TL;DR (versión corta):

- Familiarízate con los fundamentos de Pepe Coin y los factores que impulsan su valor.

- Compara métodos de venta: exchanges centralizados, P2P, swaps instantáneos y Xgram.

- Sigue un plan paso a paso para vender rápido, usando medidas de seguridad como la autenticación de dos factores.

- Vigila las comisiones elevadas y los compradores sospechosos, y revisa siempre la normativa local.

Explora los conceptos básicos de Pepe Coin

Antes de entrar en el proceso de venta como tal, es fundamental entender qué es Pepe Coin y por qué su precio puede fluctuar tan rápido. Pepe Coin forma parte de la creciente categoría de criptomonedas inspiradas en memes. Estos proyectos suelen ganar tracción mediante el ruido en redes sociales, el apoyo de la comunidad y un branding desenfadado. El sentimiento del mercado puede cambiar de golpe por una noticia o un comentario de un influencer, provocando subidas o caídas bruscas.

Estas son algunas características clave de Pepe Coin que influyen en su comportamiento de mercado:

- Valor impulsado por la comunidad: las memecoins dependen mucho de la fuerza de su base de usuarios. El entusiasmo en plataformas como X (Twitter) o Reddit puede influir enormemente en el precio.

- Riesgo de baja liquidez: algunos tokens no tienen el mismo volumen de trading que monedas grandes como Bitcoin o Ethereum. Esto los hace más volátiles y a veces algo más difíciles de vender en grandes cantidades.

- Potencial de subidas o caídas rápidas: mientras que las grandes criptos suelen moverse más despacio, las memecoins como Pepe Coin pueden dispararse o desplomarse en cuestión de horas.

- Naturaleza especulativa: muchos traders mantienen memecoins esperando multiplicar su valor. Pero si el hype se apaga, el precio también puede desplomarse con rapidez.

Como Pepe Coin está impulsado sobre todo por el sentimiento del mercado, conviene vender en momentos favorables: cuando los volúmenes de trading son altos o cuando se aprecia una tendencia alcista clara. Nadie puede predecir el mercado con certeza, pero seguir las noticias, el ruido en redes y los volúmenes te da una mejor idea de cuándo vender.

Evalúa tus métodos de venta

El siguiente paso para aprender cómo vender Pepe Coin es entender las distintas plataformas y sistemas que te permiten convertir tu cripto en otros activos digitales o en dinero fiat. Cada método tiene sus ventajas, desventajas y estructura de comisiones. La elección depende de tus preferencias, de tus requisitos de seguridad y de la rapidez con la que necesites los fondos.

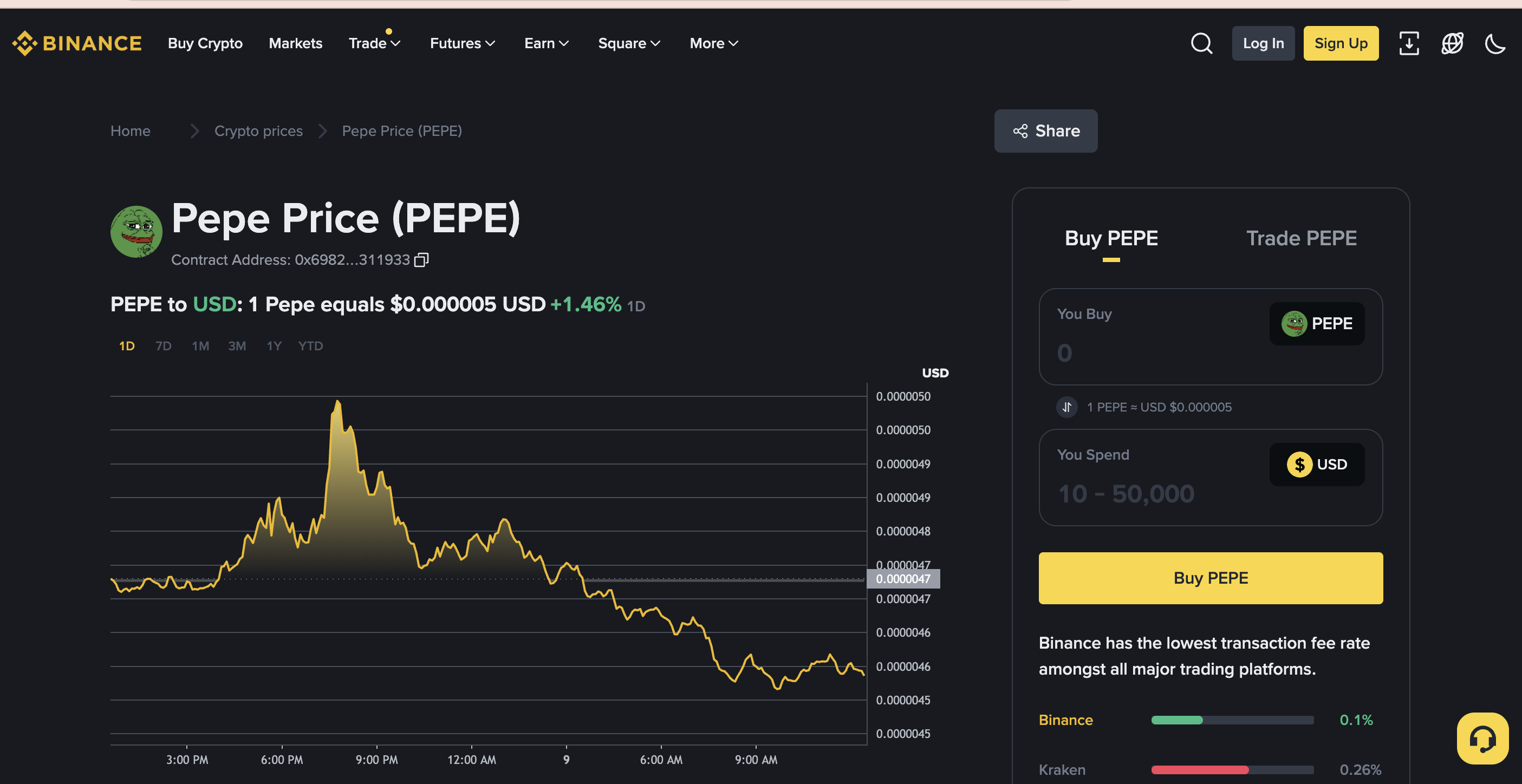

Exchanges centralizados

Los exchanges centralizados (CEX) como Binance, Coinbase o KuCoin suelen permitirte operar Pepe Coin frente a otras criptos (como USDT) o, en algunos casos, directamente frente a fiat (como USD). Normalmente cobran comisiones de trading que van aproximadamente del 0,1 % al 1 %, además de posibles comisiones de retirada.

Ventajas:

- Interfaces fáciles de usar y buena liquidez.

- Soporte al cliente dedicado.

- Funciones avanzadas como órdenes límite y de mercado.

Desventajas:

- Requieren registro y verificación de identidad (KYC).

- Tus fondos quedan bajo custodia del exchange hasta que los retires.

Plataformas peer-to-peer (P2P)

Las plataformas P2P te conectan directamente con un comprador o vendedor. Tú fijas tu propio precio y la plataforma suele ofrecer un servicio de depósito en garantía (escrow) que retiene tu cripto hasta que el pago se confirma.

Ventajas:

- Mayor control sobre el precio de venta.

- Comisiones potencialmente más bajas que en los CEX.

- Variedad de métodos de pago.

Desventajas:

- La operación puede tardar más si hay poca demanda a tu precio.

- Debes evaluar bien al comprador o confiar en el sistema de reputación de la plataforma.

Servicios de swap instantáneo

Servicios de swap instantáneo como ChangeNOW o SimpleSwap te permiten cambiar Pepe Coin rápidamente por criptos más grandes como BTC, ETH o stablecoins sin crear una cuenta. Solo indicas la dirección a la que quieres que se envíe la moneda recibida.

Ventajas:

- Transacciones rápidas.

- Configuración y verificación mínimas.

- Interfaz sencilla, sin libro de órdenes.

Desventajas:

- A veces aplican tipos de cambio menos favorables.

- Hay pocas opciones si introduces una dirección incorrecta.

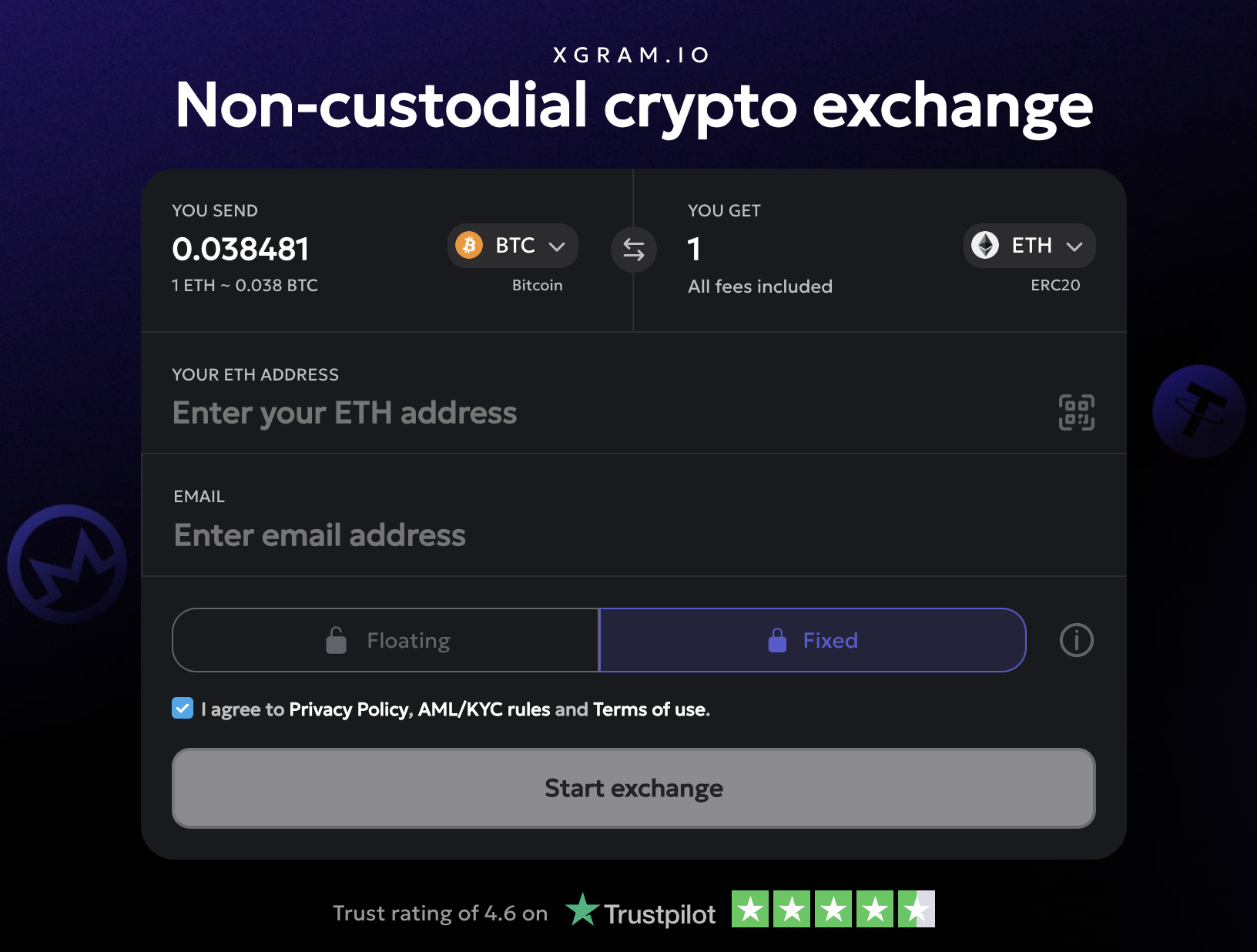

Ten en cuenta Xgram

Otro método interesante es Xgram, un servicio de intercambio online que ofrece una forma sencilla de convertir cripto sin obligarte a conectar una billetera externa. Simplemente eliges la cripto que quieres vender —en este caso, Pepe Coin— y la moneda (cripto o fiat) que quieres recibir. Luego envías tus Pepe Coin a la dirección que Xgram te indique, y la plataforma realiza el swap por ti.

Aquí tienes cinco razones por las que Xgram puede ser una buena opción:

- No necesitas conectar tu billetera: no hace falta sincronizar tu wallet personal con la plataforma, lo que agiliza el proceso.

- Comisiones más bajas: sus tarifas suelen ser competitivas y pueden ahorrarte dinero frente a otros swaps instantáneos.

- Swaps eficientes: normalmente recibes tu cripto o fiat de destino con bastante rapidez.

- Fácil de usar: la interfaz es amigable para principiantes; no necesitas experiencia en trading.

- Válido para varios tokens: si tienes otras monedas además de Pepe Coin, Xgram suele admitir una buena variedad, lo que te permite gestionar varios swaps en un mismo sitio.

Xgram puede ser una alternativa muy cómoda si te incomoda la complejidad de registrarte y operar en un CEX o el ir y venir típico de las operaciones P2P. En última instancia, tú decides qué plataforma encaja mejor con tus expectativas; solo recuerda que cada camino tiene requisitos propios, así que elige el que te inspire mayor confianza.

Sigue un enfoque paso a paso

Entender el panorama general está bien, pero también necesitas un plan estructurado. Este es un esquema sencillo que puedes usar con cualquier método. Ajusta los pasos según las características de la plataforma y trata siempre tus claves privadas con cuidado.

1. Crea tu cuenta (si es necesario)

- Si vas a usar un exchange centralizado o determinados servicios de swap, puede que debas crear una cuenta.

- Completa los pasos KYC requeridos, que pueden incluir el envío de tu documento de identidad o un comprobante de domicilio.

- Activa la autenticación en dos pasos (2FA) para reducir el riesgo de accesos no autorizados.

2. Elige tu par de trading o moneda de destino

- En un CEX, selecciona el par adecuado. En el caso de Pepe Coin, suele ser PEPE/USDT.

- En P2P, fija tu precio en la moneda que prefieras para que los compradores lo vean claro.

- En plataformas de swap instantáneo o en Xgram, simplemente indicarás qué moneda quieres recibir a cambio de Pepe Coin.

3. Transfiere o deposita tus Pepe Coin

- Si guardas Pepe Coin en una billetera personal, deberás enviarlas a la dirección de tu plataforma elegida.

- Revisa la dirección con mucho cuidado. Un solo carácter incorrecto puede provocar la pérdida permanente de tus fondos.

- Supervisa las confirmaciones de red; pueden tardar desde unos minutos hasta cerca de una hora, según la congestión.

4. Coloca la orden de venta o inicia el swap

- En un CEX, puedes usar una orden de mercado para vender rápido al precio actual o una orden límite para esperar un mejor precio.

- En P2P, confirma los datos de pago del comprador y bloquea tus Pepe Coin en escrow.

- En un swap instantáneo o en Xgram, limita a confirmar el total de la operación, las comisiones y la dirección de recepción.

5. Confirma la recepción de los fondos

- Una vez ejecutada la operación, comprueba tu saldo en la plataforma o que el activo recibido haya llegado a tu billetera.

- En P2P, no liberes las Pepe Coin del escrow hasta que verifiques que el pago ha llegado.

- Guarda los fondos recibidos de forma segura, ya sea en una billetera protegida o en una cuenta bancaria si has retirado a fiat.

6. Retira a un almacenamiento seguro

- Para una seguridad máxima, mueve tu nueva cripto a una billetera personal donde controles las claves privadas.

- Si vendiste por fiat, retira el dinero a tu cuenta bancaria, teniendo en cuenta comisiones y plazos de abono.

- Registra los detalles de la operación si los necesitas para impuestos o para tu propio seguimiento.

Evita errores costosos

Aunque tengas un plan, ciertos fallos pueden comerse buena parte de tus ganancias o añadir riesgos innecesarios. Conociendo estos puntos, puedes adelantarte y esquivarlos.

- No revisar las condiciones del mercado: vender en plena caída puede dejarte con remordimientos si el precio rebota poco después. Observa el volumen y el sentimiento general del mercado antes de confirmar.

- Usar plataformas sospechosas: investiga el historial del servicio. Evita webs con poca trayectoria, sin canales de soporte claros o con mala reputación en redes.

- Ignorar la normativa local: algunos países imponen restricciones o exigen declarar determinadas operaciones cripto. Asegúrate de cumplir con la ley en tu jurisdicción.

- Exponer tus claves privadas: ten cuidado al conectar billeteras externas a servicios nuevos. Comprueba la URL y evita caer en páginas de phishing.

- Olvidarte de las comisiones: las tarifas altas pueden erosionar tus beneficios. A veces compensa esperar a un momento con menos congestión o usar una plataforma más barata.

Reduce las comisiones de forma eficaz

Los costes de transacción pueden parecer pequeños, pero se acumulan rápido. Si no prestas atención a las tarifas del servicio y a las comisiones de red, puedes perder una parte importante de tus ganancias. Así puedes minimizar ese impacto.

Compara los costes de los exchanges

Cada CEX tiene diferentes escalones de comisiones según tu volumen mensual de trading. Revisa si puedes optar a tarifas reducidas, por ejemplo, manteniendo el token nativo del exchange o superando cierto volumen.

Elige bien el momento de la transacción

Muchas redes tienen franjas horarias con menos uso. Si vendes Pepe Coin en horas de menor congestión, las comisiones de gas pueden ser más bajas. Revisa trackers de costes de transacción o patrones históricos para intuir cuándo la red está más despejada.

Elige la plataforma adecuada

Si solo quieres hacer operaciones puntuales, un servicio sencillo pero con tarifas algo más altas puede seguir siendo razonable. Si planeas vender con frecuencia, conviene explorar plataformas especializadas como Xgram o exchanges de bajas comisiones para que el coste total sea menor a largo plazo.

Usa órdenes límite

En un CEX, las órdenes límite al precio que tú elijas a veces pagan menos comisiones que las órdenes de mercado. Muchos exchanges usan un esquema maker-taker donde los “makers” (que colocan órdenes límite en el libro) pagan menos que los “takers” (que ejecutan órdenes de mercado).

Preguntas frecuentes sobre la venta de Pepe Coin

A continuación, cinco preguntas frecuentes que ayudan a aclarar puntos delicados del proceso de venta y a sentirte más seguro al dar el siguiente paso.

¿Cómo encuentro el mejor momento para vender Pepe Coin?

Debes prestar atención a las condiciones generales del mercado y a eventos noticiosos importantes. Fíjate en cuándo el volumen de trading es más alto; normalmente es cuando el mercado está más líquido y hay menos riesgo de movimientos bruscos.¿Qué pasa si mi exchange no tiene un par PEPE-USD?

Muchos exchanges pequeños solo ofrecen pares cripto, como PEPE/USDT o PEPE/ETH. En ese caso, primero convierte Pepe Coin a un stablecoin o a una cripto principal y luego cambia o retira esa moneda a fiat.¿Hay límites sobre cuánto Pepe Coin puedo vender?

Depende de la política de la plataforma y de tu nivel de verificación. Los CEX suelen tener límites diarios o mensuales de retirada según tu perfil KYC. Las plataformas P2P a veces limitan el importe por operación. Revisa las condiciones antes de vender cantidades grandes.¿Es seguro usar una plataforma P2P si es mi primera vez?

Sí, siempre que elijas un marketplace reputado con servicio de escrow y buenas reseñas. Busca compradores/vendedores con historial positivo y nunca liberes los tokens del escrow hasta confirmar el pago.¿Tengo que pagar impuestos al vender Pepe Coin?

Depende de la normativa fiscal de tu país. En muchos lugares, vender cripto por fiat se considera un hecho imponible. Consulta las guías locales o habla con un asesor fiscal para saber cómo declarar tus operaciones.

Cierra tu estrategia

Vender Pepe Coin no es complicado si divides el proceso en pasos. Tienes varios caminos: exchanges centralizados, mercados P2P, servicios de swap instantáneo y Xgram. Lo básico es sencillo: configurar tus cuentas, intentar acertar con el momento de mercado, transferir tus monedas con cuidado, cerrar la operación y almacenar o retirar tus ganancias de forma segura.

La clave es mantenerte alerta. Vigila los movimientos bruscos de precio, las plataformas dudosas y las comisiones que pueden comerse tu margen. Con una preparación decente, puedes convertir Pepe Coin sin drama. Familiarízate con estas buenas prácticas, aplícalas en cada trade y verás cómo el proceso se vuelve cada vez más fluido. Así irás construyendo experiencia, mejorando tus decisiones de venta y protegiendo tus ganancias en este ecosistema cripto siempre cambiante.