TL;DR:

Mining LTC involves using specialized hardware (or cloud-based services) to secure the Litecoin network and earn LTC rewards. You need to consider factors such as energy costs, hardware capabilities, and mining software configurations to optimize your returns. Pool mining typically offers more consistent payouts, while solo mining requires high-end equipment and a larger energy budget. Beginners often find pool mining or cloud mining simpler to manage, especially if they want lower upfront costs.

Understand LTC mining

Before you stock up on mining rigs, it helps to know why Litecoin, known as a “digital silver” to Bitcoin’s “digital gold,” appeals to so many new and experienced crypto enthusiasts. LTC uses an algorithm called Scrypt, making it more accessible to mid-range hardware than Bitcoin’s SHA-256. In theory, this lowers the barrier to entry since you do not necessarily need top-of-the-line equipment (like the most powerful ASIC miners) to get started. However, competition has grown, and specialized ASICs for Scrypt are now prevalent, so be prepared to check your costs and potential returns carefully.

When you mine LTC, you are essentially verifying and recording transactions on the blockchain. You provide computational power to solve cryptographic puzzles, which secures the network. In return, you earn LTC block rewards plus any transaction fees included in that block. Despite the simpler algorithm, you still need to watch power usage, cooling, and hardware performance so that your setup remains profitable or at least satisfies your long-term goals.

Some people jump into LTC mining simply to explore the technology behind cryptocurrencies. They see it as a learning opportunity and a hands-on approach to crypto. Others aim to accumulate LTC for potential price growth, hoping the daily or weekly mining rewards will compound in value over time. Regardless of why you mine, it pays to know your hardware options, such as basic CPUs, GPUs, or specialized ASIC miners built just for Scrypt.

The LTC network adjusts difficulty automatically to keep block generation times (about 2.5 minutes per block) consistent. This means that, as more miners join, the difficulty rises to maintain the same block-time average. Over time, LTC’s reward halves roughly every four years, so it is essential to factor in these halvings if you plan to mine LTC for the long run. The next step is learning how to set up your hardware and software for an efficient operation.

Prepare your hardware

Once you have decided to learn how to mine LTC, your next focus is deciding on the hardware. The three main choices are:

- CPU (Central Processing Unit) – If you are truly a novice or just looking to experiment, you might try mining with your standard CPU. Yet, CPUs can rarely produce enough hashing power to offer meaningful returns on LTC.

- GPU (Graphics Processing Unit) – These are common among hobby miners and gamers because they often provide better mining performance than CPUs at a lower overall cost. AMD and NVIDIA cards can handle Scrypt-based mining, though their efficiency varies, and you will need to watch your power consumption.

- ASIC miner (Application-Specific Integrated Circuit) – These machines are custom-built to mine Scrypt-based coins like LTC. ASIC miners generally offer significantly higher hash rates than GPUs. They also tend to be more energy efficient in terms of hash per watt. However, ASICs are more expensive to purchase and can be loud due to the cooling fans.

For beginners, GPUs can be a sweet spot between performance and flexibility. If you decide to upgrade later, you can easily repurpose a GPU-based rig for other coins. On the other hand, ASICs can deliver bigger LTC mining rewards if you are willing to invest in specialized equipment and manage the associated noise and heat.

When assembling your hardware, do not forget these crucial points:

- Power supply: You want a reliable PSU (Power Supply Unit) that can handle the combined wattage of all your mining components.

- Cooling: Mining can produce high heat. Make sure you plan for airflow or water-cooling solutions to keep your rig’s temperature in check.

- Location and noise: ASICs, in particular, can sound like vacuum cleaners. If you do not have an adequate space or noise tolerance, consider GPUs or cloud mining.

Before you finalize your purchase, check online calculators that estimate your potential mining income. Input the cost of hardware, your local electricity price, and average hash rates. Pay attention to any additional shipping fees, taxes, or potential delays. Also, ensure that you are comfortable with your rig’s potential resale value if LTC’s price falls or if you decide to discontinue mining.

Configure your LTC software

If you are using a GPU or CPU, you will likely need mining software that supports the Scrypt algorithm. Common open-source programs, such as CGminer or BFGMiner, provide detailed configuration options. Some popular GPU-friendly tools (like EasyMiner) come with a user-friendly visual interface.

Here is how to set up your mining software step by step:

- Download and install a proven mining client that supports LTC.

- Edit the configuration file (if needed) with your mining pool details (if you choose a pool, which we will explain in a moment), wallet address, and hardware preferences.

- Check your GPU drivers for the best performance. Outdated or generic drivers can result in lower hashrates.

- Let the miner software run some benchmark tests (if provided) so you can adjust clock speeds or fan curves.

Most LTC miners connect to a pool rather than mining solo. This approach ensures you earn smaller but more frequent payouts. If you decide to go solo, you might wait weeks or even months for a single block reward, unless you have a large mining farm with significant hashing power.

The user interface of your chosen mining software might show you real-time stats such as share difficulty, average hashrate, accepted shares, and fan speed. Keep an eye on these stats for sudden drops or large variations. If you notice the system or software crashing frequently, check your overclock settings, or your driver’s stability.

Optimize your mining approach

To truly master how to mine LTC, you should compare different approaches: solo mining, pool mining, or cloud mining. Each method has its pros and cons, so your choice depends on your budget, hardware, and level of technical confidence.

Mining solo

Solo mining means you connect your LTC miner directly to the Litecoin network. You validate blocks on your own, which can be rewarding if you successfully solve a block. However, due to the rising hash power of the network, solo mining usually delivers sporadic rewards. If you have limited hardware, the chance of finding a block can feel like a long shot. Solo mining may suit you if:

- You want the full block reward (minus minimal fees) to yourself.

- You prefer not to split profits with pool participants.

- You have a decent amount of hashing power, such as multiple high-end ASICs.

On the downside, if luck does not favor you, you might earn no rewards for long periods. You are responsible for maintaining a full Litecoin node, which requires extra bandwidth and storage space. In short, solo mining is riskier for smaller setups but can be profitable if you have strong hardware and plenty of patience.

Mining pools

Most newcomers feel more comfortable joining a mining pool. By pooling hash power with thousands of other miners, you share in the rewards more consistently. Each valid share you submit to the pool is credited based on the pool’s payout scheme, which might be PPLNS (Pay Per Last N Shares) or PPS (Pay Per Share). Pool fees average around 1–2 percent, which is a small price to pay compared to the time you might spend waiting for a solo block reward.

Pools often have dashboards where you can view your daily or weekly earnings, track your hashrate, and easily withdraw LTC to your personal wallet. Several well-known Litecoin mining pools exist, each with varying minimum payouts or fee structures. Pick one that is reputable and has stable infrastructure so you can avoid downtime.

Cloud mining

Cloud mining is another option if you do not want to manage hardware, electricity, or heat. You rent hash power from remote data centers. You pay a contract fee, and any LTC mined is credited to you while the service provider handles the equipment, maintenance, and energy overhead. But be cautious—some cloud mining services have questionable reputations or charge hidden fees that can quickly eat into your returns. Always check reviews and do the math before you commit to a contract. Cloud mining can be a low-hassle way to earn LTC, but the profitability depends largely on LTC’s price, network difficulty, and contract terms.

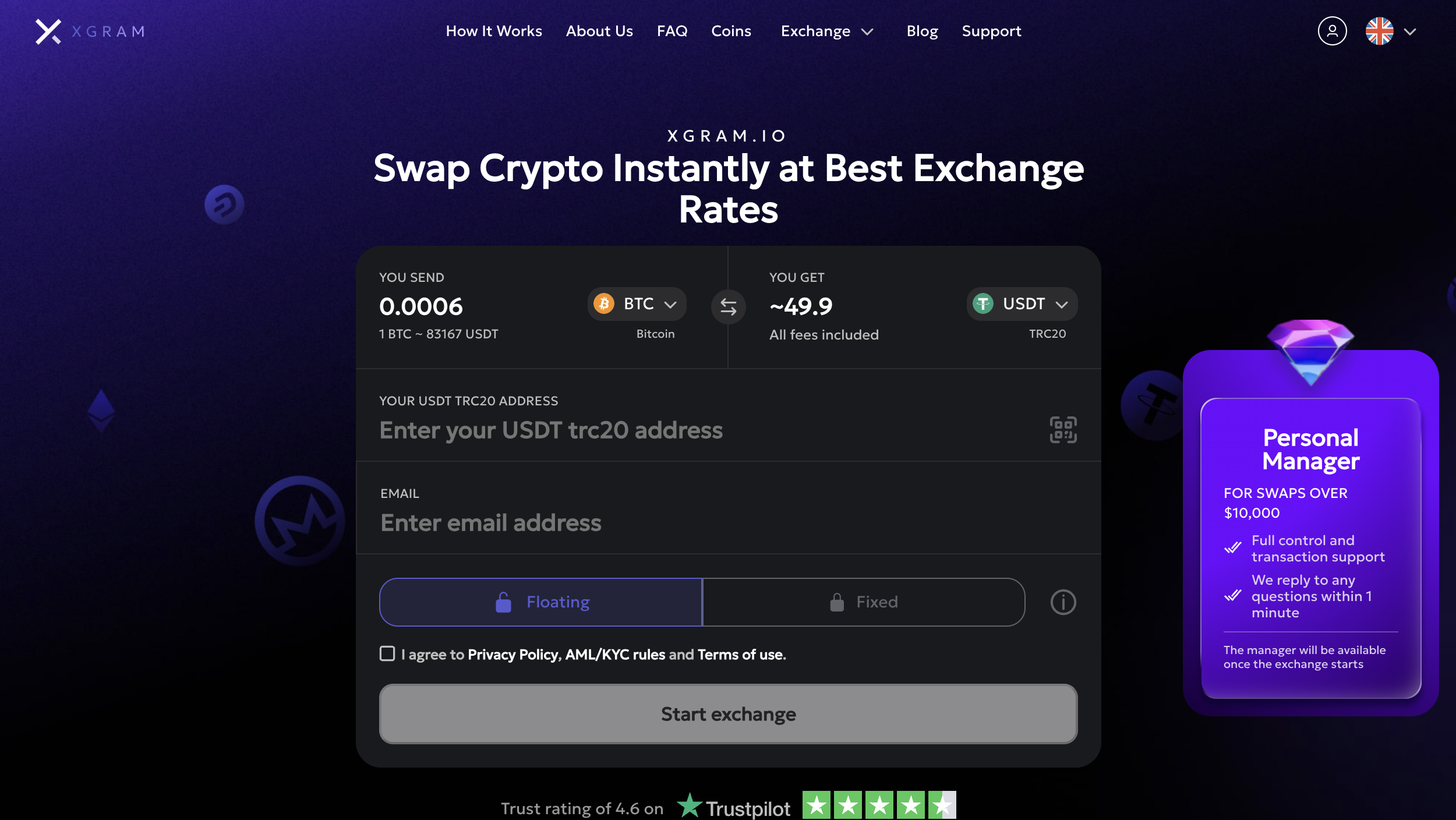

Use Xgram for easier conversions

Advancing in the crypto world often means converting your earnings into other cryptocurrencies or even fiat. Xgram is a user-friendly exchange that allows you to trade various cryptocurrencies, including LTC. It is perfect for beginners because you can complete transactions without connecting a third-party wallet. By eliminating that extra step, you can potentially reduce fees and overall complexity. Xgram supports both crypto-to-crypto and fiat-to-crypto exchanges, giving you flexible options whenever you want to buy or sell LTC. You can track your LTC balance right on the platform, which simplifies management and keeps your funds accessible.

If you are new to crypto exchanges, the process typically involves creating an account, verifying your identity (where required by regulation), then depositing LTC from your mining wallet or another source. From there, you can swap LTC into USD, BTC, or other tokens. Because you do not need to tether an external wallet, Xgram’s interface feels simpler. This approach can help you save on transaction fees, especially if you prefer smaller trades or more frequent LTC conversions.

That said, always weigh the security features of any exchange service. Even if you do not plug in your personal crypto wallet, make sure the platform offers features like two-factor authentication (2FA), account alerts, and other protective measures. If you hold large amounts of LTC, consider transferring them into your own hardware wallet eventually for maximum security. Still, for day-to-day trades or immediate conversions, Xgram’s streamlined experience can be convenient for beginners who do not want to manage multiple crypto wallets or complicated steps.

Track and optimize performance

Mining is not a “set it and forget it” activity. As you run your LTC mining setup, you will want to pay attention to:

- Hashrate: This is the speed at which your miner solves cryptographic puzzles. Higher is generally better, but watch how it changes if you tweak clock speeds or temperatures.

- Electricity usage: Keep an eye on your monthly power bill. If your equipment is guzzling electricity, optimize your GPU or ASIC settings so that the ratio of hash power to electricity cost remains profitable.

- Temperature: Excess heat can degrade hardware and cause instability. If your rig consistently runs above a safe temperature range, you risk damaging it.

- Internet connectivity: A stable internet connection is mandatory for mining. Packet loss or frequent network downtime means you will submit fewer shares and lose out on potential earnings.

Overclocking and thermal management

Many miners experiment with overclocking to squeeze extra performance out of their GPUs. Although it can lead to higher hashrates, improper overclocking can cause crashes or hardware damage. Always increase clock speeds gradually, test thoroughly, and monitor your temperature. A small bump in power or clock rates can yield noticeable hashrate improvements, but you need to balance these gains with higher electricity consumption.

When it comes to cooling, good airflow is paramount. Mount your rigs in a well-ventilated area, possibly with intake and exhaust fans. Compact spaces may require a specialized system, like a water-cooling loop for GPUs, but that might be overkill if you are just starting. Aim for a comfortable temperature range—often below 75–80°C for GPUs—so that you extend hardware life.

Monitoring tools

Plenty of third-party apps let you track hashrates, temperatures, or even pool payouts from your mobile phone. Some tools automatically shut down your rig if it overheats or if the mining software crashes. Setting up remote monitoring or alerts can help you manage your rig even when you are not physically present. This is especially helpful if you plan on letting your miner run 24/7 in a remote location like a home office or garage.

Disabling auto-updates on your machine can also help prevent forced restarts at inconvenient times, which could disrupt your mining. Instead, schedule an occasional downtime period each week or month to install important system updates. This keeps your mining rig secure and stable, all while minimizing interruptions to your LTC earnings.

Conclusion

From picking the right hardware to choosing your mining method, learning how to mine LTC does not have to be overly complicated. The keywords to success include balancing performance with operational costs, monitoring your hardware to prevent overheating, and selecting the right software to optimize your hashrate. For many newcomers, pool mining offers a gentle introduction with smaller but consistent payouts. If managing hardware feels daunting, you can explore cloud mining or even skip straight to purchasing LTC on an exchange like Xgram to keep your approach simpler.

As you gain confidence, you might upgrade to specialized ASIC rigs or tweak your GPU settings to fully optimize your setup. Regularly track your power consumption, mining difficulty, and expected returns. Stay informed about market changes because LTC’s price and mining difficulty can shift, influencing your profitability. If you are diligent and patient, mining can be more than a technical exercise—it can become a rewarding experience that grows your understanding of blockchain technology while adding LTC to your wallet.

Five FAQs about LTC mining

Can I mine LTC on my laptop?

Yes, but it is generally not recommended. Laptops have limited cooling capacity and can overheat quickly when running mining software. You might also find the hashrate to be quite low. If you are just experimenting, consider a desktop GPU or a cloud mining contract instead.What is the difference between LTC pool mining and BTC pool mining?

Both processes are conceptually similar—you contribute hashing power to a pool and share rewards. The main difference is the algorithm used, with BTC relying on SHA-256 and LTC using Scrypt. This affects hardware requirements. Litecoin typically uses more memory-intensive computations, so specialized Scrypt ASICs or GPUs are common for LTC, while Bitcoin heavily favors SHA-256 ASIC hardware.How do I store LTC safely after mining?

You can store LTC in a variety of wallets. Software wallets (desktop or mobile) are popular for quick transfers, while hardware wallets like Ledger or Trezor offer enhanced security by keeping your private keys offline. If you are regularly trading or converting, you might keep some funds on an exchange like Xgram, but for long-term storage, a hardware wallet is often considered the safest route.How can I reduce electricity costs?

Managing power is crucial for profitability. You can switch to more efficient mining hardware, undervolt or underclock your GPUs, and run your rigs during off-peak electricity hours if possible. It is also worth shopping around for utility providers or using renewable energy sources if that is an option in your area.Do I need a separate wallet to receive LTC rewards?

If you participate in pool mining, you typically link your pool account to a specific LTC address so that payout automatically arrives in your wallet from time to time. You do not necessarily need multiple wallets. However, many miners use a dedicated wallet for mining income to keep better track of earnings and separate them from other crypto holdings.