TL;DR (Quick Summary):

- Selling BNB on a centralized exchange is relatively convenient if you already have an account, but watch out for fees.

- P2P (peer-to-peer) platforms let you transact directly with buyers, but you must carefully manage security and verify user reputations.

- Instant swap services and aggregators like Xgram can help you quickly convert BNB without lengthy sign-up steps.

- Always confirm each platform’s fee structure and withdrawal limits before proceeding.

Below, you will discover detailed ways to sell BNB, compare exchanges vs P2P, learn how instant swap services operate, and review practical safety tips. By the end, you will have the confidence to convert your BNB on terms you prefer, with fewer headaches along the way.

Understand BNB basics

BNB (short for Binance Coin) originated as a utility token for the Binance platform, with uses like trading fee discounts, staking, and more. Over time, BNB has grown beyond the Binance ecosystem and become a top-traded coin across many exchanges, wallets, and defi protocols.

- BNB can be held in different wallet types: hardware wallets, software wallets, or custodial exchange accounts.

- The value of BNB is tied to market supply and demand, meaning price fluctuations are common.

- You can convert BNB to fiat currencies (like USD or EUR) or swap it for other crypto assets (like Bitcoin or stablecoins).

When you are ready to sell BNB, the main factors to consider include transaction fees, speed of execution, and safety.

Compare exchanges and P2P platforms

The key players in selling crypto are centralized exchanges and P2P platforms. They each have advantages and drawbacks, so choosing one depends on your priorities.

Centralized exchanges

A centralized exchange is a marketplace controlled by a single entity. You deposit your BNB, place a sell order, and wait for a buyer to match that order.

Pros:

Easy ordering interface.

Often higher liquidity, which means faster trade execution.

Customer support is generally available.

Cons:

You may pay transaction fees, trading fees, and sometimes withdrawal fees.

You must pass account verification (KYC), which may not suit those who want extra privacy.

Your crypto is stored in the exchange’s custodian wallet until you withdraw.

P2P platforms

In a peer-to-peer environment, you sell BNB directly to another individual, without a central operator intermediating. The platform typically provides escrow and some verification features.

Pros:

Flexibility in setting your own price or picking from various payment methods.

More privacy than fully centralized systems if you choose a partial verification route.

Opportunity to negotiate directly with buyers.

Cons:

Less liquidity compared to major centralized exchanges.

Possible risk of dealing with unverified or fraudulent buyers.

Slower trade execution if you cannot quickly find a matching buyer.

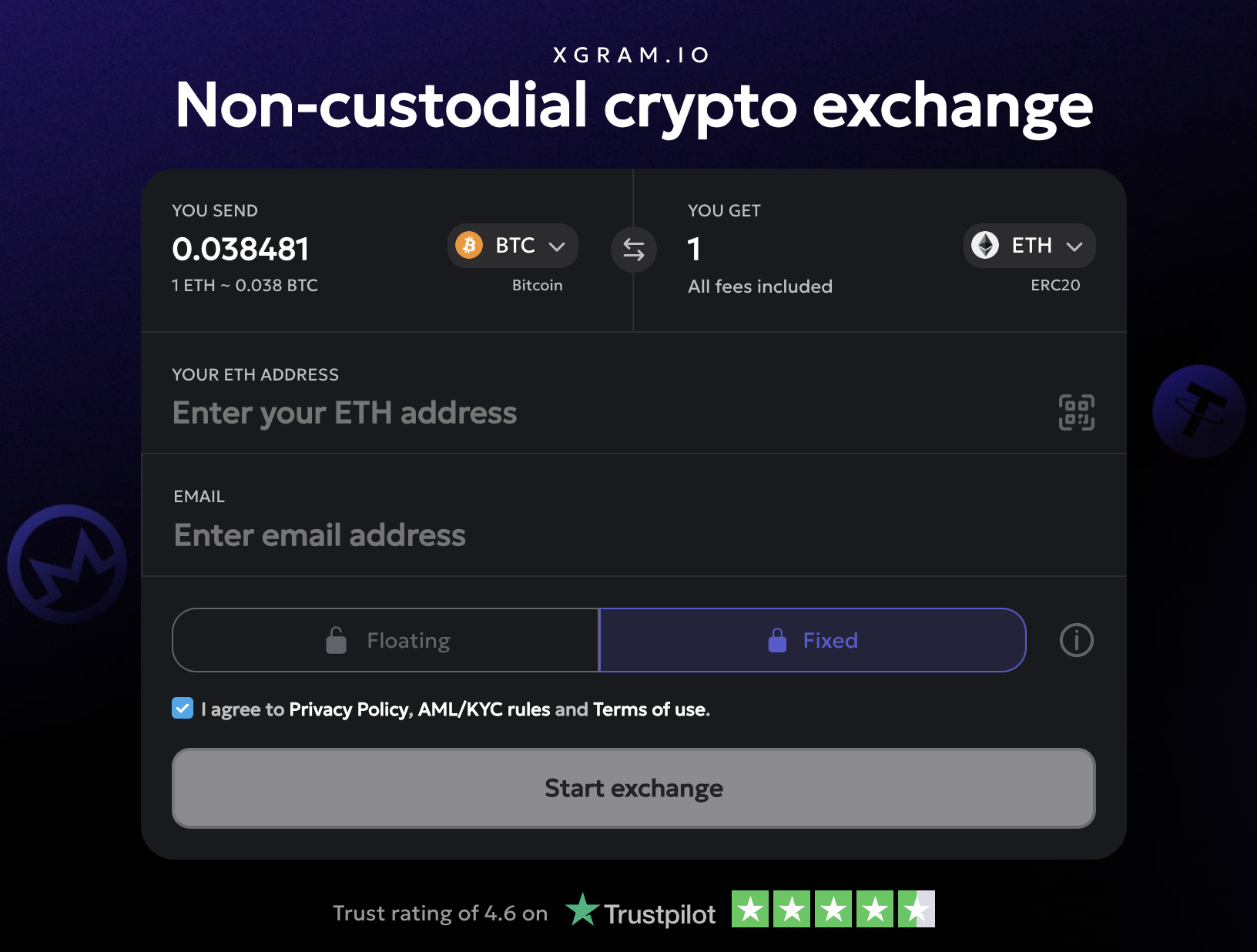

Know the basics of instant swap services

Instant swap services, also known as crypto aggregators, offer a different path for how to sell BNB. These are gateways where you can quickly exchange one crypto for another, or sometimes convert to fiat, without the overhead of an account-based system. Their designs prioritize speed and reduce sign-up friction.

- You typically enter the token you want to sell (BNB) and the token you want to receive (e.g. BTC or a stablecoin).

- The service calculates the best available rate across various sources.

- You receive the new crypto directly in the wallet address of your choice.

When you want immediate liquidity or do not want the complexity of a full traditional exchange, instant swap services can be a sensible approach, provided they have transparent fees and a proven track record of secure transactions.

Consider Xgram for BNB conversions

Xgram is one of those instant swap/aggregator services that can handle both typical and specialized crypto conversions. You may save on fees because Xgram pools price data from various exchanges behind the scenes and gives you the best possible rate at that moment. Here are five things you should know about Xgram:

- You do not need to connect a wallet to Xgram’s platform. Instead, you can simply input the wallet address where you want your swapped funds to go.

- Xgram maintains a simple interface, so you can enter how much BNB you want to sell, pick the currency you want to end up with, and quickly see the estimated fees.

- The service aggregates different liquidity providers to optimize your conversion rate, often lowering your overall transaction costs.

- Xgram completes trades rapidly. You might receive the swapped crypto in your specified wallet in just a few minutes, making it ideal for quick sells.

- Because no long registration process is involved, you frequently avoid the typical KYC hurdles that come with large centralized exchanges.

For many beginners, Xgram offers a convenient middle ground. You are not bound by the complexities of a traditional order book, and you typically avoid the wait time that might come with a P2P transaction.

Step-by-step: How to sell BNB on a centralized exchange

When you choose a centralized exchange, you want to follow a reliable process. Here is a practical approach:

1. Create or log into your account

- If you do not already have an account on the exchange, sign up.

- Complete any required KYC procedures.

- Enable two-factor authentication (2FA) for added security.

2. Deposit BNB

- Go to your exchange’s deposit section, then select BNB.

- Copy the exchange’s BNB deposit address.

- Use your existing wallet to send BNB to that address. Always confirm that you are using the correct network (BEP2, BEP20, etc.) as directed by the exchange.

3. Place a sell order

- In the trading interface, look for the BNB-to-fiat pairing if you want to convert directly to USD or another local currency. You can also switch BNB to stablecoins like USDT or USDC if that pairing is more liquid.

- Choose from a market or limit order. A market order will convert your BNB instantly at the current market price, while a limit order executes when the price hits your specified threshold.

4. Withdraw funds

- Once the trade settles, you will see your fiat or stablecoin balance.

- If you intend to turn that balance into actual cash, set up a withdrawal method such as a bank transfer, debit card withdrawal, or another available payout.

- Double-check withdrawal fees. In some cases, it might be more cost-effective to withdraw your funds in stablecoins and convert them through an alternative channel, depending on your region and local banking options.

Step-by-step: How to sell BNB on a P2P platform

If you prefer to interact directly with buyers (or enjoy greater control over your payment method), try a P2P marketplace.

1. Sign up or log in

- Register on the P2P platform you trust.

- Verify or partially verify your identity per the platform’s guidelines.

- Familiarize yourself with the security measures, such as (2FA) or email confirmations for trades.

2. Find a buyer or create an offer

- Scan the available buy orders for BNB. Each listing usually shows the price the buyer is willing to pay, the payment method they accept, and any trade limits.

- If you do not see a good match, you can create a sell order, mentioning the quantity of BNB, your price, and the payment method you prefer.

3. Park BNB in escrow or confirm the platform’s process

- Most P2P platforms have an escrow mechanism to hold your BNB until the buyer completes the payment.

- This ensures you do not lose your crypto if something goes wrong during the transaction.

4. Complete the transaction

- Once the buyer accepts your offer, wait for the payment to arrive.

- Confirm you have received the correct amount in your chosen payment method (e.g. PayPal, bank transfer, etc.).

- Release BNB from escrow to the buyer’s wallet.

5. Rate and review

- Provide feedback on your transaction partner.

- Buyers and sellers with high ratings typically inspire more trust for future trades.

Key differences in cost and liquidity

You may want to know which entire approach is cheapest or fastest. While “it depends on your region and the specific platform” is often the case, here is a broad overview:

| Aspect | Centralized Exchange | P2P Platform | Xgram / Aggregator |

|---|---|---|---|

| Fees | Trading + withdrawal fees | Variable, often flexible but can add escrow fees or premiums | Aggregates different providers for competitive rates |

| Liquidity | Generally high | Varies based on user offers | Usually stable due to multi-exchange access |

| Speed | Fast if you deposit in advance | May require time to find a matching buyer | Quick conversions, focus on instant swaps |

| User Control | Custodial until withdrawal | Direct negotiation with buyer | Minimal steps, no lengthy sign-up |

| Complexity | Medium (KYC, trading interface) | Medium (managing listings & escrow) | Low (simple swaps) |

Potential pitfalls and safety tips

Protecting your funds is a top priority when you sell BNB. Regardless of your chosen platform, keep the following tips in mind:

- Double-check network details. BNB can exist on different chains (e.g., Binance Smart Chain vs Binance Chain). Sending funds to the wrong network address may result in permanent loss.

- Watch out for hidden fees. Some platforms hide fees in the exchange rate rather than charging a visible transaction fee. Always verify the final rate.

- Confirm the buyer’s reputation. On P2P platforms, work with users who have a high completion rate, many successful trades, and positive reviews.

- Opt for a strong, unique password. If you choose to create an account on an exchange or P2P site, do not reuse your password from other services.

- Activate two-factor authentication (2FA). Whether it is SMS, email, or an authenticator app, ensure you add this layer of security wherever possible.

Additional strategies for selling BNB

You are not limited to just centralized exchanges, P2P markets, or basic swap services. Here are other ways you could approach the selling process:

- Swap BNB for stablecoins on a decentralized exchange (DEX). If you prefer staying in the crypto sphere, you can convert BNB to stablecoins like USDT or BUSD on a DEX, then later move those stablecoins to a centralized exchange to cash out.

- Use a crypto ATM. In some regions, specialized ATMs let you sell crypto for cash. However, transaction fees can be higher than other methods.

- Leverage an OTC (over-the-counter) desk. If you plan to sell a large BNB amount, an OTC service might help you avoid price slippage and handle high-volume trades more discreetly.

Prepare for stablecoins vs direct fiat

When planning how to sell BNB, you might run into a situation where direct fiat pairs are not supported in your region or on your exchange of choice. In that case, the straightforward approach is to first convert BNB to a stablecoin. From there, you can sell that stablecoin for fiat on an exchange or aggregator with better liquidity.

For example, say your preferred exchange only supports stablecoin/fiat conversions. You could:

- Swap BNB to USDT (or another stable token).

- Sell USDT for USD on the exchange fiat market.

- Withdraw your USD via a linked bank account.

This may look like an extra step, but it often gives you more flexibility and easier access to competitive trading pairs.

Double-check your region’s regulations

Before deciding on how to sell BNB, examine local regulations and policies:

- Banking rules: Some banks or payment processors block crypto-related transfers.

- Tax obligations: Depending on your jurisdiction, you may owe capital gains tax or other taxes on any profits when you sell BNB.

- Prevailing anti-money-laundering rules: Certain exchanges or P2P platforms might require identity verification to comply with legal requirements in your region.

Staying informed on your local policies will help you avoid side-effects like frozen accounts or surprise tax bills.

Manage price volatility

The crypto market can be unpredictable, and BNB is no exception. You might see the price rise or fall significantly within hours. Here are suggestions for dealing with volatility:

- Time your trade if possible. Pick a favorable market trend, but be aware that “timing the market” perfectly is nearly impossible.

- Use limit orders. On a centralized exchange, placing a limit order ensures you will not sell below your chosen price, but it might take longer to find a match.

- Watch liquidity. Check the volume on the platform you plan to use. Thin order books could lead to a bigger price impact if you sell a substantial amount of BNB.

FAQs

How long does it take to sell BNB?

It depends on the method. With a centralized exchange, selling can be near-instant once your BNB is deposited. P2P usually requires more time to find a buyer, while instant swap services such as Xgram do conversions within minutes.Why convert BNB to stablecoins first?

Converting BNB to a stablecoin like USDT or USDC can help you lock in an exact equivalent in fiat. You can then move that stablecoin onto a platform with robust fiat gateways and sell for your local currency.Are KYC checks mandatory when I sell BNB?

KYC rules vary by platform and region. Centralized exchanges typically require identity verification. Many P2P markets have partial or full KYC. Instant swap services may only need essential information, or none at all, but it depends on local regulations.What happens if I withdraw BNB to the wrong address?

If you send BNB to a non-BNB wallet or use the wrong network, your funds could be lost forever. Always verify the correct chain (e.g., BEP20 for Binance Smart Chain or BEP2 for Binance Chain) before confirming any transaction.Is it safe to store BNB on an exchange wallet?

Storing BNB on an exchange can be convenient for quick trades, but you rely on the exchange’s security. The adage “not your keys, not your coins” remains valid. Whenever possible, hold long-term funds in your own secure wallet.

Final thoughts

Selling BNB can be stress-free once you map out the right platform for your goals. Centralized exchanges offer speed and liquidity if you do not mind KYC, while P2P is all about control and flexibility, albeit with more direct user interaction. For a low-friction, near-instant path, services like Xgram curate rates and reduce steps, which makes them attractive if you want a hassle-free experience.

Regardless of your choice, keep an eye on fees, confirm you are transacting on the correct BNB network, and follow safe-storage practices for any residual funds. With a smart, cautious approach, you can convert your BNB into fiat or other assets in a way that meshes with your comfort zone. From there, your next step in managing your crypto portfolio will be a whole lot smoother.