USD vs USDT: the real dollar vs the Tether stablecoin

USD — the official U.S. currency, legal tender regulated and accepted worldwide.

- USDT — a stablecoin issued by Tether Limited, designed for the digital space. Intended to maintain 1 USDT ≈ 1 USD, but carries issuer and blockchain risks.

- Your choice depends on your purpose: for banking, payments, and savings outside crypto — USD. For fast transfers between exchanges and in DeFi — USDT.

Conclusion

USD and USDT serve different purposes. The dollar is a fiat currency with maximum legal clarity and liquidity. USDT is a digital tool for instant transactions within the crypto world. Use USD for banking and off-chain payments. Use USDT for speed, 24/7 availability, and on-chain operations — while keeping in mind the risks tied to its issuer and blockchain.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always review your local laws and platform risks before using these assets.

For large USDT amounts, use a hardware wallet and always test small transfers first. Periodically review and revoke unnecessary smart contract permissions.

FAQ

Is 1 USDT always equal to 1 USD?

The goal is to maintain the peg, but short-term fluctuations above or below 1.00 can occur during stress or low-liquidity periods. Can I always redeem USDT for USD?

It depends on your platform and jurisdiction. Direct redemption from Tether isn’t available to everyone — most users rely on exchanges, P2P markets, or swap services. Which is safer for long-term storage — USD or USDT?

For risk-free, long-term storage — USD in a regulated bank. USDT is best for active operations and liquidity within crypto but carries issuer and blockchain risks. Which network offers the lowest fees and fastest transfers?

Typically, USDT on Tron is cheaper and faster. On Ethereum, fees are higher, but the ecosystem is much larger. Do I need KYC to use USDT?

No for wallets, yes for centralized exchanges or fiat providers. On no-KYC platforms like Xgram, you simply connect your wallet and send the transaction.

This method saves time and avoids unnecessary steps with centralized exchanges or fiat gateways when you just need crypto-to-crypto transfers.

Storage: Where It’s Safer to Keep USD and USDT

USD: bank accounts, licensed payment services, or deposit products. Main risks — bank and country-level. USDT: personal wallets (hardware or mobile) and reputable exchanges for short-term storage. Main risks — lost keys, phishing, smart contract bugs, or counterparty issues.

Fees and Speed

USD moves through the banking system — speed and cost depend on the country, bank, and payment network. USDT transfers happen over blockchains — usually within seconds or minutes, costing anywhere from a few cents to a few dollars depending on network load.

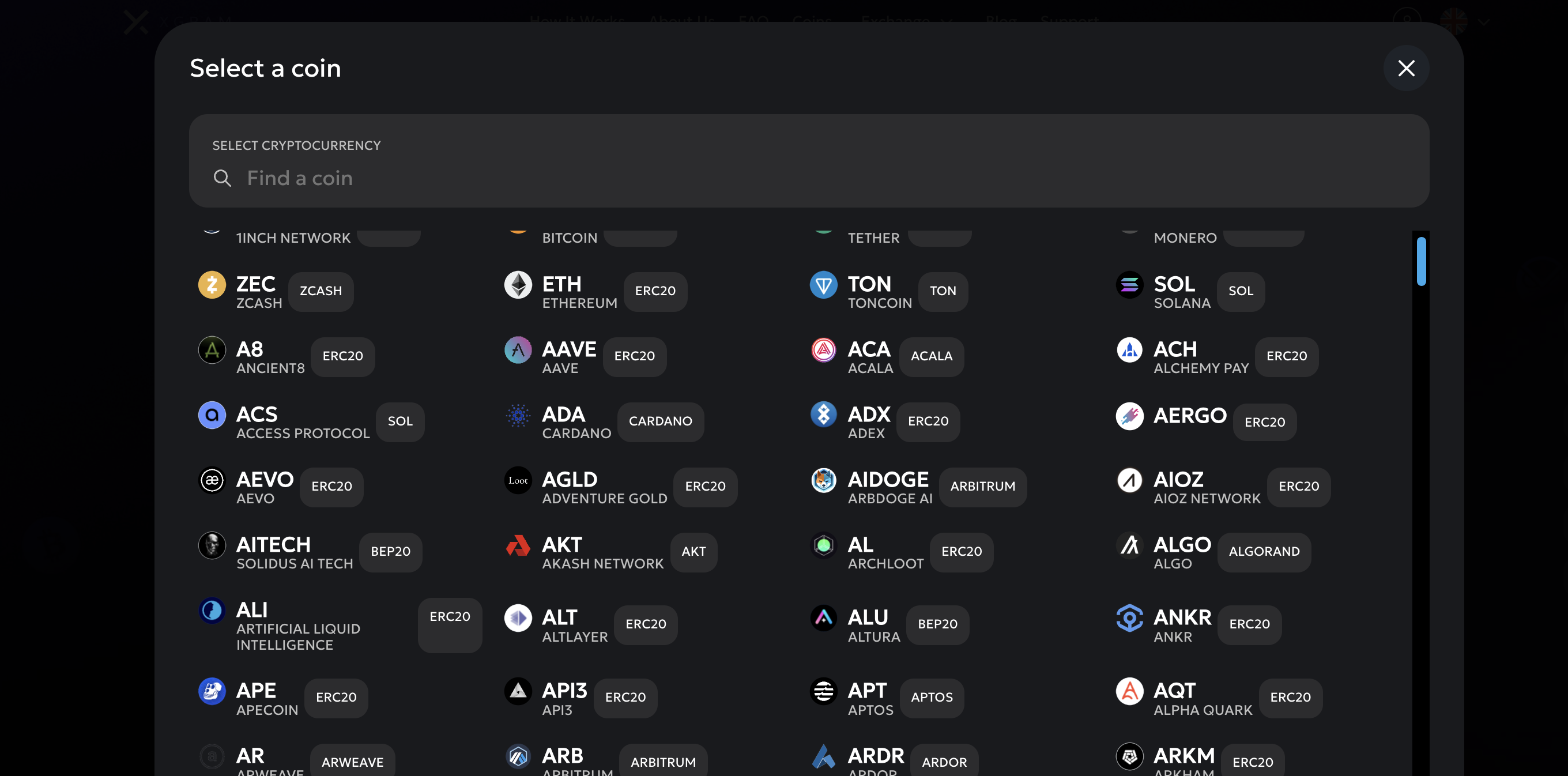

How to Quickly Exchange or Move USDT in Crypto

For fast crypto-to-crypto swaps, use Xgram.io — a non-custodial exchange with no registration or KYC.

Select the direction, for example USDT → BTC or USDT (TRC-20) → USDT (ERC-20). Enter the recipient address and amount. Choose a fixed or floating rate — the final amount and fees are shown upfront. Send your coins and receive the exchanged asset directly to your wallet within minutes.

What to Watch in 2025

Stablecoin regulation. New requirements for reserves and issuer reporting may appear. Reserve transparency. Always review issuer reports and third-party attestations. Network choice. Fees and speed depend on the blockchain: Tron is cheaper, Ethereum is pricier but has a broader ecosystem. Platform reliability. Assess counterparty risks when using P2P or exchange wallets.

USDT is better if you

actively use crypto exchanges and DeFi; need fast 24/7 transfers with low fees; understand and can manage issuer and blockchain risks while tracking the peg to 1.00.

When to Choose USD vs USDT

USD is better if you

need to operate outside the crypto ecosystem or with banks; prioritize legal protection and consumer safeguards; hold large sums long-term without frequent crypto operations.

5. Risks

USD — inflation, currency fluctuations, banking fees or delays, and potential account freezes due to compliance checks. USDT — issuer and reserve risk, regulatory pressure, blockchain and smart contract vulnerabilities, and occasional price deviations from 1.00 during stress events.

4. Liquidity and Infrastructure

USD — maximum global liquidity, supported by the banking system and payment networks. USDT — the largest stablecoin by volume in crypto, highly liquid across CEX and DEX, with 24/7 transfers processed within minutes.

3. Use Cases

USD — salaries, payments, savings, and settlements in the real economy. USDT — deposits and withdrawals via P2P, quick wallet transfers, liquidity in DeFi and DEX, and cross-chain operations.

2. Legal Status and Regulation

USD — legal tender, strictly regulated, with clear taxation rules. USDT — a private token, regulated differently across countries, depending on the platforms you use.

What Is USD

USD is the official currency of the United States, issued under the control of the Federal Reserve System. The dollar is used in global trade, held in central bank reserves, and serves as a benchmark for liquidity. Its value is supported by the U.S. economy and government regulation.

What Is USDT (Tether)

USDT is a stablecoin issued by Tether Limited. It operates on Ethereum, Tron, and other blockchains and is designed as a digital “equivalent” of the dollar. Its goal is to move value across the crypto ecosystem quickly — without bank transfers or delays. However, USDT is not legal tender and depends entirely on its issuer.

Key Differences Between USD and USDT

1. Issuer and Backing

USD is issued by the U.S. government and backed by the country’s credit and tax base. USDT is issued by a private company and backed by its reserves. The transparency of those reserves and the issuer’s policy are key risk factors.