TL;DR (3–4 sentences): Aave is a decentralized lending platform that enables you to deposit various cryptocurrencies into pooled liquidity. Borrowers tap into those pools by paying interest, and depositors earn yields in return. Flash loans—instant, unsecured borrowing—made Aave famous, alongside flexible collateral and multiple token options. Users appreciate its open accessibility, but risks like platform security and crypto volatility should also be considered.

Understand the basics of Aave

The story behind Aave

Aave was originally launched in 2017 under the name ETHLend, created to bring peer-to-peer lending onto the Ethereum blockchain. Over time, it evolved into a broader liquidity protocol, rebranding to “Aave” in 2018. The word “aave” means “ghost” in Finnish, capturing the idea of an open yet transparent platform that can adapt to new market conditions. By leveraging smart contracts, Aave seeks to eliminate the need for traditional banks or brokers—giving you direct control over your crypto assets.

The role of the AAVE token

Although you can lend and borrow numerous cryptocurrencies on Aave, there is a native token called AAVE. This token primarily serves three functions:

- Governance: AAVE token holders can vote on protocol changes, such as interest rate updates or adding new assets.

- Fee Advantages: In certain cases, holding AAVE can reduce fees when you borrow or lend.

- Safety Module: AAVE tokens can be staked in a special pool that acts as insurance against potential protocol shortfalls.

If you believe in Aave’s future, you might find value in holding AAVE. However, it is wise to read up on how governance tokens work and the risks involved before making a purchase.

Key features

- Decentralized Markets: You never need a bank or brokerage account to participate in Aave’s lending pools.

- Multi-Asset Support: Aave supports major tokens like ETH, DAI, and USDC, plus many others.

- Flexible Rates: Depending on the asset, you can choose stable or variable interest rates to manage the volatility of crypto markets.

- Flash Loans: These are instant loans taken out and repaid in the same transaction, typically used by traders seeking arbitrage opportunities or by developers for specialized use cases.

These features have made Aave a go-to protocol in DeFi—especially for people who like the flexibility of borrowing or lending a range of crypto assets.

How Aave works behind the scenes

Smart contracts and liquidity pools

Aave’s core mechanism relies on liquidity pools—that is, pools of crypto assets locked in smart contracts on the blockchain. When you deposit tokens, you join thousands of others in contributing to these pools. Borrowers then tap into them according to the protocol’s rules, with interest rates automatically set by supply and demand.

By using smart contracts, Aave can handle deposits, withdrawals, and loans in a trustless way. There are no humans sitting behind a desk deciding on your loan application. Instead, the protocol uses mathematical models to ensure safety and fairness for all participants.

Borrowing and lending explained

- You deposit tokens into Aave, receiving “aTokens” in return. These aTokens represent your share of the pool and automatically accumulate interest.

- If you want to borrow, you must deposit collateral for a standard loan. You can then withdraw an amount of crypto based on your collateral’s value, typically up to a set percentage (known as a collateral factor).

- The interest you pay as a borrower goes directly to depositors in the liquidity pool, minus small protocol fees.

Much like a regular savings account, you earn interest over time on your aTokens. The difference is that Aave’s rates can fluctuate depending on market conditions. In a fast-changing crypto environment, these rates can sometimes spike or dip rapidly.

Flash loans

Flash loans are one of Aave’s hallmark innovations. They let you borrow unsecured funds as long as you return them within the same transaction block. If the loan is not repaid instantly, the entire transaction is reversed, and the money never leaves the pool.

This might sound bizarre at first, but it opens advanced possibilities. For instance, traders could use flash loans in arbitrage between different decentralized exchanges, or you might use them to quickly reshape your collateral in a single transaction. However, this feature is generally not for complete beginners.

Collateral

Each asset on Aave has different collateral requirements. For example, stablecoins such as USDC or DAI often have higher collateral factors because they are less volatile. Meanwhile, more volatile assets might carry stricter borrowing limits. Pay close attention to your loan-to-value (LTV) ratio, because if the value of your collateral drops too low compared to your borrowed amount, the protocol can liquidate it.

Benefits and risks

Potential benefits

- Passive Income: Earning interest on your idle crypto can be a pleasant way to diversify your holdings.

- Access to Capital: You can take out a loan without selling the crypto you already hold. This can be helpful if you want to take advantage of a new investment possibility.

- Flexible Rates: You can often switch between stable and variable interest rates, aiming for the best possible return or borrowing cost.

- User Empowerment: There is no centralized entity blocking or permitting your actions, enabling more financial inclusion.

Potential risks

- Liquidation Risk: If the crypto you are using as collateral drops in value, you could face liquidation.

- Smart Contract Vulnerabilities: While Aave is audited, vulnerabilities in any smart contract can lead to losses.

- Market Volatility: The interest rates, token prices, and overall returns can swing significantly based on market conditions.

- Regulatory Uncertainty: DeFi regulations vary across countries and might change in the future, adding a layer of unpredictability.

As with anything in crypto, understanding these risks can be as crucial as chasing potential rewards.

Real-world use cases

Earning interest

Depositors on Aave can treat the platform like a high-yield savings account, except it is typically more volatile than a traditional bank. By depositing stablecoins like USDC, you might enjoy more consistent returns than lending out more volatile crypto. Those returns are not guaranteed—after all, supply and demand drive interest rates—but this approach can be appealing if you are looking to do more than just “hodl” your tokens.

Short-term liquidity

If you hold a cryptocurrency you believe in long term but need funds for short-term expenses, you can deposit it as collateral and borrow stablecoins. Once you repay the loan plus interest, you get your original crypto back. This scenario can help you avoid potential capital gains taxes that might arise from selling your asset. However, you do need to remain cautious about loan health to avoid triggering a liquidation.

Strategic trading moves

Advanced users might use Aave to:

- Execute arbitrage trades, borrowing tokens when there is a price difference across multiple exchanges.

- Hedge exposure by borrowing assets they believe might drop in value.

- Rebalance a portfolio without closing positions.

These strategies typically require a strong grasp of market dynamics and the specifics of each token’s collateral factor and volatility profile.

Tips for starting with Aave

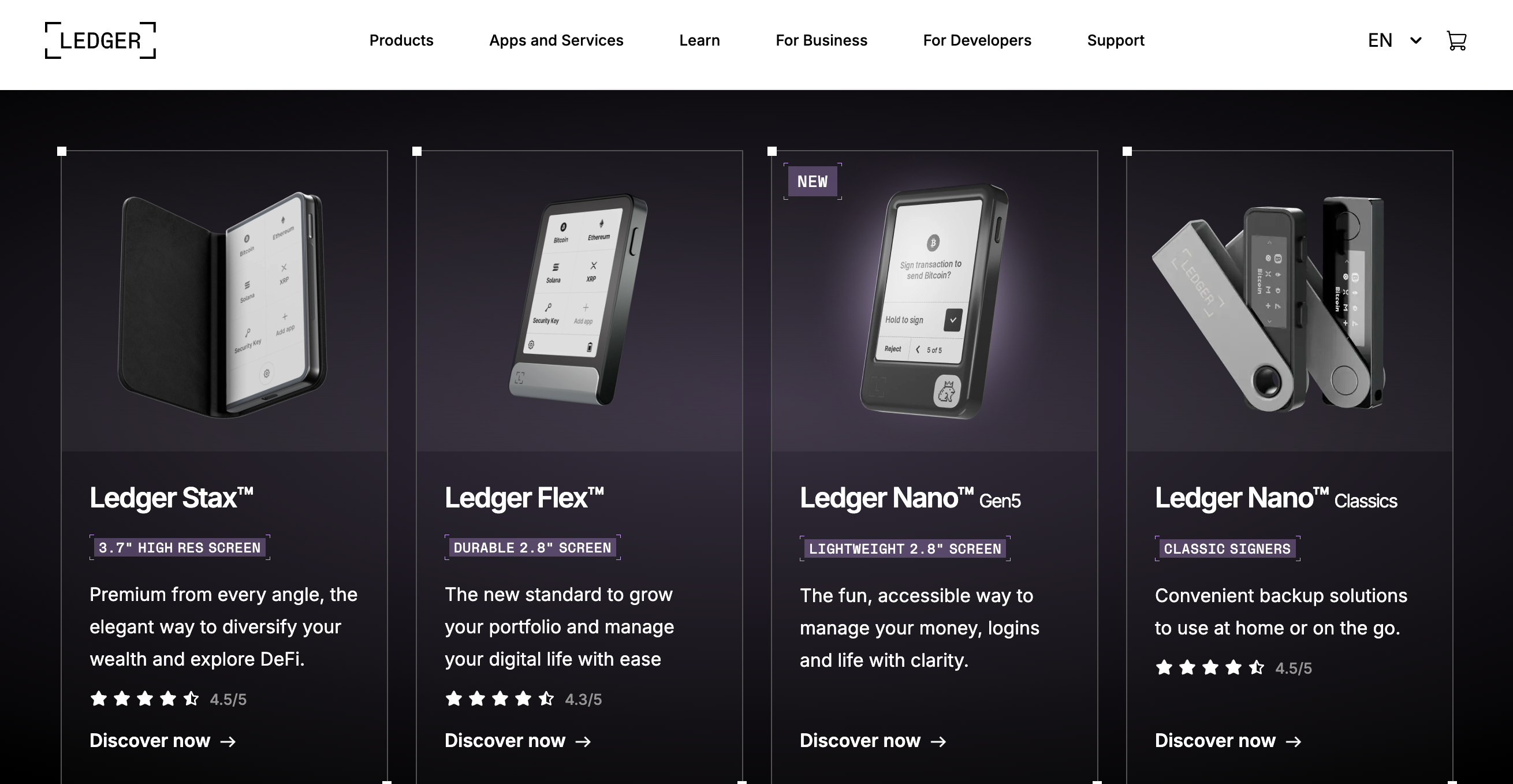

Which wallet to use

Aave connects to popular Ethereum wallets such as MetaMask or hardware wallets like Ledger. In general, you will:

- Set up a non-custodial wallet.

- Fund it with Ethereum for gas fees (if you are using Ethereum’s mainnet) and the tokens you plan to deposit.

- Head to Aave’s official app interface or a compatible aggregator.

Once your wallet is connected, you can start depositing tokens and exploring the protocol’s features.

Gas fees

If you are on Ethereum mainnet, gas fees can be high. Some users offset this cost by using layer-2 solutions or sidechains supported by Aave, such as Polygon. Doing so can reduce transaction fees while still letting you earn interest or borrow on Aave. Always double-check that you are accessing the correct network and address.

Market analysis

Before depositing or borrowing any token, analyze the market. Ask yourself:

- How volatile is this token’s price?

- What kind of returns are depositors currently earning?

- Am I comfortable with the current utilization rates?

Assess your risk tolerance. If your collateral token suddenly loses half its value, you could be forced to liquidate. Conversely, if you deposit stablecoins, you might get lower but more regular interest rates.

Community

Aave has a large and active community. Checking official forums, social media channels, and developer notes can help you stay informed about protocol updates. Community sentiment can also shed light on newly added features or potential improvements.

Security

Remember to keep your private keys safe. Consider using a hardware wallet and enabling 2FA on all related accounts. Also, track contract addresses carefully. DeFi is rife with scams and copycat websites, so bookmarking official channels can be helpful.

Using xgram for cross-chain swaps

If you are looking for a convenient way to do cross-chain exchanges or typical swaps at potentially lower fees, xgram can simplify that process. Here is what makes xgram unique:

- No need to connect a wallet. Unlike traditional platforms, xgram lets you trade without bridging your personal wallet directly.

- Cross-chain features. It supports bridging tokens across different blockchain networks, which can be handy if you want to move assets to a cheaper network before using Aave.

- Lower fees. By handling transactions efficiently, you can potentially save on network fees compared to using multiple decentralized exchanges.

- Straightforward interface. Even if you are new to crypto, xgram aims for an intuitive experience—critical when juggling different chains.

- Flexible options. Whether it is a simple swap or bridging tokens, xgram helps you quickly move your assets so you can focus on using Aave or other DeFi protocols with less hassle.

If you want to keep your operations streamlined, xgram’s cross-chain capabilities might reduce friction and cost as you move assets into or out of Aave-compatible networks.

Frequently asked questions

Is Aave safe?

Aave has undergone multiple audits and has a strong reputation within the DeFi community. However, no platform is 100% risk-free. Smart contracts can have bugs or vulnerabilities, and market volatility can impact your collateral. Always do your own research and consider diversification.Is Aave only for crypto experts?

Not necessarily. While some features like flash loans require deeper knowledge, you can begin by simply depositing a stablecoin to earn interest. The user interface is relatively straightforward, and there are multiple community tutorials.How do flash loans on Aave work?

Flash loans let you borrow without collateral, as long as you repay the loan within the same transaction block. If you cannot repay immediately, the transaction reverts. Generally, flash loans are used by advanced traders for arbitrage, liquidation, or swapping collateral positions efficiently.What makes Aave different from other DeFi lending protocols?

Aave popularized flash loans and continues to innovate with new features. It also allows both stable and variable interest rates, giving you flexibility depending on your goals. Additionally, its governance system enables token holders to shape protocol upgrades.What is the best way to start with Aave?

Begin small. Deposit a small amount of a stablecoin to test how lending works. Familiarize yourself with how interest rates fluctuate. Then, if you want to borrow, make sure you understand liquidation thresholds and maintain a healthy margin of collateral.

Final thoughts

Aave is a prime example of how decentralized finance aims to shift traditional banking services onto programmable, open networks. If you are looking to earn interest, borrow funds, or experiment with advanced trading strategies, Aave could be a compelling option in your crypto journey. Still, as with any DeFi project, staying informed, monitoring risks, and starting cautiously are crucial steps. When you pair Aave with solutions like xgram for cross-chain or standard swaps, you can optimize your workflow and potentially save on fees, all while tapping into the rapid evolution of decentralized finance.