Explore peer-to-peer basics

Peer-to-peer, often shorted to P2P, refers to a direct connection between two parties. One person sends a digital asset, such as Bitcoin, to the other. In return, that person completes payment using whatever method both sides agree on—could be cash, bank transfer, or even gift cards. No guardian or third party stands in the middle holding the funds, although some platforms provide escrow (holding funds temporarily) to reduce scams.

- Popular intangible items you can trade P2P:

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

- Collectibles like NFTs (digital tokens that certify ownership)

- In-game items, if the game permits direct trading

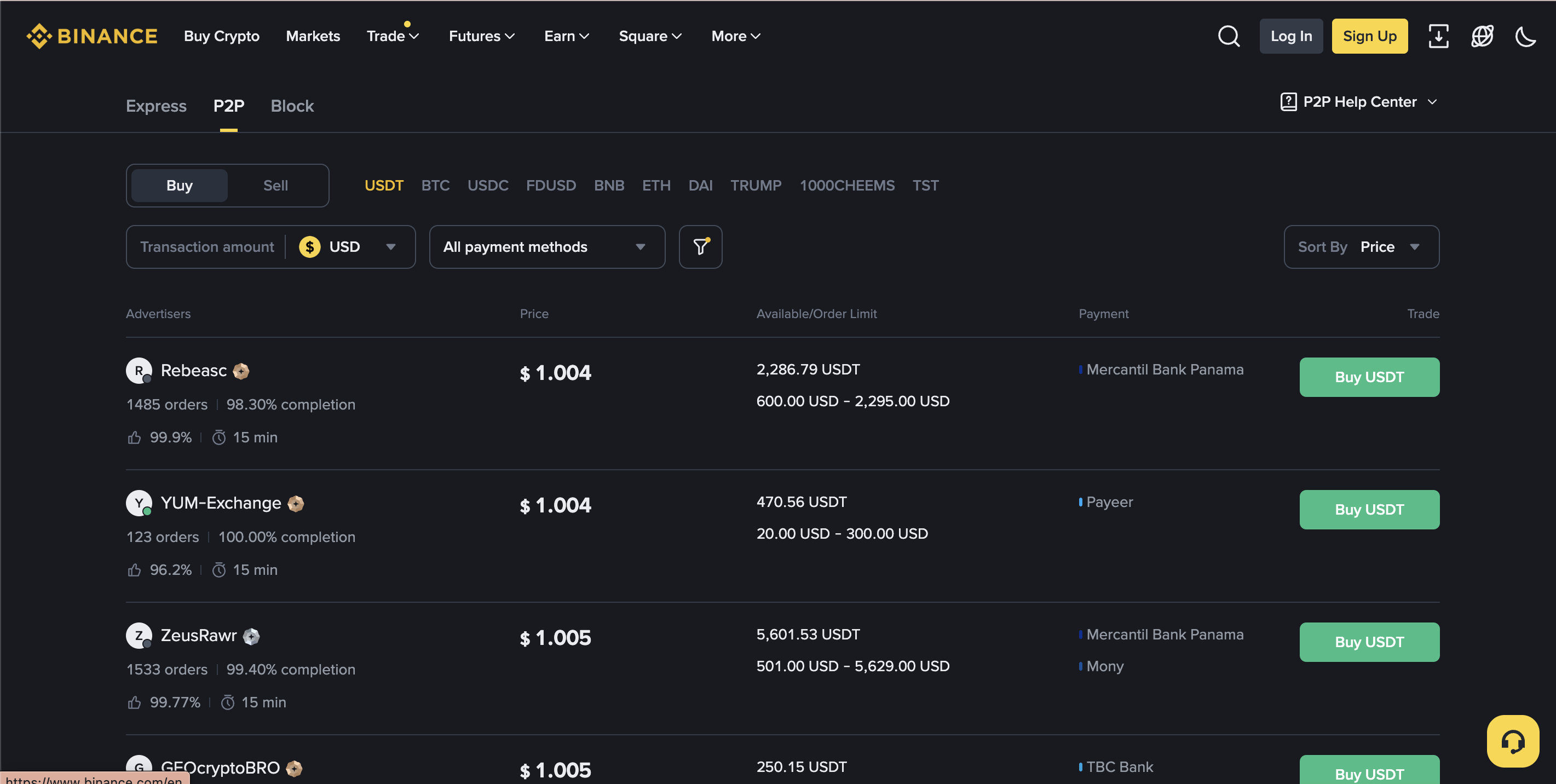

A 2023 online poll suggests that P2P exchanges can account for a large slice of crypto transactions, especially in regions where traditional banking restrictions exist. Good news—this is easier than it sounds. Most P2P platforms offer user-friendly dashboards that show who’s buying and who’s selling. You simply select a listed offer, confirm the terms, and complete the trade.

A brief history

- Early file-sharing services (like Napster in the music world) tapped the P2P architecture, letting individuals exchange data without a central server.

- Cryptocurrencies like Bitcoin arrived in 2009 with a built-in P2P focus. Blockchain technology, the distributed ledger for transactions, supports the entire “group of peers” idea.

- Modern crypto markets extended that concept, giving everyday users a chance to transact directly and bypass extra fees.

Learn why P2P matters

You might wonder: “Why does peer-to-peer trading matter for me?” In many financial systems, banks or major exchanges can limit how you trade, how much you withdraw, or what currencies you can accept. By using P2P, you often gain:

Freedom of choice

- Select from various payment methods, including local bank transfers or e-wallets.

- Decide on your own trading hours, not tethered to a single exchange schedule.

Lower fees

- Because you skip the middleman, fees are often minimal or even zero. That can save you money if you’re a regular trader.

- Occasionally, platforms that facilitate P2P might charge for escrow services, but these costs tend to be smaller than a typical trading fee.

Global reach

- P2P traders can tap into a wider user base, especially in regions where conventional financial services are tricky.

- Countries with strict capital controls often see high P2P usage, because individuals want alternative ways to move money.

Customizable trades

- You can negotiate price, payment method, and settlement time. This flexibility often leads to a better deal for both sides.

Some experts estimate that in certain emerging markets, P2P crypto trading can account for up to 40% of local crypto volume. This popularity underscores how important it is for everyday users who lack robust banking options or simply want direct control.

See P2P’s wallet impact

When you participate in a peer-to-peer exchange, you avoid depositing your funds into, say, a large exchange’s wallet. Instead, your digital assets remain in your personal wallet until you’re ready to send them directly to the buyer. This dynamic can have several impacts on your wallet:

- Greater control: You’re in charge of your private keys, meaning you hold full authority over your crypto. There’s no risk that your exchange account is suddenly frozen.

- Potential volatility: P2P usually involves trades for major cryptocurrencies like Bitcoin or stablecoins such as USDT. Your primary wallet might see rapid rises and dips if you keep active crypto holdings.

- Fewer forced conversions: On some centralized platforms, you might have to convert to fiat or move to a stablecoin for withdrawal. P2P often lets you stick to your desired token.

Common steps in a P2P transaction

- You pick a counterparty (or buyer/seller) who posts an offer.

- You both agree on the price and the payment mode.

- If there’s an escrow system, the crypto or funds go into temporary lock until the deal is done.

- You follow the platform’s rules to confirm payment.

- The assets release to the buyer’s wallet, and the seller receives money.

This direct approach to handling crypto typically means you pay fewer fees. Meanwhile, you maintain clear oversight of your assets—something many people value when aiming for financial privacy or self-custody.

Use P2P in crypto

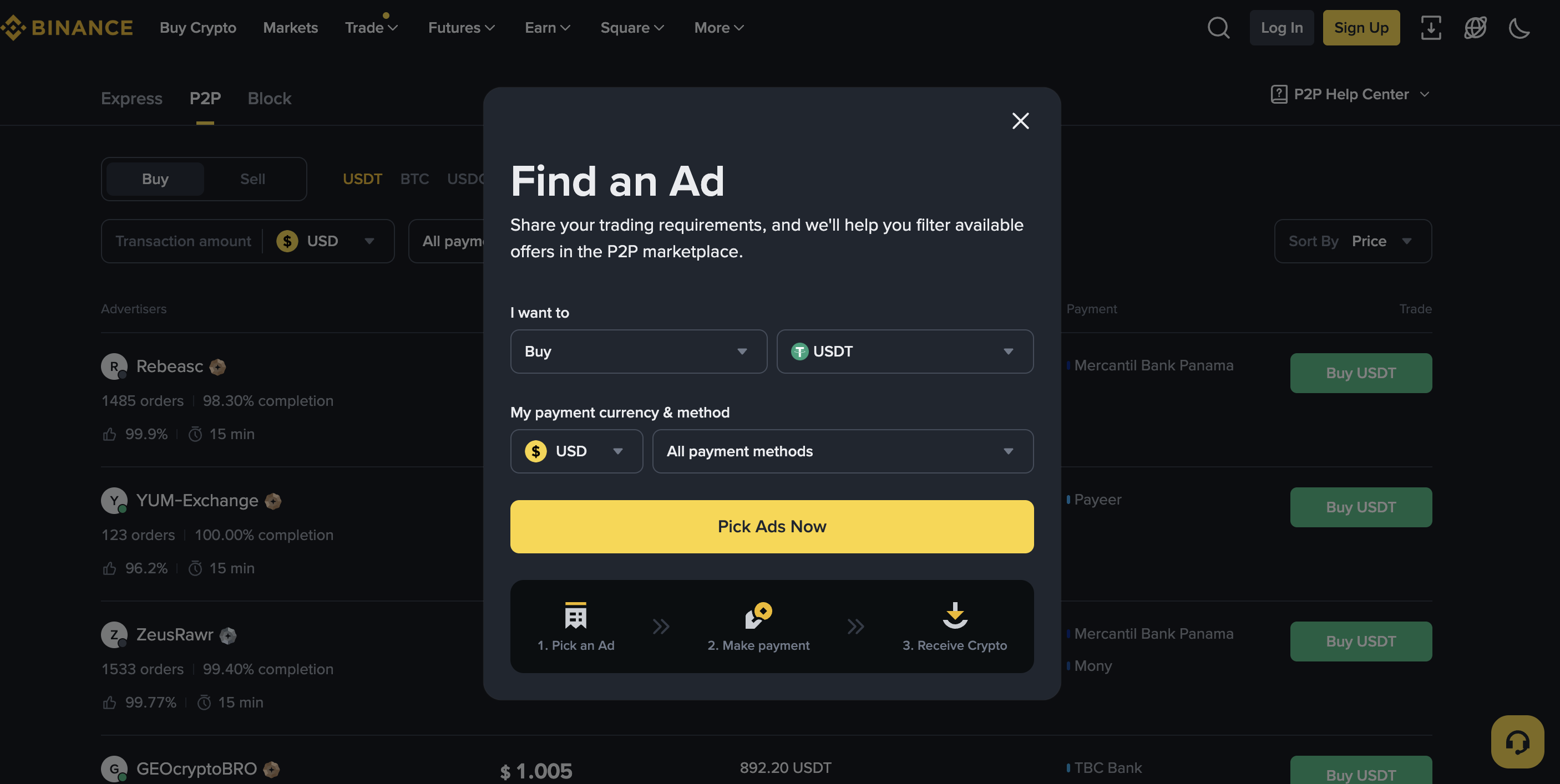

If you visit a major crypto exchange like Binance, Huobi, or KuCoin, you’ll often find a P2P tab among their trading options. In that section, you can post an ad to buy or sell digital assets, or respond to someone else’s listing. Although it’s “peer-to-peer,” large exchanges tend to incorporate safety measures, including:

- Escrow: The exchange holds the crypto temporarily, preventing either side from running off mid-transaction.

- Ratings: You can check other users’ trading history, which helps gauge reliability.

- Dispute resolution: If something goes wrong, you can submit a claim for the exchange’s support team to review.

Some traders prefer a purely decentralized approach, using dedicated P2P protocols that don’t rely on a major exchange at all. They might trade exclusively through open-source wallets and direct messaging channels. Others appreciate the safety net of an established exchange’s escrow.

Comparing P2P and traditional exchanges

| Aspect | P2P Trading | Centralized Exchange |

|---|---|---|

| Control of funds | You hold your assets until the transaction | Funds typically sit in the exchange’s wallet |

| Fees | Varies, often low | Usually has a standard fee structure |

| Speed | Depends on the agreement between parties | Usually faster due to an automated system |

| Security | Relies on user ratings or escrow | Relies on the exchange’s security systems |

| Price flexibility | Negotiable | Usually determined by market order books |

Understand benefits and risks

While peer-to-peer offers many advantages, it also carries a few concerns. Admitting both sides prepares you to make smarter decisions.

Benefits

- More privacy: You aren’t forced to share as many personal details (depending on local regulations).

- Flexible payment methods: From bank transfers to digital wallets, you can pick the option that suits you both.

- No single point of failure: Centralized exchanges can freeze or limit withdrawals during busy times or regulatory issues. P2P trading remains relatively free from these constraints.

Risks

- Scams: With no large entity, scammers might trick newbies into paying for coins they never receive. Escrow helps solve this, but caution is key.

- Slower settlement: If your counterparty delays payment, your funds might be locked in escrow for a while. Live chat or platform messaging can reduce confusion.

- Less liquidity: On certain P2P platforms, the selection of available tokens or deals might be smaller than a big exchange’s offerings.

- Price fluctuations: While you can negotiate terms, crypto asset prices move quickly. You might end up with more or less than you expected if negotiations take too long.

Good news—despite these challenges, thousands of traders successfully use P2P daily. As long as you verify user reputation and follow basic security measures, you can often avoid major pitfalls.

Choose a P2P platform

Finding the right P2P platform depends on your region, the coins you want to trade, and the payment methods you prefer. Here are a few tips to help you pick confidently:

Check reputation

- Read reviews from other users or check platform forums.

- Look for third-party audits or endorsements that confirm reliability.

- Stick to platforms with robust user rating systems.

Consider fees

- Some platforms charge a small listing fee, while others only make money on withdrawals.

- Factor in any network fees for on-chain transactions. A cost of $2 or $3 in blockchain fees might be small, but repeated trades add up quickly.

Explore features

- Escrow: This significantly lowers the chance of scams.

- KYC requirements: Some platforms ask for identity verification, others remain more flexible. Decide which environment you prefer based on your local laws and personal comfort.

- Payment methods: The best P2P platforms for you offer the ways you already use (wire transfers, mobile money, e-wallets).

In many regions, local residents have formed online communities dedicated to P2P exchanges. If you join one, you’ll likely pick up tips, discover verified trading partners, and share best practices that keep everyone safe.

Consider xgram for cross-chains

If you’re looking to save on fees and move between different blockchains, xgram can be a compelling choice. This specialized exchange (designed for cross-chain swapping) aims to let you convert one blockchain’s tokens into another without paying hefty conversion charges. Instead of sending tokens off to a centralized exchange that charges deposit and withdrawal fees, you do the entire swap in a mostly direct manner.

- Xgram leverages cross-chain bridges so you can move, for example, from a Bitcoin-based token to something on Ethereum.

- Many xgram trades are near-instant, which means less waiting than on some multi-step centralized approaches.

- Because it’s cross-chain, you can find unique pairs that might never appear on a single-chain P2P platform.

- If you need to handle multiple blockchains often, xgram’s features can drastically reduce your overall fees and keep everything in one place.

Frequently asked questions

1. Is peer-to-peer (P2P) trading legal?

Legality depends on your jurisdiction. Some countries encourage crypto usage and have no issues with P2P, while others impose restrictions. It’s best to check local regulations or consult a legal expert if you’re unsure.

2. Can new users safely try P2P?

Yes. Most P2P platforms have user-friendly interfaces and tutorial sections for beginners. Just remember to use platforms with escrow, read user ratings, and verify the payment method before confirming any deal.

3. Do I need a specific wallet for P2P?

Technically, any wallet that holds the accounts or coins you want to trade will work. However, some platforms integrate directly with certain apps, making the swap more seamless. Always confirm which wallets the platform supports to avoid confusion.

4. Why would an exchange bother with P2P if it earns fewer fees?

Exchanges know some traders prefer direct deals, and having a P2P section brings in more users overall. Even if direct trades bring fewer fees, the exchange gains popularity. That leads to a bigger user base for all its trading services.

5. How does P2P compare to decentralized exchanges (DEXs)?

They share similar values: user autonomy, fewer intermediaries. But a DEX typically runs on blockchain-based smart contracts for automated transactions, whereas P2P often involves a direct agreement (plus escrow, if available). If you want everything on-chain with coded rules, use a DEX. If you value the personal negotiation aspect, choose P2P.

Recap and next step

Peer-to-peer trading cuts out the middleman, offering you more freedom over how you buy or sell cryptocurrencies. You agree on terms with another person, lock in the deal, and avoid typical exchange fees or withdrawal limits. P2P trading is flexible, can be cost-effective, and—when done on reputable platforms—very secure.

Here’s a quick reminder of what to try next:

- Pick a trusted P2P platform that offers escrow and fair fees.

- Test a small, low-stakes trade to get comfortable with the process.

- Keep an eye on user ratings and always verify payment details.

- Consider cross-chain solutions like xgram if you need to bridge tokens between different blockchains.

And that’s it. You’ve got a handle on how peer-to-peer trading works, how it might affect your wallet, and where to go from here. It doesn’t have to feel daunting—start small, keep your security measures in place, and watch your skill (and confidence) grow along the way.