Discover USDT payment

Understanding the basics

When you first hear the term USDT, it actually refers to Tether, a cryptocurrency that aims to keep its value as close to one US dollar as possible. The idea is simple: one token is designed to equal one US dollar in valuation. So, what is USDT payment in everyday terms? It’s essentially a transaction that uses USDT coins instead of traditional currencies like USD, EUR, or other fiat money.

The stability of USDT comes from the idea that each token is supposedly backed by real-world financial assets, though the exact composition can include cash reserves, treasury bills, or other forms of collateral. While debates around full backing exist in the crypto community, the fundamental goal of USDT remains firm: provide a boarding spot for those of you who want the ease of cryptocurrency without major price swings.

Why it was created

USDT arose to solve a recognized problem with Bitcoin and other cryptocurrencies: they often swing wildly in price over short periods. This volatility can make daily transactions stressful if you’re sensitive to risk or simply want to use crypto as a form of payment or store of value. USDT was created to maintain a stable price, allowing you to more confidently move in and out of the crypto ecosystem without fearing huge losses or complicated conversion steps.

The importance of stability

If you’ve watched the price of altcoins move, you know they can rise and fall quickly. Stablecoins like USDT help smooth out this experience. Imagine you’re a gamer who earns cryptocurrency as part of an online tournament. You may want to keep your earnings in a stable form until you decide how to use them. By moving your crypto into USDT, you’re less exposed to the massive highs and lows that can happen with other digital assets.

Stability is also helpful for trading. If you’re active on a crypto exchange, you might temporarily store your funds in USDT while looking for the next coin to buy. This buffer ensures you don’t lose value during your search. Essentially, USDT acts as a safe harbor without making you go through bank transfers or other more complex fiat gateways.

See how USDT works

Blockchain foundation

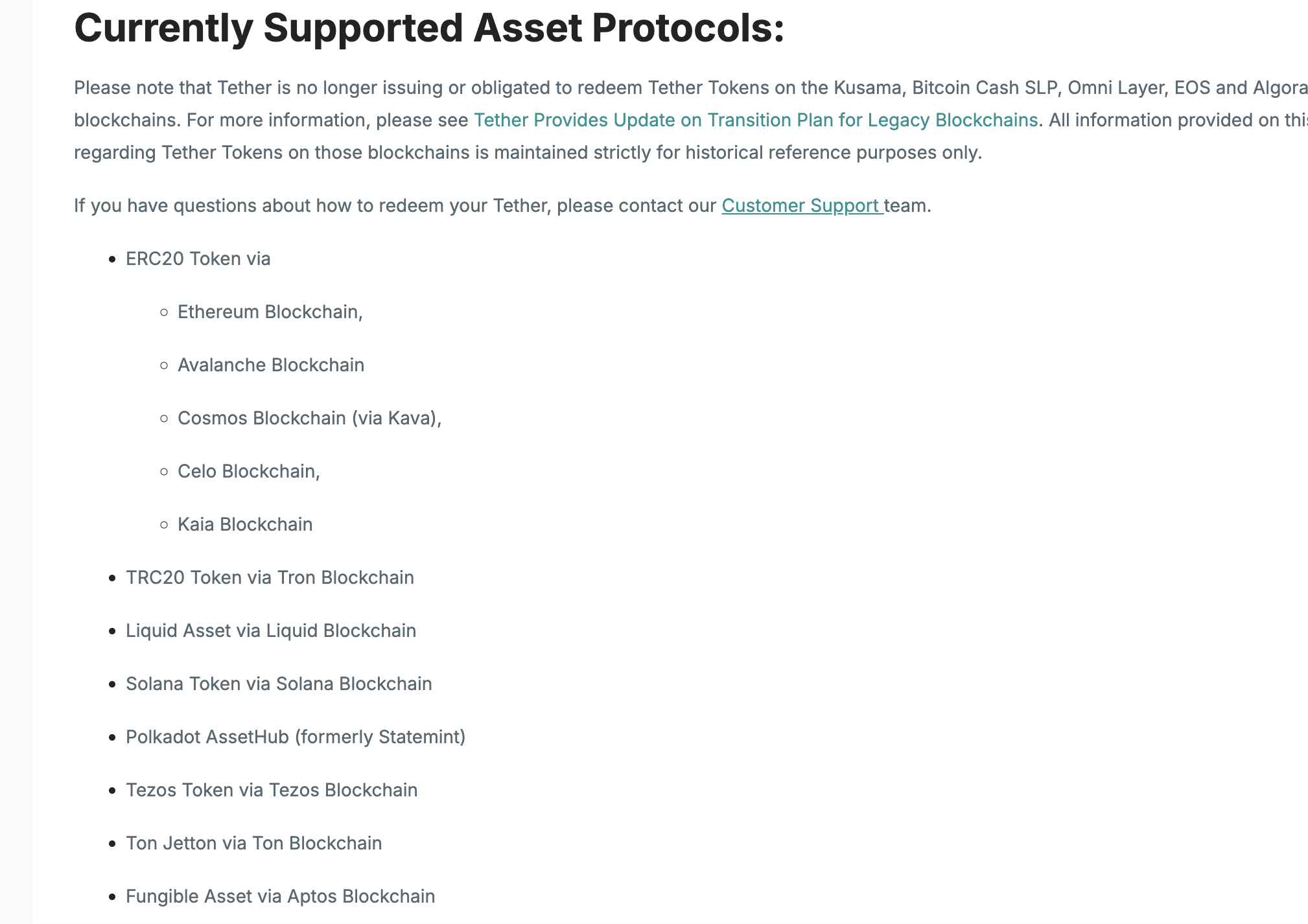

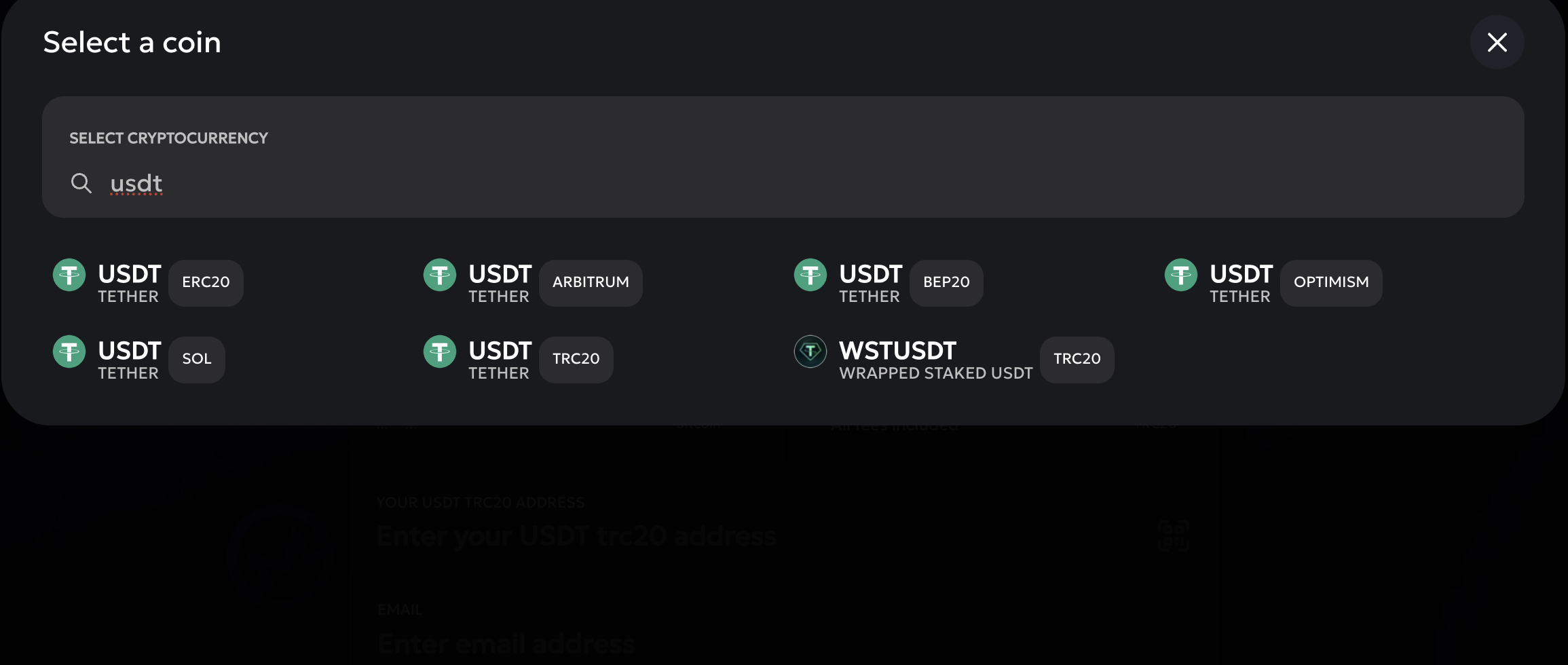

You’ll find USDT on various blockchains such as Ethereum, Tron, and even more specialized networks. What that means for you is flexibility. If you’re comfortable using the Ethereum network (known for smart contracts), you can hold USDT in an Ethereum-compatible wallet. Prefer lower transaction fees? Then maybe you’d store it on the Tron network. Whichever platform you choose, the principle remains the same: your tokens exist as entries on a public ledger, representing a stable value pegged to the US dollar.

One key point to remember is that these transactions are still subject to blockchain conditions. So even though the value is stable, you may face network congestion, which might slow or slightly increase transfer costs. For smaller trades, these fees can add up, so it’s smart to be selective when deciding which network to use for your USDT transactions.

P2P trading on exchanges

Most major crypto exchanges nowadays have a dedicated P2P (peer-to-peer) section, where you can buy or sell USDT directly from other users. This is often helpful if you live in a country with strict banking rules for international crypto transactions. In P2P trading, you and another individual agree on the payment method and price. The exchange generally holds the crypto in escrow until your deal is completed, giving you both a layer of safety.

P2P markets are popular for many reasons:

- You can pick from multiple payment methods (bank transfers, mobile wallets, etc.).

- You often get more competitive rates than if you rely on fixed exchange prices.

- You can avoid high card-processing fees that some centralized platforms charge.

The combination of USDT’s stability and the convenience of P2P trading helps you trade crypto with lower risk and, potentially, fewer middleman fees.

Recognize the benefits

Fast transaction times

While USDT doesn’t magically accelerate blockchain speeds, transferring it is typically faster than traditional bank transfers—especially international ones. If you’re used to waiting days for funds to move through banks, the near-instant nature of many crypto transactions might surprise you.

For example, if you decide to top up your trading account with USDT from a personal wallet, it often takes just a few minutes before you can continue with your next step. The speed depends on the specific blockchain you use, but generally, transfer times are measured in seconds or minutes rather than days.

Reduced volatility

USDT’s main draw is that it’s pegged to the US dollar. Cryptocurrency markets can be unpredictable. One day you might see your favorite coin double in value, and by the next morning, it might lose half those gains. By contrast, a stablecoin helps protect you from this rollercoaster. When you’re in USDT, you can keep your value stable, making it easier to plan your next move.

This stability can also be reassuring if you’re sending money to family or friends. If you want to transfer $1,000 worth of crypto, using USDT ensures that value stays consistent during the transfer process. In contrast, if you used a volatile asset and it dropped 10 percent overnight, you’d wind up sending less actual value.

Try xgram for cross-chain

Now, you might wonder how you can move USDT cost-effectively across different blockchains. That’s where platforms like Xgram step in. Imagine you have USDT on the Ethereum network but want to use it on Tron for lower transaction fees. Xgram can handle this cross-chain conversion for you, so you don’t have to juggle multiple tools or specialized swaps.

Saving on fees

One of the major draws of using xgram or other cross-chain solutions is saving on fees. When you send USDT on certain networks, fees can spike, sometimes making small transactions impractical. By choosing a more cost-effective blockchain through xgram, you can cut down on those fees. A difference of just a few dollars per transaction might not seem big at first, but if you’re making many transfers, those savings quickly add up.

Additionally, you might discover that some networks offer upsides in speed and convenience. From your perspective, the key is evaluating which blockchain environment best suits your needs—both financially and functionally.

Apply USDT in daily life

Online shopping with USDT

A growing number of online merchants accept payments in cryptocurrency, including USDT. While not as universally recognized as Bitcoin, USDT is rapidly gaining traction. For you, this can mean:

- Easier cross-border purchases without worrying about currency exchange rates.

- Potential discounts if the merchant offers special deals for crypto payments.

- A more private way to handle transactions, since you’re not always required to provide credit card details.

Look for stores that have integrated advanced payment gateways or specialized crypto checkout systems. Each platform is different, so pay attention to any special instructions the merchant may offer.

Cross-border transfers

If you have family members abroad or you’re freelancing for international clients, cross-border transfers can be a hassle. Banks charge fees that can feel quite steep, and sometimes the service can take days to process. With USDT, you cut out many of these headaches:

- Transactions settle relatively quickly.

- Fees are often lower than international bank wires or remittance services.

- You avoid fluctuating exchange rates because USDT is pegged to the dollar.

Simply transfer your coins directly to a friend’s wallet. For even lower fees, consider shifting networks via xgram if that helps you find the best path.

DeFi applications

In the decentralized finance world, USDT is widely used as a base trading pair or collateral asset. You might stake it in liquidity pools on DeFi platforms, earning yields in return. You can also use lending protocols to lend your USDT to other users, potentially earning interest. While DeFi can be complex for beginners, it offers a wealth of tools for engaging with your USDT beyond spending or storing it. Keep in mind that different DeFi platforms have different rules and security measures, so it’s always wise to do a bit of research before committing your tokens.

Stay safe with USDT

Choosing a wallet

Part of knowing what is USDT payment involves learning how to store your tokens securely. Here’s a quick overview of wallet options:

- Mobile wallets: Convenient and user-friendly, but more susceptible to hacking or loss if your phone is compromised.

- Hardware wallets: Physical devices that keep your private keys secure offline, reducing the risk of remote attacks.

- Desktop wallets: Installed on your computer, giving you more direct control, but still exposed to viruses or malware if your system is not protected.

Different wallet solutions may also support only certain networks. If you plan to switch between Ethereum and Tron, make sure your chosen wallet can handle both.

Keeping private keys secure

Your private keys are the soul of your USDT holdings. Anyone who obtains them can spend or transfer your assets. That’s why you should:

- Never share your private keys or seed phrases with anyone.

- Store backups in multiple secure locations in case you lose the original.

- Use strong passwords and enable two-factor authentication (2FA) wherever possible.

Beware of scams

Increasingly, phishing attacks and giveaway scams target crypto holders. Remain cautious about unsolicited DMs or emails offering freebies, and always double-check web addresses. Criminals often use near-identical URLs to trick you into entering your private details on a counterfeit website. Keeping an up-to-date antivirus and practicing good web hygiene go a long way in protecting your USDT.

FAQs about USDT

What is USDT payment?

A USDT payment is any transaction that uses Tether tokens (USDT) as the currency. Because USDT tracks the value of the US dollar, it provides a stable way to send and receive funds within the crypto ecosystem.How do I buy USDT?

You can buy USDT on most major exchanges by using a credit card, bank transfer, or by trading it for other cryptocurrencies. You can also explore P2P platforms where you negotiate directly with a seller, which can be convenient if regulated payment channels are limited in your region.Is USDT the same as Tether?

Yes. Tether is the company behind USDT tokens. These tokens go by the symbol USDT on exchanges. Occasionally you’ll see variations on different blockchains (like USDTe on Tron), but they all represent Tether’s stablecoin.Do I need a special wallet?

Any wallet that supports the blockchain where you hold USDT should work. For example, if you’ve chosen the Ethereum version of USDT, you can use any Ethereum-compatible wallet. Always confirm the network details to avoid accidentally sending tokens to the wrong chain.Are there risks to using USDT?

Although it’s pegged to the US dollar, risks still exist. Tether’s collateralization strategy is sometimes debated, and you rely on Tether’s backing to maintain its full dollar value. Additionally, storing USDT on an exchange carries the risk of hacks or exchange bankruptcy. Using a secure personal wallet mitigates some of these concerns.

Wrap up your knowledge

By now, you should have a clearer understanding of what is USDT payment and how it fits into the broader crypto landscape. Whether you’re researching USDT to protect your finances from volatility, planning to make cross-border transfers with fewer fees, or diving into DeFi projects, stability is the core appeal of this popular stablecoin. Platforms like xgram further empower you to move these tokens across blockchains seamlessly, helping you cut costs and travel smoothly between different crypto ecosystems.

Ultimately, your experience with USDT hinges on your goals and your willingness to explore various tools. Approach each step—buying, storing, or transacting—with care, and lean on reputable platforms to help you along the way. After all, the whole point is to make your crypto journey simpler, not more complicated. If you keep your learning curve steady and stay alert to best security practices, you’ll be well on your way to integrating USDT into your daily financial life.