Comprender los tokens de IA

Qué son

Los tokens de IA son activos digitales que impulsan proyectos que combinan inteligencia artificial y protocolos blockchain. Por ejemplo, puedes pensar en ellos como un ticket o membresía para plataformas donde los modelos de IA realizan tareas de procesamiento de datos o impulsan aprendizaje automático en la nube. Estos tokens pueden otorgarte derechos de voto, acceso a servicios basados en IA (como reconocimiento de patrones) o incluso representar propiedad parcial de una aplicación impulsada por IA.

Un análisis de mercado de 2024 de Crypto Insights encontró que más del 12 % de los nuevos proyectos cripto lanzados incorporaron IA de alguna manera. La razón es simple: combinar las capacidades predictivas de la IA con la seguridad y descentralización del blockchain puede generar soluciones innovadoras. Algunos proyectos permiten ofrecer tu poder de cómputo para entrenar modelos de IA, recibir recompensas en tokens de IA y votar sobre cómo evoluciona el sistema. Otros se centran en usar IA para automatizar el trading cripto, con el objetivo de detectar patrones más rápido que los algoritmos tradicionales.

A pesar del entusiasmo, deberías analizar más a fondo los fundamentos de cada proyecto. Un token de IA solo es tan sólido como su plataforma subyacente. Verifica si la plataforma realmente usa tecnología de IA (modelos de aprendizaje automático, análisis predictivo o redes neuronales) o si el término "IA" se utiliza principalmente como argumento de marketing. Evaluar estos tokens requiere el mismo nivel de análisis que cualquier otra cripto: lee los whitepapers, revisa las credenciales del equipo de desarrolladores y evalúa su aplicación en el mundo real.

Casos de uso típicos

Cientos de proyectos centrados en IA están surgiendo, pero algunos casos de uso claros se destacan:

- Mercados de datos: algunos tokens de IA permiten comprar y vender conjuntos de datos. Estos proyectos buscan crear una biblioteca compartida de datos de alta calidad, esenciales para entrenar modelos de aprendizaje automático.

- Cómputo descentralizado: ciertas plataformas permiten ofrecer recursos informáticos para tareas de IA, desde reconocimiento de voz hasta clasificación de imágenes. A cambio, recibes tokens de IA según la cantidad de poder de cómputo que aportes.

- Análisis predictivo y trading: hay tokens vinculados a motores predictivos avanzados que pronostican movimientos del mercado utilizando aprendizaje automático de vanguardia. Estas plataformas pueden usar IA para reducir la especulación en el trading de criptomonedas o acciones.

- Gobernanza de IA: algunos tokens funcionan como mecanismos de voto, lo que significa que puedes influir en la dirección del proyecto. Si se trata de una IA de código abierto, puedes votar qué funciones o actualizaciones de modelos priorizar.

La buena noticia es que no necesitas un doctorado en aprendizaje automático para ver su potencial. Paso a paso, puedes evaluar la estrategia, la tecnología y el ritmo de adopción de cada proyecto. Solo asegúrate de mantener la calma, porque como en todas las tendencias de rápido crecimiento, no todos los tokens de IA son una mina de oro.

Explora las características principales

Sinergia con el aprendizaje automático

Los tokens de IA suelen girar en torno a sistemas de aprendizaje automático descentralizados, donde los algoritmos procesan grandes volúmenes de datos sobre una red blockchain. Esta sinergia permite ejecutar o acceder a servicios de IA sin que una autoridad central controle el flujo de datos. También puede reducir los costos del análisis de datos. Un caso común es el cómputo distribuido: imagina un clúster global de computadoras (cada una recibiendo tokens de IA) colaborando en tareas como reconocimiento de imágenes o procesamiento de lenguaje natural.

Desde la perspectiva del usuario, obtienes acceso a herramientas de aprendizaje automático impulsadas por recursos colectivos. Esto elimina los altos costos iniciales normalmente necesarios para montar infraestructura de IA. Por ejemplo, si quisieras analizar un conjunto de datos para tu pequeño negocio, podrías usar una plataforma de IA descentralizada en lugar de comprar hardware costoso. Un estudio piloto de 2023 de Tech X Labs encontró que las empresas redujeron hasta un 35 % sus costos generales al usar recursos informáticos descentralizados.

Potencial de los mercados de datos

En muchos proyectos de IA, los datos son el verdadero protagonista. Los tokens de IA pueden facilitar el intercambio de datos entre pares, garantizando que los datos de calidad lleguen a los algoritmos adecuados. Imagina una plataforma que entrena modelos de lenguaje y necesita millones de fragmentos de texto. En lugar de pagar a un agregador centralizado, la plataforma puede recompensar a individuos en todo el mundo por compartir sus conjuntos de datos únicos. Al tokenizar todo el proceso, se obtiene transparencia, menos fricción y una sensación de pertenencia a un ecosistema más amplio.

En la práctica, podrías ver un mercado donde investigadores médicos suben registros de pacientes anonimizados, empresas de software comparten datos analíticos o universidades publican conjuntos de investigación. Los tokens de IA se convierten en el “pago” por estos valiosos recursos. Este esquema también puede ampliar la disponibilidad de datos, lo que a su vez impulsa modelos de IA más dinámicos.

Beneficios de la automatización

La automatización es un tema central para estos tokens. En lugar de depender de una empresa que almacene, mantenga o procese los datos, los tokens de IA están diseñados para automatizar tareas mediante “contratos inteligentes” que se ejecutan automáticamente cuando se cumplen ciertas condiciones. Estos contratos inteligentes pueden incorporar lógica de aprendizaje automático para mejorar los resultados con el tiempo.

Imagina un contrato para una plataforma de seguros descentralizada. Los algoritmos de IA analizan entradas del usuario —como imágenes de accidentes, datos de geolocalización y registros de sensores— y procesan automáticamente las reclamaciones basándose en patrones reconocidos. Toda la cadena funciona con tokens, por lo que no tienes que esperar una revisión manual. Para tareas más simples, estos sistemas pueden acelerar procesos y reducir costos operativos.

Evaluar beneficios y riesgos

Potencial al alza

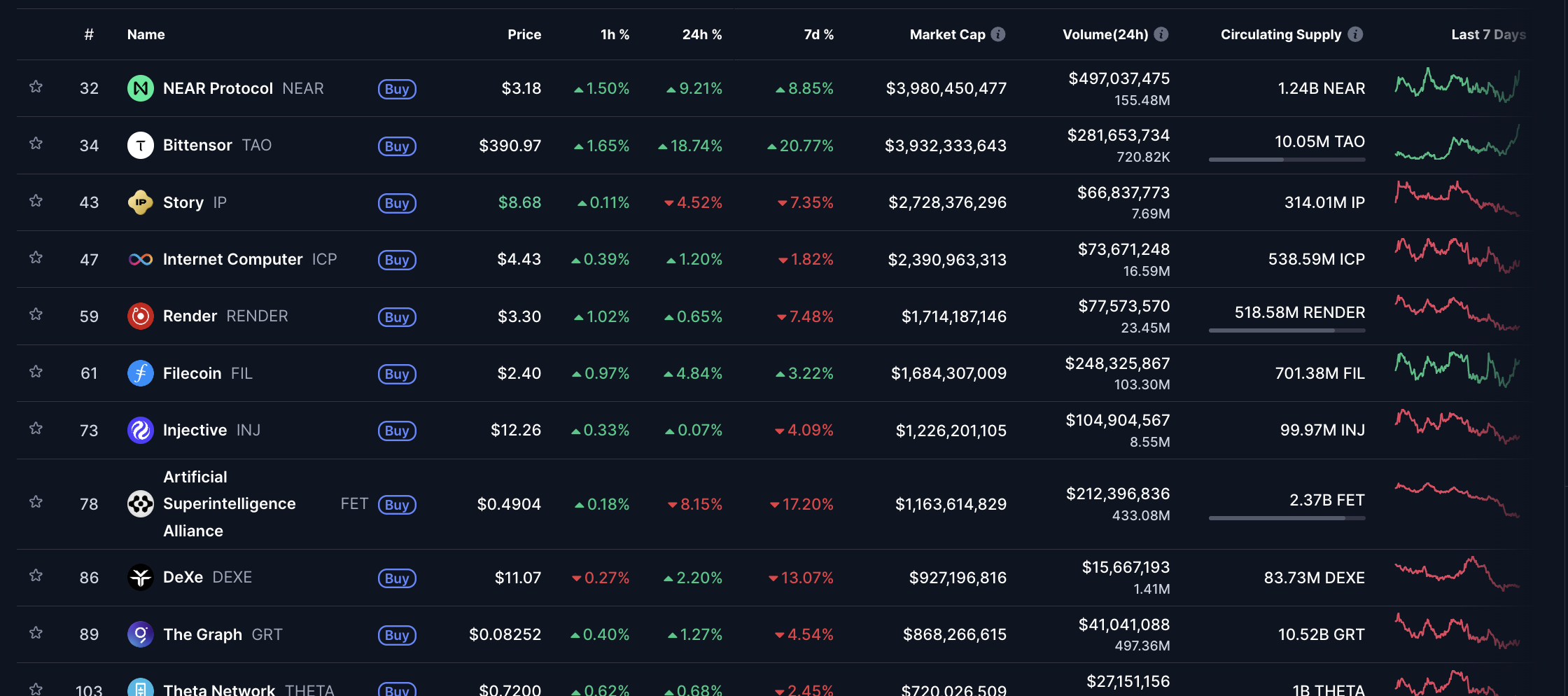

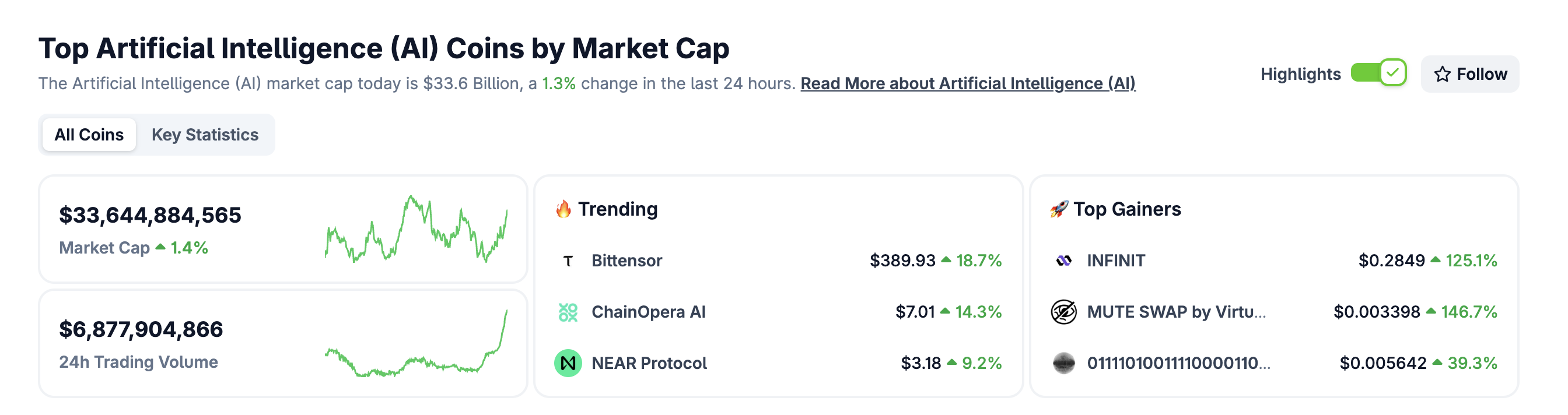

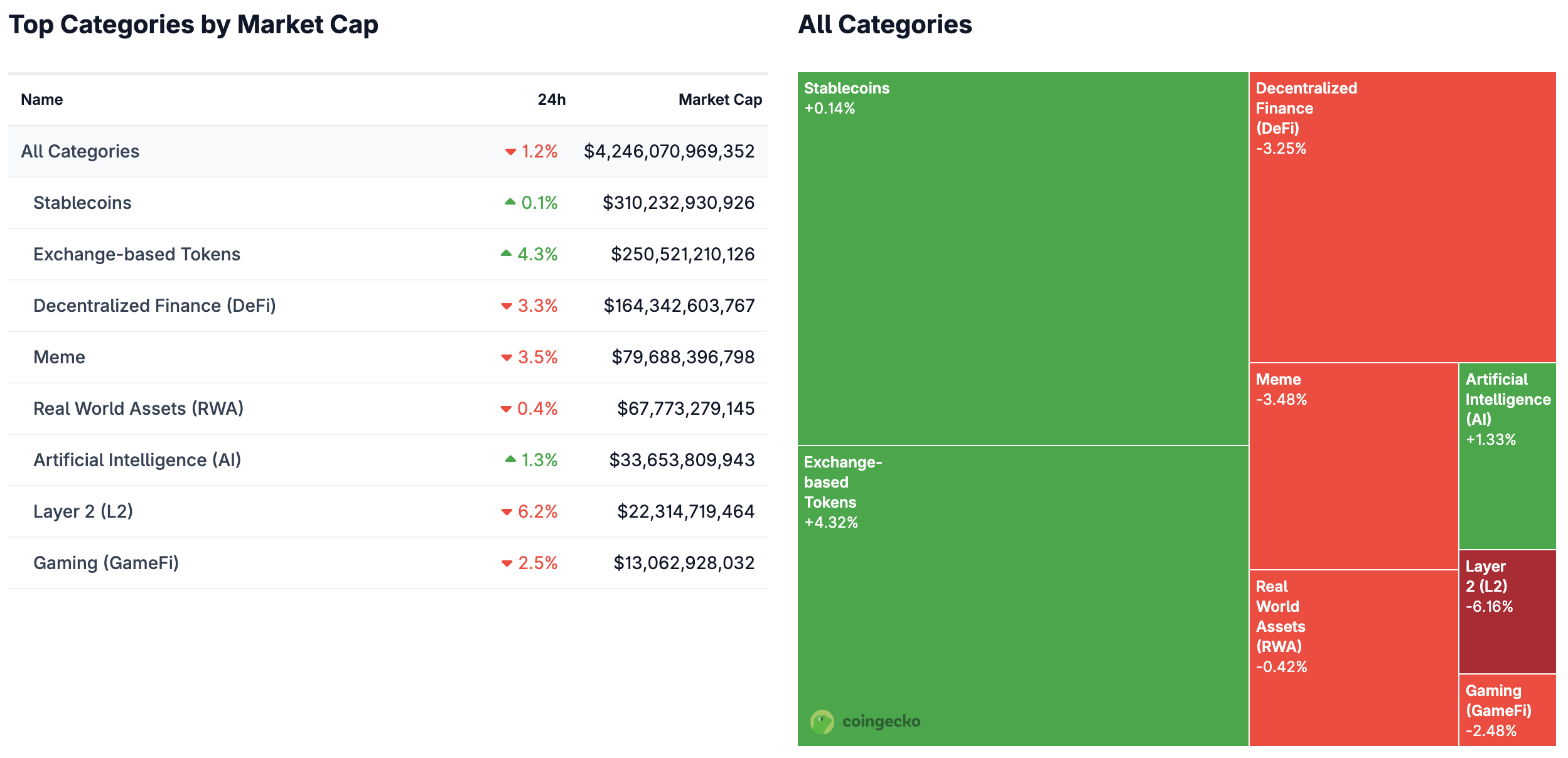

Si buscas segmentos de crecimiento rápido en el mundo cripto, los tokens de IA han sido destacados por algunos analistas como “estrellas emergentes”. Según una encuesta de Blockchain Today en 2024, el 28 % de los inversores institucionales planean asignar parte de sus fondos a proyectos centrados en IA. Este impulso a veces significa que los tokens pueden aumentar rápidamente su valor. Incluso si solo una fracción de los proyectos de IA prospera, esos tokens podrían registrar ganancias significativas.

Más allá de la apreciación del precio, si posees tokens de IA con privilegios de gobernanza integrados, puedes influir en la dirección del proyecto. Eso puede significar votar sobre actualizaciones de código, decisiones de marketing o expansiones a nuevos mercados. Simbólicamente, también implica ser parte de una comunidad de investigación que impulsa la IA hacia adelante sin una autoridad central que la controle.

Riesgos comunes

Sin embargo, no todos los tokens de IA son iguales. Algunos proyectos dependen más de palabras de moda que de tecnología real. Pueden mencionar “aprendizaje automático” o “redes neuronales” sin tener una base técnica comprobada. Además, los tokens de IA tienden a ser más complejos que las criptomonedas convencionales, lo que los hace más difíciles de evaluar.

También vale la pena señalar que muchos proyectos de IA dependen en gran medida de fuentes de datos externas. Si esas fuentes fallan o son inexactas, el modelo de IA podría producir resultados erróneos. La volatilidad de los mercados cripto significa que una sola noticia negativa puede provocar ventas masivas. Aunque las ganancias pueden ser grandes, las pérdidas también pueden serlo.

Navegar la volatilidad

Como muchas criptomonedas, los tokens de IA pueden fluctuar drásticamente en precio. Si estás acostumbrado a inversiones más tradicionales con variaciones diarias moderadas, estos saltos rápidos pueden resultarte incómodos. Es difícil predecir el mercado, por lo que podrías preferir un enfoque a largo plazo centrado en el valor fundamental.

Además, presta atención a la liquidez. Los tokens de IA más pequeños pueden tener menos traders activos, lo que dificulta comprarlos o venderlos a un precio justo. Si posees una cantidad grande, corres el riesgo de “slippage”, es decir, que el intento de vender rápidamente haga bajar el precio. Una estrategia equilibrada —dividiendo tus inversiones entre diferentes monedas, acciones o activos— puede ayudar a reducir este riesgo.

Pasos para invertir

Investiga a fondo

Primero, siempre lee el whitepaper. Debe ofrecer una explicación clara de cómo se integra la IA y cuál es la hoja de ruta. Si ves demasiadas frases genéricas, eso es una señal de alerta. Los proyectos serios suelen detallar la arquitectura de su modelo de IA, las instituciones asociadas (como universidades o laboratorios de investigación) y los casos de uso reales. También conviene revisar las credenciales del equipo de desarrolladores. Por ejemplo, si el ingeniero principal ha publicado investigaciones reconocidas en IA o si el equipo tiene experiencia lanzando proyectos blockchain exitosos, puedes tener más confianza en su capacidad.

También puedes observar la comunidad detrás del token: canales activos de Telegram o Discord, foros de desarrolladores y commits en GitHub. Los proyectos con una comunidad sólida y desarrollo constante tienden a durar más. Revisa si han sido auditados: una plataforma confiable de tokens de IA suele asociarse con empresas de ciberseguridad reconocidas para garantizar la protección de sus contratos inteligentes y sistemas base.

Protege tus activos

Mantener tus tokens de IA seguros es tan importante como elegir los adecuados. Los consejos tradicionales se aplican: guarda los tokens en billeteras confiables. Las billeteras de hardware o el almacenamiento en frío reducen el riesgo de hackeos, ya que permanecen desconectadas. También activa la autenticación de dos factores siempre que sea posible; así, aunque alguien adivine tu contraseña, no podrá acceder fácilmente a tu billetera.

Otra capa de seguridad consiste en verificar la dirección del contrato del token que planeas comprar. Algunos estafadores crean tokens con nombres similares para engañar a los inversores. Verifica todo dos veces antes de transferir fondos, porque una vez que envías cripto a una dirección incorrecta, es casi imposible recuperarla.

Considera Xgram para el intercambio

Si alguna vez quieres intercambiar tus tokens de IA rápidamente, puedes probar Xgram. Es una plataforma fácil de usar que te permite cambiar diversas criptomonedas, incluidos los tokens de IA emergentes, con solo unos clics.

Preguntas frecuentes

¿Son seguros los tokens de IA como inversión?

La seguridad depende de la legitimidad del proyecto, tu horizonte de inversión y las condiciones generales del mercado cripto. Aunque algunos tokens de IA muestran un crecimiento fuerte, también pueden ser muy volátiles. Es recomendable investigar a fondo, diversificar y nunca invertir más de lo que puedes permitirte perder.¿Cómo guardo los tokens de IA?

Puedes almacenarlos en billeteras digitales compatibles con el estándar de la blockchain del token (ERC-20 u otros). Para mayor seguridad, usa billeteras de hardware o métodos de almacenamiento fuera de línea. Siempre confirma la dirección correcta del contrato y sigue cuidadosamente las instrucciones de la billetera.¿El valor de los tokens de IA depende del rendimiento de la IA?

En muchos proyectos, sí. Los tokens suelen aumentar de valor si los servicios de IA muestran utilidad real. Si la IA falla o los datos subyacentes son defectuosos, el token puede perder valor. El sentimiento del mercado también influye mucho: las noticias o el hype pueden mover los precios, independientemente del rendimiento técnico.¿Necesito conocimientos técnicos para invertir en tokens de IA?

No necesariamente. Aunque conocer algunos conceptos básicos de aprendizaje automático ayuda, puedes invertir con éxito centrándote en las métricas del proyecto, la reputación del equipo, la tokenómica y la participación de la comunidad. Muchas veces, los propios equipos publican explicaciones accesibles y responden preguntas en foros públicos.¿Cómo evalúo qué token de IA es el adecuado para mí?

Empieza por lo básico: revisa el whitepaper, las credenciales del equipo y el problema real que el proyecto intenta resolver. Observa si la parte de IA es fundamental o solo marketing. Fíjate en el apoyo de la comunidad, los hitos del roadmap y las auditorías de seguridad. Luego decide si el token se ajusta a tus objetivos financieros y nivel de riesgo.

Resumen y próximos pasos

Cuando analizas qué son los tokens de IA, queda claro que combinan dos campos de vanguardia —inteligencia artificial y blockchain— en algo con un enorme potencial. Puedes acceder a proyectos de IA que aprovechan datos descentralizados, análisis predictivo o automatización avanzada. Sin embargo, es importante equilibrar el optimismo con la precaución: no todos los tokens de IA son “la próxima gran cosa”. Investiga bien, revisa al equipo desarrollador y mantén una visión amplia de tu portafolio cripto.

¿Quieres empezar? Elige un proyecto prometedor con tecnología transparente y una comunidad sólida. Luego compra una pequeña cantidad para entender cómo funciona. Si más adelante quieres intercambiar tus tokens, plataformas como xgram pueden facilitarte el proceso. Dar pasos pequeños y consistentes te ayudará a familiarizarte con este nicho del mundo cripto y, quién sabe, quizá descubras que los tokens de IA encajan perfectamente con tus objetivos. La sinergia emergente entre IA y blockchain podría ser una adición inteligente a tu estrategia de inversión.