Why We Built This

We’ve spent months privately building and using DeFi Vaults by Xgram to manage our own portfolios. Through real-world use, we refined yield strategies and interfaces until we knew it was time to go public. The market clearly needs safer yields, simpler tools, and better control. DeFi Vaults by Xgram is our answer — a product born from experience and built for the self-custody generation.

What It Is

Xgram aggregates yield opportunities across DeFi into one streamlined platform. Start directly from your wallet in one click — Xgram never takes custody. No more jumping between protocols, chains, or apps. Just choose a strategy, click, and you’re in. Think of it as your one-stop interface for DeFi yield — with full asset control.

Key Features

- Non-Custodial: Funds go from your wallet straight to on-chain protocols. Xgram only routes transactions — never holds your assets.

- One-Click yield earning: Behind one confirmation, we handle all swaps, bridges, and staking actions automatically.

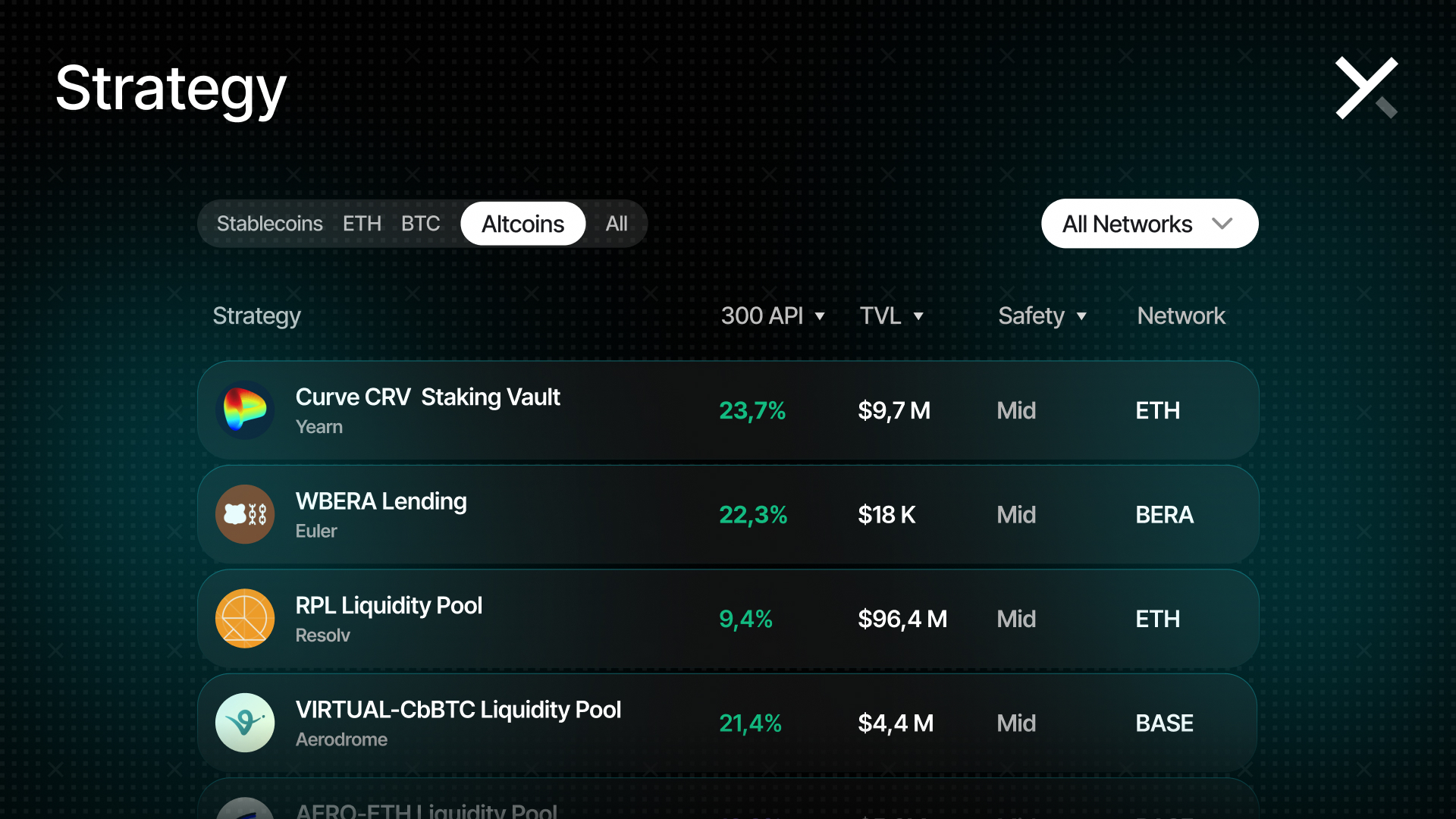

- Wide Integration: Supports 8+ chains and 50+ protocols. From lending to staking, it’s all accessible under one roof.

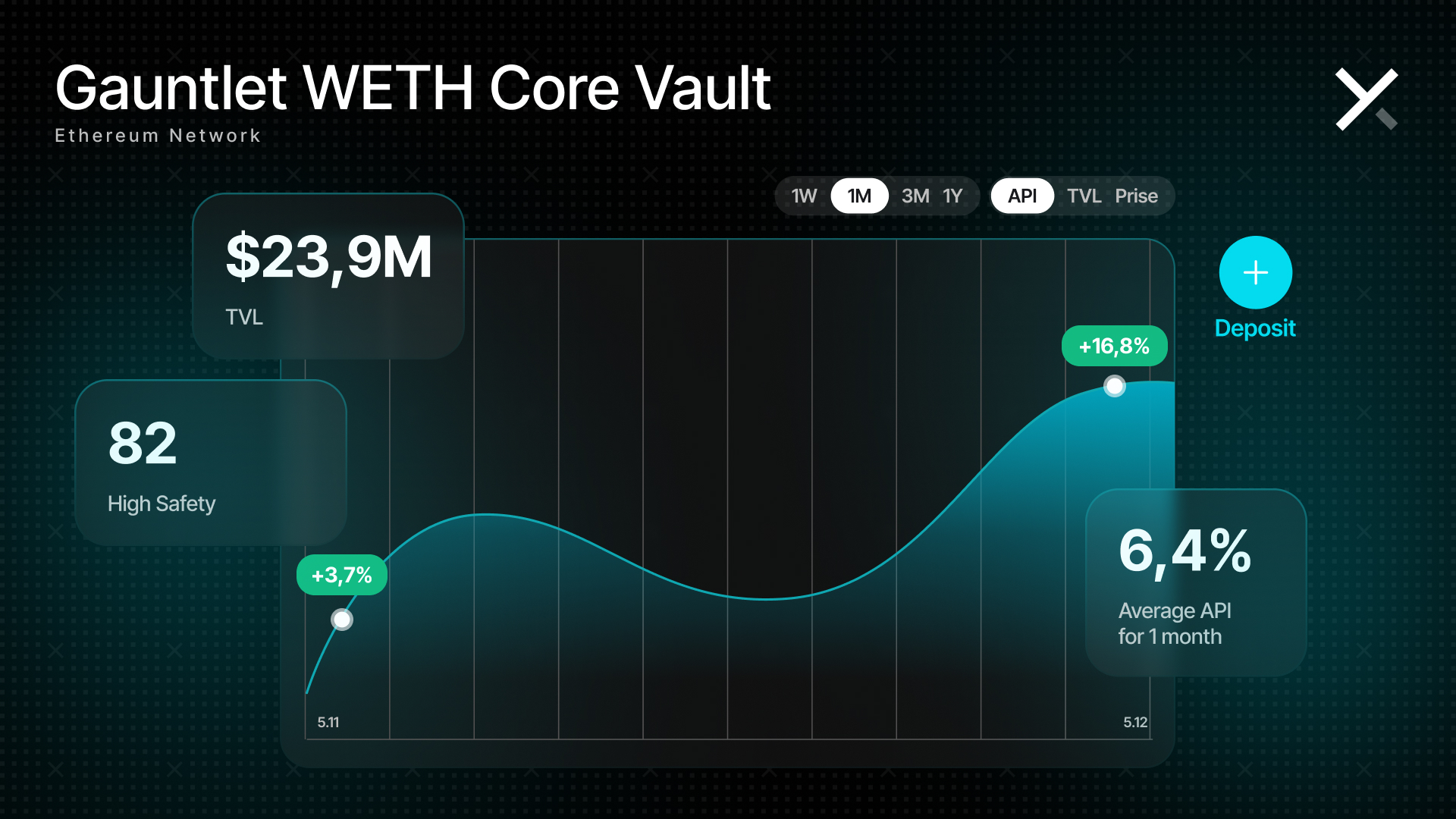

- Transparent Analytics: Each strategy shows real-time APY, TVL, risk category, and historical performance — all pulled from on-chain data.

Example Vaults

- USDC – Conservative: ~7–8% APY via tested lending strategies. High safety score and low volatility.

- ETH – Liquid Staking: 3–5% APY by auto-compounding stETH. Uses protocols like Lido and Rocket Pool.

- BTC – Lending: 3–5% APY on WBTC via cross-chain yield markets. Moderate risk.

- Altcoins: 18–19% APY in emerging DeFi token pairs. High risk, high upside.

Each vault appears as a card with APY, risk, TVL, and asset type — letting users compare and filter easily.

How It Works

- Connect Your Wallet — MetaMask, WalletConnect, etc.

- Pick a Vault — Filter by asset, chain, or risk level.

- Sign to Start Earning — One transaction handles all on-chain steps.

- Manage Portfolio — No lockups. Monitor earnings and exit in one click.

Security & Transparency

Audited Strategies Only

All strategies on Xgram Vaults are built on audited DeFi protocols. We carefully review each platform’s security track record, audit reports, code maturity, and on-chain usage before integrating. Only battle-tested protocols make it into our vaults — no experimental contracts or unvetted platforms.

What We Show Users

Each vault comes with live APY, TVL, safety score, and historical performance — all sourced from on-chain data. We also display strategy details like protocol used, risk category, and asset type. No hidden logic or black-box metrics — just full transparency to help users participate confidently.

Roadmap: Launching Q1 2026

After private testing, we’re preparing for public launch in Q1 2026. Ahead of that, we’ll share:

- A whitepaper and docs on how yields and contracts work

- Sneak peeks of the interface and live strategies

- Waitlist signups for early access and bonuses

We’ll include in the release:

- Platform with dashboard and vault list

- Grid of vault cards with real APYs and risk scores

- User flow diagram — Connect → Choose Strategy → Earn

- Analytics dashboard mockup for tracking earnings

In Conclusion

DeFi Vaults by Xgram is our way to bring institutional-grade yield strategies to self-custodial users — with one-click simplicity and full transparency. Launching Q1 2026. Join us in redefining how DeFi yield should work.