Understand the basics of liquidity

Liquidity in any market—stocks, commodities, or crypto—is all about speed and stability. When you hold a cryptocurrency that is “liquid,” you can sell it fast at the current market price. If you own a coin with little liquidity, finding a willing buyer might take longer, and you may have to accept a lower price. Good news, this is simpler to grasp than most people think. Once you see liquidity in action, you’ll quickly realize why it’s so essential for fair and efficient trading.

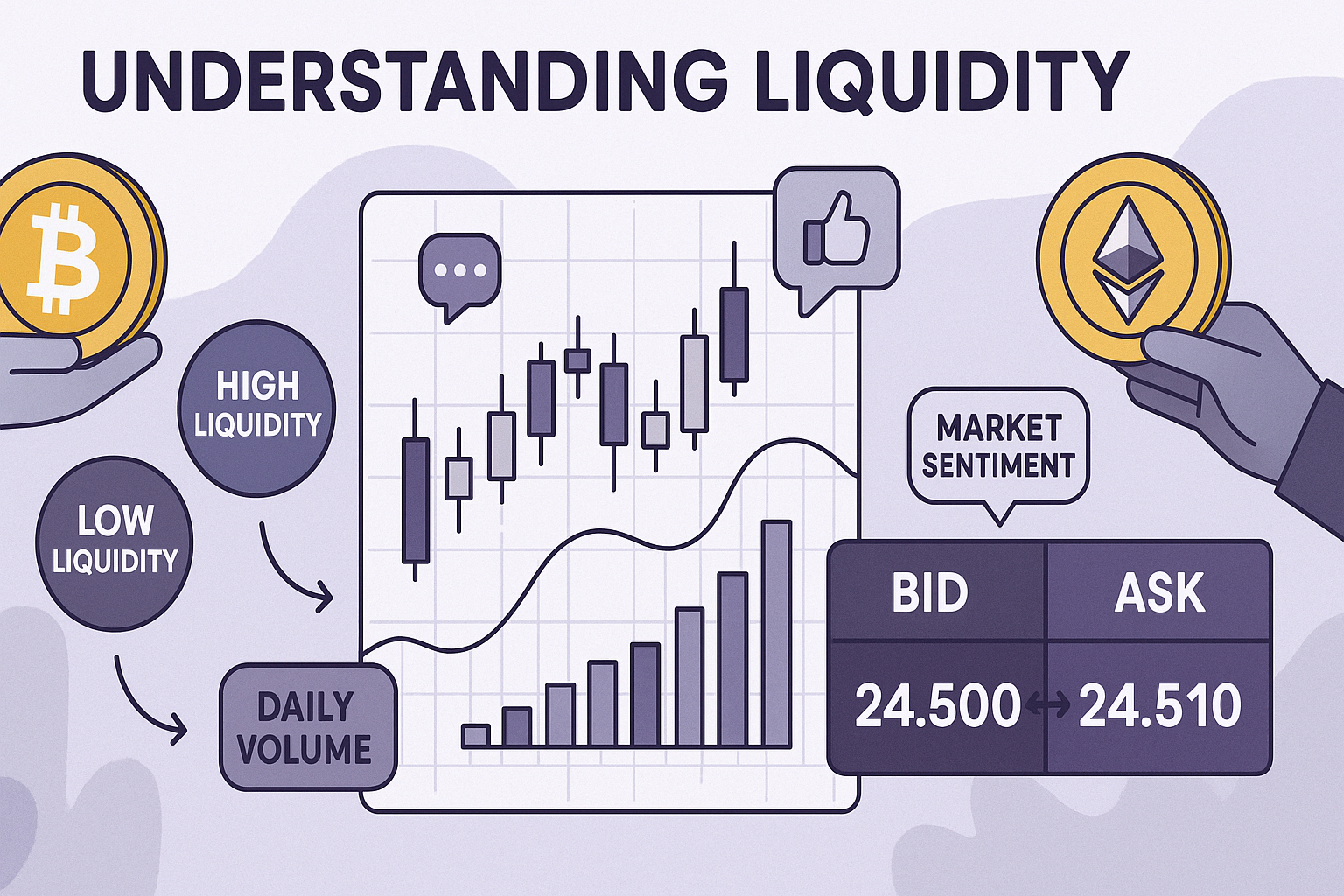

In the crypto world, high liquidity often shows up where many participants trade regularly. You’ll notice that popular coins, such as Bitcoin or Ethereum, have a lot of daily trading volume. All those buyers and sellers create tighter spreads between bid (what buyers pay) and ask (what sellers want). Tighter spreads mean less friction for you when you buy or sell, which typically reduces unexpected slippage (price difference from your expected rate).

Liquidity can also link directly to market sentiment. If a coin is hotly discussed on social platforms and many users race to buy it, that sudden activity might increase volume—boosting its liquidity in the process. However, it can also swing in the opposite direction if the hype cools down, so it’s good to keep a balanced view.

Explore factors that influence liquidity

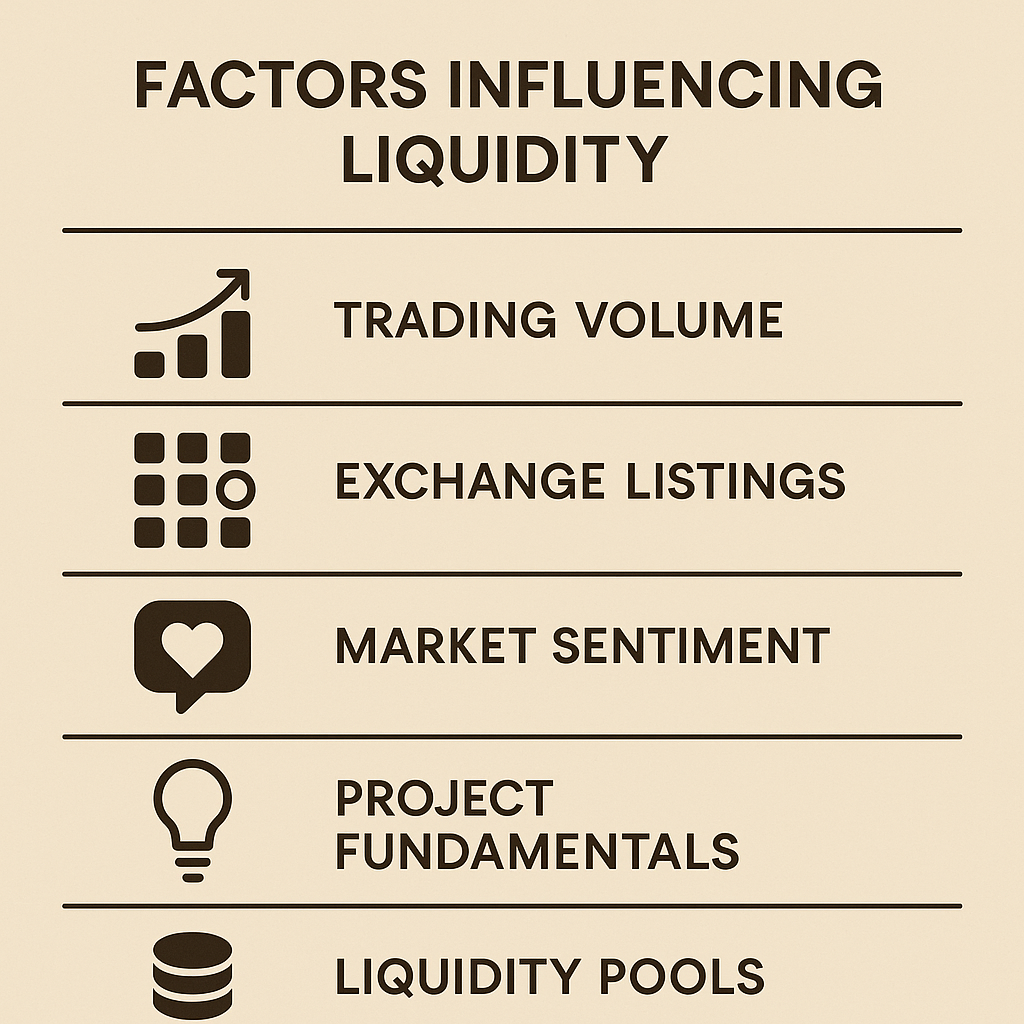

Multiple factors can drive how liquid a particular token is. When you know these factors, you can better judge the potential risks of jumping into a new coin or an emerging DeFi project. Here are some of the main influences:

- Trading volume: The more active the trading pairs for a token, the more likely you can enter and exit quickly. A coin with billions in daily volume has strong liquidity.

- Exchange listings: The number of exchanges that list a coin plays a huge role. A coin listed on top-tier exchanges typically has better liquidity than a coin limited to just one niche platform.

- Market sentiment: Public opinions, news coverage, or even social media buzz can pull in more traders, boosting volume and liquidity.

- Project fundamentals: A well-regarded token with a real-world use case might enjoy more confidence from traders, impacting liquidity positively.

- Availability of liquidity pools: In DeFi specifically, pool-based models let you swap tokens quickly, provided the pool is large enough to handle bigger trades without changing the price too much.

Sometimes, you’ll see a short spike in liquidity if a big influencer mentions a project or a company announces a new partnership. But if that interest fades, the liquidity could go down just as fast. It’s smart to look for consistency rather than one-off bursts. A 2023 industry poll found that 65% of crypto users prefer consistent, moderate liquidity over random flurries of heavy volume. This indicates that stable market conditions can make traders feel more confident, helping them stick to regular buy and sell strategies.

Learn how liquidity affects price

Liquidity and price are closely tied. When lots of people buy and sell a token regularly, trades go through with minimal price movement. If only a small group is interested, even one moderate buy or sell can swing the price significantly. That’s why high liquidity is often viewed as a sign of market stability.

Here’s a simple scenario:

- High-liquidity coin: Suppose a coin trades millions of dollars per day on several well-known exchanges. If you place a buy order, you’ll likely pay close to the current market price because there are enough sellers to fill your order almost instantly.

- Low-liquidity coin: If a coin has only a tiny trading volume, your buy or sell order could be a large share of the day’s total volume. Because the order is so big relative to the market, it might push the price up or down more drastically.

This phenomenon is why smaller tokens can have wild price swings. With fewer people trading, the market is sensitive to sudden demand or supply. Maybe you’ve heard of tokens jumping 100% in a day, only to plunge just as fast. Liquidity (or the lack of it) often plays a part.

The good part is that you can check order books or trading volumes to gauge liquidity. Many crypto platforms show the depth of an asset’s order book. If you see a steady list of buy and sell orders at close price intervals, that is often a sign of decent liquidity. And if the buy-sell gap is huge, it tells you that it might be easier to move the price.

See why liquidity is crucial for DeFi

Decentralized finance (DeFi) has created a new landscape of financial tools—lending, staking, and more. In DeFi, liquidity is particularly important because it connects a variety of projects, each with different tokens and trading pairs. An automated market maker (AMM) platform like Uniswap or Curve uses liquidity pools to facilitate trades. These pools rely on individuals or institutions depositing pairs of assets (for example, ETH and a stablecoin) which then allows others to swap one token for the other.

Without enough deposits, a DeFi pool may not have enough tokens on hand to cover large exchanges, forcing the price to slip significantly if the trade is big. This is why you’ll see so many DeFi projects trying to incentivize users to provide liquidity with rewards. The more tokens poured into a pool, the less likely any single trade can cause wild price fluctuations.

But it’s not all sunshine. In DeFi, high yields can draw in more liquidity, but they can also attract short-term opportunists who might leave once rewards drop. So you’ll want to look at how sustainable a platform’s incentive model is. Good news, you don’t need to become an economics expert to figure this out. Simply diving into a platform’s documentation or reading user reviews can help you gauge whether the yields are realistic.

Measure and track liquidity

Having a sense of how to measure liquidity can make your trading decisions a lot more confident. Different methods offer different insights, but they all circle back to how swiftly you can buy or sell.

Here are a few ways you can track liquidity:

- Daily trading volume

- Check the token’s 24-hour trading volume on your favorite site or aggregator. A higher volume usually signals that more people are buying and selling.

- Order book depth

- Look at how thick or thin the order book is. If many orders around the same price exist, the market is typically more stable.

- Bid-ask spread

- The gap between sellers’ ask prices and buyers’ bid prices is a quick snapshot of how efficiently the market operates. A narrow gap tends to mean better liquidity.

- Liquidity pool size

- For DeFi, find out how large the pool is for the token pair you want to trade. A bigger pool usually means less slippage.

You don’t need to check these details obsessively, but it helps to have a basic understanding before you jump into a trade. You might find that a coin has lots of social media hype, but dismal daily volume. Alternatively, you might see a stable but modest coin with decent volume spread across multiple exchanges. By measuring metrics consistently, you’ll feel more prepared to handle any price swings.

Find reliable liquidity sources

If you’re aiming for quick trades or stable prices, where you trade matters. Different platforms provide different levels of liquidity. In crypto, large centralized exchanges often serve as prime liquidity hubs, but decentralized platforms can also offer strong liquidity if there’s a robust user base.

Many traders start with well-known centralized exchanges because it’s straightforward. You’ll typically see a wide list of trading pairs, high volumes, and user-friendly tools. DeFi platforms, on the other hand, let you hold your keys and still trade through liquidity pools. Either path can work. The main question is: do you prefer a custodial approach (centralized) or a non-custodial approach (DeFi)?

Here’s another option if you want to explore new ways to exchange your tokens: xgram. xgram is an emerging platform that aims to streamline crypto exchanges, letting you swap tokens or coins with minimal friction. It encourages a user-friendly design, so you can quickly see how much or how little liquidity is available. If you’re wondering whether it suits your needs, you can start by checking how many trading pairs it supports. xgram also provides stats on daily volume, making it easier for you to assess whether the platform holds enough liquidity for the trades you have in mind. If you ever decide to branch out from your go-to platforms, xgram might be worth a look.

Wherever you go, always keep your goals in mind. If you plan to day trade, you want a place with high real trading volume and minimal fees. If you’re more into “set it and forget it” investments, you might not need an exchange with the highest possible liquidity—just enough to let you enter or exit without big price shocks.

FAQs

Below are some of the most common questions about liquidity in crypto. These points can help you fill in any blanks and boost your understanding, especially if you’re stepping into DeFi for the first time.

Is high liquidity always good?

High liquidity generally indicates a healthy market, but it doesn’t guarantee positive price movement. A token can be highly liquid but still trend downward if more people are selling than buying. Liquidity simply means you can buy or sell quickly at stable prices. If you see a downward slope, you can still exit, but the price may not be what you hope for.

Can a new token have good liquidity?

Yes. Some new tokens attract large numbers of early backers or are supported by strong liquidity programs, so they can have impressive trading volumes right out of the gate. However, you need to be cautious. Liquidity can vanish just as fast if the interest orreward structure changes. If you’re considering a new token, check how stable its liquidity has been over time, even if it’s only been trading for a few months.

What is a liquidity pool?

A liquidity pool is a pot of tokens smart-contract users deposit in pairs (like ETH and USDC) so others can swap between those tokens. This model is central to many DeFi exchanges (such as Uniswap), where traditional buyers and sellers are replaced by automated market makers. You, as a liquidity provider, typically earn fees from trades that occur in the pool.

How do liquidity providers make money?

When you provide liquidity to DeFi pools, you often earn a share of the trading fees. Every time someone swaps tokens in that pool, a small fee is taken and distributed proportionally among all the providers. Some DeFi platforms also give bonus tokens as incentives. But there’s a risk called impermanent loss—if the token prices shift a lot, you might end up with fewer of the more valuable tokens.

Is DeFi liquidity risky?

DeFi isn’t risk-free. Impermanent loss, smart contract exploits, or sudden drops in reward rates can all impact your returns. On the flip side, many DeFi projects undergo audits and share open-source code, so you can research them before diving in. A balanced assessment of both potential gains and these risks can help you decide whether DeFi liquidity is right for you.

Wrap up and next steps

All in all, liquidity in crypto is about how effortlessly you can purchase or sell digital assets without sending prices lurching. It influences your trading fees, the stability of your investments, and even how quickly you can act on market news. If you’re just stepping into this world, good news, you don’t need to memorize a complex formula. Focus on the fundamentals—trading volume, order book depth, or liquidity pool size—and you’ll have a solid foundation to make decisions that fit your style.

Here are a few steps you can take right now:

- Check the 24-hour trading volume of any coin you plan to trade or invest in.

- Glance at order books on centralized exchanges or the total value locked in DeFi pools.

- Try out a smaller test trade or deposit in a liquidity pool before going all in.

- Explore alternative platforms (like xgram) if you want more options for swapping tokens.

- Keep learning—follow reputable sources, read official documentation, and talk to other traders.

Taking these actions helps you avoid unpleasant surprises and keeps you engaged in the market. You’ve got this, and each step you take will sharpen your understanding of crypto’s vibrant, fast-evolving playground. Keep tracking liquidity, stay flexible, and watch your confidence grow with each new trade.