Explora los fundamentos del bridging

Cuando las blockchains operan de forma independiente, cada red tiene su propio conjunto de reglas, tokens y métodos de consenso. Es como tener dos tiendas de aplicaciones completamente diferentes en sistemas operativos distintos. El bridging es un mecanismo que te permite pasar de una red a otra, generalmente bloqueando o quemando tokens en la cadena de origen y acuñando o desbloqueando tokens equivalentes en la cadena de destino.

Los puentes son esenciales para las finanzas descentralizadas (DeFi), ya que te permiten acceder a oportunidades sin tener que usar múltiples billeteras o vender y recomprar tus activos cada vez. Si posees tokens en la Red A pero quieres hacer staking en una granja de rendimiento en la Red B, el bridging puede simplificarte ese proceso.

Por qué el bridging es importante

- Te da acceso a nuevos protocolos y dApps de DeFi.

- Puedes encontrar mejores tasas de interés o tarifas más bajas en otra cadena.

- Fomenta la competencia saludable en el ecosistema, impulsando la innovación constante de las blockchains.

- Te ayuda a diversificar el riesgo distribuyendo tus activos entre múltiples redes.

Jerga común del bridging (definiciones rápidas)

- Lock and mint: Tus tokens originales se bloquean en una cadena y se acuñan nuevos tokens “envueltos” en la cadena de destino.

- Burn and mint: Similar, pero tus tokens se queman en lugar de bloquearse antes de ser acuñados en otra cadena.

- Relay: Un componente que escucha ambas cadenas para confirmar transacciones y proporcionar pruebas.

Evalúa los beneficios del bridging

Antes de comenzar a transferir tus activos mediante un puente, es útil entender por qué el bridging puede cambiar el juego. Nadie quiere dar pasos extra sin una buena razón, pero existen argumentos convincentes para probarlo.

Más opciones de rendimiento

Diferentes redes pueden sobresalir en distintos aspectos de DeFi. Una cadena puede tener la mejor plataforma de préstamos con stablecoins, mientras otra ofrece el mercado NFT más atractivo. Con el bridging puedes moverte entre cadenas para buscar mejores APYs (rendimientos anuales), tarifas más bajas o NFTs únicos que no existen en tu cadena principal.

Menor congestión de red

Seguro has oído quejas sobre las altas tarifas en algunas blockchains conocidas. Cuando una red está congestionada, las tarifas de gas y los tiempos de confirmación pueden arruinar tu experiencia DeFi. Con el bridging puedes cambiarte a una cadena menos saturada, ahorrando en comisiones y acelerando tus transacciones.

Ecosistema sin fricciones

Con el tiempo, las aplicaciones descentralizadas están adoptando compatibilidad entre cadenas, haciendo que el bridging se sienta más como viajar entre ciudades vecinas que cruzar un océano. A medida que el mundo multi-chain crece, el bridging se volverá aún más fluido y fácil de usar.

Nota sobre seguridad

Aunque el bridging puede ser muy útil, la seguridad de tus tokens siempre es prioritaria. Algunos puentes dependen de intermediarios confiables o contratos inteligentes complejos con vulnerabilidades potenciales. Por eso es importante investigar cómo funciona un puente específico y si cuenta con la confianza de la comunidad cripto.

Comprende los riesgos del bridging

Aunque el bridging suene como una solución perfecta, no está libre de riesgos. Conocer los posibles peligros te ayudará a proteger mejor tus fondos.

Vulnerabilidades en contratos inteligentes

Muchos puentes dependen de múltiples contratos inteligentes o sistemas de validación externos. Un error en el código puede poner en riesgo tus activos. Elige siempre puentes auditados, con equipos transparentes y código público.

Limitaciones de liquidez

Algunas soluciones de bridging usan pools de liquidez para respaldar los intercambios de tokens. Si un pool es pequeño, podrías enfrentar alto slippage o falta de fondos suficientes. Elige puentes con liquidez profunda y reputación sólida.

Custodios centralizados

Algunos métodos de bridging utilizan intermediarios que retienen tus tokens antes de emitir versiones envueltas en otra cadena. Esto reintroduce centralización en un entorno descentralizado. Evalúa si ese nivel de confianza se ajusta a tus objetivos y tolerancia al riesgo.

Picos en las tarifas

Aunque el bridging suele ser más económico que usar varios exchanges, aún puedes enfrentar aumentos en las tarifas si las cadenas están congestionadas. Observa los mempools (colas de transacciones) para hacer bridging en momentos con menores costos.

Compara los métodos de bridging más comunes

Al explorar las soluciones de bridging, verás distintos enfoques, cada uno con ventajas y desventajas. La elección depende del tamaño de tu transferencia, tu nivel de confianza en los custodios centralizados y la rapidez que necesites.

| Método | Ventajas | Desventajas |

|---|---|---|

| Puente centralizado | Fácil de usar | Requiere confiar en una sola entidad |

| Puente descentralizado (sin confianza) | Elimina intermediarios, totalmente en cadena | Puede ser más complejo o tener menos liquidez |

| Intercambios cross-chain | Intercambio rápido y directo token por token | Depende de la liquidez agregada, puede tener riesgos de precio |

| Puentes de Capa 2 | Tarifas más bajas, ideal para escalabilidad | Normalmente compatibles solo con una blockchain base |

Ejemplo de puente centralizado

Algunos exchanges o proyectos ofrecen sus propios servicios de bridging. Simplemente depositas tus tokens en una cadena, y la plataforma te los entrega en otra. Es fácil de usar, pero depende completamente de la seguridad del proveedor.

Ejemplo de puente descentralizado

Protocolos como Wormhole o Multichain utilizan contratos inteligentes complejos para bloquear tokens en una cadena y liberarlos en otra, sin un control centralizado. Esto se alinea con la filosofía DeFi, aunque puede requerir más configuración o experiencia.

Descubre el futuro del multi-chain

A medida que evoluciona el espacio cripto, cada blockchain se especializa en algo distinto: algunas en NFTs, otras en pagos rápidos o privacidad. El bridging multi-chain será cada vez más importante, permitiéndote elegir el mejor entorno para hacer crecer tus activos.

Podrás esperar:

- Experiencias más fluidas, con puentes casi invisibles dentro de las apps DeFi.

- Modelos de seguridad mejorados que reduzcan los riesgos.

- Más oportunidades en DeFi, NFT y metaverso, sin fricción entre cadenas.

- Gobernanza cross-chain, para votar en varias redes desde una sola interfaz.

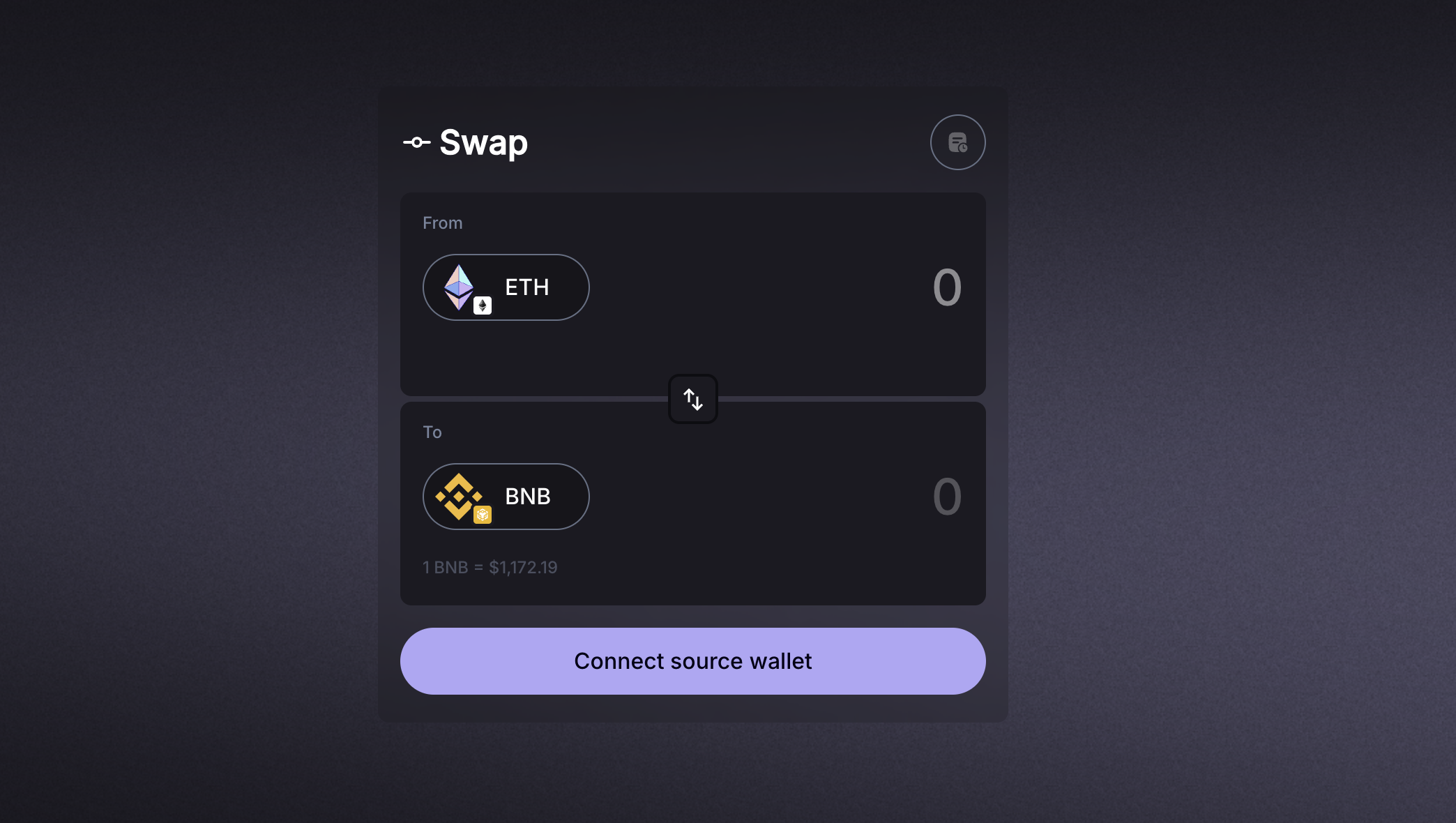

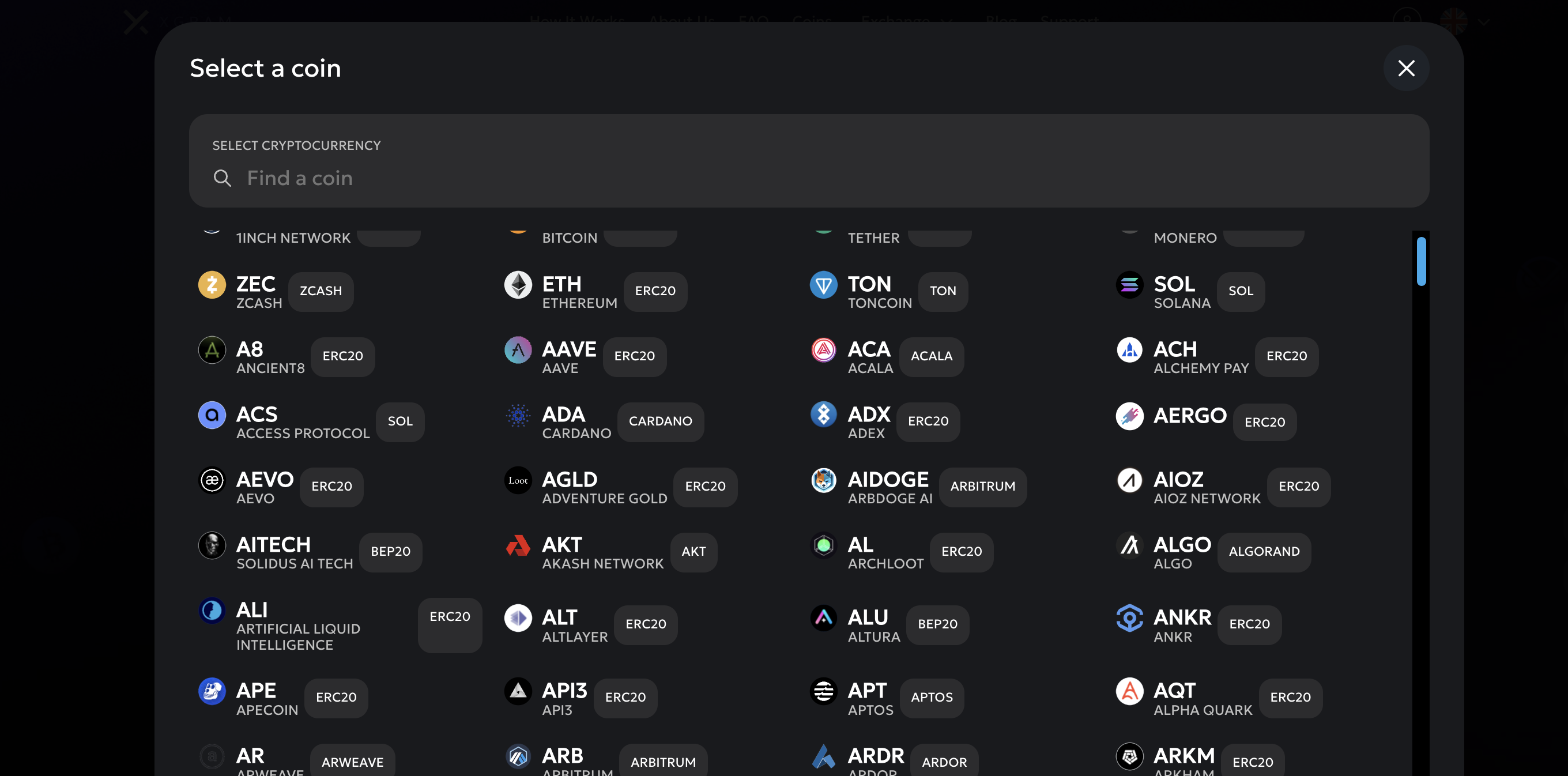

Usa Xgram para el bridging entre cadenas

Xgram es una plataforma diseñada para ayudarte a intercambiar o transferir tokens entre diferentes cadenas con tarifas bajas. Su objetivo es simplificar el proceso de bridging mediante una interfaz clara y directa.

El equipo de soporte de Xgram está disponible 24/7 para ayudarte si algo sale mal durante una transacción. En general, es una herramienta muy práctica si planeas mover tus activos entre cadenas.

Sigue las mejores prácticas del bridging

Ninguna solución elimina por completo los riesgos del bridging, pero algunos hábitos pueden reducirlos significativamente. Piensa en estas recomendaciones como una red de seguridad antes de probar algo nuevo.

1. Haz tu propia investigación

- Consulta redes sociales, foros y la documentación oficial.

- Verifica si el proyecto ha sido auditado.

- Pregunta en comunidades si tienes dudas.

2. Diversifica tus activos

- No pongas todos tus huevos en la misma canasta.

- Distribuye tus fondos en varias redes para reducir riesgos.

- Transfiere solo lo que estés dispuesto a arriesgar.

3. Empieza con pequeñas cantidades

- Haz una prueba con una cantidad mínima de tokens.

- Confirma que todo esté correcto antes de mover grandes sumas.

- Verifica posibles tarifas ocultas o pasos adicionales.

4. Presta atención al momento

- Consulta los niveles de congestión de la red.

- Haz bridging en horas con menor tráfico.

- La paciencia puede ahorrarte mucho en gas.

5. Protege tu billetera

- Usa billeteras confiables y actualizadas.

- Mantén tus claves privadas o frases semilla fuera de línea.

- Activa la autenticación de dos factores si está disponible.

Preguntas frecuentes

¿Qué tipo de activos se pueden transferir?

Puedes transferir criptomonedas, stablecoins e incluso algunos NFTs. Sin embargo, la compatibilidad depende del proveedor del puente.¿El bridging puede reducir mis tarifas?

Sí, al mover tus tokens a una cadena con tarifas más bajas puedes ahorrar dinero. Solo considera las tarifas del puente y el gas de ambas redes.¿Es más rápido que usar un exchange centralizado?

Depende. A veces los exchanges son más rápidos, pero el bridging suele ser más directo y ocurre desde tu propia billetera.¿Pierdo la propiedad de mis tokens al hacer bridging?

No. Tus tokens bloqueados o acuñados siguen bajo tu control mientras tengas las claves privadas correspondientes.¿Cómo elijo el puente correcto?

Lee reseñas, busca auditorías y considera factores como liquidez, tarifas y facilidad de uso. Si eres principiante, elige uno sencillo aunque tenga un pequeño costo adicional.

Conclusiones clave

El bridging en cripto trata sobre libertad: libertad para experimentar en distintas blockchains, buscar mejores rendimientos y evitar tarifas altas. Al mover tus tokens de forma segura entre cadenas, tomas el control de tus propios recursos.

Antes de empezar, investiga los puentes disponibles y prueba con montos pequeños. Una vez te sientas cómodo, puedes explorar plataformas agregadas como Xgram para una experiencia más eficiente. Probablemente descubras nuevas oportunidades de inversión que antes no estaban a tu alcance.

¿Listo para probar el bridging? Mantente atento a las próximas joyas DeFi que solo existen en otras cadenas y deja que el bridging te abra un mundo de posibilidades multi-chain.