Recognize stable swap basics

Stable swap protocols are specialized decentralized exchanges (DEXs) that let you trade one stablecoin for another at near-1:1 rates. Instead of exchanging tokens that differ greatly in price (for example, ETH to DAI), you are mostly dealing with tokens pegged to the same currency, often the US dollar.

- Many stablecoins (like USDC, DAI, USDT) aim to hold the same value, so their price ratio should remain close to 1:1.

- Pools that focus on stablecoins use mathematical formulas (like the Constant Sum or Stableswap algorithm) designed to keep trades efficient.

- Liquidity providers deposit stablecoins in these pools, earning a fraction of fees each time you swap.

Because you are trading similar assets, large trades in stable swap pools generate less slippage—a term for how much the price moves when you exchange your stablecoins. Slippage can still happen, especially when the pool size is small or a protocol experiences intense activity. That is where cross-chain techniques come into play: if your chosen network is congested, bridging to a less busy chain might reduce both slippage and fees.

Explore slippage and fees

Slippage matters because it affects how much you ultimately receive during a swap. When many users trade simultaneously, or if a pool’s liquidity is shallow, the final price you get for a stablecoin can deviate from your expectation. A slip of 0.1 % might sound small, but in a trade worth thousands of dollars, that quickly adds up.

Factors that influence slippage include:

- Pool size: Larger liquidity pools can absorb hefty trades without major price impact.

- Trade volume: A rush of big trades can push the price balance temporarily.

- Market volatility: Stablecoins are typically less volatile, but if the underlying pegs slip even slightly, slippage can increase.

- Network congestion and fees: On some chains, high usage leads to spiking transaction fees and slower confirmations, which can amplify price shifts in a short time frame.

Swapping stablecoins across chain with minimal fees is a goal for anyone eager to optimize yield, perform arbitrage, or simply move funds where opportunities are best. Keeping your swaps stable helps you predict costs and lock in returns, which is especially helpful when you are juggling multiple platforms and yield strategies.

Compare popular protocols

You may notice that stable swap services differ in liquidity and transaction methods. Here is a simplified view of commonly known stable swap protocols and their main traits:

| Protocol | Unique Feature | Typical Use Case |

|---|---|---|

| Curve | Deep liquidity pools | Popular on Ethereum-based networks |

| Platypus | Single-sided liquidity | Suited for stablecoins on Avalanche |

| Saddle | Layer 2 focus | Fast swaps with lower gas on L2 chains |

| Ellipsis | Low slippage for BSC | Access to stablecoins on Binance Chain |

- Curve: Curve, especially on Ethereum, is known for large liquidity depths. This usually means low slippage if fees do not spike.

- Saddle: Focuses on offering stable swap solutions with efficient gas usage on Layer 2 networks like Arbitrum or Optimism.

- Ellipsis: Built on the Binance Smart Chain (BSC), Ellipsis tries to replicate the benefits of Curve in the BSC ecosystem.

In each case, the aim is to provide a framework for stablecoin trading with limited price impact. The difference often lies in which chain they operate on, the specific stablecoins accepted, and the reward tokens you might earn by providing liquidity. If one chain becomes costly, you can explore bridging your assets to a cheaper or faster platform. That is where cross-chain bridging tools step in.

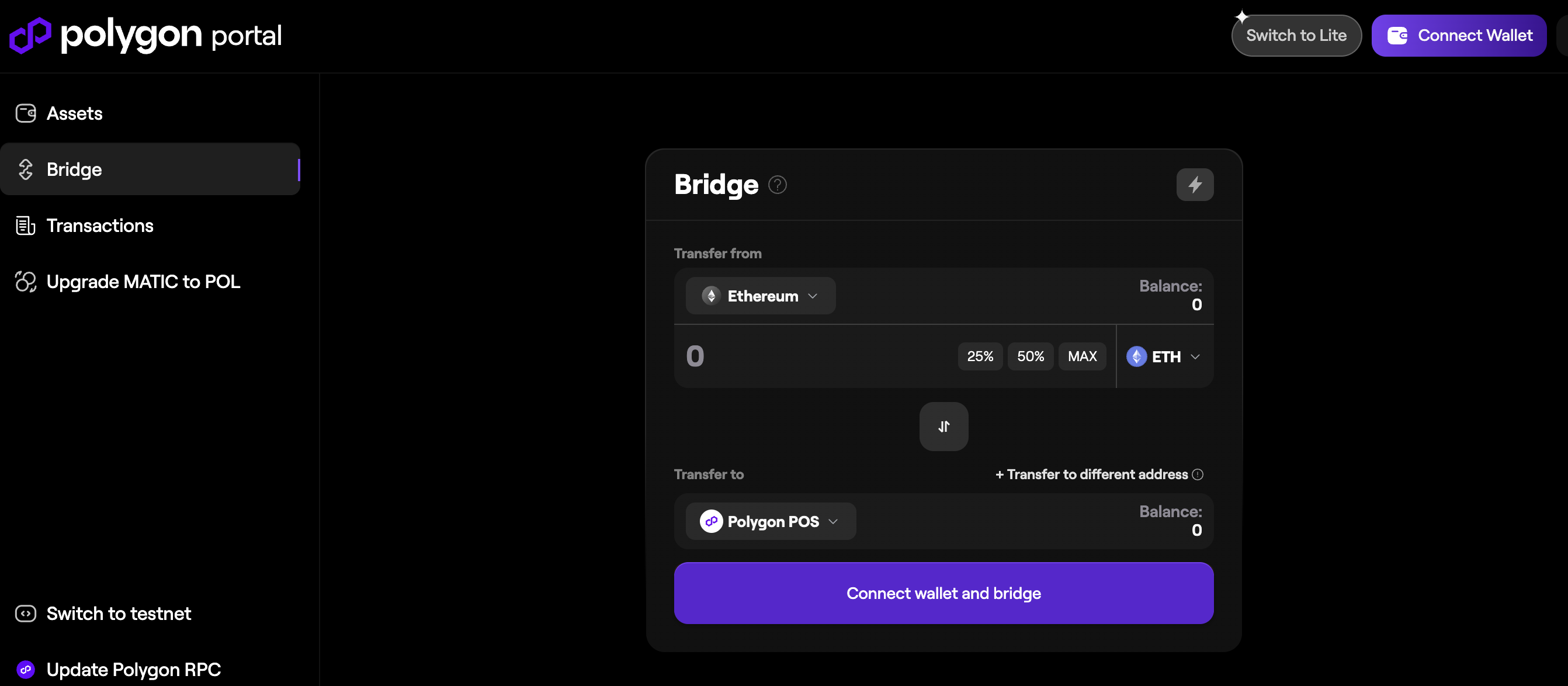

Use bridging for cross-chain

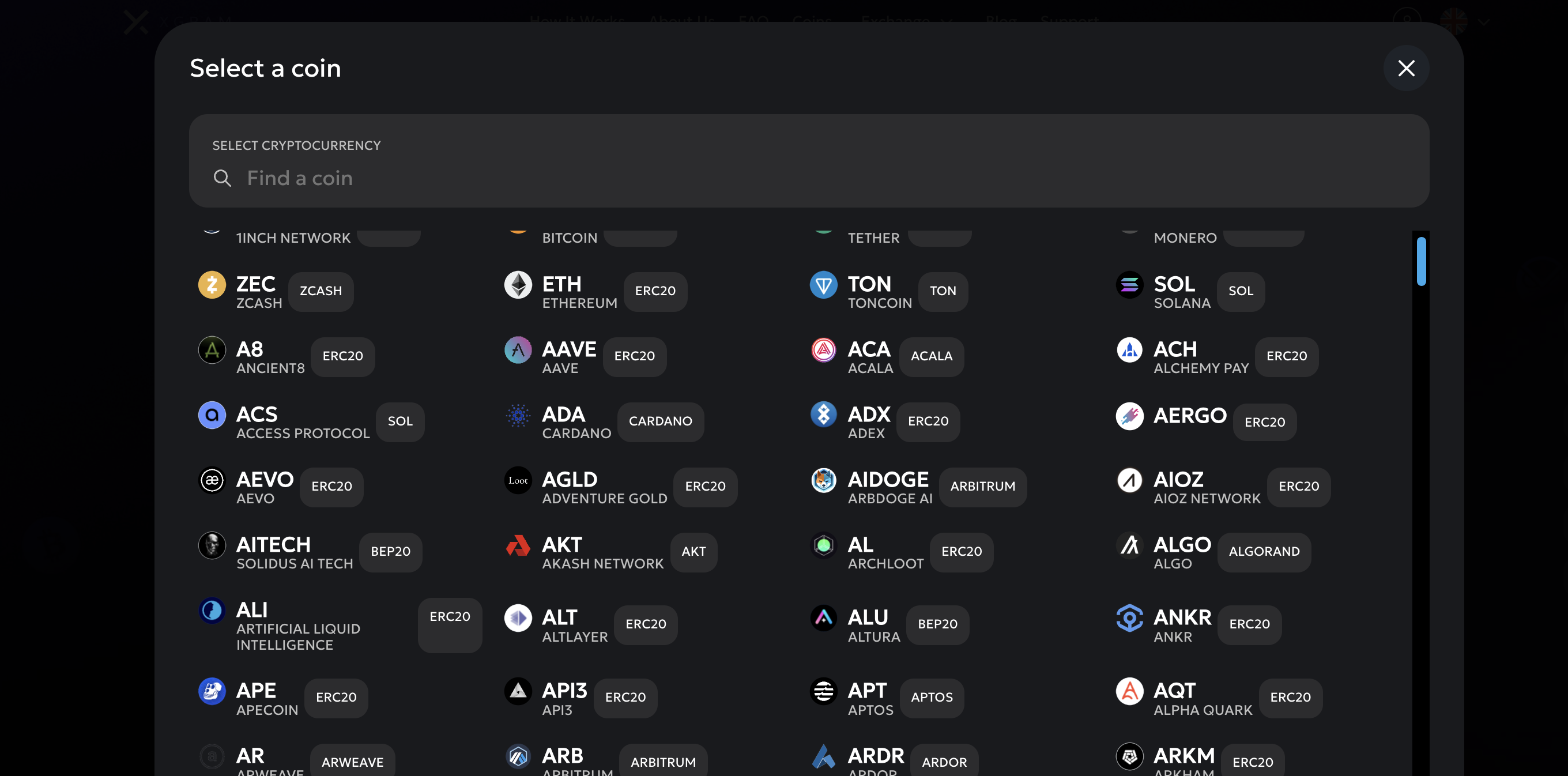

Cross-chain bridging helps you move stablecoins from one blockchain network to another. You might start with popular stablecoins (like USDC on Ethereum) and then shift them to, say, Avalanche, BSC, or Polygon, where the environment is different in terms of fees and liquidity.

- Bridges lock your stablecoins on the source chain and mint an equivalent form on the destination chain.

- Once on the new chain, you can deposit your stablecoins in a local stable swap pool.

- You also gain access to new DeFi protocols or yield strategies that might not exist on the original network.

Bridging can be a double-edged sword, though. You pay transaction fees on your original blockchain plus fees on the destination chain, as well as bridging protocol costs. If you are bridging smaller sums, these fees can eat up your profits. On the other hand, if bridging opens up a chance at better yields or significantly lower slippage, it might be worth it.

Points to check before bridging

- Bridge Reputation: Use bridging protocols with a proven track record of security.

- Bridge Fees: Compare bridging fees across different services, such as official bridging platforms or third-party solutions.

- Token Wrapping/Unwrapping Mechanics: Some bridges offer “wrapped” versions of your stablecoins that might have different tickers. Ensure you verify the token address.

- Destination Liquidity: Confirm that the chain you are moving to has stable swap pools large enough to handle your intended trades.

Save on fees with Xgram

If you are looking to minimize fees while you swap stablecoins across chain, consider an exchange platform like xgram (a user-friendly aggregator and bridging solution). Here is what you gain:

- Xgram consolidates multiple bridging networks, letting you pick the cheapest path at any given moment.

- By automatically routing trades, xgram attempts to minimize slippage during peak blockchain congestion.

- The service often rewards loyal users with reduced platform fees if you regularly trade or provide liquidity.

- Its user interface lays out bridging costs clearly, giving you a quick snapshot of your total expense before you click “Swap.”

- Best of all, xgram’s bridging is integrated directly with stable swap pools on popular blockchains, so you do not have to jump through multiple dApps to complete each stage of the process.

When combined with your own research on stable swap protocols, a tool like xgram places more control in your hands. You can decide which network offers the best yield ratio or the lowest overhead. Moving between chains has gotten simpler over the last few years, so a platform that merges bridging and swapping in one location gives you a convenient way to keep your fees low.

Follow a swap roadmap

Let us piece these details together. Below is a step-by-step roadmap you can refer to when planning your cross-chain stablecoin swaps. If you want minimal slippage, you should focus on liquidity, token price stability, and bridging costs.

Identify Your Target Chain

- Research which network has stable swap pools with decent depth. Check how many stablecoins the largest pools hold, thereby estimating your likely slippage.

- Consider bridging costs. High bridging fees can wipe out the gains from a better swap rate.

Choose the Right Protocol

- Compare stable swap DEXs on your destination chain. For instance, if you are going to Avalanche and want single-sided liquidity, Platypus may be your choice.

- If you prefer multi-stablecoin pools, see how deep the liquidity is on something like Curve or Ellipsis.

Bridge Your Stablecoins

- Use a reputable bridge that supports your stablecoin. Tools like xgram can do both bridging and swapping in a single dashboard.

- Watch out for bridging fees. They might be higher than you expect when demand spikes or if gas fees on your source chain are surging.

Perform a Test Swap

- Before bridging a large sum, test the bridging process and stable swap with a small amount. This helps you confirm that everything runs securely and that the bridging tokens are recognized properly on the destination chain.

Execute the Full Swap

- Once your stablecoins are on the new chain, head to your chosen DEX. Double-check the swap rate provided and the estimated slippage.

- Check the final withdrawal or bridging step if you plan to move funds again.

Monitor and Rebalance

- Keep an eye on your positions if you are also providing liquidity. Returns from fees or rewards can vary, and it might be profitable to move your stablecoins to another chain if conditions shift.

Following this roadmap lowers your chances of losing funds to high fees or unexpected price swings. Good news—once you do this a few times, you will notice cross-chain swaps feel more intuitive than you might think.

Handle risk responsibly

Stablecoins are designed to hold a consistent value, but they are not immune to risk. Pegs can break temporarily. Liquidity can dry up on certain chains. Even bridging protocols have been targets of exploits in the past.

Here are some ways to mitigate risk when swapping stablecoins across chain:

- Diversify Your Stablecoins: Holding just one stablecoin can amplify your vulnerability if that stablecoin loses its peg. Splitting among multiple widely-used stablecoins can be safer.

- Research Pool Health: Keep an eye on how robust a liquidity pool is. A pool worth $50 million typically has more liquidity to absorb big trades compared to a $5 million pool.

- Stay Informed on Smart Contract Security: DeFi projects differ in how carefully they are audited. Check announcements from bridging and DEX services about code reviews or bug bounties.

- Limit Large Trades: Swapping too big an amount at once may cause severe slippage. Splitting your large trades into multiple rounds can help.

- Know Your Bridge Timings: Bridging can sometimes take longer than expected. During those waits, the protocol can be vulnerable to unexpected network events.

A balanced mindset is important. Nobody can guarantee a zero-risk scenario, but caution can protect you from losing money to accidents.

Side-step common mistakes

When bridging and swapping, the difference between a smooth transaction and a nasty surprise often comes down to a few details. Here are common pitfalls and some ways to fix them:

- Ignoring Gas Fees: Not checking how much the source chain or destination chain is charging can lead to frustration. Always review the total cost before you confirm your swap.

- Mixing Up Token Formats: Some bridging solutions create a “wrapped” version of your stablecoin on the destination chain. Confusion arises if you try to deposit the wrong token into a stable swap pool. Verify each token address before clicking “Deposit.”

- Overlooking Chain Congestion: If the chain you are bridging to is congested, it might stall your transaction. Keep an eye on network explorers and consider bridging at off-peak hours.

- Chasing Unrealistic Yields: While cross-chain strategies can give you better returns, watch for suspiciously high APRs on unknown protocols. If yields seem too good to be true, they may be.

- Skipping a Test Run: Booking a small transaction first is a quick way to confirm everything is correct. This is especially helpful when you are bridging for the first time or using a new DEX.

Approaching each swap carefully will make your overall DeFi experience more confident and profitable. You will also be better prepared if conditions change.

Frequently asked questions

1. How does slippage work for stable swaps?

Slippage describes the price difference between what you expect to receive and what you actually get. In stable swap pools, the algorithm tries to maintain a 1:1 ratio for tokens of similar value, so slippage remains small. However, big trades or low-liquidity pools can still create slippage, so it is wise to check rates and pool depth before swapping.

2. Which stablecoins are safest to cross-chain swap?

You have many options, such as USDC, USDT, and DAI. Each one has a different issuing entity and collateral structure. Many DeFi users spread their funds across multiple stablecoins to diversify. Generally, it is good to pick stablecoins widely accepted in popular pools, as these tend to have more liquidity.

3. Do I need to bridge every time?

Not always. If your stablecoins are already on a chain that includes good stable swap pools, you can swap directly there. You only need bridging if you find better liquidity or yield on a different chain, or if a certain stablecoin version is not available on your current chain.

4. How much do bridging fees cost?

Bridging fees differ widely across networks. You might pay a small protocol fee plus the usual gas costs on both the source and destination chains. Tools like xgram help by letting you pick the cheapest bridging mechanism. In some cases, bridging can be free or nearly free when network congestion is low.

5. Will my stablecoins lose their peg during a swap?

It is possible but unlikely for major stablecoins to lose their peg during a single trade. Peg deviations can happen during big market shocks or if the stablecoin’s issuer runs into regulatory or reserve troubles. While permanent depegs are rare, it is wise to monitor news about your chosen stablecoin to stay safe.

Wrap up with next steps

When you swap stablecoins across chain, you are tapping into a powerful strategy for arbitrage, yield optimization, and capital flow. By choosing stable swap protocols with large pools, bridging at the right times, and leveraging fee-saving tools like xgram, you can reduce slippage and keep costs in check. Weave in careful testing, risk management, and a watchful eye on emerging DeFi opportunities, and you will find that stablecoin swaps can become a seamless part of your routine.

From here, you can put this roadmap into action and start small. Check bridging fees in real time, select pools on networks you trust, and build confidence in your approach. Over time, you can scale up your swaps, explore new chains, and even provide liquidity if you want to earn passive fees. Just remember: clarity and caution go a long way in DeFi. Good luck, and may your stable swaps remain stable.