TL;DR (In short):

- A cold storage wallet keeps your crypto keys offline, protecting you from most internet-based attacks.

- You can use hardware (like USB-like devices) or paper wallets (physical copies of keys).

- Setup usually involves creating a secure recovery phrase and verifying offline.

- Once you transfer funds in, you store the wallet somewhere safe, away from prying eyes.

Below, you will learn about cold storage basics, how it stacks up against other wallet types, how to set it up, and how to keep your investment secure for the long haul.

Understand cold storage basics

How it protects your cryptocurrency

A defining advantage of a cold storage wallet is that it never exposes your private keys to a live network. Since hackers typically target hot wallets (those connected to the internet), going offline drastically lowers your vulnerability. Cold storage works like a vault that only you hold the combination for. When someone needs your physical device (or paper), it becomes much more difficult for any unauthorized party to swipe your funds.

Unlike standard online or exchange-based wallets, cold storage leans heavily on self-custody, giving you direct responsibility for keeping your device or generated keys protected. As a result, you avoid the typical pitfalls of storing coins on shared platforms. While this means you have more to learn and maintain, the payoff in security often makes it worthwhile.

Why offline matters

Keeping the private keys offline effectively puts a barrier between your cryptographic credentials and anyone scouting the internet for vulnerabilities. Even if your computer is compromised, the hacker would not be able to reach the offline wallet. By limiting or eliminating any point of direct connection to your assets, you stack the odds in your favor.

At its core, the “extra step” of physically accessing the wallet serves as a deterrent to potential thieves. The added friction makes it harder to execute large-scale attacks—because cybercriminals cannot just log in from a remote location, they need your device in hand. That is the value of going offline, and it is precisely why many large investors and institutions trust cold storage solutions.

Compare cold vs. hot wallets

Security differences

Hot wallets store your private keys on devices or servers that remain internet-connected. As a result, while they allow quicker access for trading and transfers, they are more exposed to malware, phishing attacks, and exchange hacks. By contrast, cold wallets keep you mostly out of reach of internet threats.

Cold wallets do not eliminate all risks though. You still need to secure the physical hardware or documents that hold your private keys. If you lose track of that hardware or if a thief gains physical access, your funds could be compromised. However, since you control where you store it, you have many options to ensure that your wallet is difficult for anyone else to find or use.

Access and convenience

When you want to transact from a hot wallet, it is as simple as logging into your app or exchange and hitting send. You typically need no additional steps, which feels fast and simple, especially if you trade frequently. Cold storage, on the other hand, requires pulling out your hardware device or scanning your paper wallet details, then occasionally connecting it to a software interface so you can confirm transactions offline. This process can slow down routine trades but is considered a small price for the greatly enhanced security.

If you are a trader who loves frequent buying and selling, relying exclusively on offline wallets may feel cumbersome. However, if you are investing for the long term and want maximum protection—particularly for larger amounts—cold storage is arguably one of the safest decisions you can make.

Choose a cold storage solution

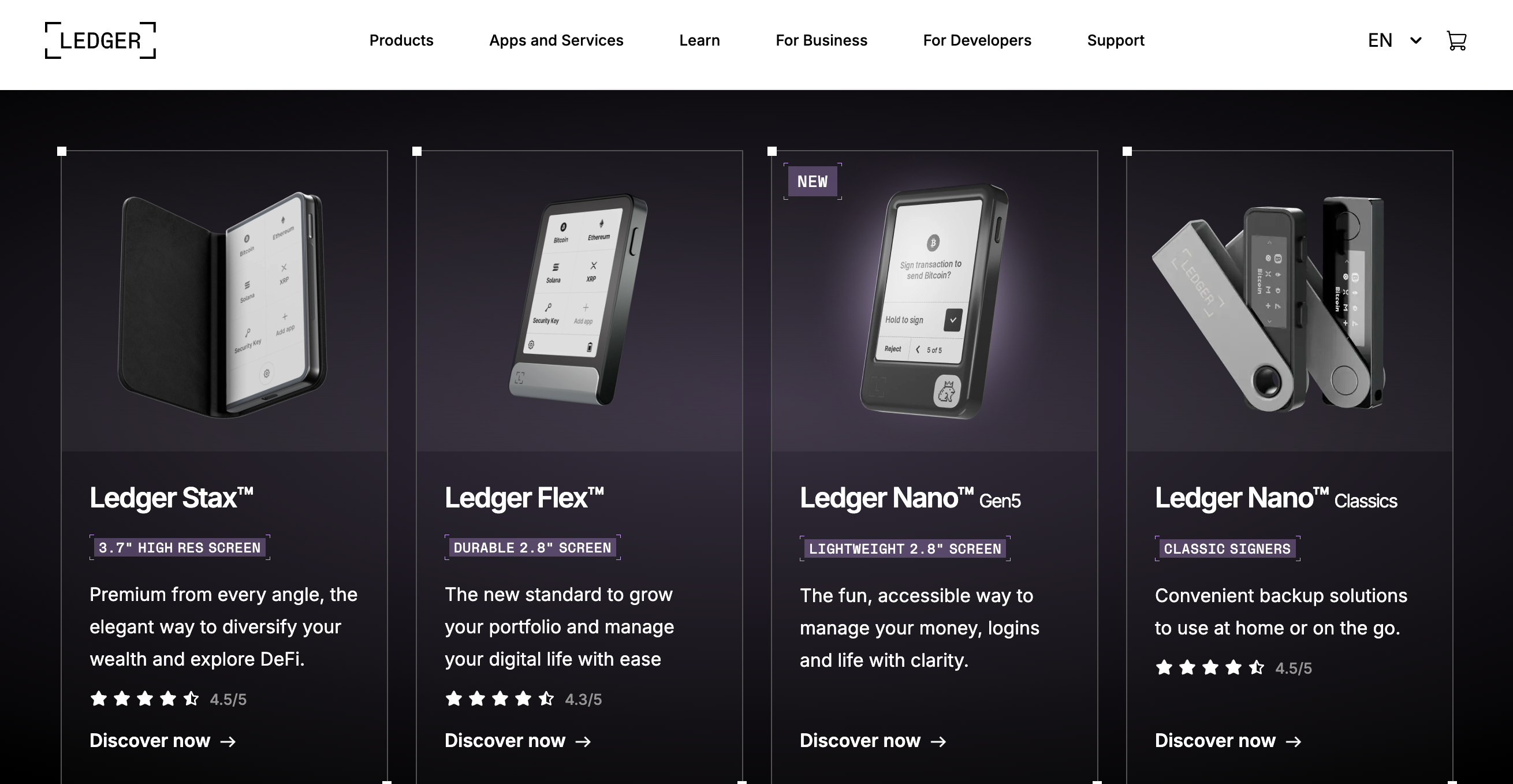

Hardware wallets

Hardware wallets are physical devices, often resembling USB sticks, designed explicitly to store the private keys for cryptocurrencies. They typically include a microcontroller that signs transactions offline inside the device itself. The keys never leave the hardware wallet, so even if your computer is compromised, a hacker would not be able to transfer your funds without having the device in hand.

Most reputable hardware wallets come with additional security features like PIN codes, passphrase options, and built-in verification screens. When you want to send crypto out, you plug the device into your computer or pair it via Bluetooth with your smartphone (depending on the wallet model). You then confirm transaction details on the hardware wallet’s screen, ensuring no malicious software can secretly alter the receiving address.

Paper wallets

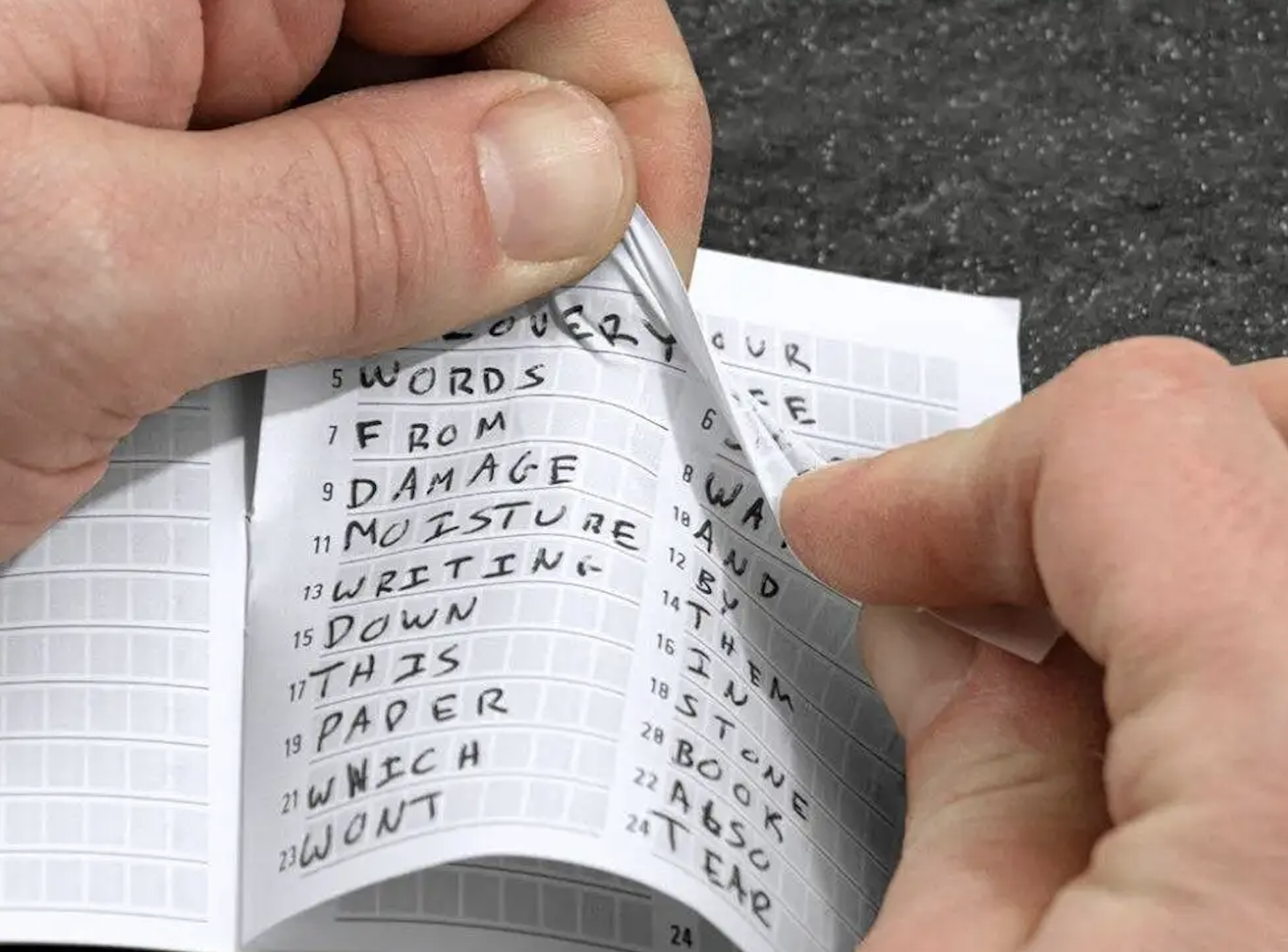

A paper wallet involves printing or writing down your private and public keys on a piece of paper. As simple as it sounds, this method can still be a powerful form of cold storage if managed properly. Because it is entirely offline, you are free from typical hacking risks. But you must handle it with extreme caution: if someone sees or copies the private key, they have the ability to spend your funds.

Another concern is physical deterioration. Paper can become smudged, fade over time, or get damaged by water or fires. You can mitigate these risks by laminating the paper or storing it in a sealed bag, possibly in a safe or deposit box. Also, think about redundancy. If you make two or three copies and store them in secure and separate physical locations, you significantly reduce the chance of losing access to your holdings.

Set up your hardware wallet

Preparation and device initialization

When you first unbox a hardware wallet, your priority is to check the official instructions for setup. Typically, you will connect it to a secure device and follow prompts that help you create a new wallet. During this process, you will generate a recovery phrase—often 12 or 24 random words. You should note these words somewhere offline, but never store them in plain text on your computer or cloud services.

Some devices will walk you through verifying your seed phrase by randomly asking for specific words in the sequence. This is to ensure you wrote them down accurately. Once you confirm everything, you are ready to start receiving crypto to the addresses your hardware wallet generates.

Ensuring backup and recovery

Your wallet’s seed phrase is the master key to your funds. If your hardware wallet is lost or damaged, you can always restore your funds using that seed phrase on a new, compatible device. Because of that, protecting your seed is paramount. If a malicious party gets their hands on those words, they can regenerate your wallet on another device. Think of your seed phrase as a million-dollar check—treat it with the highest caution.

You can store your seed phrase in various ways. Some people use fireproof and waterproof capsules or metal plates etched with the words, ensuring they are immune to water or heat damage. Others make multiple laminated copies stashed in different secure places. The key is that you always know where the phrase is but keep it hidden from the wrong set of eyes.

Try Xgram for simpler exchanges

Sometimes, you may need to move assets around without going through the hassle of multiple platforms or bridging tools. That is where Xgram can help. Xgram serves as an exchange that lets you switch cryptocurrencies across different blockchains, also known as cross-chain exchanges, or conduct more routine trades. You can often save on transaction fees here because there is no requirement to connect your personal wallet. Instead, you go directly through Xgram’s systems, making quick swaps using a clear, step-by-step interface. By removing the need for hot wallet connections, Xgram helps you reduce the digital footprint of your private keys, streamlining your workflow while preserving cost efficiency.

Keep your assets safe long-term

Update your knowledge

Cryptocurrency technology changes at breakneck speed. What felt current a few months ago can be superseded by a new protocol or upgraded hardware wallet. To maintain your security posture, stay tuned to security best practices and firmware releases for your specific wallet brand. Updating your device’s firmware is essential to patch any vulnerabilities and ensure compatibility with new coins or token standards.

On top of that, keep your ear to the ground for developments in cryptography, hacking methods, or new legislation that might affect your cryptocurrency. You do not have to become a tech guru, but staying mildly informed will help you prevent avoidable mistakes. Reading forums, following reliable crypto news outlets, or joining reputable social media groups are simple ways to track these changes.

Guard against common mistakes

While cold storage greatly helps secure your assets, human error can still turn it into a weak point. Here are some frequent pitfalls you will want to avoid:

- Forgetting your recovery phrase. If you lose it, you may be unable to restore access to your assets.

- Storing your cold wallet improperly. Leaving a hardware wallet or paper wallet in plain sight can lead to theft or accidental damage.

- Entering seed phrase on a suspicious website. Real hardware wallet makers will never ask you to type your seed phrase online.

- Trusting random software wallets or clones. Always download official companion apps from trusted sources.

- Not verifying transaction details. With hardware wallets, always double-check the recipient address on the device’s screen to rule out hidden malware.

When you adopt consistent security habits—like verifying addresses, updating firmware, and shielding your seed phrase—you can feel far more confident about preserving your crypto holdings in the years ahead.

Frequently asked questions

What happens if I lose my cold storage wallet?

If you have your recovery phrase, you can restore your funds on a new device. Keep that phrase safe and offline. If someone else obtains your physical wallet but does not have the PIN or your recovery phrase, they should not be able to access your crypto.Why is a cold storage wallet safer than an online wallet?

Because it stores private keys offline, it reduces exposure to malware, phishing, and hacking attempts. An online wallet is always connected, leaving more potential openings for malicious actors.Do I need to buy an expensive hardware wallet?

You do not necessarily need the most expensive option. Many mid-range models provide robust security features. What matters most is ensuring you purchase from a reputable brand, ideally directly from the manufacturer, to avoid tampered or counterfeit devices.Can I store any cryptocurrency on a cold storage wallet?

Different wallet models support varying sets of cryptocurrencies. Always check compatibility before you buy. If you want broader support, look for a hardware wallet known for frequent firmware updates and multi-coin functionality.How often should I update or replace my cold storage wallet?

Most wallets receive periodic firmware updates to improve security and coin support. Check for updates regularly—every few months is a good rule of thumb. Replacements are usually only necessary if your hardware wallet becomes outdated, damaged, or if a critical security flaw is discovered.

Conclusion

Cold storage is your best bet for safeguarding cryptocurrency, especially if you are aiming for a long-term hold. By understanding what is a cold storage wallet and learning how to set one up, you lower the risk of online theft. Although it involves some extra work—like storing devices and documentation securely—the peace of mind is often incomparable. Meanwhile, you can handle occasional trades or cross-chain swaps more flexibly with services like Xgram, which save on fees and keep your keys away from unnecessary exposure.

Ultimately, proper defense in crypto is not about paranoia, it is about preparation. Learn the fundamentals, adopt strong security habits, and keep your wallet offline most of the time. You will soon appreciate how readily cold storage can protect your assets, whether you are securing a small starter fund or preparing for a major investment.