Clarifier les fondamentaux d’un DEX

Les échanges décentralisés (DEX) sont des places de marché numériques où vous pouvez échanger des crypto-actifs sans déléguer la garde à une plateforme centralisée. Contrairement aux échanges traditionnels (où vous créez un compte, déposez des fonds et faites confiance à une entreprise pour conserver vos actifs), un DEX fonctionne sur la blockchain via des contrats intelligents. Ces contrats sont des accords auto-exécutoires. Dans de nombreux cas, les fonds se déplacent directement entre votre portefeuille et celui d’un autre utilisateur.

Négociation pair-à-pair expliquée

Les DEX permettent de véritables échanges pair-à-pair, ce qui signifie que vous pouvez échanger des coins avec un autre utilisateur quasi en temps réel. Au lieu de remettre vos tokens à une chambre de compensation centrale, vous interagissez avec le portefeuille de la contrepartie. Parce que tout est alimenté par un réseau distribué, il n’existe pas d’entité unique de contrôle. Aucune entreprise ne dicte quelles pièces sont listées et personne ne peut geler des transactions unilatéralement.

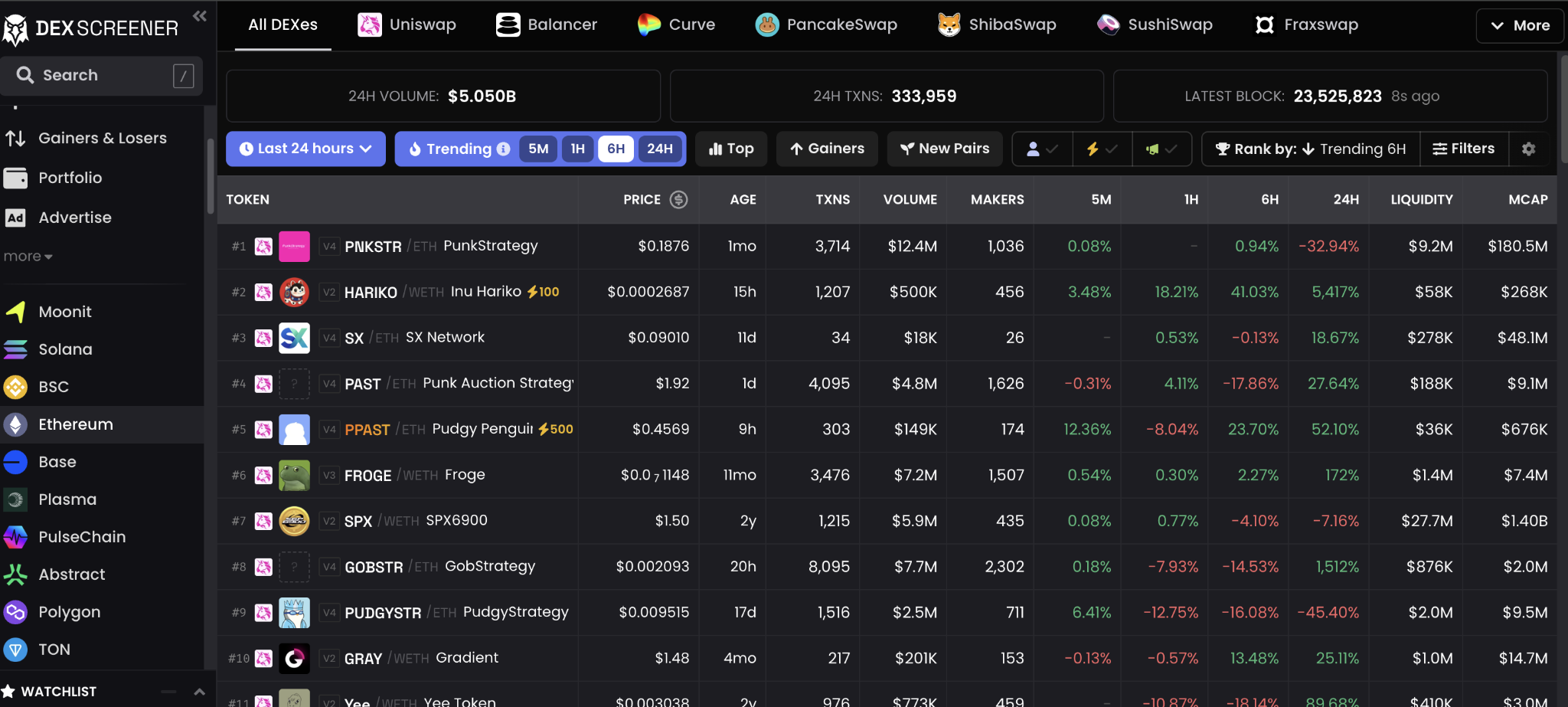

Un avantage clé est la rapidité avec laquelle de nouveaux tokens apparaissent sur certains DEX. Vous pouvez découvrir des projets à un stade précoce bien avant leur arrivée sur un échange traditionnel. Dans le même temps, sachez que les tokens plus petits peuvent être plus volatils et plus difficiles à revendre si la liquidité est faible.

Pas d’autorité centrale

Sur la plupart des échanges centralisés, une société joue le rôle de gardien. Elle fixe les règles de listing, gère l’infrastructure serveur et stocke vos données privées. Sur un DEX, il n’y a pas d’intermédiaire corporatif. À la place, les contrats intelligents veillent au respect des conditions d’échange (prix, montant, horodatages). Dès que vous cliquez pour confirmer un swap dans votre portefeuille, la blockchain enregistre la transaction.

Cette configuration réduit le risque d’un piratage d’un point de défaillance unique, puisqu’un attaquant devrait compromettre un réseau distribué de nœuds—tâche plus difficile (bien que pas impossible). Comme vous conservez vos propres clés, les DEX réduisent aussi le risque de perte de fonds due à l’insolvabilité d’une entreprise ou à des erreurs internes.

Voir comment fonctionnent les DEX

Les échanges décentralisés utilisent différents mécanismes pour traiter les transactions. Les deux plus courants sont les teneurs de marché automatisés (AMM) et les carnets d’ordres on-chain. Bien que tous deux soient pair-à-pair, la façon de trouver une contrepartie varie.

Pools de liquidité et AMM

Les pools de liquidité sont des réserves de tokens basées sur des contrats intelligents. Par exemple, si vous souhaitez échanger de l’ETH contre un stablecoin, une plateforme AMM puise dans un pool financé par d’autres utilisateurs, appelés fournisseurs de liquidité. Ces derniers déposent à la fois de l’ETH et le stablecoin dans le pool et reçoivent en échange une fraction des frais de trading.

Lorsque vous initiez un échange, l’AMM calcule un prix selon une formule (souvent le produit constant, x * y = k). Le pool ajuste automatiquement ses réserves, afin que votre ordre puisse s’exécuter sans avoir besoin d’un acheteur ou d’un vendeur direct à cet instant. Cette approche rend le trading plus fluide et accessible, surtout pour les nouveaux tokens ou les marchés à faible volume. Cependant, les fournisseurs de liquidité peuvent subir une perte impermanente si les prix varient fortement ; ce n’est donc pas sans risque.

Carnets d’ordres on-chain

Certains DEX reproduisent le style plus familier des échanges centralisés—un carnet d’ordres. Ce registre recense toutes les ordres d’achat et de vente en attente d’appariement. La différence est que tout se trouve sur la blockchain ; vous voyez donc les ordres et les transactions en temps réel sans avoir à faire confiance à une base de données privée.

Dans les systèmes de carnet d’ordres on-chain, votre transaction peut attendre jusqu’à ce qu’un autre utilisateur place un ordre correspondant à votre prix, ou jusqu’à ce que vous la mettiez à jour ou l’annuliez manuellement. Cela vous donne souvent un contrôle plus fin sur la façon et le prix d’exécution, mais exige en général des frais réseau (gas) plus élevés et peut être plus lent en période de faible liquidité.

Explorer les avantages et limites des DEX

Comme tout outil crypto, les échanges décentralisés ont des forces et des faiblesses. Comprendre les deux vous aide à décider si un DEX convient à votre style.

Avantages :

- Vous contrôlez vos clés privées ; vous détenez donc vos actifs à tout moment.

- Souvent pas besoin d’inscriptions complexes ni de vérifications d’identité, ce qui préserve votre vie privée.

- Large choix de tokens, incluant souvent des projets nouveaux ou de niche introuvables ailleurs.

- Moins de risque qu’un piratage majeur vide un unique portefeuille central, même si des failles de code peuvent exister.

Inconvénients :

- Aucun recours si vous perdez vos clés ou envoyez des tokens à la mauvaise adresse. Vous êtes entièrement responsable de vos erreurs.

- Frais réseau potentiellement élevés lors de congestions (surtout sur les chaînes populaires).

- Risque de tomber sur des tokens frauduleux ou des projets de faible qualité, car les DEX imposent moins de barrières au listing.

- Interfaces parfois déroutantes pour les débutants, source d’erreurs.

Beaucoup considèrent les DEX comme une porte d’entrée vers une véritable souveraineté financière. En parallèle, vous pouvez conserver une partie de vos fonds sur un service centralisé si vous privilégiez un filet de sécurité ou un environnement plus régulé. Un équilibre entre les deux approches est souvent la stratégie la plus saine.

Comparer DEX et CEX

Comment les échanges décentralisés se comparent-ils aux centralisés (CEX) ? Chacun a sa place dans l’écosystème.

Garde :

CEX : l’exchange conserve vos fonds. Vous lui faites confiance pour les sécuriser.

DEX : vous détenez vous-même vos tokens. La sécurité du portefeuille est sous votre responsabilité.

Sécurité :

CEX : en cas de hack, l’exchange peut vous rembourser… ou pas. Tout dépend de ses politiques.

DEX : moins de points de défaillance uniques, mais une faille de contrat intelligent ou un phishing peut toujours causer des pertes.

Liquidité :

CEX : généralement une liquidité plus profonde pour les principaux tokens.

DEX : la liquidité varie selon la paire. Les DEX populaires sur les gros tokens peuvent égaler ou dépasser le volume de certains CEX.

Expérience utilisateur :

CEX : souvent plus simple pour les débutants, avec support client ou fonds d’assurance.

DEX : plus flexible, mais requiert d’être à l’aise avec les portefeuilles, les frais et les adresses de contrat.

Les plateformes centralisées restent pratiques si vous cherchez une rampe d’accès facile ou une aide immédiate. Les DEX, eux, offrent la possibilité d’explorer l’écosystème DeFi, d’essayer de nouveaux tokens et de garder le contrôle de vos clés privées.

Plonger dans la synergie du DeFi

Les échanges décentralisés n’existent pas en vase clos. Ils se connectent au prêt, à l’emprunt, au yield farming, etc. Si vous vous lancez dans le DeFi, vous utiliserez probablement un DEX à un moment donné—pour acheter un token de gouvernance d’un protocole en lequel vous croyez, ou pour staker vos actifs dans une ferme de rendement.

- Prêt et emprunt : un DEX vous aide à échanger rapidement les tokens empruntés ou remboursés, sans dépendre d’un gardien centralisé.

- Yield farming : les fournisseurs de liquidité sur DEX gagnent souvent des récompenses (tokens de gouvernance ou frais de trading). Certains déplacent leur capital quotidiennement pour chasser les rendements.

- Distribution de tokens de gouvernance : les protocoles distribuent souvent des tokens via le liquidity mining. Si vous fournissez de la liquidité à une paire, vous pouvez recevoir des tokens supplémentaires conférant droits de vote ou partage de revenus.

Le grand attrait, c’est la synergie—vos tokens peuvent être échangés, « farmés », stakés ou utilisés comme collatéral sans « middle office ». Ce modèle de « money legos » est emblématique du DeFi : vous empilez des briques financières pour composer votre propre expérience.

Appliquer les bonnes pratiques en sécurité

Le potentiel du trading décentralisé est enthousiasmant, mais la prudence est essentielle. Puisque vous êtes aux commandes, de petites erreurs coûtent de l’argent réel. Pour gérer le risque :

- Vérifiez les adresses de contrat : des tokens frauduleux imitent parfois des symboles connus. Assurez-vous d’avoir l’adresse officielle depuis une source fiable.

- Observez la liquidité du token : si le pool est minuscule, vos échanges subiront un fort slippage ou vous pourrez difficilement sortir de position.

- Protégez votre seed phrase (phrase de récupération) : lors de la création d’un portefeuille, vous recevez une phrase de 12 à 24 mots. Conservez-la en lieu sûr (de préférence hors ligne). La perdre, c’est perdre l’accès à vos fonds, définitivement.

- Méfiez-vous du phishing : des fraudeurs clonent des sites de DEX populaires ou envoient des liens malveillants sur les réseaux sociaux. Ajoutez vous-même le site officiel à vos favoris.

La bonne nouvelle : une fois les bases acquises et la gestion autonome de votre portefeuille maîtrisée, utiliser un DEX peut devenir aussi simple qu’ouvrir une appli bancaire. La différence, c’est que vous—et non une autorité centrale—fixez les règles de vos transactions et de la garde de vos actifs.

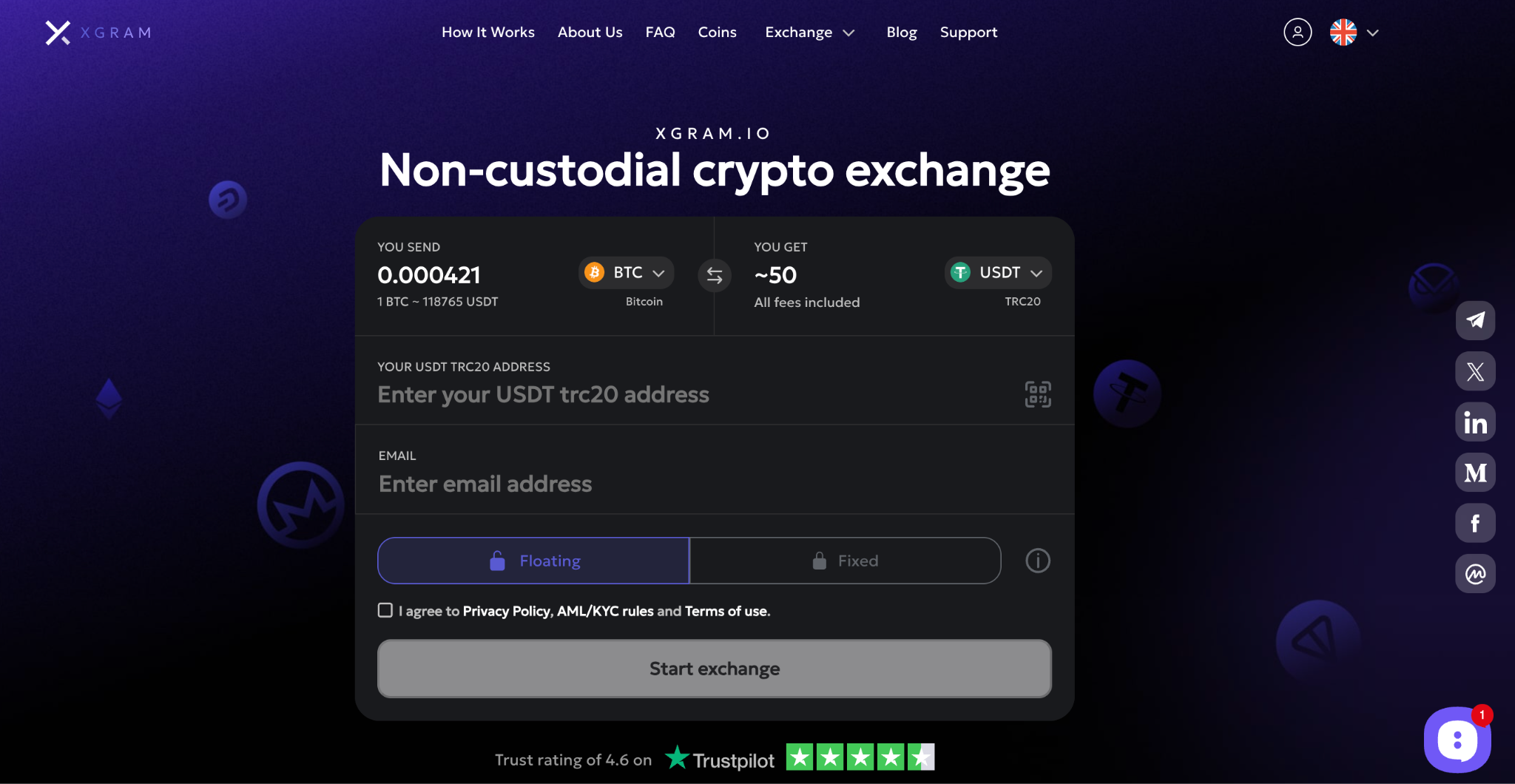

Essayer Xgram pour les swaps

Si vous souhaitez un moyen convivial d’échanger des tokens, pensez à Xgram. Ce service agrège plusieurs DEX et pools de liquidité pour trouver le meilleur taux pour vos swaps. Ce faisant, xgram vous évite de visiter plusieurs plateformes pour comparer les prix manuellement.

Si vous êtes prêt à expérimenter, commencez par un petit échange. Ainsi, vous confirmez que le processus fonctionne comme prévu avant d’engager des montants plus importants.

Conclusion

Vous avez désormais une vue d’ensemble de ce qu’est un DEX et de pourquoi il peut vous donner la main sur votre parcours crypto. Un échange décentralisé renforce votre autonomie—vous détenez les clés, vous choisissez vos transactions et vous pouvez explorer de nouveaux tokens avant leur arrivée sur des plateformes grand public. En parallèle, restez attentif aux adresses de contrat, à la liquidité et aux bonnes pratiques de sécurité. Une fois l’interface apprivoisée et l’idée acceptée que vous—plutôt qu’une entreprise—êtes aux commandes, les possibilités sont considérables : passer rapidement d’un token à l’autre, couvrir vos positions ou simplement tester de nouvelles opportunités. Rappelez-vous : vous pouvez combiner le meilleur des deux mondes—un échange centralisé robuste pour certains besoins, et un DEX pour un trading souverain et flexible. Essayez, restez vigilant et progressez par petits pas assurés vers l’avenir décentralisé.

Questions fréquentes

Quelle est la différence entre un DEX et un CEX ?

Un DEX (decentralized exchange) ne s’appuie pas sur une autorité centrale pour la garde des fonds ou l’appariement des ordres. Les échanges ont lieu pair-à-pair sur la blockchain. Un CEX (centralized exchange) sert d’intermédiaire, conserve vos actifs et apparie les ordres sur ses propres serveurs. Sur un DEX, vous contrôlez vos tokens ; sur un CEX, l’exchange détient la garde.Ai-je besoin d’un portefeuille crypto pour utiliser un DEX ?

Oui. Sur un DEX, vous connectez un portefeuille personnel (comme MetaMask) à la plateforme. Vous conservez vos clés privées et signez les transactions pour confirmer les échanges. Il n’y a pas de système traditionnel identifiant/mot de passe. Si vous perdez vos clés privées ou votre phrase de récupération, vos fonds sont irrécupérables ; stockez-les en sécurité.Les échanges décentralisés sont-ils sûrs ?

Ils peuvent être relativement sûrs si vous utilisez des DEX bien évalués, gardez votre portefeuille sécurisé et restez attentif aux détails. Il n’y a généralement pas de point de défaillance unique comme avec un dépositaire central, mais vous assumez l’entière responsabilité de vos transactions. Vérifiez toujours les adresses des contrats, méfiez-vous des faux sites et évitez les liens suspects.Comment fonctionnent les frais sur les DEX ?

Les DEX facturent généralement deux types de frais : les frais réseau (gas) et les frais de trading. Si le DEX s’appuie sur une blockchain congestionnée, le gas peut grimper. Les frais de trading vont aux fournisseurs de liquidité ou au protocole du DEX. Certains agrégateurs ont aussi leur propre structure tarifaire. Vérifiez bien les détails avant d’approuver une transaction.Que se passe-t-il si je perds mes clés privées ?

Malheureusement, si vous égarez votre phrase de récupération ou vos clés privées, vous ne pouvez pas récupérer vos fonds. Il n’existe pas d’autorité centrale pour réinitialiser un mot de passe. C’est le compromis de l’auto-garde. Conservez une sauvegarde de votre phrase de récupération, idéalement hors ligne, dans un lieu sûr auquel vous seul avez accès.