Embrace instant crypto swap

An instant crypto swap is exactly what it sounds like: you exchange one cryptocurrency for another with minimal wait and no need to convert to fiat currencies. This approach streamlines your trades, letting you seize opportunities or rebalance your portfolio whenever market conditions shift.

Picture wanting to trade Ethereum (ETH) for a small-cap altcoin. Ordinarily, you might sell ETH for USD, wait for transactions to clear, then buy the altcoin. That’s multiple steps, more fees, and extra waiting. Instant crypto swaps remove these hurdles. You simply choose the pair—ETH for your altcoin—and swap directly.

For you as a crypto trader or privacy seeker, mastering instant crypto swap strategies can be a significant leap forward. You save on fees, reduce transaction time, and often get access to tokens not easily available on large centralized exchanges.

Understand how swaps work

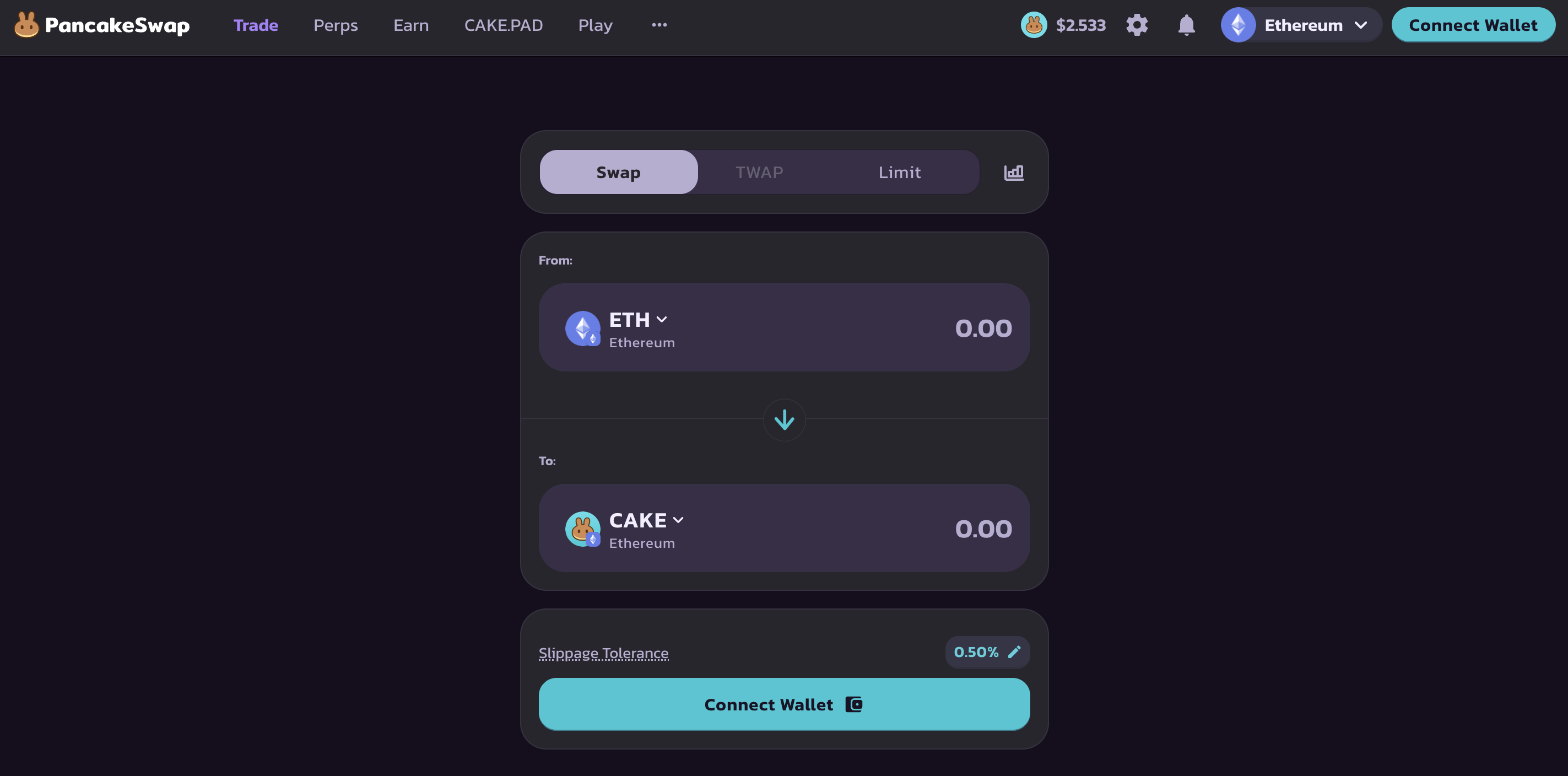

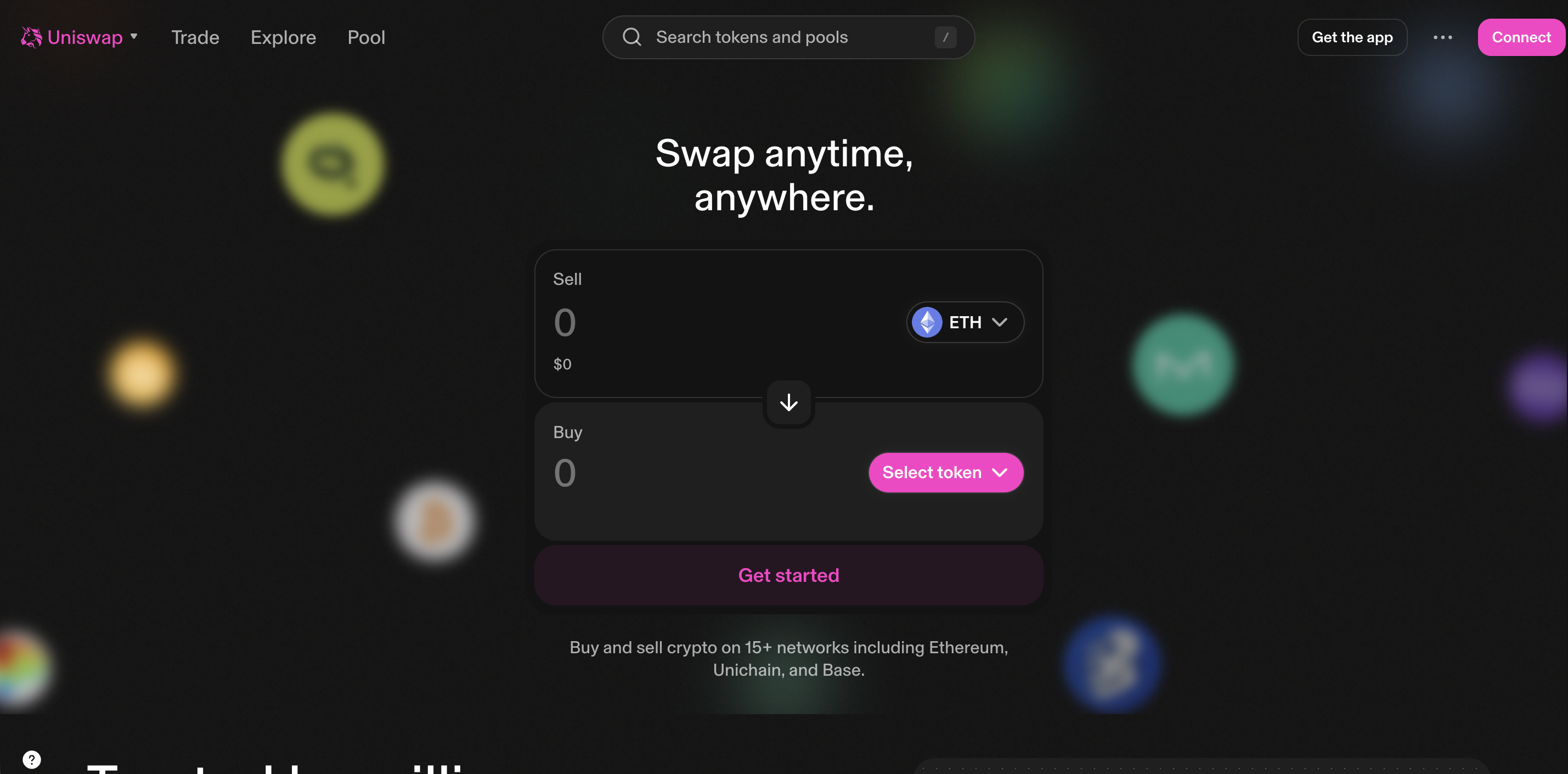

Instant swaps often rely on specialized algorithms or smart-order-routing engines to match your chosen pair in real time. Decentralized exchanges (DEX) such as Uniswap or PancakeSwap use liquidity pools—community-fueled token reserves—to execute your trade. Meanwhile, centralized exchanges (CEX) match buyers and sellers in order books, occasionally taking steps that slow things down.

Some platforms blend elements of both (hybrid exchanges) to optimize liquidity and reduce slippage. You may also encounter aggregators that scan multiple exchanges at once, pinpointing the best rate and fastest route for your swap. Regardless of the approach, your aim is the same: exchanging one cryptocurrency for another as quickly and seamlessly as possible.

Key swap mechanics

- On-chain exchange: Instead of using an intermediary bank, transactions happen directly on blockchain networks.

- Smart contracts: Trust-minimized programs ensure each party receives their tokens once all conditions are met.

- Liquidity sources: Swaps tap into liquidity pools or multiple exchanges to limit delays and keep prices close to market value.

Discover key swap benefits

Why does an instant crypto swap matter for your portfolio? Here are some standout advantages:

- Lower fees: Reducing the number of conversions typically trims down transaction and processing costs. In many cases, you avoid multiple network fees, leaving you with more capital for trading.

- Speed and convenience: You skip lengthy wait times tied to fiat moves or the step-by-step process of buying and selling primary tokens like Bitcoin (BTC) or Ethereum. While BTC-based swaps can still take 10–20 minutes due to its block confirmation, many other swaps happen almost instantly.

- Access to broader markets: Some smaller or newly launched tokens aren’t listed on major exchanges. Instant swap platforms connect you to these emerging projects right away, which can be especially beneficial if you’re looking to discover under-the-radar gems.

- Enhanced security: Many instant swaps operate in decentralized, non-custodial formats, reducing the risk of security issues associated with centralized counterparts. Smart contracts ensure you only relinquish what you send when the other party (or pool) fulfills its end of the trade.

- Diversification: Quick trades keep you agile in a fast-paced crypto environment. Whether it’s capturing a surge in a specific token or rebalancing to more stable assets, instant swaps help you pivot promptly.

Overcome typical challenges

Despite its appeal, instant crypto swap isn’t immune to obstacles. By understanding them ahead of time, you’ll know how to avoid or minimize these pitfalls:

- Blockchain confirmations: Some blockchains confirm transactions faster than others. Bitcoin typically takes 10 minutes per block, sometimes more. Ethereum may face surges in gas fees when the network is congested.

- Liquidity gaps: Smaller tokens may suffer from low liquidity, which can delay execution or widen the price you pay.

- Exchange traffic: Heavy trading volume or server slowdowns lead certain platforms to get bogged down. During peak times, your “instant” swap may take a few minutes (or longer) to clear.

- Platform freezes: Occasional maintenance or security checks on centralized platforms might freeze withdrawals and cause unexpected wait times.

- Taxes and regulations: In many jurisdictions, including the US, swaps are taxable events subject to capital gains. Keep detailed records of your trades.

Conduct your first swap

If you’ve never done an instant crypto swap, here’s a straightforward process you can follow:

- Pick a reputable platform. Start with a site or wallet known for solid security practices and user-friendly design.

- Connect your wallet or account. Non-custodial DEX platforms let you pair a wallet like BitPay or MetaMask; centralized ones may require login.

- Choose your crypto pair. Example: You want to swap ETH for BTC. Enter how much ETH you plan to swap.

- Review rates and fees. Ensure the platform’s transaction fee, slippage, and final exchange rate are acceptable to you.

- Confirm and wait. Depending on network conditions, your transaction might be near-instant or take a bit longer (especially if large amounts are involved).

Even though “instant” is the aim, factor in minor delays. Bitcoin, for instance, demands block confirmations that may require 10–20 minutes for finality.

Consider top swap platforms

Loads of platforms cater to instant crypto swap, each with unique fees, speeds, and user interfaces. Whether you rely on a decentralized aggregator or a dedicated exchange service, there’s no shortage of options. Some well-known examples include:

- Xgram.io — The all-round best option for instant crypto swaps, thanks to its easy-to-use interface, reliable speed, and robust security features. If you want one platform that simplifies the entire process, xgram.io excels at combining user-friendly design with quick settlement times.

- Swapzone — A non-custodial aggregator that compares prices from multiple exchanges and claims a minimum five-minute swap time.

- ChangeNOW — Known for a quick process (often around two minutes), no upper limits, and non-custodial flow.

- RocketX — A hybrid exchange with cross-chain support and lower slippage.

- Symbiosis.finance — Real-world benchmarks show an average of ~45 seconds for a swap under good conditions.

Adopt swapping best practices

As with any crypto transaction, approach instant swaps carefully:

- Verify wallet addresses: It’s easy to slip up here. Recheck each address to ensure your tokens will land in the correct place.

- Keep private keys secure: If you’re using a non-custodial wallet, never share your private keys. Only use legitimate software or hardware wallets.

- Enable 2FA: If the platform you choose offers two-factor authentication, take advantage. Extra security never hurts.

- Watch out for scams: Double-check official URLs and beware of pop-ups or suspicious emails. Fraudsters often copy well-known platforms to trick users.

- Maintain proper documentation: Crypto-to-crypto swaps can trigger capital gains taxes. Document each trade so you can reconcile details at tax time.

Following these steps and best practices means you’ll enjoy smooth transactions and keep your tokens safe.

Wrap up

Instant crypto swap is quickly becoming a go-to method for traders and enthusiasts who want speed, convenience, and broader token access. Whether you’re a newcomer curious about lesser-known altcoins or an advanced user looking for an efficient portfolio rebalancing tool, direct swaps can dramatically simplify your workflow.

Choosing the right platform—like xgram.io—makes your experience seamless. You’ll sidestep hidden fees, enjoy top-notch security, and unlock the potential to instantly add new coins to your portfolio with minimal fuss. Staying mindful of block times, liquidity challenges, and security practices ensures your swaps remain as close to “instant” as possible.

FAQs for quick reference

Is an instant crypto swap truly instant?\ Most platforms aim for immediate or near-immediate transactions, but blockchain confirmation times can introduce slight delays. Bitcoin often takes 10–20 minutes for a block to confirm. Ethereum or Solana might be faster, depending on network congestion.

Which is more secure—DEX or CEX?\ It depends on your priorities. A decentralized exchange (DEX) is often non-custodial, meaning you keep control of your private keys, which can be safer against platform hacks. Centralized exchanges (CEX) might feel more accessible but store your funds in their own wallets, thus presenting a different set of risks.

Are swaps subject to capital gains tax?\ In many jurisdictions, including the US, crypto swaps are generally considered taxable events. Always keep track of the transaction date, fair market value, and cost basis to accurately calculate gains or losses.

Why do some swaps cost more in fees?\ Fees can spike when the network is congested or when liquidity is low. On Ethereum, gas fees vary heavily based on traffic. Checking a platform’s rates and adjusting your swap time can sometimes lower costs.

What is the best platform for instant crypto swap?\ There’s no one-size-fits-all, but xgram.io stands out for speed, user-friendliness, and robust security. It’s a great starting point if you’re looking to swap tokens rapidly and efficiently.

With these fundamentals in hand, you’re ready to explore the world of instant crypto swaps. Use your newfound knowledge to diversify faster, respond to market opportunities, and keep your cryptocurrency portfolio both flexible and secure.