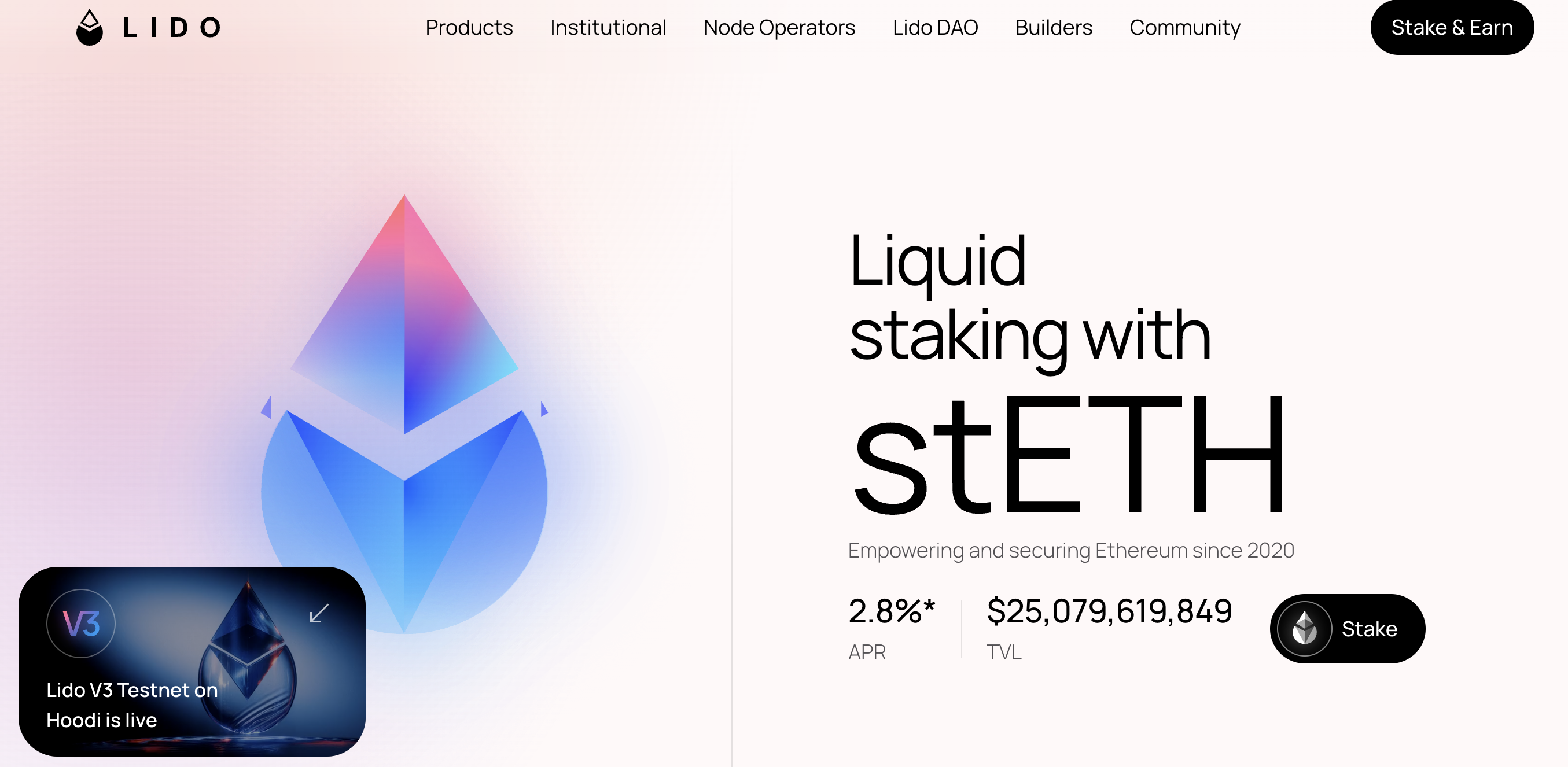

TL;DR: Lido is a platform that simplifies staking so you can earn potential rewards on networks such as Ethereum, Solana, and more. It issues tokens that represent your staked asset, giving you continued liquidity and flexibility. You do not need to worry about meeting bigger minimum staking requirements. However, as with any crypto service, it is important to understand the risks and do your own due diligence.

Discover Lido basics

Lido started with a core idea: make staking easier for everyone. Traditional staking often requires a large minimum balance (like 32 ETH for Ethereum) and forces you to lock those funds for a set period. Not everyone can afford that much crypto, and even if you can, waiting months or years to move your tokens can feel restrictive. Lido helps get around these barriers by pooling user deposits and delegating them to vetted node operators. Instead of locking your tokens, you receive a liquid token in return, such as stETH for Ethereum, representing your stake.

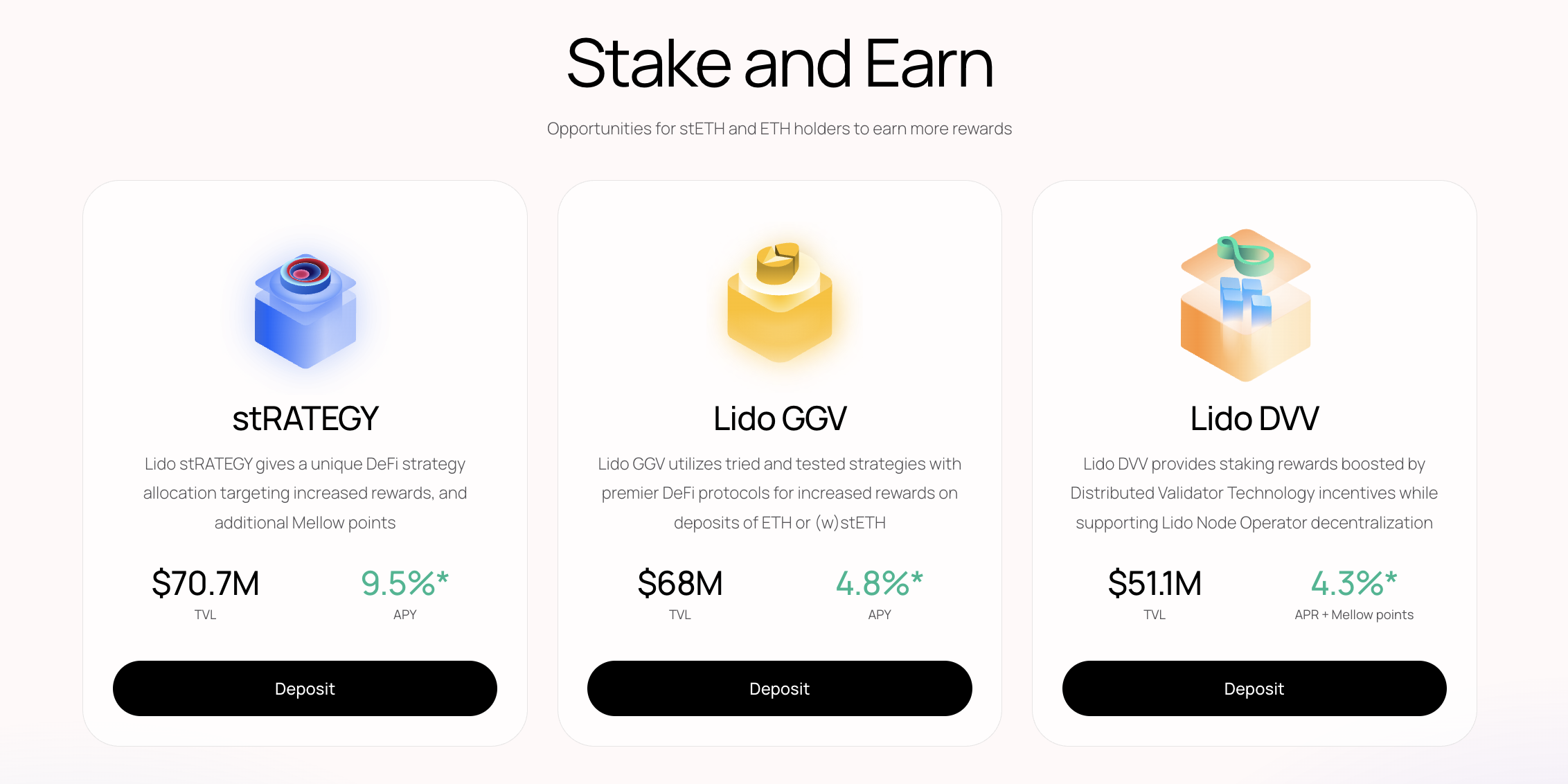

When you own a liquid staking token from Lido, you keep access to your funds for trades, collateral, or any activity you prefer. Meanwhile, behind the scenes, your staked crypto contributes to network security and earns potential staking rewards. The “liquid” part means you could, at any time, sell or spend this representation token on supported exchanges or DeFi platforms. Essentially, you are staking and staying flexible at the same time.

That dual goal, earning yield plus preserving liquidity, has made Lido one of the most popular liquid staking protocols out there. Even if you only have a fraction of one ETH, you can still participate. You also do not need extensive technical know-how. Lido’s interface is user-friendly, and the platform works with multiple wallets. With it, you can confidently stake, track your rewards, and avoid the complexity of running a validator node yourself.

Why try Lido

If you are new to crypto, you might occasionally feel overwhelmed by the jargon and technical hurdles around staking. Lido’s aim is to cut through that noise. By pooling your stake with many other users, the platform lowers the barrier to entry. Here are some specific benefits you could consider:

- Low minimum thresholds: You can stake significantly less than 32 ETH on Lido, letting you get started without a huge investment.

- No binding lock-ins: With liquid staking tokens such as stETH, you can use them in trading, lending, or other DeFi protocols.

- Automated rewards: You do not have to manually claim your staking rewards. They often accrue directly to your wallet in real time (or in set intervals, depending on the blockchain rules).

- Reduced risk of mistakes: Running your own validator can be risky if you misconfigure software, risk hardware failures, or lose your private keys. Lido delegates these tasks to professional node operators.

For beginners, the absolute control over your digital assets is key. You receive tokens that represent your staked balance, so you can see and move them at your own pace. If you want to dip your toe in advanced DeFi, these “staked tokens” can serve as collateral or can be swapped when you need. That flexibility could make a real difference if you decide to rebalance your portfolio mid-stake. Keep in mind that while Lido is a helpful tool, it is still part of the broader Ethereum (and multi-chain) ecosystem, which can carry all the usual crypto risks such as market volatility and smart contract vulnerabilities. By weighing the potential benefits against the drawbacks, you can decide whether Lido fits your personal risk tolerance and financial objectives.

How Lido works

Understanding the mechanics of Lido can give you confidence in how your stake is being handled. Essentially, Lido sits in the middle of a three-step process: you deposit your crypto, node operators stake it on a Proof of Stake (PoS) network, and Lido issues you a liquid token that represents your staked balance plus any staking rewards.

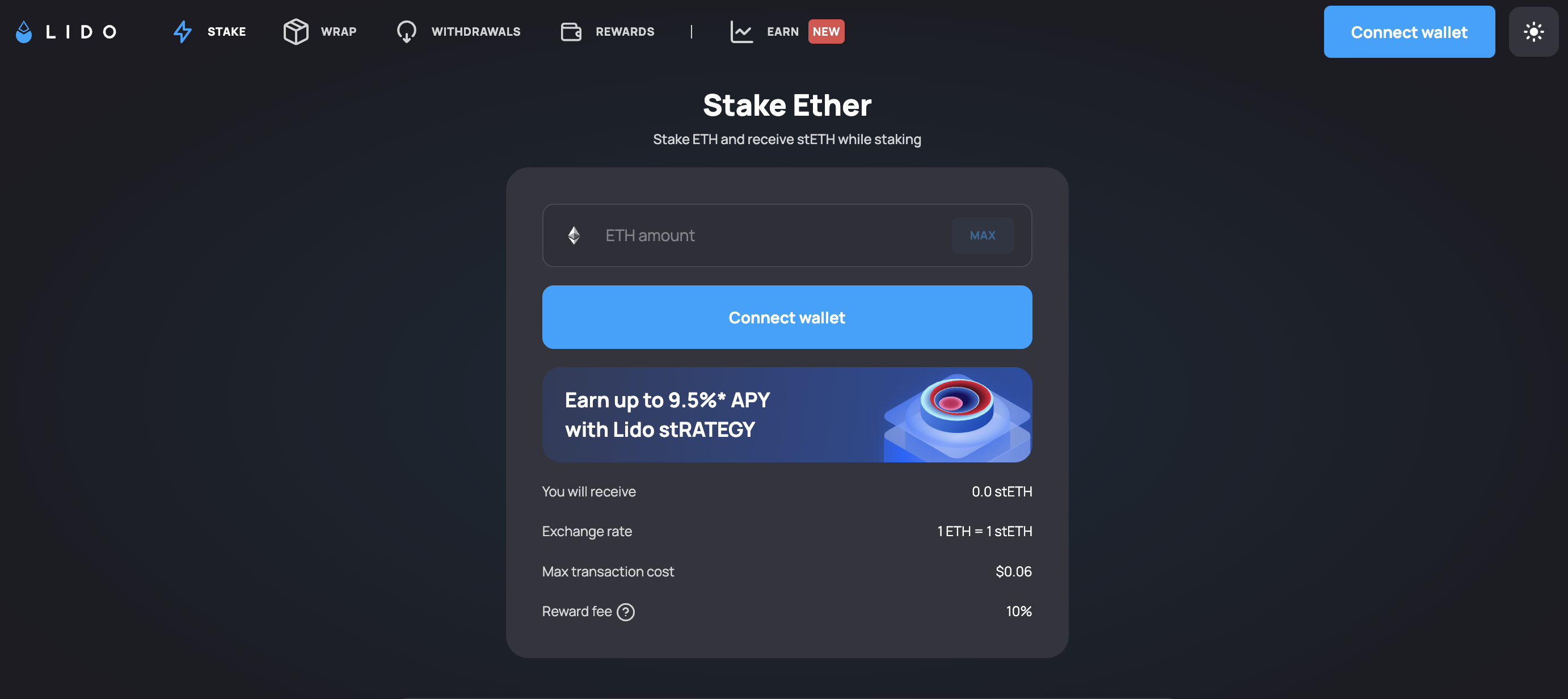

- You deposit your tokens: On the Lido interface, you can choose which blockchain’s token to stake, such as ETH. You send your tokens through a smart contract.

- Lido hands the tokens to node operators: Lido’s smart contract delegates your deposit to chosen node operators who spin up validators secured by that pooled stake. These validated blocks earn rewards, which are then funneled back into the pool.

- You receive stTokens: The moment you deposit your tokens, you get stETH or a similar stToken for other blockchains. These tokens accrue staking rewards over time. Essentially, each stETH you hold reflects your share in the staked pool, including newly accumulated rewards.

- Rewards are auto-reinvested: Instead of sending you discrete reward payouts, Lido incorporates them into the token’s value. So if the underlying staked crypto grows, your stToken automatically grows in value. In practice, you simply keep your stTokens in your wallet, watch them increase in worth, and remain free to trade or lend them if you wish.

Those steps happen seamlessly in the background. You do not manually choose node operators, nor do you have to check in daily to claim rewards. Lido does it all while charging a small fee that covers validator operations. This structure saves you from the complexities of staking, and the risk of errors is spread across multiple operators. If you decide you no longer want to hold stETH, you can swap it back for ETH on many decentralized exchanges.

It is important to note that while Lido reduces technical friction, it does introduce a smart contract layer. There is a certain trust in the protocol not being compromised and in node operators functioning properly. Still, Lido’s track record to date and the participation of reputable validators help many users feel comfortable relying on it for long-term staking.

Compare Lido vs. direct staking

You might wonder how Lido stacks up against staking on your own. Direct staking typically means becoming a validator if you have the minimum required balance (for example, 32 ETH on Ethereum) or delegating to a validator for blockchains where that option exists by default. Below is a quick comparison:

| Factor | Lido | Direct Staking |

|---|---|---|

| Minimum requirement | Very low (fraction of an ETH) | Often high (e.g., 32 ETH for ETH) |

| Liquidity | Yes, via stTokens | No, unless the network allows early withdrawals |

| Operator management | Handled by Lido’s selected nodes | You must run or pick your own validator |

| Reward distribution | Auto-compounded within stTokens | Dependent on network or validator setup |

| Technical complexity | Low, just deposit and receive tokens | Higher, you might need to maintain uptime |

| Fees | Protocol fee for Lido + network fees | Minimal if you do it yourself, but must manage hardware or rely on a delegation fee |

For everyday crypto holders without the hardware or time to run their own validator, the convenience is clear. Even in networks where delegation to a validator is simpler, you typically give up liquidity. Lido’s approach attempts to combine an easy stake process with the ability to keep your tokens moving. However, if you prefer absolute independence and already own the required crypto amount, direct staking might be appealing. You avoid Lido’s fees and you maintain total control. Just remember that you also take on more responsibility.

Use Xgram for cross-chain trades

When you explore liquidity and staking rewards on multiple networks, you often face the challenge of high transaction fees and bridging complexities. That is where Xgram can come in handy. xgram is an exchange platform where you can perform both cross-chain swaps and normal trades, letting you shift assets across different blockchains. It does not require you to connect a wallet, which streamlines the user experience. By using Xgram, you could potentially reduce fees when moving stETH across sidechains or bridging other tokens. This way, you save money and time, while preserving your staking and investment strategies in one place.

As you keep stTokens, you may want to diversify across different chains or convert part of your stake to a stablecoin if market conditions change. xgram’s cross-chain service helps you handle such a move without juggling multiple wallets or bridging services that often pile on transaction fees. That lower friction can lead to more efficient portfolio management. If you decide to jump between networks or experiment in other DeFi ecosystems, xgram’s interface gives you a single environment to do so. Ultimately, if your priority is convenience and savings, xgram may offer a significant improvement over traditional bridging setups.

Check potential pitfalls

Like any crypto strategy, using Lido is not a shortcut to guaranteed gains. Before you begin, it helps to be aware of potential pitfalls and set your expectations accordingly.

- Smart contract risks: By depositing your ETH into Lido’s protocol, you rely on the security of Lido’s code. Though Lido is audited and widely used, no contract is 100% immune.

- Node operator trust: While Lido selects reliable validators, each operator is human or software-run, and mistakes or mismanagement can happen. The risk is spread among many vetted operators, but it is still something to note.

- Market fluctuations: Even if you earn staking rewards, the price of ETH or another staked asset might drop, reducing the dollar value of your holdings. Liquid staking tokens can sometimes trade at a slight discount to the underlying asset, particularly during volatile markets.

- Protocol fees: Lido charges a fee for providing its service, taken from your staking earnings. While reasonable for most people, it still cuts into your final profit.

- Limited control over updates: If the underlying blockchain, such as Ethereum, makes major changes, Lido and its operators handle adjustments behind the scenes. You do not have total say in how those protocol changes roll out, though Lido’s governance structure involves community proposals and voting.

It is also worth remembering that once you hold stETH, you are still subject to the normal gas fees when moving around Ethereum. If fees spike, you can end up paying quite a bit to move or trade your stTokens. Factor these costs in when you decide whether the convenience is worth it. Overall, if you are a newer investor, approaching Lido with a balanced perspective can help you avoid surprises.

FAQs about Lido

Below are five common questions people ask about Lido:

How do I start staking with Lido if I am a complete beginner?

To begin, you typically need a crypto wallet like MetaMask or a hardware option that supports the Ethereum network. Then visit Lido’s official site, choose the token you want to stake, and follow the prompts. Lido’s interface will guide you through the deposit steps, and once you confirm the transaction, you should see your new stTokens in your wallet.Do I keep full ownership of my crypto when I use Lido?

Yes. You no longer hold the original tokens on your wallet address, because they are pooled for staking, but you do receive stTokens that represent your stake. These stTokens effectively preserve your ownership. If in the future you swap them back for the original token, you will retrieve your stake plus any accrued rewards (minus fees).Are Lido yields fixed or guaranteed?

No, staking rewards vary based on network conditions, total validators, and other factors. Lido passes on the rewards from the underlying blockchain, so they can fluctuate. You might notice a lower annual percentage yield (APY) when the network is congested or a higher yield if block rewards and participation changes. Always remember these yields are not guaranteed.Can I stake tokens other than Ethereum on Lido?

Yes, Lido supports multiple blockchains like Solana and Polygon (when available). Each chain has its own staking token, such as stSOL or stMATIC. They work similarly to stETH by providing liquidity in parallel to your staked deposit.How do I exit my position if I change my mind?

Since you have stTokens, you can sell or swap them anytime on supported exchanges. There is no specific “unstaking” process through Lido itself. If your stTokens trade near or at the price of the underlying asset, swapping them should be straightforward. In some bearish markets, there could be slightly less liquidity and the price might diverge from the main token. That is why it is good to plan ahead and pick a time when you can get a favorable exchange rate.

Wrap up your Lido strategy

Lido aims to bring simplicity and flexibility to staking. It pools users’ funds, delegates them to professional node operators, and issues liquid tokens (like stETH) so you have the best of both worlds—yield generation plus the freedom to move your assets. By removing the high minimum requirements and letting you keep liquidity, Lido opens a door to new crypto users who want to test out staking without being stuck.

That said, always keep a watchful eye on possible risks. Smart contract issues, node operator trust, market swings, and fees can affect your returns. Take the time to see how Lido fits into your broader crypto goals. If you are comfortable with the trade-offs, liquid staking can help you put idle assets to work.

Lido is just one piece of the broader digital asset puzzle. If you are juggling multiple tokens or chains and want to move between them efficiently, you can rely on cross-chain platforms like xgram to cut down on fees and complexity. Bringing these tools together can streamline your crypto journey: stake with Lido for liquid rewards and use xgram to quickly handle cross-chain swaps. With those core steps in place, you are ready to navigate the staking world with more confidence.