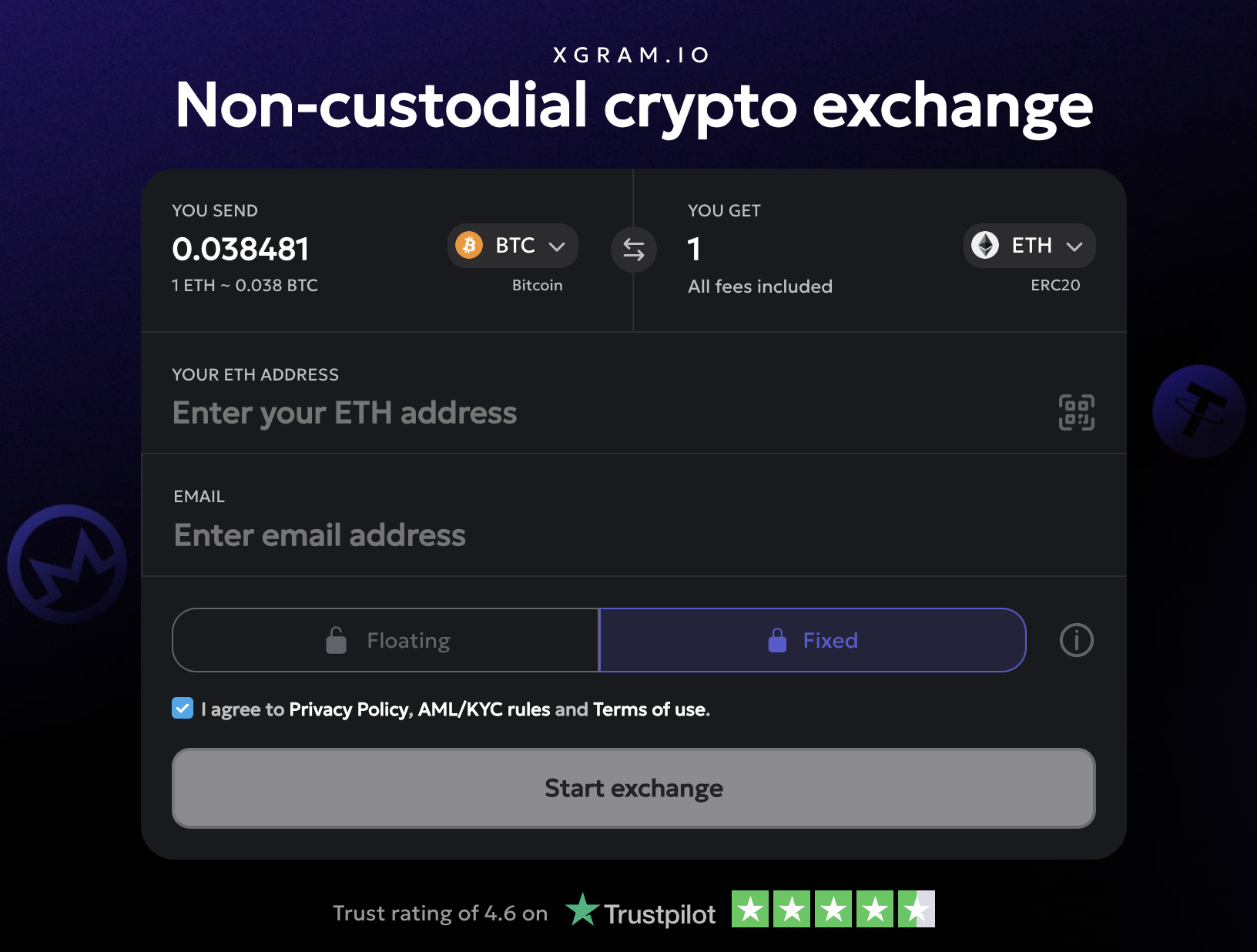

- Connect to a DEX/swap aggregator: For simple swaps, use non-custodial platforms like Xgram.io — enter amount, select pair (e.g., USDT to PAXG/XAUT), review rate/fees, confirm tx. Assets arrive directly in your wallet—no KYC or account.

- For DeFi: Uniswap (Ethereum), or cross-chain bridges for XAUT on TRON/TON.

Xgram.io excels for quick, intermediary-free access to tokenized gold with competitive rates and low slippage on major pairs. Ideal if avoiding centralized custody.

Method 3: Direct from Issuer (Advanced)

Paxos platform: Mint PAXG directly (deposit fiat/gold equivalent). Tether: Similar for XAUT. Higher mins/fees, best for large/institutional buys.

Fees, Taxes, and Yield Opportunities

| Category | Typical Cost (2026) | Notes |

|---|---|---|

| Exchange Trading | 0.1–0.2% | Binance/Kraken low; varies by VIP level |

| Network Gas | $1–$20 (Ethereum), <$1 (TRON for XAUT) | Use Layer-2 or multi-chain to save |

| Issuer Fees | 0–0.25% creation/redemption | PAXG zero storage; XAUT ~0.25% |

| Taxes | Capital gains on sell/redeem | Track basis; use Koinly/CoinTracker |

DeFi Yields: Lend PAXG on Aave (~3–6% APY), provide liquidity on Uniswap pools (PAXG/USDC ~4–8% with risks like impermanent loss). Monitor via DeFiLlama.

Security & Common Mistakes to Avoid

- Use hardware wallets for >$5K holdings.

- Avoid phishing (check URLs, never click unsolicited links).

- Don't store on exchanges long-term (hacks like FTX 2022).

- Common pitfalls: Ignoring audits, chasing low-fee scams, not withdrawing after buy, tax non-reporting.

Advanced Tips for 2026

Dollar-cost average (DCA) buys during gold dips. Diversify across PAXG/XAUT. Monitor RWA trends (Messari forecasts $10T by 2030). For redemption: Contact issuer for physical (fees + shipping; min high). Track via CoinMarketCap alerts or issuer dashboards (PAXG bar serial lookup).

Conclusion

Buying gold-backed crypto in 2026 is accessible and strategic for diversification. Start small: Research → Wallet → Fund → Swap/Trade → Secure. Use trusted platforms (Kraken/Binance for ease, Xgram.io for privacy swaps). With gold's strong outlook, tokenized assets like PAXG/XAUT offer a modern hedge. DYOR, start conservatively, and stay updated on audits/regulations.