Cross-chain swap, DeFi dünyasında hızla vazgeçilmez bir araç haline geliyor. İki farklı blok zinciri arasında doğrudan varlık transferine izin vererek, ticaret, arbitraj ve portföy esnekliği açısından yeni fırsatlar sunuyor. En önemlisi ise, token’larınızı merkezi borsalardan geçirmeden cüzdanınızın tam kontrolünü elinizde tutmanızı sağlıyor. Aşağıda, cross-chain swap’lerin nasıl çalıştığını, neden önemli olduklarını ve güvenle nasıl başlayabileceğinizi adım adım öğreneceksiniz.

Cross-chain’in temellerini anlayın

Cross-chain swap, iki veya daha fazla blok zinciri arasında kripto para takası yapmanın merkeziyetsiz ve güvene dayanmayan bir yoludur. Örneğin, Ethereum’daki token’larınızı BNB Chain’deki token’larla değiştirmek istiyorsunuz, ancak bunu merkezi bir borsaya yatırmak istemiyorsunuz. Cross-chain swap bu işlemi doğrudan gerçekleştirir, böylece aracıları ve karmaşık çekim adımlarını ortadan kaldırır.

Bu tür bir takas, “atomik swap sözleşmesi” olarak bilinen özel bir akıllı sözleşmeye dayanır. “Atomik” kelimesi burada işlemin ya tamamen gerçekleşeceği ya da hiç gerçekleşmeyeceği anlamına gelir. Yani, siz eski token’larınızı göndermedikçe yeni token’larınızı alamazsınız, karşı taraf da doğru miktarda token göndermedikçe hiçbir şey gerçekleşmez. Herhangi bir adım başarısız olursa işlem güvenli bir şekilde iptal edilir.

Cross-chain swap’in çalışmasını sağlayan bazı temel kavramlar şunlardır:

- Hash Time-Locked Contracts (HTLC): Belirli koşullar karşılanana kadar fonları kilitleyen akıllı sözleşmelerdir. Genellikle gizli bir hash ve zaman sınırı içerir.

- Relayer veya doğrulayıcılar: Bazı protokoller, farklı blok zincirlerdeki olayları doğrulayan düğüm ağları kullanır. Bu düğümler, bir zincirde token yatırdığınızı doğrular ve ardından diğer zincirdeki token’ların serbest bırakılmasını tetikler.

- Köprüler (Bridges): İki ayrı blok zinciri arasında veri veya token aktarımını sağlayan protokollerdir. Bir cross-chain swap, tek bir köprü sistemi içinde veya birden fazla köprü arasında gerçekleşebilir.

Bu terimler ilk başta karmaşık gelebilir, ancak iyi haber şu ki, pratikte süreç oldukça basittir. Birçok cross-chain platformunda hashing veya köprüleme detaylarıyla uğraşmazsınız. Sadece token’ı, miktarı seçip işlemi onaylarsınız ve protokol gerisini halleder.

Neden cross-chain swap önemlidir

Cross-chain swap’ler, özel anahtarlarınızın kontrolünü kaybetmeden farklı ekosistemleri keşfetmenize olanak tanır. Birden fazla blok zincirinde DeFi işlemleri yapmak istiyorsanız, bu swap’ler süreci kolaylaştırır, ücretleri düşürür ve zamandan tasarruf sağlar. Farklı borsalar veya köprüler arasında token taşımak yerine, tüm işlemi tek bir akışta yapabilirsiniz. Bu esneklik, yeni kazanç fırsatlarının, hızlı arbitraj işlemlerinin ve yatırım çeşitliliğinin önünü açar.

İleri düzey DeFi kullanıcıları arasında cross-chain swap’lerin popülerleşmesinin birkaç nedeni şunlardır:

- Varlıklarınızın tam kontrolü: Artık merkezi bir hizmete güvenmenize gerek yok. Özel anahtarlar tamamen sizde kalır.

- Daha düşük işlem ücretleri: Merkezi borsalar genellikle depozito, çekim ve işlem ücreti alır. Cross-chain swap bu ücretlerin çoğunu ortadan kaldırabilir.

- Daha hızlı sonuç: Uzun onay süreleri yerine, iki taraf da işlemi onayladığında swap anında tamamlanır.

- Çok zincirli uyumluluk: DeFi’nin geleceği çok zincirli yapıya dayanıyor. Cross-chain swap’leri öğrenmek, çoklu blok zincir fırsatlarına erişmenizi sağlar.

Doğru yaklaşımı seçin

Bir cross-chain swap yapmanın birkaç yolu vardır. Her yöntemin farklı bir kullanıcı deneyimi, ücret yapısı ve güvenlik modeli bulunur.

- DEX toplayıcıları (Agregatörler)

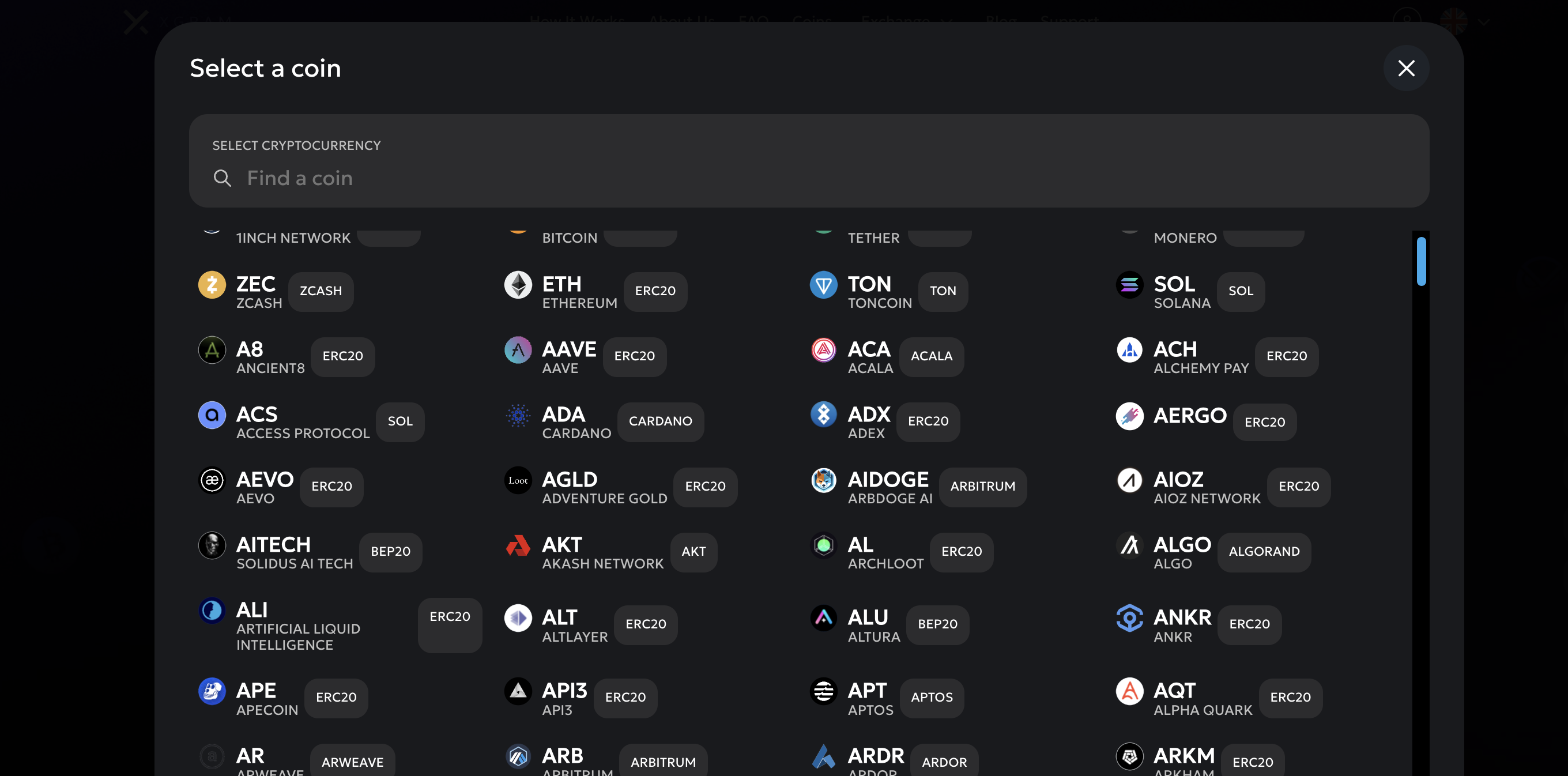

1inch, Sushi veya PancakeSwap gibi bazı siteler, farklı blok zincirlerdeki birden fazla merkeziyetsiz borsayı (DEX) bir araya getirir. Token’larınızı seçersiniz ve toplayıcı sizin için en iyi rotayı bulur. Bazı ek ücretler olabilir, ancak size zaman kazandırır. - Yerel köprüler

Polygon veya Avalanche gibi birçok blok zinciri, Ethereum ile token transferi için resmi köprüler sunar. Token’lar bir zincirde kilitlenir ve diğerinde “wrapped” versiyonu basılır. Bu yöntem, iki ağ arasında işlem yapmak için güvenilir bir seçenektir. - Çok zincirli DEX’ler

Bazı merkeziyetsiz borsalar birden fazla blok zincir üzerinde çalışır. Böylece zincir A’daki bir token’ı zincir B’deki başka bir token ile takas edebilirsiniz. Yeterli likidite varsa bu yöntem oldukça pratiktir. - Atomik swap protokolleri

Burada iki kullanıcı, token’larını zaman kilidi içeren bir akıllı sözleşmeye yatırır. Şartlar yerine getirilirse token’lar değişir, aksi takdirde işlem iptal edilir. En merkeziyetsiz ve güvenilir yöntemlerden biridir.

Yaygın hatalardan kaçının

- Yanlış zincire gönderim: Yanlış ağ seçimi, geri döndürülemez kayıplara neden olabilir. Onaylamadan önce mutlaka kontrol edin.

- Gizli ücretler: Bazı köprüler veya toplayıcılar gizli komisyonlar alabilir. İşlemden önce ücretleri karşılaştırın.

- Düşük likidite: Bazı token çiftlerinde likidite az olabilir, bu da yüksek slippage oranlarına yol açar.

- Sahte platformlar: Dolandırıcı “bridge” siteleri kullanıcıları kandırabilir. Daima denetlenmiş, güvenilir protokolleri tercih edin.

- Akıllı sözleşme hataları: En popüler platformlar bile güvenlik açıklarına sahip olabilir. Kullanıcı yorumlarını ve denetim raporlarını kontrol edin.

Daha fazla verimlilik için Xgram’ı deneyin

Xgram, DeFi kullanıcılarının ücretlerden tasarruf etmesine ve işlemlerini basitleştirmesine yardımcı olan bir cross-chain takas toplayıcısıdır. Xgram, çeşitli köprüleri ve likidite havuzlarını tarayarak en verimli rotayı bulur. Ücretleri önceden gösterir ve işlemleri birleştirerek gaz maliyetlerini düşürür. Sürekli yeni blok zincirleri destekleyerek 10.000’den fazla token çifti sunar.

Sonuç

Cross-chain swap’ler, çoklu blok zincirlerde yatırım yapmak isteyen kullanıcılar için önemli bir beceri haline geliyor. Akıllı sözleşmeleri, köprüleri ve toplayıcıları anlayarak maliyetlerinizi azaltabilir ve fırsatlarınızı artırabilirsiniz. Küçük miktarlarla başlayın, ücretleri karşılaştırın ve güvenilir platformları (örneğin Xgram) kullanın. DeFi’nin geleceği çok zincirli — ve cross-chain swap’leri öğrenmek bu devrimin ön saflarında olmanızı sağlar.