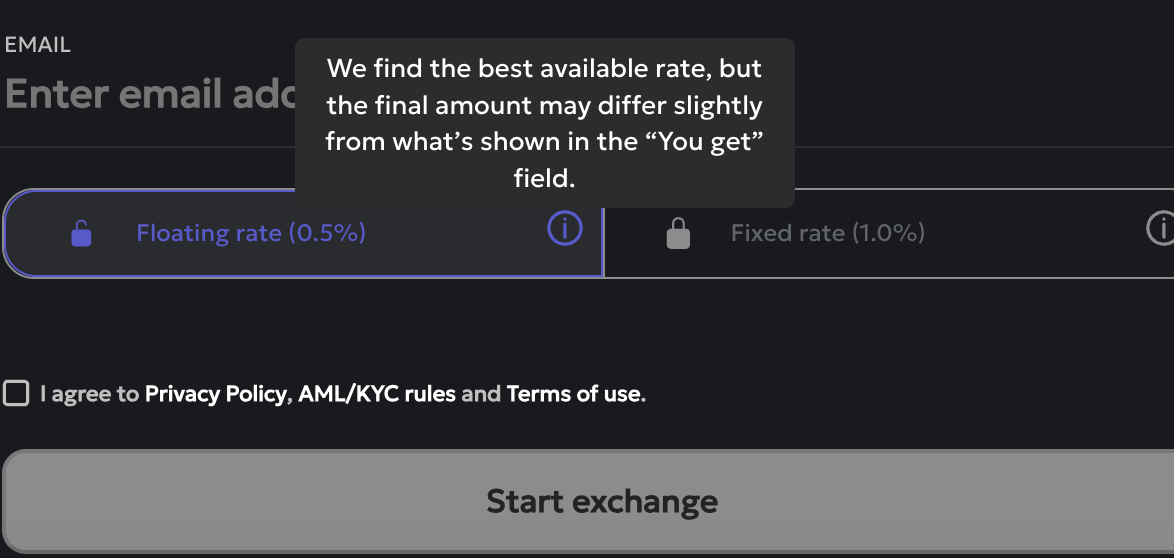

What is a floating rate?

A floating rate means the platform picks the best available exchange rate at the moment your transaction is processed. You usually get a better deal and a slightly lower fee — because the system is reacting in real time to what’s happening in the market.

But there’s a catch: the final amount you receive may differ slightly from what was originally shown. That’s because crypto prices change quickly, and the rate might shift a little during the processing time.

If you're just sending funds to a friend, swapping tokens for yourself, or doing a casual transaction — floating rate works great. You’ll still get a very close estimate, and you’re saving on fees.

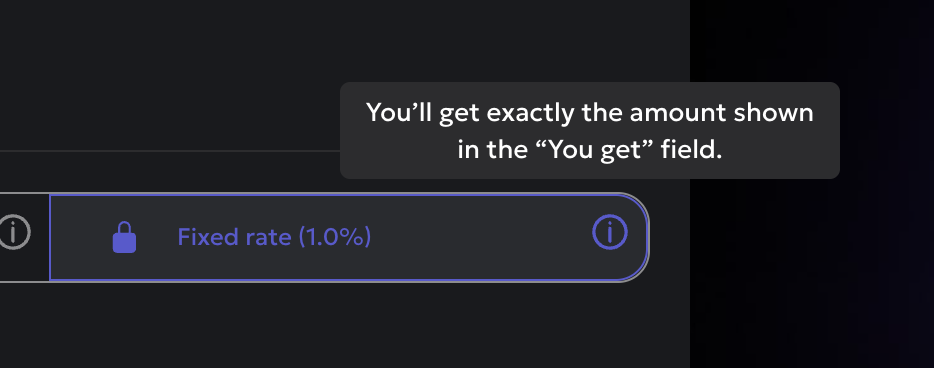

What is a fixed rate?

A fixed rate locks in the amount you’ll get at the start of the transaction. No matter how the market moves a few seconds later, you’ll receive exactly what was shown in the “You get” field.

The fee is usually a bit higher — you’re essentially paying for that rate certainty. But in return, you avoid surprises, and you know exactly how much your recipient will receive.

Why fixed rate is sometimes essential

Let’s say you’re paying for a service or a subscription — and the system expects exactly 50 USDT. If you send 49.97 or 50.02, the payment might get rejected or stuck. That’s where fixed rate comes in handy: it ensures that you send the correct amount down to the cent.

It’s also a must-have for businesses or merchants accepting crypto via automated systems or payment gateways. When every decimal counts, fixed rate gives peace of mind.

Which one should you choose?

If you're looking for the best deal and don’t mind slight variations, go with floating rate — it's perfect for personal use.

But if you’re making a payment, sending money to a business, or working with set invoice amounts, then fixed rate is the safer option — it guarantees accuracy.