Entiende por qué el bridging importa

Muchos traders de cripto antes se conformaban con mantener todas sus inversiones en una sola blockchain, normalmente Ethereum. Pero con el auge de plataformas de smart contracts como BNB Chain y Polygon, más usuarios han distribuido sus fondos entre múltiples redes. Un agregador del sector en 2024 encontró que los volúmenes de bridging se dispararon más de un 130%, impulsados en gran medida por protocolos DeFi que ofrecían mayores rendimientos en cadenas menos congestionadas.

Puede que notes que el bridging resuelve un problema crítico: cada cadena tiene sus propios estándares de tokens y reglas de transacción. Sin bridging, te perderías oportunidades cross-chain o dependerías de exchanges centralizados para cambiar del token nativo de una cadena a otro. Los bridges llenan ese vacío. Bloquean o queman tus tokens originales en la cadena de origen y luego acuñan o liberan los activos correspondientes en la cadena de destino.

Sin embargo, no todas las soluciones de bridging son iguales. Algunas priorizan la experiencia de usuario y la velocidad. Otras se enfocan en una seguridad sólida. Equilibrar ambas es crucial si guardas grandes cantidades de capital o haces bridging con frecuencia entre varias blockchains. En este ámbito verás enfoques variados, desde bridges especializados construidos por equipos de un solo protocolo hasta soluciones de propósito general que admiten decenas de redes.

Compara las funciones clave de los bridges

Antes de elegir una solución de bridging, querrás comparar ciertos aspectos fundamentales. Dedicar tiempo aquí ayuda a mantener tus fondos seguros y tus comisiones bajo control.

Seguridad

- Un buen bridge cripto se basa en smart contracts bien auditados. Busca soluciones con pruebas rigurosas y verificación formal. Algunas también usan configuraciones multifirma o validadores externos.

- Un alto valor total bloqueado (TVL) puede ser un arma de doble filo. Sí, indica confianza generalizada, pero también atrae a posibles atacantes. La clave es equilibrar código probado con una fuerte supervisión de los desarrolladores.

Velocidad

- La velocidad del bridging suele oscilar entre unos minutos y unas horas. La mayoría de soluciones usan confirmaciones on-chain para garantizar la finalidad.

- Si necesitas transacciones instantáneas para operaciones sensibles al tiempo, prioriza soluciones que funcionen con métodos de consenso avanzados o esquemas de capa 2.

Costo

- Las comisiones de gas pueden acumularse, especialmente durante la congestión de la red. Los bridges que agrupan transacciones o que operan en cadenas más baratas pueden ayudar a reducir costes.

- Algunas soluciones de bridging cobran una pequeña comisión adicional sobre el gas. Verifica siempre la estimación de coste total del bridge antes de hacer clic en “Confirmar”.

Activos admitidos

- La variedad de tokens que puedes puentear es crucial. Las stablecoins basadas en Ethereum son las más comunes. Pero si quieres puentear activos menos frecuentes, busca soluciones como Multichain o Celer cBridge que admiten catálogos grandes de tokens.

- Confirma siempre que la cadena de destino admite la funcionalidad de tu token. Los activos sintéticos o envueltos a veces pierden ciertas características si la red destino no es plenamente compatible.

Experiencia de usuario

- Interfaces amigables, indicadores claros de progreso y conexiones sencillas de billeteras hacen que el bridging sea más accesible.

- Para bridging repetido, guardar direcciones personalizadas de tokens o presets de bridging puede reducir pasos repetitivos.

Explora las principales herramientas de bridging

A continuación encontrarás una lista curada de soluciones de bridging destacadas. Cada herramienta tiene un enfoque específico, así que elegir una depende de qué valoras más: velocidad, seguridad o una gran selección de cadenas.

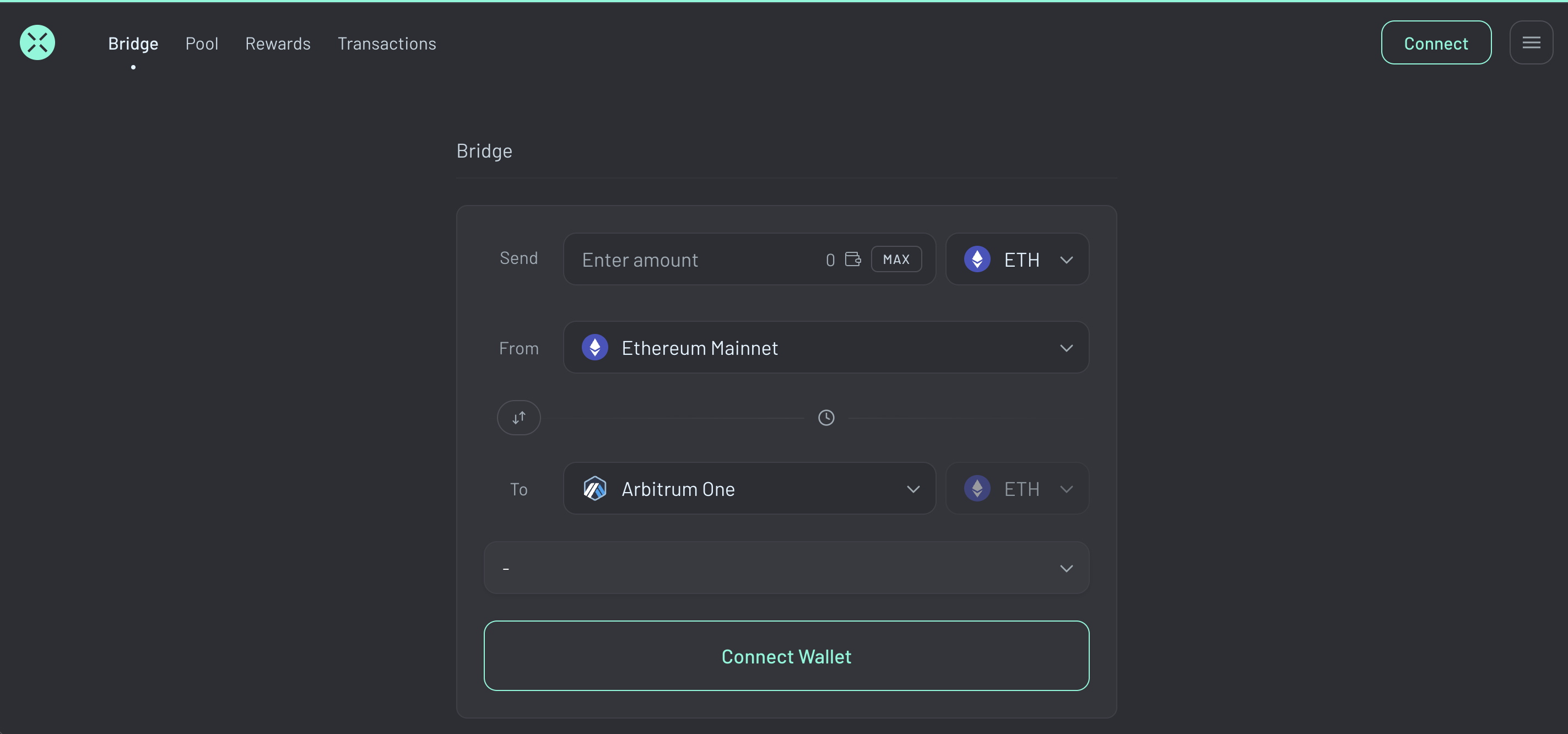

Wormhole Bridge

Wormhole es una capa de mensajería cross-chain creada inicialmente para Solana, que desde entonces se ha expandido a muchas otras redes — Ethereum, BNB Chain, Polygon y más. Bloqueas tokens en la cadena de origen y acuñas tokens “portal-wrapped” en la de destino. Este diseño ayuda a acelerar las transferencias de activos, aunque el sistema siempre recomienda verificar las direcciones correctas.

Ventaja clave

La gran ventaja de Wormhole es su amplio soporte multichain. Si eres usuario de Solana o mueves tokens con frecuencia entre Ethereum, Avalanche o Polygon, Wormhole puede unificar tus activos sin usar múltiples plataformas de bridging.Consideraciones

Aunque Wormhole es fácil de usar, incidentes de ciberseguridad en el pasado pusieron a prueba la confianza de la comunidad. El equipo ha reforzado medidas de seguridad, incluidos programas de recompensas por bugs y auditorías frecuentes. Suele ser rápido, pero vigila las comisiones si haces bridging en momentos de alta congestión en Ethereum.

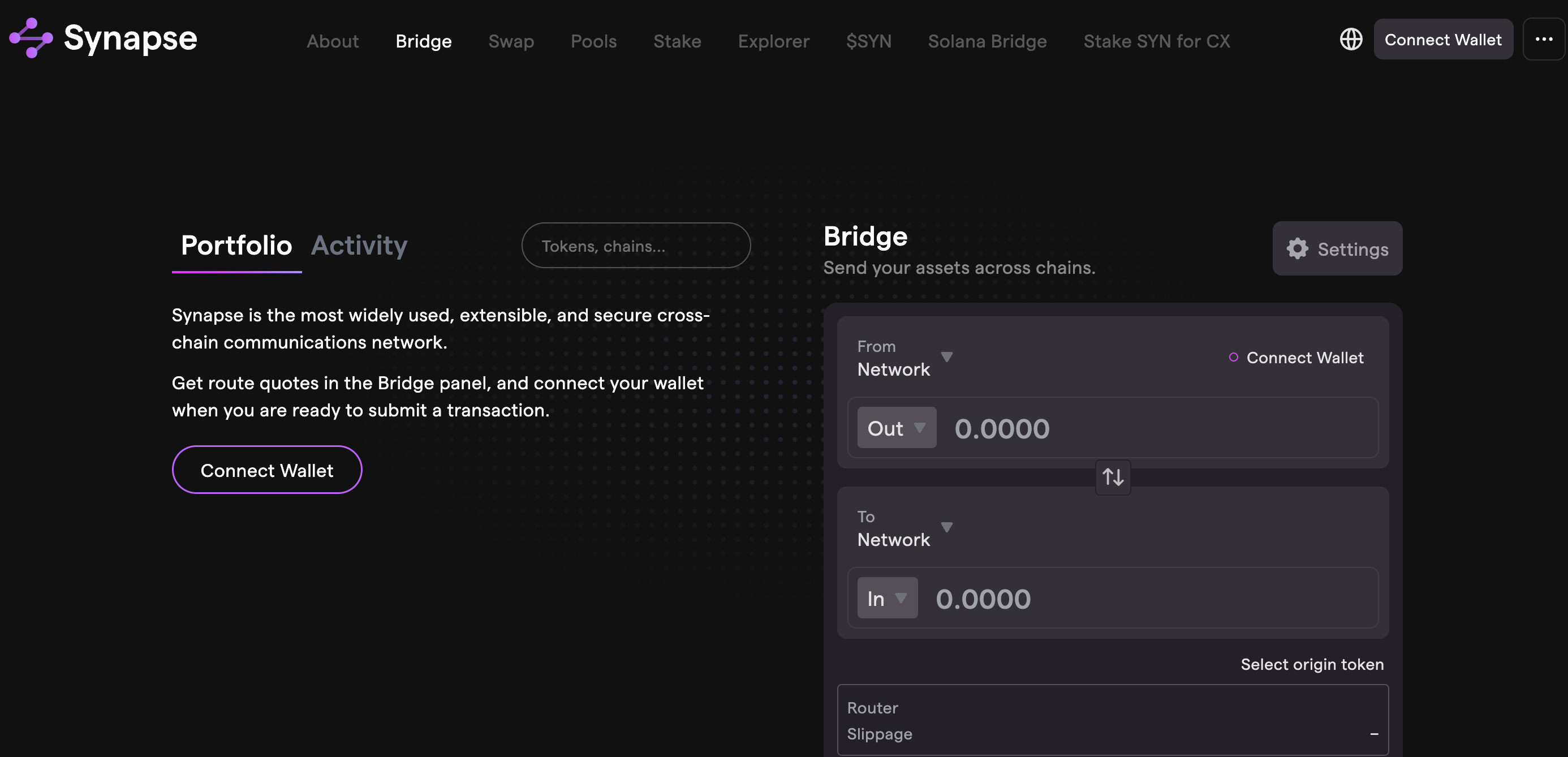

Synapse Protocol

Synapse Protocol se define como una capa de interoperabilidad universal, ofreciendo bridging para stablecoins y diversos activos envueltos. Usa un enfoque de AMM (market maker automatizado) para permitirte intercambiar tokens anclados entre distintas cadenas. También puedes hacer staking o aportar liquidez en Synapse para obtener recompensas adicionales.

Ventaja clave

La velocidad es un gran argumento de venta. Synapse suele finalizar transacciones cross-chain en minutos, gracias a contratos avanzados de bridging. Es especialmente popular entre traders de arbitraje que mueven fondos varias veces al día entre cadenas compatibles con EVM como Arbitrum u Optimism.Consideraciones

Debido al modelo AMM, verás comisiones ligadas a la liquidez disponible en los pools. Ciertos tokens o redes pueden costar más cuando la liquidez es baja. En el lado positivo, las stablecoins suelen tener un deslizamiento ajustado. Revisa la salida estimada de tu ruta; el coste puede fluctuar si haces bridging de montos grandes en horas valle.

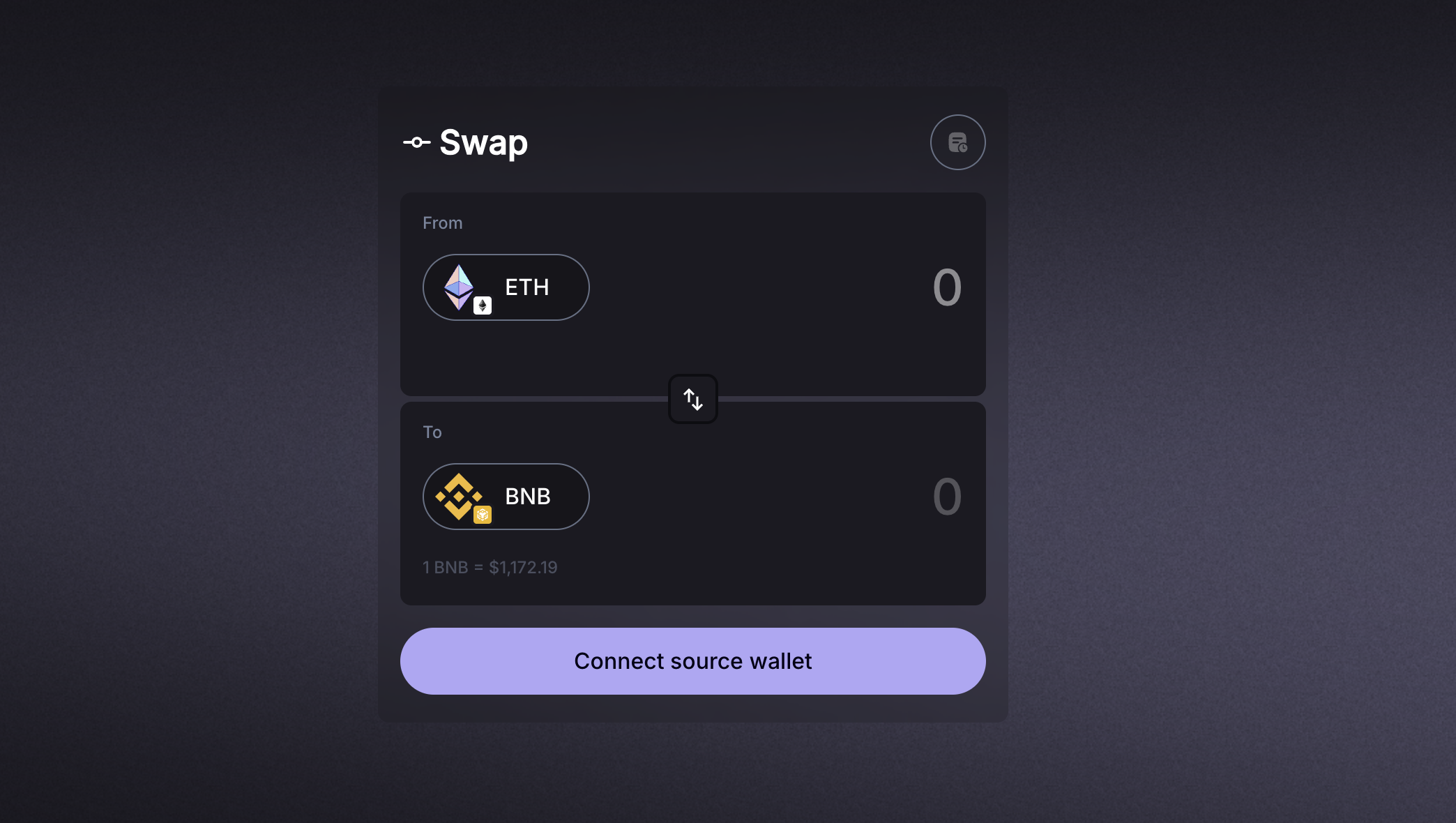

Celer cBridge

Celer cBridge forma parte de Celer Network, conocida por soluciones de escalado de capa 2. Su bridge busca alta seguridad y sobrecoste mínimo. Puedes transferir tokens entre múltiples blockchains, incluidas Ethereum, BNB Chain, Polygon, Fantom y otras. Celer también ofrece una interfaz especializada que consolida opciones de bridging para que elijas fácilmente el mejor par para tu operación.

Ventaja clave

Celer tiene un amplio historial en tecnologías de capa 2 y bridging. Usa un modelo híbrido que combina verificación on-chain con guardianes de estado off-chain. Este enfoque ayuda a mantener las comisiones predecibles a la vez que refuerza la seguridad.Consideraciones

Probablemente apreciarás cBridge si quieres una interfaz directa. Sin embargo, tokens más exóticos pueden tardar más en aparecer en su directorio de activos. Además, la velocidad del bridging puede depender de las confirmaciones de bloques en la cadena de destino. Si alguna cadena está muy cargada, el proceso puede demorar más.

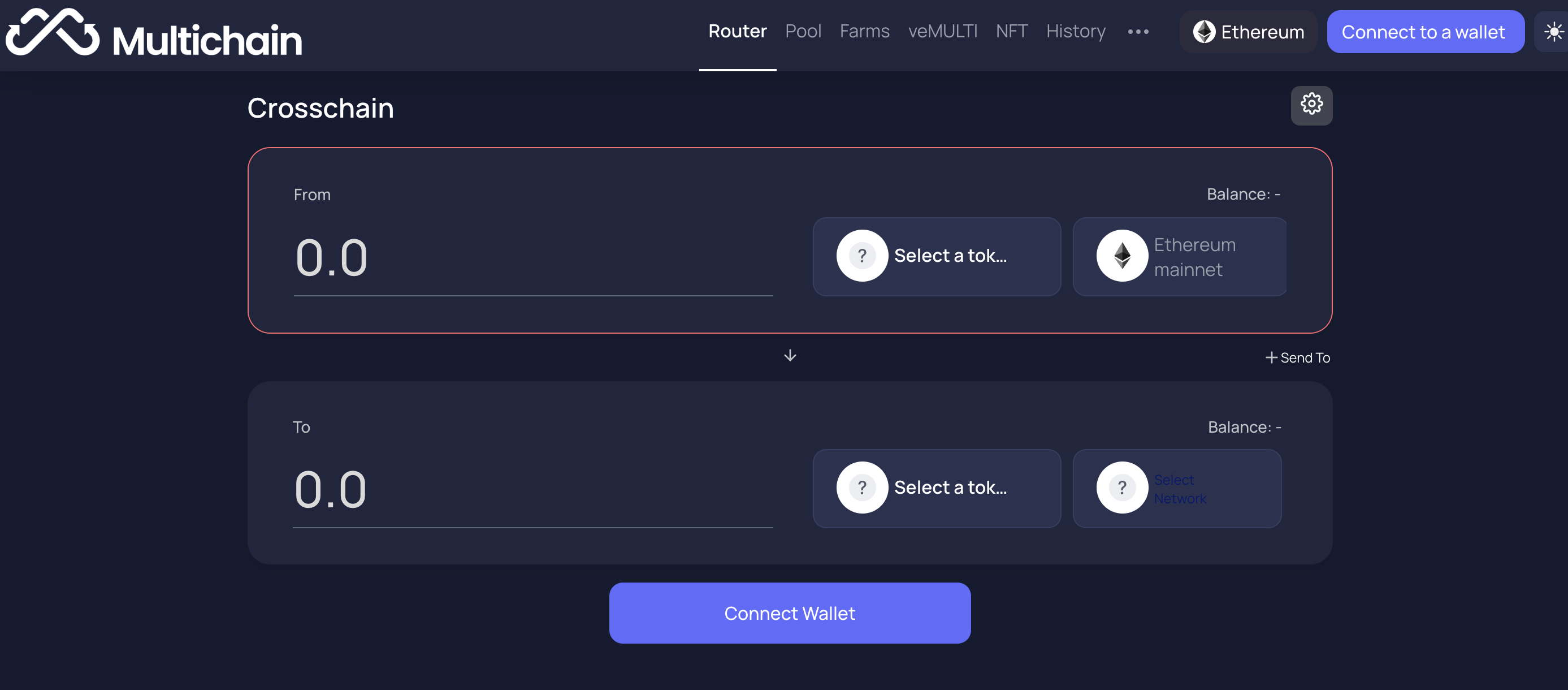

Multichain

Anteriormente conocida como Anyswap, Multichain es una solución cross-chain muy utilizada que puede manejar decenas de redes. Ofrece tanto bridging de tokens como swaps nativos cross-chain. Operando un amplio conjunto de smart contracts, Multichain asegura cada activo transferido con nodos de computación multipartita (MPC). En términos simples, distribuye el control entre múltiples participantes para reducir puntos únicos de fallo.

Ventaja clave

Multichain es extremadamente versátil, con soporte para tokens de Ethereum, BNB Chain, Fantom, Avalanche, Arbitrum, Polygon y muchos ecosistemas más pequeños. Si tienes tokens raros o emergentes, lo más probable es que Multichain ya permita puentearlos.Consideraciones

Al ser una plataforma grande de bridging, conviene verificar que el activo que trasladas esté oficialmente soportado y no sea una imitación. Las comisiones pueden acumularse si haces pequeños bridgings con frecuencia, así que controla tus costes. En conjunto, Multichain equilibra seguridad sólida con amplia cobertura de cadenas, pero un poco de diligencia del usuario marca la diferencia.

Across Protocol

Across Protocol se promociona como una opción de bridging rápida y económica, utilizada con frecuencia para enviar tokens entre redes de capa 2 de Ethereum. Usa un modelo de “relayers” en el que actores designados adelantan los fondos del usuario en la cadena de destino y luego reclaman el reembolso desde la cadena de origen.

Ventaja clave

Las transacciones a menudo se liquidan en minutos, incluso si la cadena de origen requeriría muchas confirmaciones. Esto ayuda si necesitas desplegar fondos rápidamente para rendimientos o arbitraje. Quienes operan con sensibilidad temporal valoran la rápida finalidad de Across.Consideraciones

En ocasiones, las comisiones de bridging en Across pueden subir si la liquidez de los relayers está tensionada. Además, el protocolo se enfoca principalmente en L2s de Ethereum, por lo que el bridging hacia otras cadenas no EVM puede ser limitado. Si buscas una solución específica para L2, Across merece una mirada.

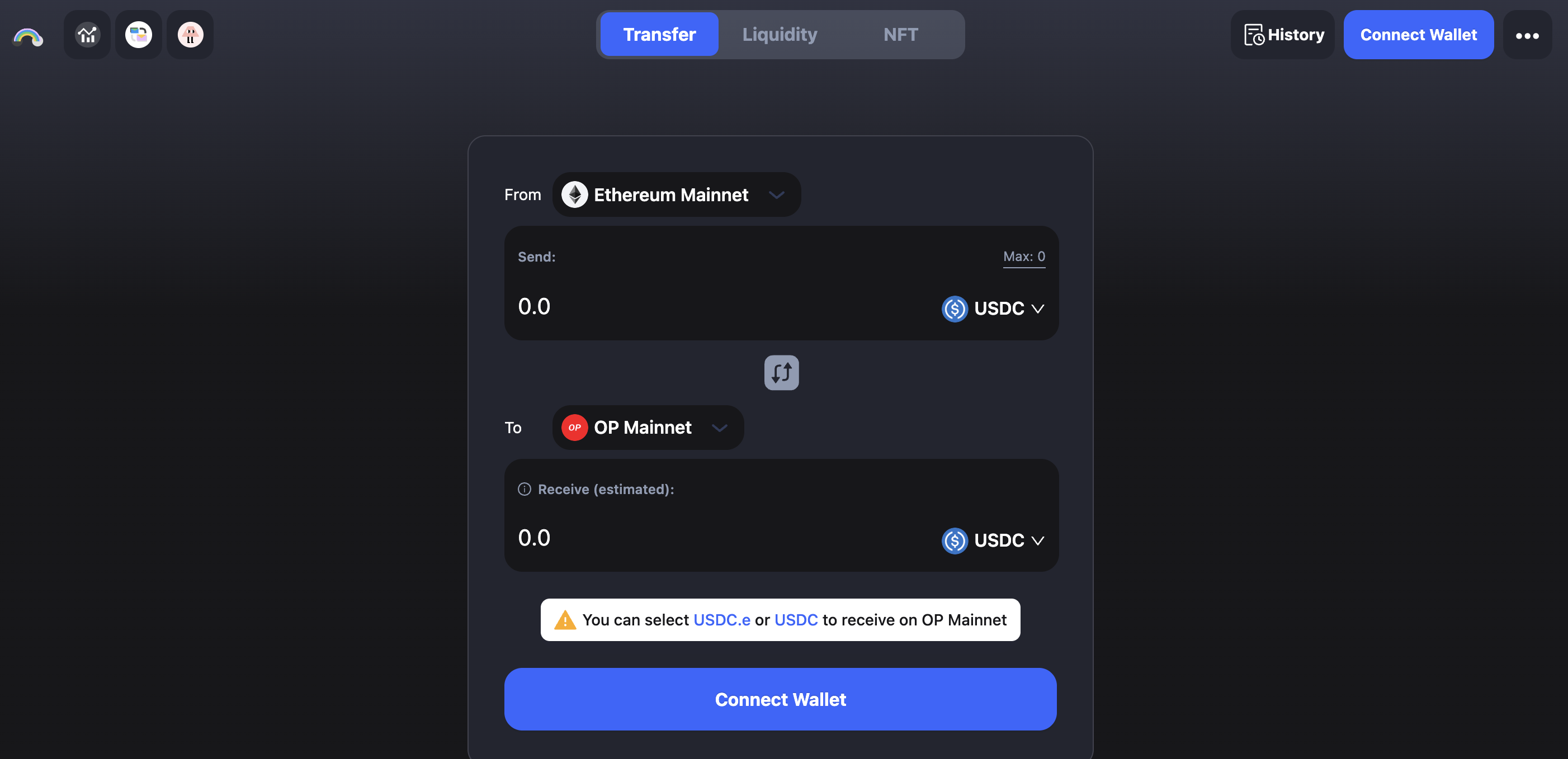

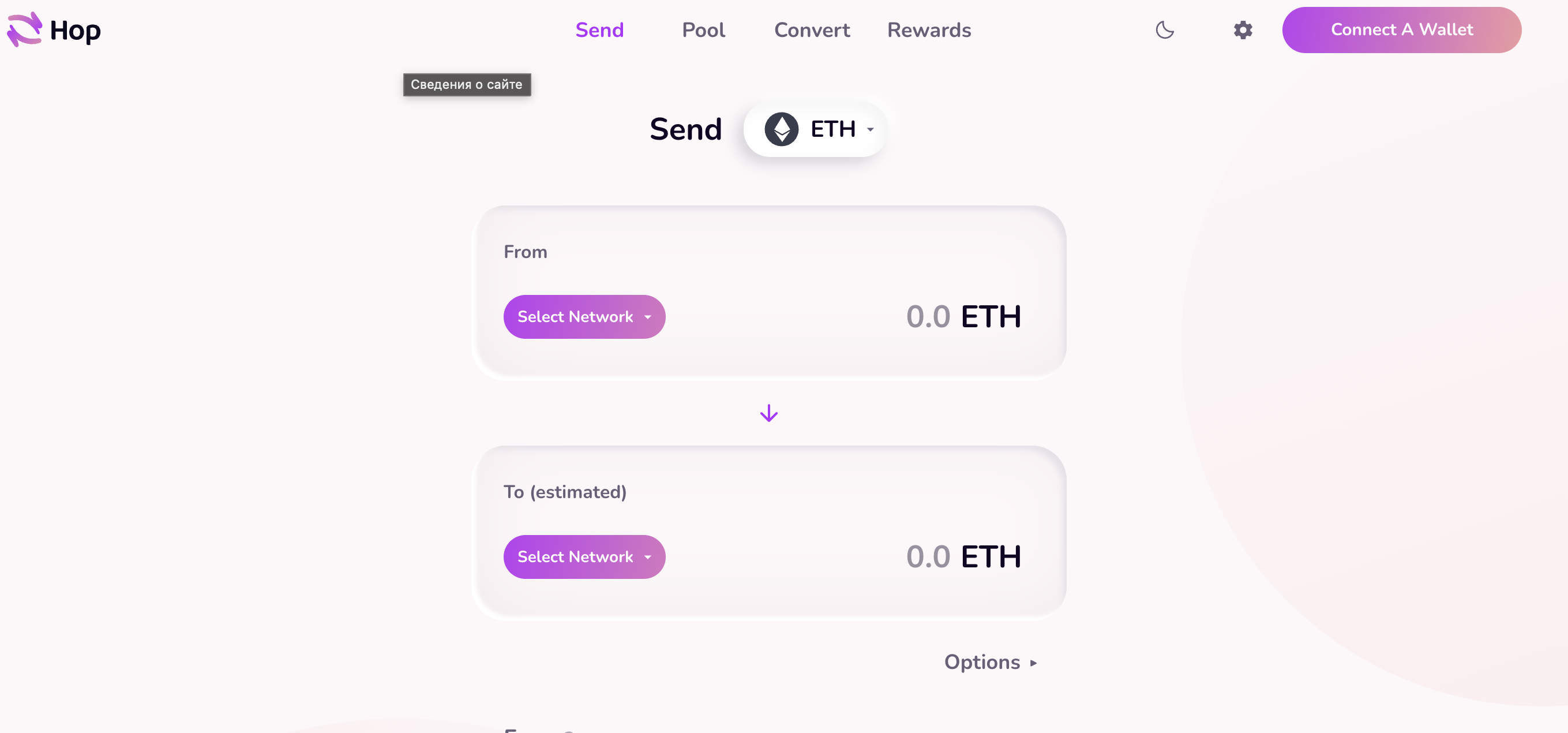

Hop Protocol

Hop Protocol es otro sistema popular de bridging para soluciones de capa 2 basadas en Ethereum. Tiene un mecanismo especializado que usa “hTokens” de Hop como intermediarios. Depositas tu token en una cadena, acuñas el hToken correspondiente y luego lo canjeas en la cadena de destino.

Ventaja clave

Hop es conocido por puentear stablecoins y equivalentes de ETH con rapidez entre redes como Arbitrum, Optimism y Polygon. Ofrece instrucciones claras que minimizan errores de bridging. Este enfoque también puede reducir el deslizamiento en movimientos grandes de stablecoins.Consideraciones

El enfoque de Hop en L2s puede dejar fuera algunas cadenas menos conocidas. Si necesitas swaps cross-chain hacia una red no EVM, tendrás que buscar otra opción. Además, las comisiones parecen modestas, pero pueden aumentar con la actividad de la red, por lo que el timing sigue importando.

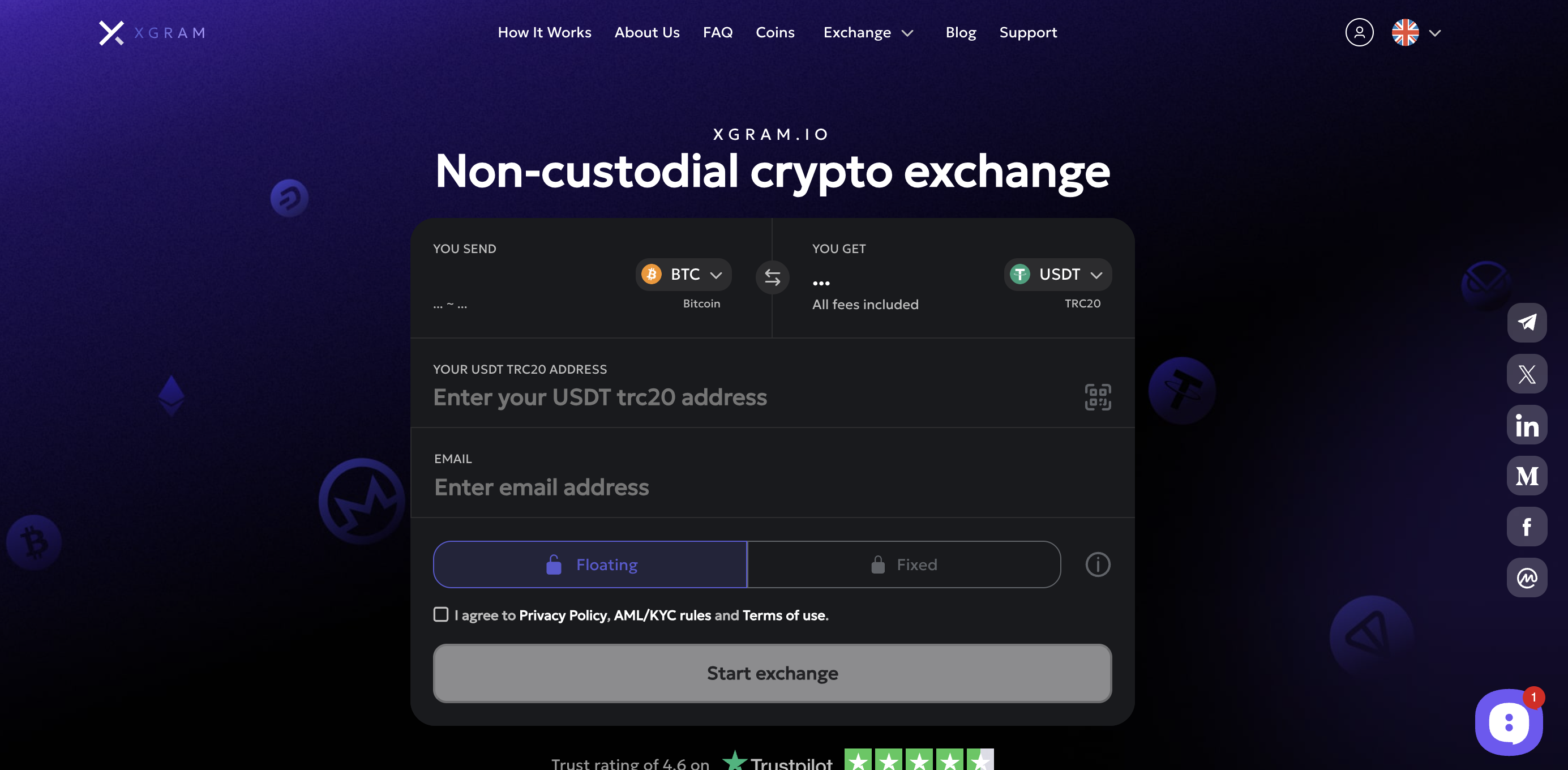

Mención especial a Xgram

Xgram es un exchange que también admite transacciones cross-chain, dándote la oportunidad de ahorrar en comisiones al hacer bridging. A menudo verás ahorros gracias a las rutas agregadas de xgram, especialmente si puenteas activos en montos pequeños. La interfaz directa de la plataforma te guía en cada paso para que confirmes fácilmente las cadenas y tokens implicados.

Revisa las mejores prácticas de bridging

Una vez que hayas identificado tu plataforma de bridge preferida, deberías aplicar algunas buenas prácticas para evitar errores.

Verifica las direcciones de los contratos

Asegúrate siempre de estar haciendo bridge del token correcto. Copiar una dirección al azar de redes sociales o usar un enlace de contrato desactualizado puede ocasionar pérdidas. Los sitios oficiales de bridges suelen proporcionar las direcciones correctas de los tokens más comunes.Monitorea el estado de la transacción

La mayoría de los bridges muestran actualizaciones en tiempo real o hashes de transacción. Vigila las confirmaciones para saber exactamente cuándo deberían aparecer tus tokens en la cadena de destino. Si el proceso tarda más de lo indicado, revisa si la red está congestionada.Prueba con montos pequeños

Cuando uses un bridge por primera vez o interactúes con una nueva cadena, comienza con una transacción de prueba pequeña. Esto te ayuda a confirmar que tienes suficientes tokens de gas en la cadena de destino y que tu billetera está configurada correctamente.Guarda copias de respaldo

Mantén un registro de los IDs de transacción. Si algo sale mal, los equipos de soporte de los bridges normalmente necesitan el hash de transacción o el número de referencia del bridge para ayudarte.

Aprende consejos rápidos para reducir tarifas

Las tarifas de bridging pueden acumularse si mueves activos con frecuencia entre múltiples redes. La buena noticia es que controlarlas es más fácil de lo que parece. Aquí tienes algunos consejos para ahorrar costos.

Elige bien el momento

- La congestión de la red en Ethereum suele variar. Si es posible, programa tus transacciones en horas de menor tráfico. Los fines de semana o las horas nocturnas suelen ofrecer comisiones más bajas.

Prefiere redes L2 o más baratas

- Si tu objetivo es mover fondos a ecosistemas con menores costos, puedes usar una red L2 como Arbitrum u Optimism, y desde allí continuar hacia otras cadenas compatibles con EVM. Este enfoque por capas puede requerir pasos adicionales, pero cada operación puede ser más barata que hacerlo directamente desde una cadena costosa.

Usa herramientas agregadoras

- Plataformas como xgram pueden analizar diferentes rutas de bridging y mostrarte la más económica. Toman en cuenta tasas de cambio, tarifas de gas y comisiones de bridge, ofreciéndote una interfaz única para conseguir el mejor precio.

Agrupa tus operaciones

- En lugar de hacer muchos envíos pequeños, agrúpalos en transacciones más grandes para reducir tarifas repetidas. Por ejemplo, hacer bridge 10 veces con 0.01 ETH cada una puede costarte más que hacerlo una sola vez con 0.1 ETH.

Aprovecha incentivos de staking o liquidez

- Algunos bridges ofrecen incentivos en tokens si aportas liquidez a sus pools, compensando los costos de bridging. Si planeas mover grandes cantidades, puede valer la pena revisar si hay programas de recompensas activos.

Preguntas frecuentes

¿Puedo hacer bridge de NFTs con estas herramientas?

Puedes transferir ciertos NFTs mediante protocolos como Wormhole o Multichain, pero no todos los bridges los admiten aún. Siempre verifica si tu colección específica es compatible, ya que el bridging de NFTs requiere contratos inteligentes especializados.¿Qué pasa si mis tokens no llegan a tiempo?

Si el bridge tarda más de lo esperado, revisa el hash de transacción o la página de estado. El alto tráfico de red o la falta de gas en alguna cadena pueden causar demoras. También puedes contactar al equipo de soporte del bridge con los detalles de tu transacción.¿Debo preocuparme por la liquidez?

La liquidez importa si tu token es poco conocido o si el bridge depende de pools de intercambio. La baja liquidez puede aumentar tarifas o causar alto slippage. En el caso de stablecoins o tokens principales, la liquidez suele ser suficiente para mantener costos estables.¿Es seguro mantener tokens envueltos (wrapped)?

En general, los tokens envueltos son seguros si el bridge subyacente está auditado y tiene buena reputación. El mayor riesgo aparece si el custodio o contrato que administra los tokens bloqueados sufre un ataque. Mantente al tanto de auditorías y posibles vulnerabilidades. Si haces bridge de grandes cantidades, considera diversificar entre varios bridges auditados.¿xgram realmente ofrece menores costos?

xgram encuentra la ruta cross-chain más barata al combinar liquidez, comisiones y tasas de cambio en un solo cálculo. Funciona como un agregador que analiza diferentes caminos de bridging según tus tokens y cadenas. Aunque no siempre garantiza el precio más bajo, muchos usuarios reportan costos promedio menores frente al uso de un solo bridge.

Reflexiones finales

Elegir la plataforma de bridge adecuada puede ahorrarte tiempo, dinero y estrés. Cada solución ofrece una combinación única de cobertura multi-chain, seguridad y tarifas, por lo que conviene tener varias opciones a mano. Así, si una plataforma se congestiona o tu token no es compatible, siempre tendrás un plan alternativo.

En definitiva, lo mejor es empezar con montos pequeños y confirmar cuidadosamente cada paso. Con tantas oportunidades en DeFi, unos pocos bridges estratégicos pueden ayudarte a desbloquear rendimientos o ejecutar arbitrajes rápidamente. Solo recuerda vigilar las tarifas, verificar direcciones y estar atento a las nuevas soluciones de bridging que vayan surgiendo. A medida que perfecciones tu enfoque, reducirás la fricción de las transacciones multi-chain y aprovecharás al máximo tus activos dentro del ecosistema cripto.