2026'da Kripto Para ile Nasıl Para Kazanılır

TL;DR:

- Blockchain ve dijital varlıkların temel kavramlarını öğrenerek başlayın.

- Hedeflerinize uygun bir kazanç yöntemi seçin: al ve tut, al-sat (trading) veya staking gibi.

- Güvenilir bir borsa platformu seçin ve risk yönetimini ön planda tutun.

- Vergiler konusunda düzenli olun, öğrenmeye devam edin ve kripto piyasaları geliştikçe uyum sağlayın.

Kripto paranın temellerini anlayın

Kripto paranın temellerine hâkim olmak, ileride alacağınız kararları doğrudan etkiler. Blockchain, tokenomics ve hashing gibi yabancı terimlerle karşılaşacaksınız – ancak gözünüz korkmasın. Bu yapı taşlarını iyi anlamak, günlük al-sattan pasif gelir stratejilerine kadar daha ileri yöntemlere hazırlanmanızı sağlar.

Temel bilgiler

Kripto para, güvenlik için kriptografi kullanan ve merkeziyetsiz teknolojiye dayanan dijital bir para biçimidir. Geleneksel bir banka veya finans kurumu olmadan transfer edilebilir ve saklanabilir. Defteri tek bir merkezi otorite yerine bilgisayar ağları (node’lar) doğrular. Bu yapı, şeffaflığı ve manipülasyona karşı dayanıklılığı artırır.

Bitcoin, 2009 yılında ortaya çıkan ilk kripto paradır ve hâlâ dünyadaki en bilinen dijital varlıktır. O günden bu yana binlerce farklı kripto para piyasaya sürülmüş olup her biri farklı özellikler ve kullanım alanları sunar.

Piyasa görünümü

Kripto piyasası hızlı fiyat dalgalanmalarıyla bilinir. Bazı varlıklar bir hafta içinde %30 yükselip, sonraki hafta %20 düşebilir. Bu volatilite kısa ve uzun vadeli kazanç fırsatları sunar. Ancak dikkatsizlik, kayıplara yol açabilir; bu nedenle planlama kritik öneme sahiptir.

Borsalar, haber siteleri ve sosyal medya kripto fiyatlarını büyük ölçüde etkiler. Bazı coin’ler topluluk ilgisi ve hype ile hareket ederken, bazıları gerçek kullanım alanları ve teknolojik gelişmeler sayesinde daha istikrarlı ilerler. Piyasa trendlerini takip ederek sağlam projeleri ayırt edebilir ve geçici balonlardan kaçınabilirsiniz.

Blockchain’in rolü

Her kripto paranın temelinde, tüm onaylanmış işlemlerin yer aldığı halka açık bir veritabanı olan blockchain bulunur. Tek bir sunucuya bağlı kalmak yerine birçok node üzerinde çalışarak kayıtların korunmasını ve değiştirilememesini sağlar.

Bu merkeziyetsiz yapı sayesinde blockchain’ler kapatılması veya bozulması zor sistemlerdir. Eşler arası (peer-to-peer) işlem mantığını destekler; yani banka veya ödeme aracısı olmadan doğrudan işlem yapabilirsiniz. Blockchain bakış açısını benimsemek, kriptonun yalnızca spekülasyon değil; finans, lojistik ve daha birçok alanda inovasyon potansiyeli taşıdığını gösterir.

Kazanç yöntemlerini keşfedin

“Kripto para ile nasıl para kazanırım?” sorusunun tek bir cevabı yoktur. Al ve tut stratejisinden aktif trading’e, pasif gelir modellerine kadar her risk seviyesine ve zaman ayırımına uygun yöntemler vardır. Aşağıda yeni başlayanlar için bazı seçenekler yer alıyor.

Al ve tut

Kripto jargonunda HODL olarak bilinen bu yöntem, uzun vadede değer kazanacağına inandığınız bir varlığı satın alıp tutmayı ifade eder. Günlük fiyat dalgalanmalarına fazla odaklanmazsınız; aylar veya yıllar içindeki genel yükselişi hedeflersiniz.

Bu strateji sadeliğiyle öne çıkar. Teknoloji, benimsenme ve ekip gibi temel unsurlara göre projeler seçilir ve piyasa gürültüsü görmezden gelinir. Sabır gerektirir ama günlük stres düşüktür. Birçok yatırımcı bu yöntemle başlar.

Trading

Piyasa ile sürekli etkileşim isteyenler için trading daha aktif bir kazanç yöntemidir. Teknik analiz veya piyasa sinyalleriyle kısa vadeli fiyat hareketleri tahmin edilir. Günlük trader’lar saatler içinde pozisyon açıp kapatırken, swing trader’lar günler veya haftalar boyunca pozisyon tutar.

Trading; disiplin, sağlam bir plan ve stop-loss gibi risk yönetimi araçları gerektirir. Kripto piyasası 7/24 açık olduğu için tükenmişlik riski yüksektir. Ayrıca işlem ücretleri ve spread’ler, sık al-sat yapanların kazançlarını azaltabilir.

Staking ve yield farming

Staking, proof-of-stake (PoS) ağlarında coin’lerin kilitlenerek ağ güvenliğine katkı sağlanmasıdır. Karşılığında ağın kendi token’ı ile ödüller kazanılır. Bu yöntem pasif gelir elde etmek isteyenler için daha az efor gerektirir.

Yield farming ise DeFi ekosisteminde likidite havuzlarına veya lending protokollerine varlık yatırmayı kapsar. Getiriler yüksek olabilir ancak riskler de artar. Platformun güvenliği ve geçmişi mutlaka araştırılmalıdır.

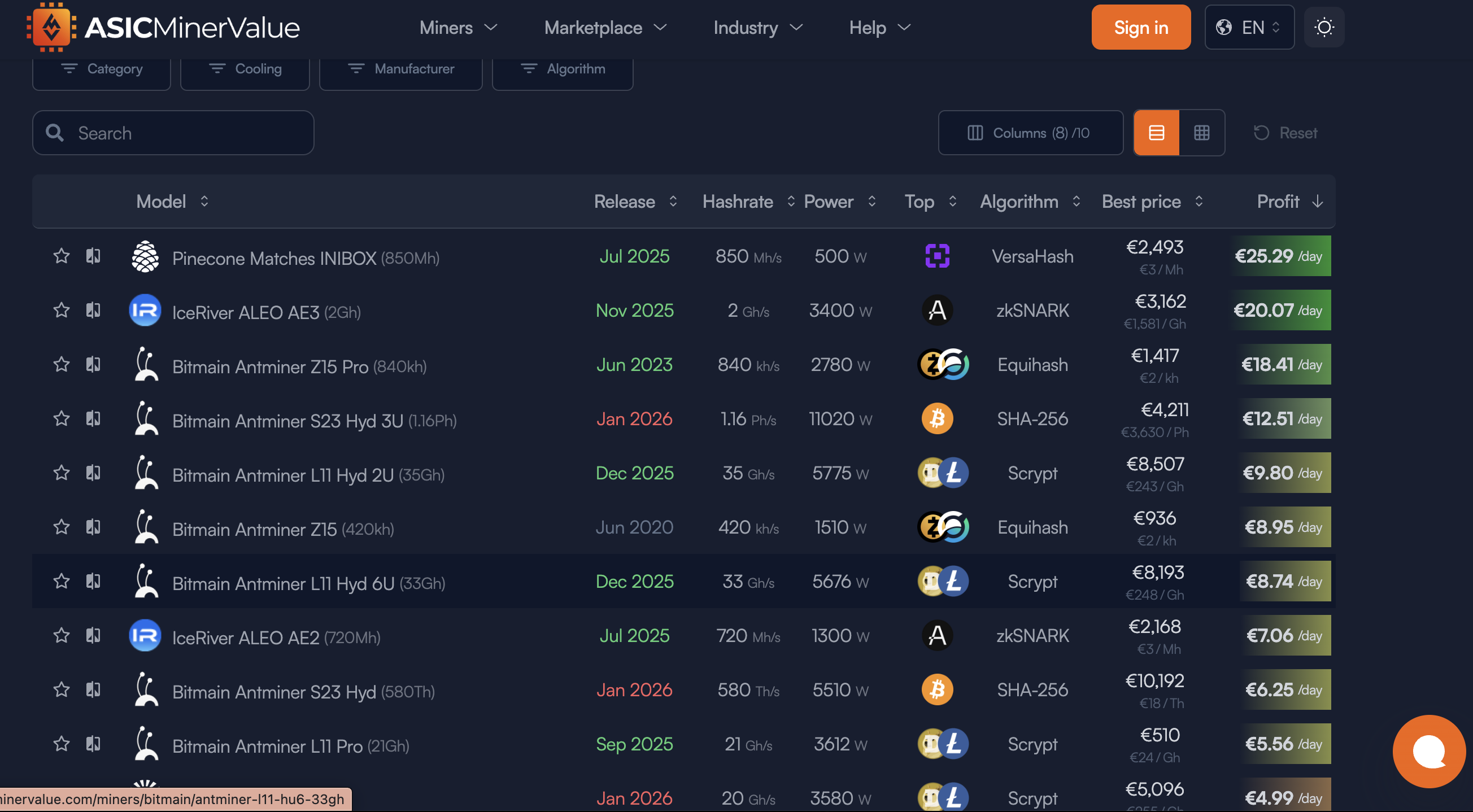

Madencilik

Bitcoin gibi kripto paraların madenciliği, karmaşık hesaplamalar yapan özel donanımlar kullanılarak ağın güvenliğinin sağlanmasıdır. Karşılığında yeni üretilen coin’ler ödül olarak verilir. Günümüzde madencilik genellikle büyük veri merkezlerinde yapılır.

Yeni başlayanlar için donanım ve elektrik maliyeti yüksek olabilir. Bazı altcoin’ler evde madencilik için hâlâ uygundur ancak getiri iyi hesaplanmalıdır. Çoğu kişi için diğer yöntemler daha pratiktir.

Kripto ile freelance ve mikro kazançlar

Yazı yazma, tasarım veya yazılım gibi becerileriniz varsa kripto ile ödeme alabilirsiniz. Bazı freelance platformları Bitcoin veya Ethereum ile ödeme yapan müşteriler sunar. Bu sayede büyük yatırımlar yapmadan kripto biriktirebilirsiniz.

Ayrıca küçük görevler, anketler veya içerik etkileşimi karşılığında kripto kazandıran uygulamalar da vardır. Büyük kazanç sağlamaz ama pratik öğrenme sunar.

Borsa platformu kullanımı

Borsalar kripto alım-satımının kapısıdır. Merkezi ve merkeziyetsiz borsalar bulunur. Güvenilirlik, ücretler ve kullanım kolaylığı değerlendirilmelidir.

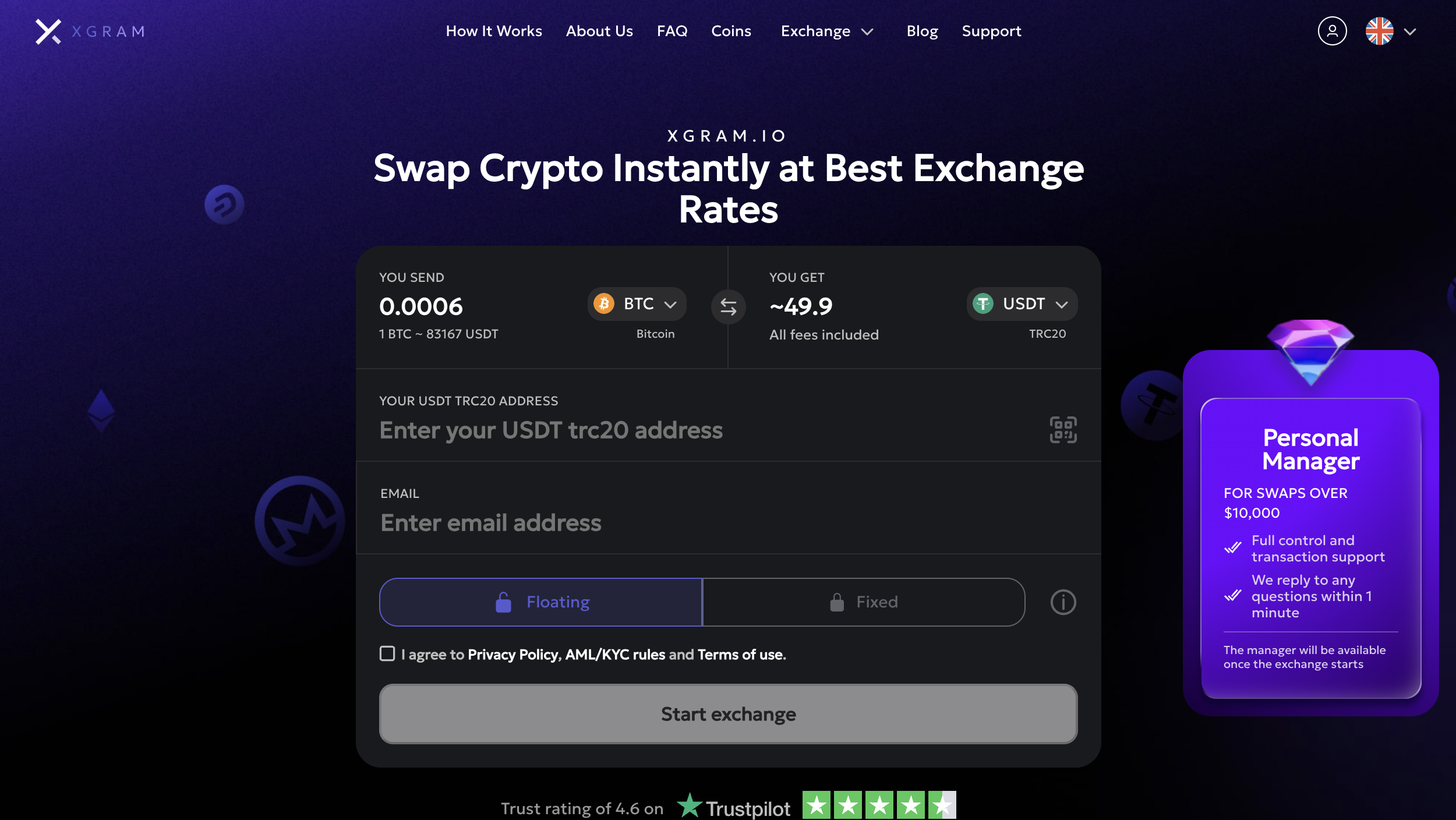

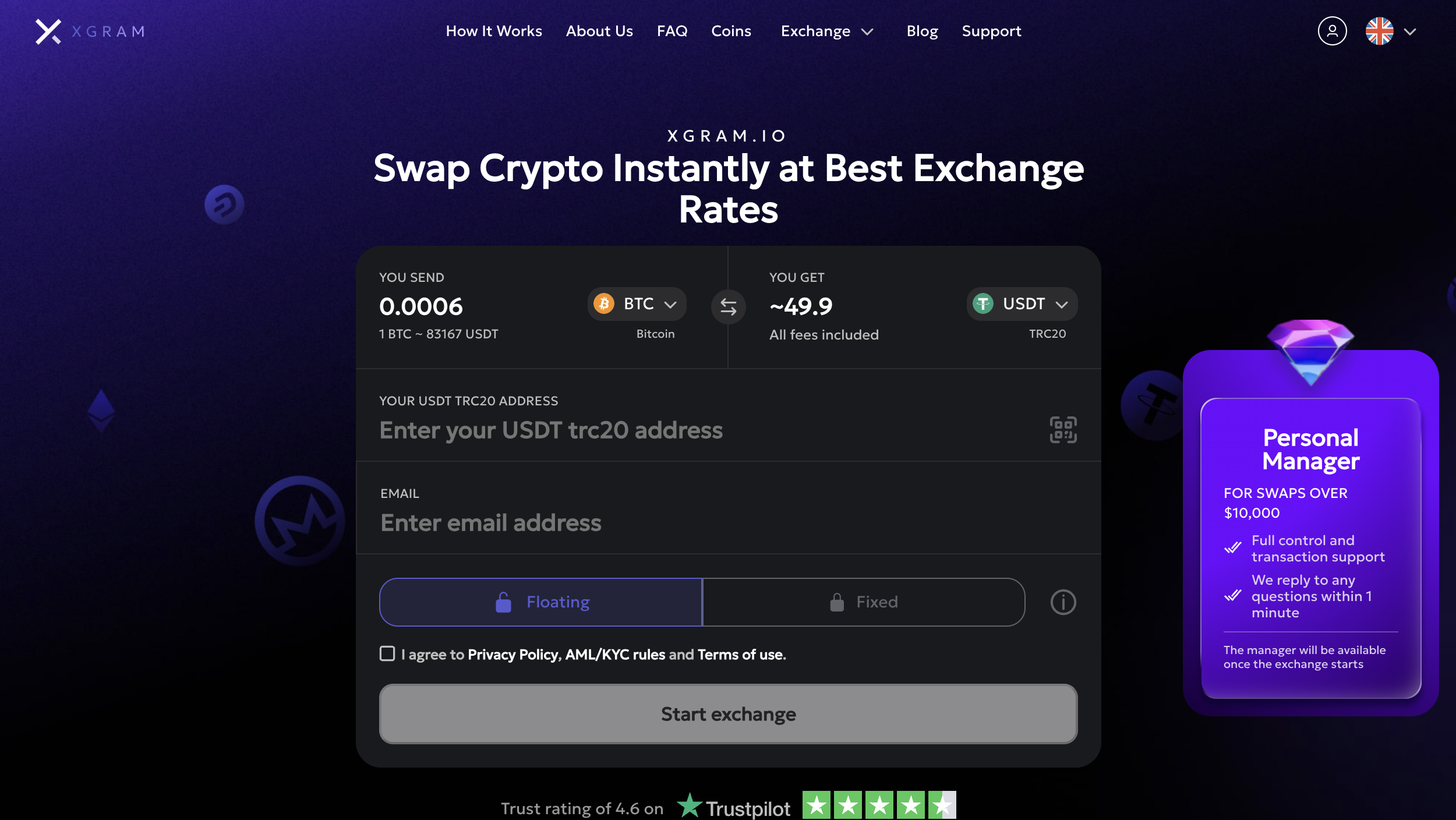

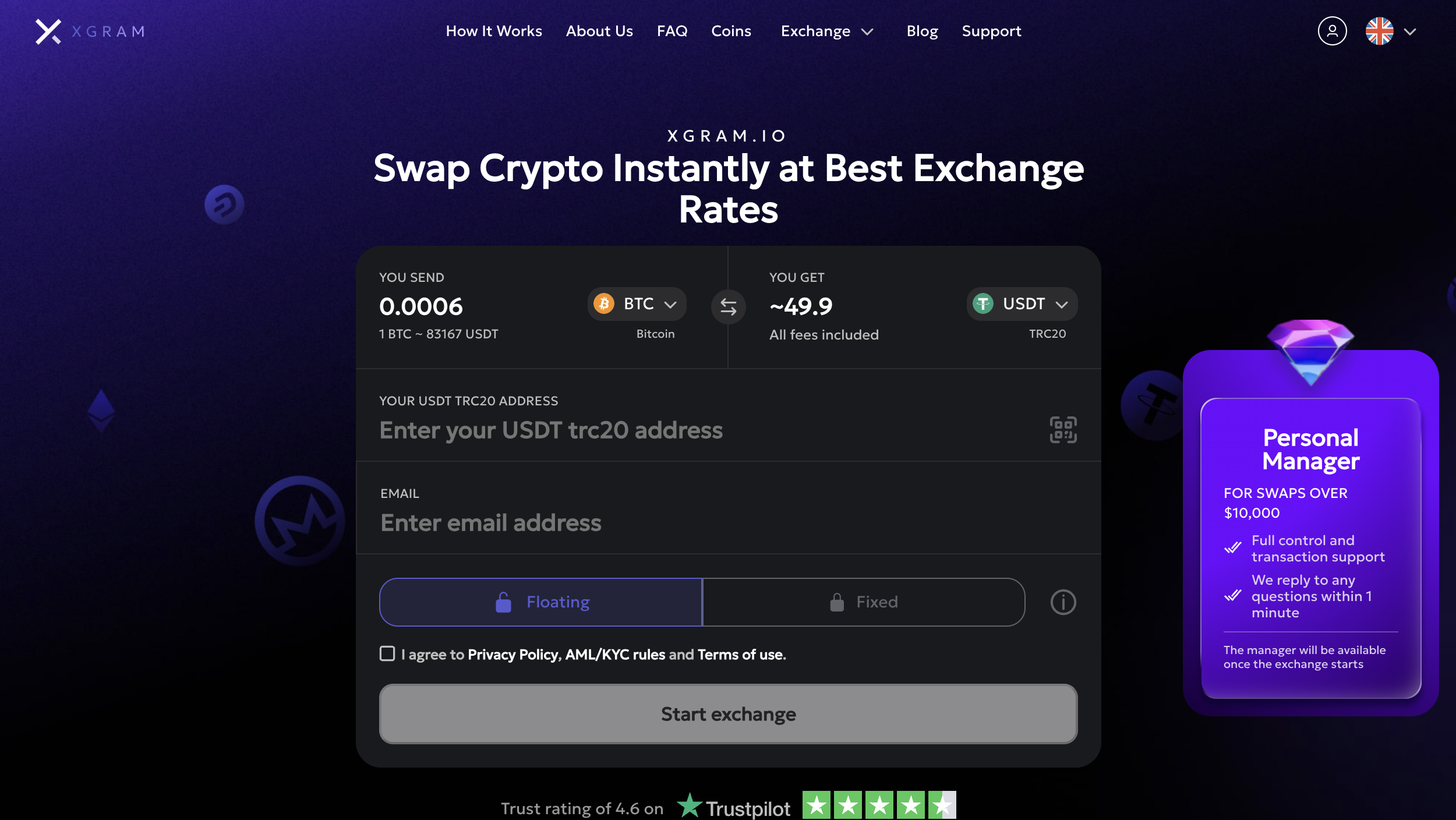

Xgram ile hızlı takas

Xgram, kripto ve fiat para arasında hızlı ve düşük maliyetli takas yapmak isteyenler için tasarlanmış bir platformdur. Cüzdan bağlamadan işlem yapabilirsiniz, bu da özellikle yeni başlayanlar için süreci kolaylaştırır. İşlemler genellikle hızlıdır ve varlıklarınızı zahmetsizce yönetmenizi sağlar.

Sonuç

Kripto para ile para kazanmak; bilgi, disiplin ve doğru stratejiyle mümkündür. Küçük adımlarla başlayın, riskleri yönetin ve güvenliği ihmal etmeyin. Sabır ve sürekli öğrenme ile kripto dünyasında uzun vadeli başarı mümkündür.