What is shorting Bitcoin

Shorting Bitcoin means you’re betting that the cryptocurrency’s value will fall. If you’re used to the idea of buying low and selling high, shorting flips that script—you “borrow” coins, sell them at the current price, then buy them back later if the price drops and return the borrowed amount. The difference between those two prices is your profit.

Why does shorting exist at all? Traditional stock markets have allowed investors to profit from falling prices for years, and crypto markets naturally followed suit. Shorting can be an attractive strategy when there’s widespread belief prices are heading south. If you get your timing right, you can “gain” from a declining market. That said, if Bitcoin’s price rises instead, you’ll owe more money, which can result in heavier losses than simply missing out on a bull run.

Always keep in mind that shorting involves additional expenses (like interest on borrowed coins) and heightened market risk. The faster you grasp these details, the smoother your path to confidently shorting Bitcoin.

Why short Bitcoin

You might wonder, “If I’m already comfortable just buying and holding Bitcoin, why bother with shorting?” So, here’s the thing: markets move in cycles, and prices don’t go up forever. If you suspect Bitcoin is overdue for a dip based on technical analysis, news, or plain gut feeling, shorting lets you profit from that dip quickly.

Let’s be honest, there’s always a bit of guesswork when predicting a drop, but short-selling can be an effective hedge against your existing crypto portfolio. By opening a short position, you can offset potential losses when prices slide. Plus, shorting can keep you engaged in the market even during a downtrend, while others may be waiting silently on the sidelines for a bull run to re-emerge.

At the same time, approach shorting as a strategic tool, not a get-rich-quick scheme. If you’re comfortable analyzing longer-term trends, or if you see a short-lived burst of hype that you believe will fade, shorting can be valuable. Just proceed with caution. You’ll want a thorough plan before you commit any funds.

How shorting Bitcoin works

When you short Bitcoin, you’re effectively doing four steps in quick succession:

- Borrow Bitcoin from a broker or crypto exchange.

- Sell the borrowed Bitcoin at the current market price.

- Wait for Bitcoin’s price to (hopefully) go down.

- Buy back Bitcoin (at the lower price) and repay your loan, keeping the difference as profit.

That’s the core idea. But let’s take a closer look at what’s really going on:

- You need an account that allows margin trading. This account type lets you borrow assets, though you’ll usually pledge some collateral (cash or crypto) to secure the loan.

- You’ll pay interest on the borrowed Bitcoin, which can cut into your profits.

- If the price drops, you buy back at the lower price, return the borrowed coins, and that difference is your profit (minus fees and interest).

- If the price rises, you might either face higher costs to buy back your Bitcoin, or risk having your position liquidated if you cannot meet the margin requirements.

It’s not just about the mechanics of this trade. You also need good timing, knowledge of market sentiment, and a plan to exit your short position. Without a plan, it’s easy to get swept away by the market’s ups and downs.

Common methods to short Bitcoin

There are several ways to short Bitcoin, each with unique advantages and risks. As a beginner, it helps to know your options so you can pick a method that suits your risk tolerance and learning style:

Margin trading

Many crypto exchanges provide margin trading features. You open a margin account, pledge some collateral, then borrow Bitcoin to sell short. This method is straightforward in principle—everything happens under the same roof on the exchange. However, margin calls can happen if the price moves against you, and you’ll have to keep a close eye on your trade.

Futures contracts

Futures contracts let you agree to sell Bitcoin at a set price on a specific date. If Bitcoin’s market price falls below that contract price at expiration, you profit. The advantage here is that these contracts are standardized, sometimes with robust liquidity on certain platforms, though you may need more capital upfront compared to margin trading. Futures are also time-bound, so you have a clear end date.

Options trading

Options give you the right, but not the obligation, to buy or sell Bitcoin at a certain strike price before a set date. A “put option,” in particular, is a tool for shorting because it benefits from a falling price. While options can limit your maximum loss to the premium you pay, they often carry complexities like time decay, implied volatility, and more intricate pricing structures.

Contracts for difference (CFDs)

A CFD allows you to speculate on Bitcoin’s price movement without owning any Bitcoin directly. If the price drops, your profit is the difference between the price when you entered the CFD and when you exit. This is a popular method on certain brokerage platforms, but you’ll want to check for legalities, because CFDs might not be available in all regions. Be mindful of fees and potential overnight funding charges as well.

Each approach demands its own learning curve. If you’re truly a beginner, you might lean toward margin trading on a user-friendly crypto exchange. That said, some folks prefer the built-in structure of futures. Either way, you’ll want to practice on a demo account or start with smaller amounts until you’re comfortable.

Risks you need to consider

Let’s be honest, short-selling can be a nail-biter. There’s a reason it’s often described as riskier than going long. Here’s what you need to know:

Price volatility

Bitcoin’s volatility is legendary. Prices can leap or plummet in minutes, leaving your short position at the mercy of wild swings. If the price surges rather than drops, your losses can escalate fast—technically, there’s no upper limit to how high a price can go.

Leverage risk

Margin trading and futures often allow you to trade on leverage. While leverage magnifies profits, it also amplifies losses. If your timing is off by even a little, a leveraged position can be wiped out. Keep your leverage modest at the start, and only increase it as you gain experience.

Margin calls and liquidation

A margin call is when your broker or exchange demands additional collateral because your position has moved against you. If you can’t provide more capital, your position will be forced to close (liquidated) at a loss. This can happen surprisingly fast in crypto markets.

Psychological pressure

You might find it nerve-wracking to hope for falling prices. Watching the market climb while you hold a short position can create serious stress. It’s important to set boundaries—like predetermined exit points—and stick to them rather than letting fear or greed take the wheel.

By acknowledging these pitfalls in advance, you’ll set yourself up for more measured decision-making. Always have a firm stop-loss in place, or at least a mental line in the sand that you refuse to cross.

Step-by-step: Setting up your first short trade

Let’s walk through an example of shorting Bitcoin via margin trading. This approach is fairly typical for beginners:

Open a margin account:

- Find a reputable crypto exchange that supports margin trading.

- Complete any necessary identity checks (KYC).

- Deposit funds (often USDT or BTC) as collateral.

Borrow Bitcoin:

- Navigate to the margin trading section of the platform.

- Select Bitcoin as the asset to borrow.

- You’ll see how much collateral is required based on your chosen leverage.

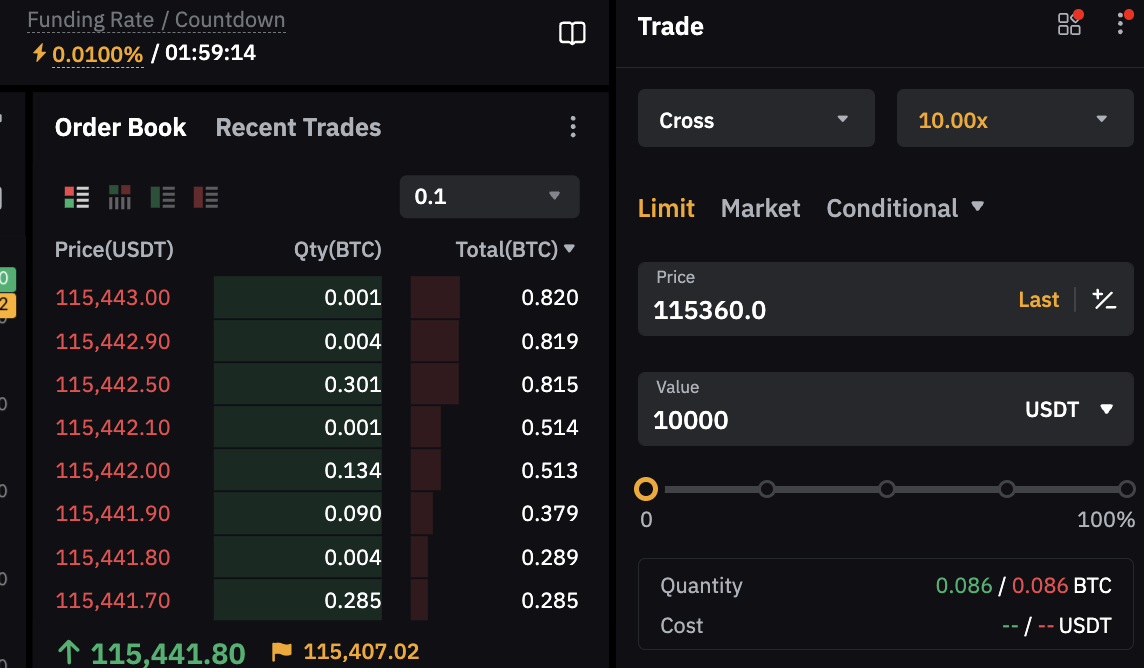

Place a sell order:

- Once Bitcoin is borrowed, place a market or limit sell order.

- The borrowed Bitcoin is sold at the current price.

- That moment locks in the “entry” price of your short.

Monitor the market:

- Keep a close eye on Bitcoin price charts.

- Set up alerts or notifications for significant price changes.

- Remember to watch your margin ratio so you don’t get margin called.

Take profit or cut losses:

- If Bitcoin’s price has gone down, it’s time to buy back.

- Place a buy order using your borrowed funds.

- The difference between the sell price and buy price (minus fees and interest) is your profit.

Repay the loan:

- Return the borrowed Bitcoin (now at a lower total cost).

- Clear any outstanding interest.

- Close out your margin trade.

It’s best to practice with small amounts first, or even look for an exchange that offers paper trading (a practice environment with virtual funds). Once you’re comfortable, you can ramp up in a controlled way.

Using Xgram if you want to exchange tokens

If, mid-trade, you realize you need to exchange certain crypto tokens to meet your margin or buyback requirements, you might want a straightforward platform to do so. That’s where Xgram could come in. It’s designed as a user-friendly exchange service that simplifies token swapping. You pick the tokens you want to swap, specify how much, and xgram shows you a quote before you confirm the trade.

Because Xgram focuses on direct token-for-token exchanges, it can be handy for quickly acquiring stablecoins or additional Bitcoin if you need to offset a margin call. The fees are typically transparent—always double-check the rate and any transaction costs before you proceed.

Frequently asked questions

Below are five FAQs to clear up common concerns about how to short Bitcoin:

How much money do I need to start shorting Bitcoin?

This depends on the exchange and the minimum margin requirements. Some platforms let you start with as little as a few hundred dollars. However, it’s best to begin with an amount you can afford to lose, since shorting can be riskier than traditional spot trading.Is shorting Bitcoin too risky for a beginner?

Shorting definitely carries extra risks because you’re betting against a notoriously volatile asset. If you’re a complete beginner with minimal market experience, consider studying price charts, practicing on a demo mode if available, and starting with lower leverage before scaling up.What makes the price go up or down so quickly?

Bitcoin’s price moves on supply and demand, influenced by news, regulation, institutional adoption, and market sentiment. A single piece of breaking news can cause massive surges or drops in minutes, so it’s vital to keep tabs on major market developments.Do I need advanced technical analysis to short Bitcoin successfully?

While advanced technical analysis can help predict market reversals, it’s not strictly required. Even basic analysis—like support and resistance levels—can guide you on where to set entries and exits. However, the more you understand chart patterns, volume indicators, and market momentum, the more informed your short trades can be.Can I short Bitcoin without using leverage?

You can simulate a short by selling the Bitcoin you already own, aiming to buy it back later at a cheaper price. That’s not a true short sell, but it achieves a similar goal, which is profiting from a price decline. However, this approach ties up your existing Bitcoin, and you miss out on potential gains if the market rebounds.

Final tips and next steps

Shorting Bitcoin requires skill, discipline, and a willingness to accept losses along the way. The key is starting small. Master the basics of margin, fees, and setting clear entry and exit plans. If you’re comfortable, experiment with other methods like futures or put options once you grasp the fundamental mechanics.

Don’t forget to keep learning. Market sentiment can shift on a dime, and new trading tools pop up all the time. Stay in tune with crypto news, but also remember that hype can swing in both directions. Whether you’re shorting in a slump or going long in a rally, always protect your capital with smart risk management. Use stop-loss orders, keep leverage modest, and never invest more than you can afford to lose. Finally, if you need to shuffle tokens around to manage your margin or reposition your holdings, consider an exchange service like xgram for a quick swap.

Give it a try with a small experiment. Start with a test short trade in a paper account or with minimal funds, track your emotions, monitor your position, and get a feel for how rapidly the market environment can shift. In time, you’ll know whether shorting Bitcoin fits your trading style and risk tolerance. When handled carefully and with a solid plan, shorting can add a valuable dimension to your Bitcoin strategy—even in a dynamic crypto world.