TL;DR (Short version in 3–4 sentences):

You can sell NEAR Protocol by signing up for a crypto exchange, peer-to-peer (P2P) marketplace, or instant swap service. Each method lets you convert NEAR into fiat or other cryptocurrencies, though fees and transaction speeds differ. Be sure to confirm wallet addresses, use strong security measures, and research each service’s reputation. If you want a simple, fee-conscious approach, consider exploring platforms like Xgram, which do not require you to connect a wallet and can save on transaction costs.

Understand Near Protocol

Before you sell, it helps to know the basics. NEAR Protocol is a layer-1 blockchain that focuses on speed, scalability, and user-friendly development. It aims to make decentralized applications more accessible to everyday users. If you have acquired NEAR tokens through staking, earning rewards, or buying on various exchanges, you can easily convert them to other cryptocurrencies or fiat currencies such as USD or EUR.

When you decide to sell NEAR, your main concerns typically include:

- Getting a fair market price.

- Minimizing transaction or withdrawal fees.

- Using a secure, trusted platform.

You typically have three broad methods to consider: centralized crypto exchanges, P2P marketplaces, or instant swap services. Each option comes with unique benefits and trade-offs. It is wise to pick the method that reflects your comfort level and your desired outcome, whether that is speed, minimal fees, or privacy.

Explore ways to sell NEAR

You can sell NEAR Protocol in various ways, and no single method is perfect for everyone. The right choice depends on how quickly you want to trade, how important privacy is to you, and how you plan to receive your funds.

Use a centralized crypto exchange

Centralized exchanges are among the most common platforms for buying or selling NEAR. These exchanges hold users’ assets temporarily and match trades via internal order books.

- Sign up and verify. You create an account, meet any Know Your Customer (KYC) requirements, and then deposit your NEAR tokens.

- Place an order. You can create a market sell order (which sets the current available price) or a limit sell order (which waits for a specific price).

- Withdraw your proceeds. Once your trade completes, you can withdraw the funds in fiat or convert to another crypto, depending on the exchange’s supported pairs.

Pros:

- Usually have high liquidity, which can lead to faster transaction completion.

- Provide clear interfaces and well-documented help articles.

Cons:

- Fees may be higher than you expect, and they vary by exchange.

- You must trust the exchange to hold your funds temporarily.

Opt for a P2P marketplace

If you like more control over your trade, peer-to-peer (P2P) marketplaces let you buy or sell NEAR directly with another person. You can often negotiate terms such as price, payment method, or escrow conditions.

- Create an account. Most P2P sites require a quick signup and minimal verification, though it can vary.

- Post or respond to offers. You can set your own price for NEAR or browse existing offers to find a buyer.

- Use escrow. The platform usually provides an escrow service that holds your tokens or funds until both parties confirm the transaction.

- Complete payment and release. You might use bank transfers, digital wallets, or even cash in some scenarios. Once the payment is confirmed, the escrow releases the tokens.

Pros:

- More flexible in terms of payment methods and pricing.

- Can be cost-effective if you find the right deal.

Cons:

- May be slower than an exchange-based trade, as timely communication matters.

- If you do not use a reputable escrow, P2P can be riskier.

Try instant swap services

Instant swap services offer a way to sell NEAR quickly without dealing with order books or direct negotiations. You simply select the input (NEAR) and the desired output (fiat or another cryptocurrency), then confirm the swap.

- Navigate to the swap page. Many instant swap providers do not require registration, although some ask for minimal KYC if you exceed certain transaction amounts.

- Enter the amount of NEAR to sell. The platform typically calculates a quote in real time.

- Confirm and execute the swap. You deposit NEAR to a one-time address and receive the chosen currency in return.

Pros:

- Extremely quick for small to medium trades.

- No need to manage complex orders.

Cons:

- Exchange rates can vary, potentially yielding a less favorable price than a standard exchange.

- Service fees might not always be transparent.

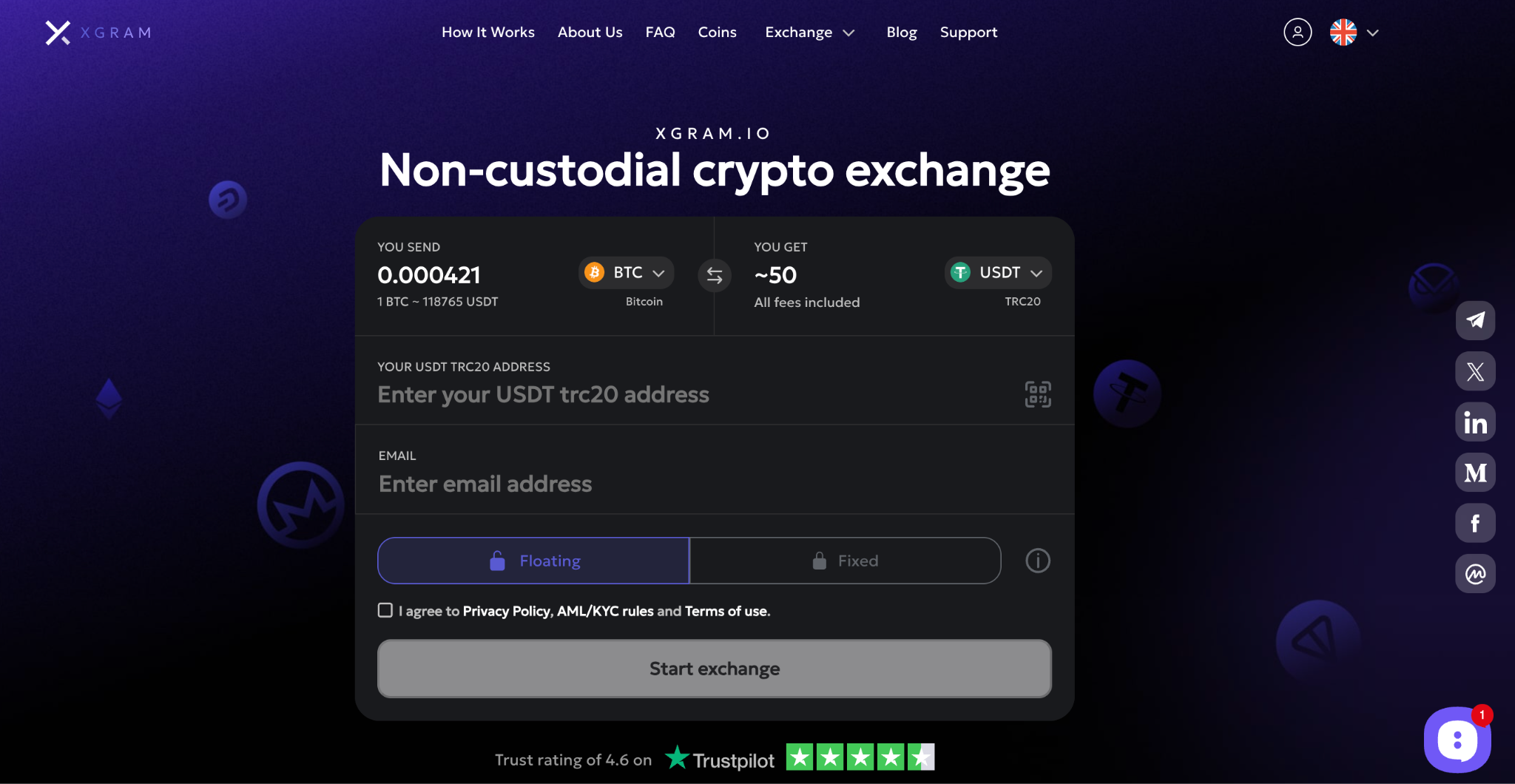

Check out Xgram for flexible trades

Xgram is a straightforward exchange platform where you can sell NEAR with fewer steps than most traditional services. It aims to keep fees low and simplify your trading experience:

- You do not need to connect or synchronize an external wallet, which helps reduce setup time.

- You can straightforwardly convert NEAR into fiat or other crypto without dealing with multiple dashboards.

- The platform often scores competitively on fees, letting you keep more of your proceeds.

- You gain access to typical exchange services plus the convenience of near-instant swaps, if those suit you better.

- For newcomers, Xgram’s user-friendly design is appealing, since it prioritizes clarity and minimal friction from signup to payout.

If you need a platform that blends the speed of instant swaps with the familiarity of an exchange, Xgram might deserve a spot in your shortlist.

Prepare your accounts

Once you have identified a method to sell NEAR, the next step is creating or updating the relevant accounts. Although each approach demands slightly different steps, you will typically encounter a similar onboarding experience.

- Check compliance needs. Exchanges and P2P platforms often have country-specific regulations. Confirm that you can trade NEAR where you live, and see if the service supports your currency.

- Complete KYC verification. In many regions, you must provide proof of identity. This might involve uploading your ID or passport, along with running through a basic face verification or address check.

- Set up two-factor authentication (2FA). To protect your newly created account, it is best to enable 2FA through an authenticator app or SMS. If you opt for SMS, just bear in mind that authenticator apps are considered more secure.

- Fund or sync your wallet. On centralized exchanges, you deposit NEAR from your personal wallet into your exchange wallet. On a P2P platform, you might transfer NEAR directly into an escrow contract.

If you already have a personal wallet, make sure you have enough NEAR to cover network transaction fees. While NEAR’s transaction fees are known to be relatively low compared to some other blockchains, it still pays to keep a small buffer. Even when using Xgram where you do not need to connect a wallet, ensure you have your NEAR tokens ready in a secure place so you can move them as needed.

Transfer and confirm your NEAR

The next phase involves moving your NEAR tokens to the platform you chose. This is a critical step, because entering the wrong address or skipping confirmations can lead to delays or lost funds.

Locate the deposit address.

- On a centralized exchange, you typically navigate to your “Wallet” or “Funds” section and choose “Deposit NEAR.”

- If you are dealing with a direct swap service, you will likely see a temporary address or a QR code to send your tokens.

Double-check addresses.

- Many wallets let you copy and paste automatically. Avoid typing addresses manually, because one small typo could result in lost tokens.

- Checking the first few and last few characters of the address before finalizing helps reduce mistakes.

Wait for confirmations.

- Some services require a certain number of network confirmations before your tokens show up in your balance.

- Keep an eye on your account page or transaction history to see when the deposit is officially recognized.

Consider timing.

- Although NEAR transactions are generally fast, the destination platform might take a few extra minutes to confirm your deposit.

- If your transaction seems stuck, review your transaction hash on a block explorer that supports NEAR to ensure it went through.

These steps are usually straightforward, yet they remain essential to avoid headaches down the line. Rushing through them can lead to avoidable errors.

Finalize your sale

After your NEAR tokens arrive in your chosen platform, you are ready to finalize the trade. This stage usually involves telling the platform how many tokens you want to sell, what price you want to aim for (if that is an option), and to which currency you want to convert.

Select your trading pair.

- On a centralized exchange, you might see a “NEAR/USD” or “NEAR/BTC” pair, among others.

- On a P2P platform, confirm the payment method or specific fiat currency you want in return.

Decide your order type (exchange only).

- Market order: Sells your tokens immediately at the current market price. Great if you want speed.

- Limit order: Lets you set a specific sell price. Useful if you believe the market price will rise to your chosen level.

Watch the fees.

- Most exchanges apply a trading fee, often deducted automatically.

- If you sell via instant swap or Xgram, check if you see a breakdown of fees included in the quoted price.

Confirm the transaction.

- Once the order is executed, your platform should show the final trade details.

- For P2P trades, wait for the buyer to transfer payment and confirm within the escrow before you release your NEAR.

Withdraw your funds.

- If you turned NEAR into fiat on an exchange, you will usually withdraw to your bank account or e-wallet.

- Some platforms let you withdraw stablecoins, which you can then convert elsewhere if you need.

When you see your new currency—fiat or crypto—inside your account or wallet, you have successfully sold NEAR Protocol. While the process is not too complicated, it is worth repeating a final check of your transaction results to ensure you received the correct amount.

Enhance safety and security

Your main priority when selling NEAR tokens should be safeguarding your assets. Although most reputable exchanges and P2P platforms do their best to protect users, your personal decisions and vigilance are crucial in avoiding scams or losses.

- Use authorized services. Stick to well-known, reputable platforms. When in doubt, do a quick background check by reading user reviews or exploring crypto communities.

- Beware of phishing links. Do not click on suspicious ads or messages claiming to offer exclusive bonuses. Bookmark the official URLs of your favorite exchange or P2P site.

- Avoid oversharing. Do not post your transaction details publicly, and be cautious with direct messages asking for personal info.

- Leverage hardware wallets. If you hold significant amounts of NEAR, consider storing them on a hardware or cold wallet until you are ready to sell. Move them to a hot wallet or exchange account only when trading.

- Keep track of updates. Platforms evolve constantly. If your chosen exchange or P2P service announces changes in terms of service or new security measures, stay informed.

Selling NEAR can be smooth and straightforward, but your awareness makes all the difference. If something feels off at any stage, pause and investigate.

Frequently asked questions

Is NEAR Protocol easy to sell for beginners?

Yes. Many popular exchanges and swap services support NEAR, making it relatively simple to sell. Whether you choose a centralized exchange, a P2P platform, or a quick swap service, the process is no harder than selling other major tokens.What is the safest way to sell NEAR Protocol?

Generally, the safest approach involves using a well-established exchange that has robust security measures and a strong reputation for reliability. You can also improve safety by enabling two-factor authentication, confirming deposit addresses, and never sharing sensitive login details.How do I minimize fees when selling NEAR?

Compare the transaction and withdrawal fees of various platforms. Some centralized exchanges might support cheaper withdrawal methods, while instant swap services sometimes bundle the fees into the quoted price. You can also explore Xgram, which often has lower fees and does not require you to connect a wallet to complete the transaction.Can I sell NEAR directly for fiat?

Yes. Many centralized exchanges offer direct trading pairs with fiat currencies like USD, EUR, or GBP. After the trade, you can withdraw to your bank account or digital wallet, assuming the exchange supports your region.Can I swap NEAR for other cryptos instead of fiat?

Absolutely. If you want to hold another cryptocurrency, pick platforms or services that allow you to convert NEAR to your target coin. You might start with a NEAR/BTC or NEAR/ETH trading pair, then later trade those coins for a stablecoin or another asset of your choice.

Wrap up and next steps

Selling NEAR Protocol might feel like a leap at first, but you have all the tools to make confident decisions. Whether you opt for a centralized exchange, P2P platform, or a convenient instant swap service such as Xgram, the basic process remains the same. Confirm your chosen platform’s credibility, double-check wallet addresses before transferring funds, and pay attention to the fees you are charged.

If you are still unsure, start small by selling a fraction of your NEAR tokens to learn the ropes. Over time, you can fine-tune your strategy by comparing fees, exploring different platforms, and selecting the payout options that fit your finances. Selling crypto is not just about liquidating assets—it is about managing risk wisely, exploring market opportunities, and staying secure in a fast-moving landscape. You have got this, and we trust this guide has lit the path toward your next NEAR Protocol transaction. Happy trading!

давай на все языки перевод