How to Sell SEPA

TL;DR (Short Version for Busy Readers)

- Check different selling methods — exchanges, P2P, and instant swaps.

- Know how SEPA works: you need accurate bank account details, so your money arrives safely.

- Transfer your Bitcoin, place a sell order, and confirm your local regulations.

- Prioritize security: use a strong wallet, enable two-factor authentication, and verify your account details for a proper SEPA payout.

Understand how SEPA works

SEPA stands for the Single Euro Payments Area. It standardizes bank transfers in euros across participating countries, aiming to make payments simple, secure, and fast. Here is what you need to know before selling your Bitcoin to SEPA:

- SEPA covers more than 30 European countries, so if you have a euro-denominated bank account in one of them, you are likely eligible.

- Transfers typically take one to two business days, though this can vary.

- Make sure you enter your IBAN (International Bank Account Number) correctly. A single typo can lead to a failed or delayed transaction.

SEPA is basically a streamlined way to get the euro proceeds of your Bitcoin sale into your bank account. Once you see how these bank transfers tie into crypto exchanges or P2P marketplaces, the rest of the selling process becomes much clearer.

Compare your selling options

You have several ways to convert Bitcoin into euros and transfer them via SEPA. Each comes with its own pros, cons, and steps.

Centralized exchanges

A centralized exchange (CEX) is a known, regulated platform where you create an account, deposit your Bitcoin, and sell through a market order or limit order.

- Pros: High liquidity, user-friendly dashboards, robust security measures if well-established.

- Cons: You typically pay transaction and withdrawal fees, and the sign-up requires personal data for identity checks.

Examples include major international brands where you can link your bank details and request a SEPA withdrawal after selling.

P2P platforms

Peer-to-peer (P2P) platforms match you directly with another user who wants to buy your Bitcoin. You can agree on a price, payment method, and arrange the deal without a centralized third party holding your funds.

- Pros: Often lower fees than major exchanges, more privacy than some centralized platforms.

- Cons: There is a risk of dealing with unverified traders, and you must handle the transaction carefully to avoid scammers.

For beginners, P2P can be a good option if you choose a reputable site with a strong reputation system. Always confirm the buyer’s track record and read user reviews.

Instant swap services

Instant swap services focus on speed and simplicity. You enter how much Bitcoin you want to sell, provide a receiving address or bank details, and the service handles the trade behind the scenes.

- Pros: Quick, straightforward, usually no need to maintain a wallet with the service.

- Cons: You might see a slight premium or reduced rate because these platforms bundle fees into the exchange rate.

Many find these services convenient if they value immediate transactions more than the absolute best price.

Follow the selling steps

Once you choose your method, it is time to take practical action. The basic workflow is similar whether you use an exchange or a P2P marketplace. You can adapt these steps to your chosen platform.

- Check identity requirements: Most regulated platforms need to verify your identity (KYC). This can involve uploading an ID, proof of residency, or a selfie holding your documents.

- Secure your Bitcoin: Before you sell, ensure your assets are in a wallet you control. If you bought your Bitcoin elsewhere, you will need to send it to the platform’s deposit address (for exchanges) or hold it in your own wallet if using P2P.

- Place your sell order: On an exchange, you set the amount of Bitcoin you want to sell and confirm the price. On P2P, you choose a buyer who offers a favorable rate and confirm the transaction details.

- Provide your bank details: Double-check your IBAN, any references the exchange might require, and confirm the name on your account.

- Confirm the sale: Finalize your order. Wait for the blockchain confirmations (applies if you send from your wallet).

- Withdraw euros to SEPA: Once the platform has received your Bitcoin, you can initiate a SEPA payout. Depending on the exchange, it could arrive as early as the same day or within a couple of business days.

All these steps might sound complex initially, but once you complete one or two transactions, you will find the routine. The biggest challenges are ensuring your details match exactly and you follow security best practices.

Secure your transactions

When you sell Bitcoin, safety is paramount. Fraudsters might target your transaction, or you could lose funds due to carelessness. Here are some basics:

- Use two-factor authentication (2FA)

Always enable 2FA on your account. A password alone is vulnerable if you accidentally leak it. - Check the transaction details

Does the recipient name on the bank account match your own name if you are using an exchange? Does the buyer on a P2P marketplace have a verifiable record of successful trades? Be extra cautious. - Keep your private keys safe

If you use a non-custodial wallet, protect your seed phrase. Never share it with anyone, even if they claim to be “support.”

One small oversight can be enough for a failed transaction. Always confirm you have a stable internet connection and you are using the official website or verified app for your chosen platform.

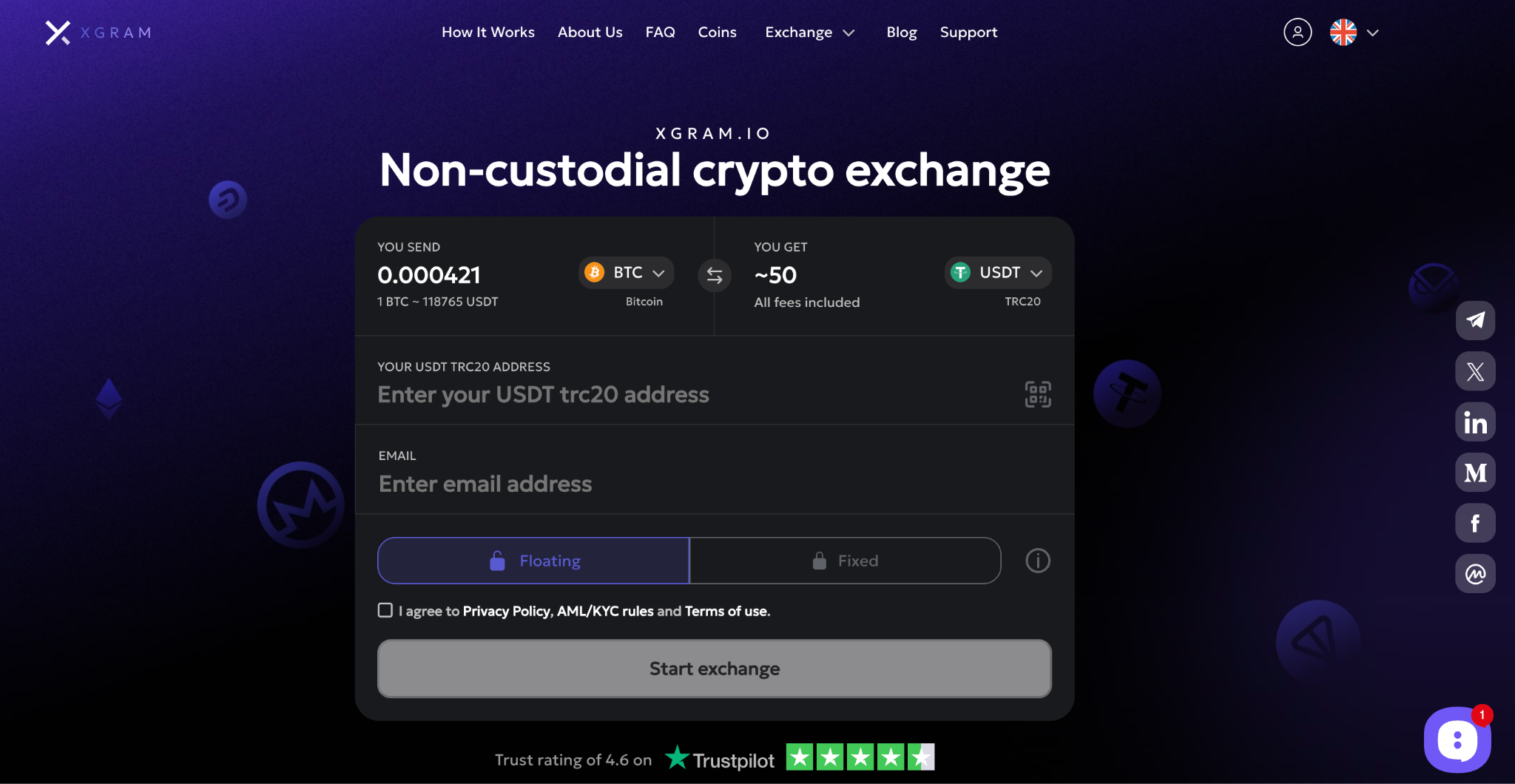

Try Xgram swaps

If you want an instant swap solution, consider Xgram. It is a straightforward service for exchanging Bitcoin (and other popular cryptos) into euros. Here are five key points to know:

- Xgram supports standard swaps that simplify the process.

- You can convert multiple cryptocurrencies without needing to connect an external wallet.

- The fees are generally lower compared to many other instant platforms.

- You can retain more of your earnings since there are fewer hidden costs.

- The streamlined transaction flow means you can complete your sale in just a few clicks.

With its simplified approach, Xgram might save you time and reduce the potential for user errors. That is especially helpful if you are new to crypto and do not want to juggle multiple apps or complicated sign-up procedures.

Avoid common mistakes

When it comes to how to sell bitcoin to sepa, the learning curve can catch you off guard. Speed bumps are normal, but you can prevent most of them with simple know-how:

- Entering the wrong IBAN: Even a small typo can delay your payout. Always verify that you typed your bank details correctly.

- Not accounting for fees: Trading fees, withdrawal fees, and network fees can add up. Understand the total cost before selling your Bitcoin.

- Selling at the wrong time: Crypto prices fluctuate. Monitor the market trend to avoid selling during sudden dips, unless you are comfortable with the price.

- Ignoring local rules: Depending on your region, you might have specific requirements for tax reporting. Failure to comply can lead to an unwelcome surprise later.

Keep track of these pitfalls so that when you press “Sell,” you can do so with confidence. A single quick review can protect you from frustrating, time-consuming errors.

Consider local regulations

Different countries have distinct rules for taxes, reporting, and anti-money laundering (AML) compliance. While the Single Euro Payments Area standardizes remittances, it does not standardize every crypto oversight.

- Research if you need to declare your crypto transactions annually to your tax authorities.

- See if your country imposes capital gains taxes or has singled out crypto for special reporting.

- Keep transaction receipts or screenshots in case authorities request documentation of your trades.

Following local regulations not only helps you avoid penalties, but also fosters peace of mind. You can continue exploring crypto opportunities without looking over your shoulder.

Build your exit strategies

Selling Bitcoin to SEPA the right way opens more doors for you down the road. When you figure out your ideal method, you create a blueprint you can reuse anytime you want to cash out. This approach is part of building your larger crypto strategy:

- Plan your holdings

Decide how much Bitcoin you want to keep for potential long-term gains and how much you would rather convert into euros. - Schedule regular reviews

Markets move quickly. Weekly or monthly check-ins help you decide if you should sell, hold, or rebalance. - Explore multiple platforms

If you have used only a single exchange, experimenting with a P2P site or an instant swap solution like Xgram can add flexibility.

Having backup plans can keep you agile. If one platform has issues or raises fees, you can comfortably switch to your next best option.

Frequently asked questions

1. Do I need a special bank account for SEPA transfers?

You do not need a special bank account, but you do need an account in a European bank that supports SEPA transfers. Check with your bank to confirm you can receive euro payments from a crypto-related source.

2. Can I sell Bitcoin to SEPA immediately?

In many cases, yes. If you already have Bitcoin on a verified exchange (or you are using an instant swap service like Xgram), you can sell and request a bank withdrawal within minutes. The SEPA bank deposit may take one or two business days to arrive.

3. How do I track the SEPA payment status?

Most exchanges or P2P platforms allow you to see a withdrawal status page. It will show whether they have processed your funds. You can also monitor your bank account for incoming transactions. If there is a delay, contact customer support and verify your IBAN.

4. What if my transaction fails?

First, confirm that all your personal and banking details were correct. If the platform reports an error, check with customer support for specific instructions. In rare cases, your bank may refuse the transfer if they suspect something unusual. Communicate with both the platform and your bank for a swift resolution.

5. Is there a minimum amount to sell?

Minimum amounts vary by platform. Some centralized exchanges may require you to sell at least 10 or 20 euros worth of Bitcoin. Others have no strict minimum. Check the FAQ or terms of the specific service you plan to use.

Selling Bitcoin to SEPA is more approachable than it initially looks. By picking the right method, verifying your credentials, and following best practices, you can turn your crypto into euros securely and efficiently. Once you complete your first few transactions, it becomes second nature. You will learn how to optimize fees, handle local restrictions, and adapt your strategy over time — all without the stress of guesswork.