Explore the origins of Bitcoin

To understand the background of Bitcoin, you’ll want to start in late 2008. The world was in the throes of a major financial crisis, and trust in banks had taken a serious hit. During this turmoil, someone (or possibly a group) called Satoshi Nakamoto distributed a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It was sent to a cryptography mailing list, a digital forum where enthusiasts shared ideas about secure communication and decentralized networks.

In these first communications, Satoshi outlined a new way to send money without relying on a central authority. Instead, Bitcoin would rely on what’s called a “blockchain,” which is a public ledger maintained by a network of computers rather than one institution. This approach meant that transactions could be verified by the network itself, reducing the need for a single, controlling gatekeeper.

It’s useful to remember that Bitcoin emerged at a moment of heightened distrust in traditional finance. A person reading that whitepaper in 2008 might have felt it offered a daring vision: a currency for the digital age, governed by decentralized code, not by central bank executives. Early adopters were intrigued by the straightforward yet revolutionary logic that anyone could help maintain the network, earn freshly minted Bitcoins, and transact worldwide with minimal fees or interference. That spark of curiosity continues today, especially for people who want to know which mastermind came up with such a concept. Getting a clear handle on Satoshi Nakamoto’s identity is challenging, but understanding the context of 2008–2009 gives you a solid starting point.

Look at Satoshi’s early communication

Satoshi’s writing style is perhaps your next major clue. From 2008 to 2011, Satoshi posted on forums and communicated privately with early developers who joined the Bitcoin project. These messages were polite, direct, and surprisingly brief. You can still find many of them online, often archived in their original form. If you skim them, you’ll pick up on a voice that was confident yet humble—almost strictly focused on perfecting Bitcoin’s code, responding to questions, and guiding new collaborators.

During those first couple of years, Satoshi coordinated crucial decisions to ensure Bitcoin would remain decentralized and secure. For example, Satoshi was instrumental in capping Bitcoin’s total supply at 21 million coins, which many enthusiasts now consider a core feature of its scarcity. In addition, Satoshi wrote about peer-to-peer networks and cryptographic tools with an ease that suggested deep familiarity with the subject. Some of these early posts reference established thinkers in digital currency and cryptography, indicating careful scholarship. Meanwhile, Satoshi offered minimal personal details, leaving only logical arguments for how Bitcoin should evolve.

One thing stands out if you browse Satoshi’s archived texts: the absolute lack of self-promotion or personal branding. You rarely see references to an individual story or background. Instead, Satoshi adhered to an understated tone. That consistent focus on the project, rather than any personal credit, has driven speculation that perhaps Satoshi was more than one person working under a shared pseudonym. Others imagine a single individual with an uncanny ability to remain objective and discreet. Either way, these communications reveal someone (or a group) determined to let the technology speak for itself. They also hint at a personality comfortable with secrecy, a clue you may want to keep in mind as we move forward.

Investigate the main suspects

Curiosity about Bitcoin’s founder has led independent researchers, journalists, and even law enforcement agencies to propose various candidates. Over time, specific names have surfaced repeatedly. Here are some prominent figures often mentioned, with a quick sense of what makes them interesting prospects:

| Candidate | Reason for Suspicion | Evidence or Disclaimer |

|---|---|---|

| Hal Finney | One of the earliest Bitcoin contributors, received first Bitcoin transaction | Style similarities exist between his writing and Satoshi’s, but Finney denied being Satoshi |

| Nick Szabo | Pioneered “bit gold” idea, an early digital currency concept | Strong cryptographic background, but he consistently denies being Satoshi |

| Dorian Nakamoto | Shares last name, profiled by a major publication | He firmly stated he had zero involvement, evidence was circumstantial |

| Craig Wright | Publicly claimed Satoshi identity | Has yet to conclusively prove it cryptographically, many in the community remain skeptical |

| Other possibilities | Speculation about a team including Adam Back, Gavin Andresen, or other cryptography experts | No direct proof, most remain theories |

Let’s break down some details:

Hal Finney

Hal Finney was a talented cryptographer and an early Bitcoin adopter, known for being the first person (besides Satoshi) to use Bitcoin software. He also received the first-ever Bitcoin transaction from Satoshi. Many enthusiasts point to Finney’s writing, which seems similarly clear and detail-driven as Satoshi’s. However, Finney publicly stated he was not the mastermind behind Bitcoin and provided email exchanges with Satoshi as part of his defense.

Nick Szabo

Nick Szabo is a computer scientist recognized for conceptualizing a project called “bit gold,” which predates Bitcoin and shares some of its principles. Researchers who analyzed writing patterns note parallels between Szabo’s style and Satoshi’s communications, suggesting they could be the same person. But Szabo has consistently denied any part in Bitcoin’s founding. His involvement in digital currency circles certainly placed him in the right place at the right time, yet no concrete proof has materialized.

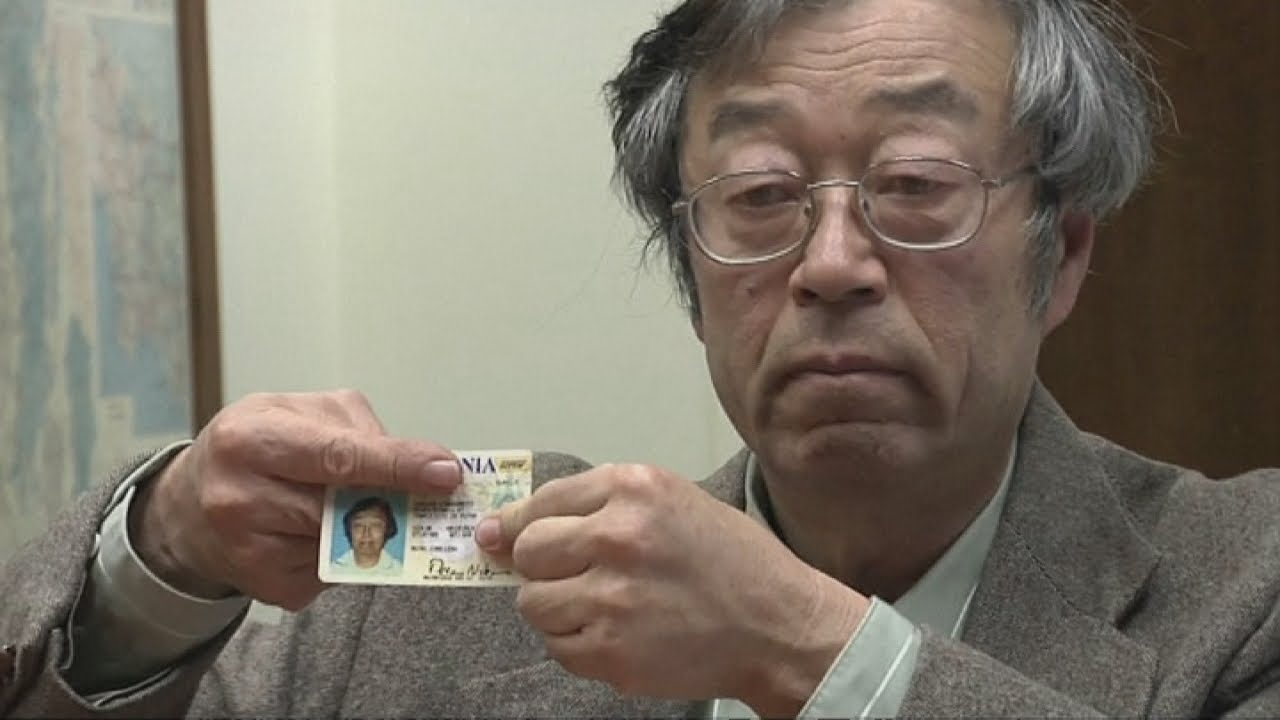

Dorian Nakamoto

In 2014, a reporter singled out Dorian Nakamoto because he lived near Los Angeles, had some technical background, and shared the last name “Nakamoto.” The resulting media firestorm put him under great scrutiny. Eventually, the evidence proved flimsy and mostly circumstantial: although Dorian had worked as an engineer, he insisted he had nothing to do with Bitcoin’s invention. The fiasco highlighted how quickly rumors can catch fire when the public yearns for a real face behind the Satoshi name.

Craig Wright

Possibly the most outspoken claim came from Craig Wright, an Australian entrepreneur who, in 2015, declared himself Satoshi. He presented some cryptographic verifications that other researchers judged to be incomplete or misleading. Key members of the Bitcoin community asked him for additional cryptographic proof—specifically, to sign a message with a private key tied to addresses known to be owned by Satoshi. So far, no unambiguous evidence has emerged, and mainstream sentiment remains that Wright has yet to meet the high bar of proof.

Other possible names

In crypto’s earlier years, some guessed that Satoshi might be a group of open-source developers, or even a government agency. Figures such as Adam Back, Gavin Andresen, and Wei Dai have come up, yet none have admitted to being Satoshi. Most of these possibilities rely on partial overlaps in writings or code styles, and, to date, no single argument stands above the rest. If you’re intrigued by mysteries, you’ll find debates online for each candidate. Good news, though: you’re not required to pick a side to appreciate Bitcoin’s technology.

Weigh the cryptographic clues

Because Bitcoin is a piece of software built around cryptography, you might figure that cryptographic forensics could reveal who Satoshi is. Indeed, some attempts have been made via “stylometric analysis,” a process that compares writing samples to identify unique patterns and habits. This technique has pinned Satoshi’s style on Nick Szabo more than once, though it’s not definitive and doesn’t constitute foolproof proof. Another angle is to check addresses known to be part of early mining activities. Some believe Satoshi might still hold the private keys to an immense fortune. Over the years, watchers have monitored certain wallets for any unusual movement. The logic goes that if these funds were ever moved or assigned to a candidate, it could effectively unmask the real Satoshi.

Despite the best detective work (and ongoing curiosity), the trail remains famously cold. Each suspect has plausible reasons and partial evidence, yet no one has come forward with unquestionable cryptographic signatures belonging to Satoshi. This ambiguous status highlights the strength of good operational security—anonymity can hold firm when the individual (or group) behind it is disciplined. For you, it’s a lesson in how cryptography not only secures digital coins, but can also cloak the identity of brilliant innovators when they choose to conceal themselves.

Understand the impact of anonymity

You might wonder: why does it matter that Satoshi remains hidden? Well, investor confidence and network stability often hinge on trust. In a conventional system, you trust a central authority like a bank or government. In Bitcoin’s design, trust is distributed across many participants, and the protocol itself enforces transparent rules. Satoshi’s anonymity can reinforce the notion that no single person is “in charge,” which aligns with the decentralized spirit. And from an ideological stance, some find it liberating that Bitcoin’s creator does not step in to manipulate the system.

On the other hand, this anonymity can raise valid concerns. The fact that Satoshi likely owns a large stash of Bitcoin means in theory, a single entity controls a mass of coins that could influence the market if they were sold or used in specific ways. Some folks talk about the possibility of a “Satoshi dump,” where those holdings could flood the market and tank the price. Yet, since Bitcoin’s inception, these coins have mostly remained untouched. That inaction only fuels more mystery—why keep such wealth idle for so long?

Additionally, in the regulatory world, there’s sometimes a push to identify major stakeholders. If Satoshi’s identity were definitively known, you might see governments press them for compliance or hold them accountable for the network’s function. So far, that scenario is off the table. For Bitcoin enthusiasts, Satoshi’s exit from the public eye is often regarded as a masterstroke that preserves the project’s neutrality. If no single founder can be pinned down, regulators and critics can’t easily attack or coerce a central figure, giving Bitcoin a unique level of resilience.

Consider reasons for staying hidden

Given how high-profile Bitcoin has become, you might guess that staying anonymous has significant benefits. From a purely practical angle, anonymity shields a founder from overwhelming media attention, legal entanglements, or even physical risk. Since Bitcoin deals with finances on a global scale, it’s easy to imagine that governments or criminals might try to target the person who wrote the code.

Another motivation might be philosophical. Bitcoin was built to be trustless, meaning you don’t have to rely on a single point of authority. If Satoshi’s identity were known, it could skew perceptions—people might look to them as a guiding figure rather than relying on the community’s consensus. By disappearing from the conversation, Satoshi leaves developers, miners, and users to maintain the system themselves, living up to the protocol’s decentralized ethos.

From your perspective, anonymity can seem puzzling in an age where big ideas are usually followed by relentless coverage and public recognition. Yet there’s a long tradition of people who prefer to let their inventions speak for themselves. If you read Satoshi’s early forum posts, you’ll sense a drive to solve a technical problem, not to chase fame or fortune. Could it be that Satoshi’s personal passions lie elsewhere, or that fulfilling their vision required stepping back to ensure it wasn’t overshadowed by personality?

Envision Bitcoin’s future

Despite the question of who might be behind the pseudonym, Bitcoin’s development continues. It is open-source, so individuals across the globe can review and contribute code. Over the years, groups of developers have refined the protocol, addressing scaling issues and encouraging adoption on many different interacting networks known as “layers.” The Lightning Network, for instance, is an add-on designed to make transactions faster and less costly. This ecosystem approach allows Bitcoin to evolve in response to the market’s needs, even without a chief architect present.

For you, the lesson is that Bitcoin’s success or failure doesn’t hinge on discovering Satoshi. The system has reached a level of worldwide usage—ranging from institutional investors to small-scale merchants—that surpasses the influence of any single individual. Regulatory discussions continue, profitability for miners rises and falls, and new innovations appear over time. Yet the central question “who is Satoshi” remains an intriguing sideline, occasionally flaring in social media debates or news headlines. Day-to-day usage of Bitcoin is not halted by the mystery. If anything, the puzzle underscores how a technology can gain widespread momentum on its own merits.

Looking forward, Bitcoin might serve as a reliable store of value or remain a staple in some investment portfolios, even as other coins or tokens offer different features. In many ways, Satoshi’s anonymity could symbolically reflect Bitcoin’s spirit of independence from conventional authority. Whether you see that as an asset or a gap, it’s undeniably part of the currency’s identity.

If you want a user-friendly way to exchange tokens, you might consider Xgram. This service aggregates multiple decentralized exchanges and liquidity pools to find the best rate for your token swaps.

Recap and next step

At this point, you’ve explored how Bitcoin emerged from a cryptography mailing list in 2008, discovered the key suspects people have named as Satoshi, and learned the reasons why the man (or group) behind Bitcoin might still prefer the shadows. You’ve also seen how anonymity protects Bitcoin’s decentralized ethos, even while it creates open questions about trust and accountability. If you’re wondering if anyone will ever crack the enigma and definitively answer, “Who is Satoshi?”, you’re not alone. The world has been waiting on that conclusion for over a decade, with no clear resolution in sight.

If this topic captivates you, consider watching the ongoing community discussions about cryptographic evidence, or reading archived forum posts from the earliest days of Bitcoin’s launch. You can also explore the technical side of how wallets, keys, and the blockchain protocol come together to make Bitcoin function without a central authority. Good news—this is easier than it sounds. Many beginner-friendly tutorials online walk you through Bitcoin basics, from buying a few satoshis (the smallest unit of Bitcoin) to setting up a secure wallet.

In the end, Satoshi’s real identity might never be revealed, and that is part of Bitcoin’s unique story. Whether or not we learn the truth, the code stands on its own, and millions of people continue to trust and use Bitcoin daily. As new platforms and updates emerge, you’ll be able to form your own perspective on how valuable anonymity is in a digital system. Your next step is to keep digging and keep asking questions. Understanding how one anonymous figure transformed global finance may deepen your appreciation for the technology—and even guide how you participate in the crypto world.