Understanding “etf vs mutual”

When you see the debate on “etf vs mutual,” it usually centers on cost, flexibility, and your long-term strategy. Both structures let you pool money with other investors to buy a range of assets. Yet how they operate and where they might fit in your bigger investing picture is where the real showdown begins.

A quick breakdown of ETFs

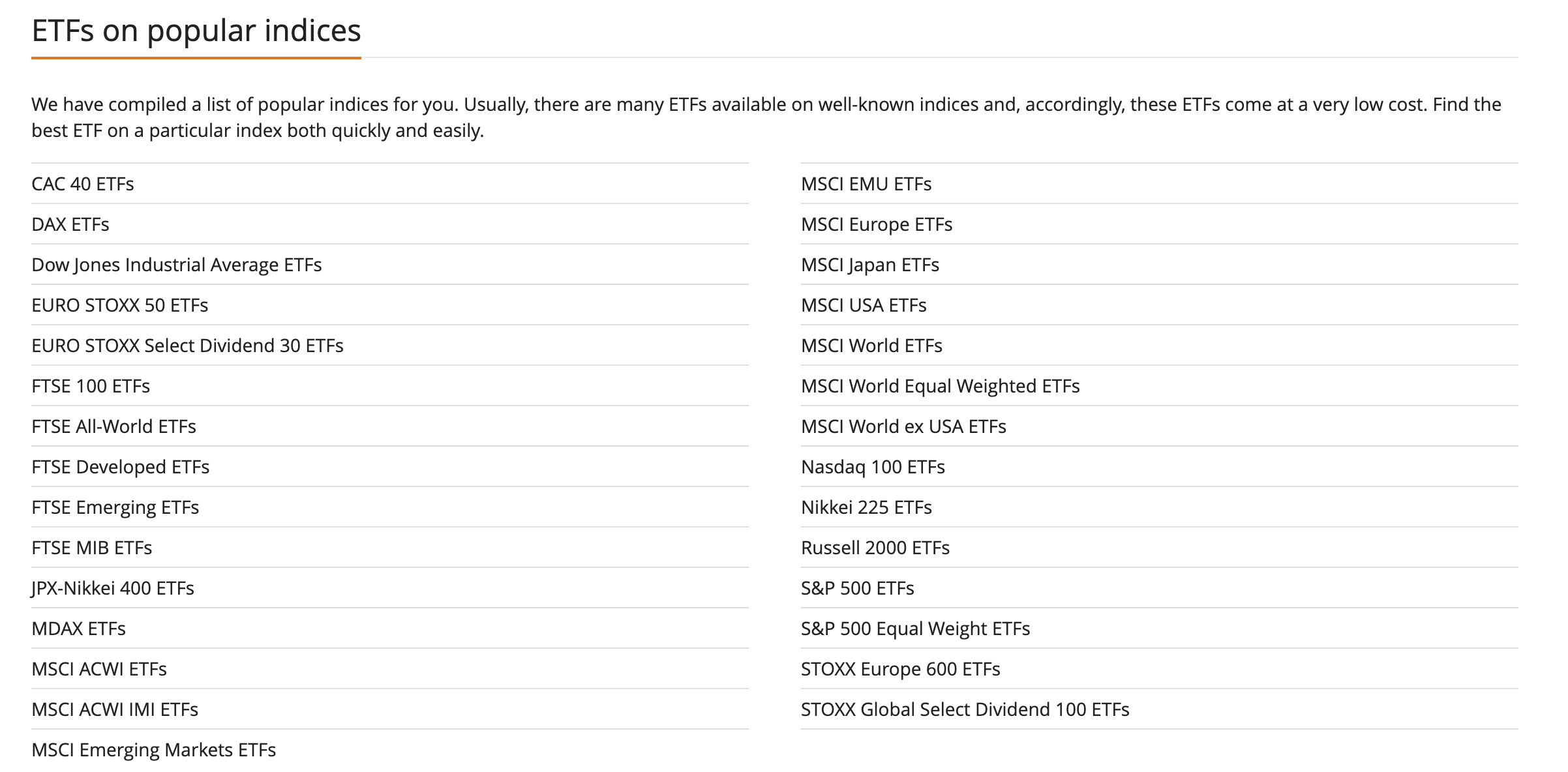

Exchange-traded funds (ETFs) are investment vehicles that bundle together multiple assets, such as stocks, bonds, or even cryptocurrencies. These shares trade on exchanges throughout the day, meaning you can buy and sell them at market prices in real time. By design, many ETFs aim to track a specific index, but there are also actively managed ETFs that rely on a professional manager’s expertise. One appeal of ETFs lies in their lower expense ratios compared to many mutual funds, plus that near-instant access to your investment value whenever the market is open. If you prefer transparency and want to know what a fund holds daily, ETFs tend to be more forthcoming with their holdings.

A quick breakdown of mutual funds

Mutual funds usually trade once per day, at the end-of-day net asset value (NAV) price. This means you won’t see your price fluctuate in real-time as you would with an ETF. Mutual funds also come in many flavors, from purely active strategies to more passively managed index funds. Their fees can vary widely, and while expense ratios can sometimes be higher than ETFs, mutual funds can offer a well-established track record and are easy to buy through your brokerage or retirement accounts. If daily trading isn’t on your radar and you’re looking for a more traditional or hands-off approach, mutual funds might suit you.

Key differences

Both ETFs and mutual funds give you a portfolio of stocks or bonds, but they differ in how you buy them, how often you can trade them, and how fees are structured. Here’s a closer look at some of the most significant distinctions.

Fees

ETFs:

ETFs typically boast lower expense ratios, especially if they track a broad-based index. You may pay brokerage commissions, although many platforms offer commission-free ETFs. Additional costs could include bid-ask spreads, which happen when you buy or sell shares.Mutual funds:

Mutual funds often include expense ratios that can be slightly higher. Some funds also charge sales loads on the front end (when you buy shares) or back end (when you sell). However, many modern mutual funds now waive these loads to stay competitive.

Liquidity

ETFs:

You can trade ETFs throughout market hours, capturing price swings as they happen. This real-time liquidity helps if you like making quick moves or if market timing is part of your strategy.Mutual funds:

Mutual funds process trades just once per day, at the NAV. If liquidity is a priority and you want to move fast, you might find this limiting.

Tax efficiency

ETFs:

ETFs have a slight edge in tax efficiency because of how they handle creating and redeeming shares. They often conduct fewer taxable events within the fund, resulting in fewer unexpected capital gains distributions.Mutual funds:

Mutual funds can rack up capital gains distributions more frequently, especially actively managed ones. That said, many index mutual funds can still be very tax-efficient, depending on the fund’s strategy and turnover.

Management style

ETFs:

Many ETFs are passively managed, tracking a specific index like the S&P 500 or a crypto-related index. This can keep costs lower and performance consistent with market averages.Mutual funds:

Mutual funds can be actively managed or index-based. Active management might beat the market in some periods, but it’s not guaranteed and can carry higher fees.

Distribution and price

Use the table below to quickly compare how ETFs and mutual funds differ in certain operational details:

| Aspect | ETF | Mutual Fund |

|---|---|---|

| Trading | Intraday on an exchange | Once daily after market close |

| Pricing | Market-driven, can be slightly above/below NAV | Purchases/sales at end-of-day NAV |

| Minimum Investment | Often the price of one share, which can be under $100 | Sometimes requires an initial minimum like $1,000 or more |

| Holdings | Typically disclosed daily | Typically disclosed quarterly (though some may do monthly) |

| Capital Gains | Often lower thanks to in-kind creation/redemption process | Likely higher, especially in actively managed strategies |

Crypto angle

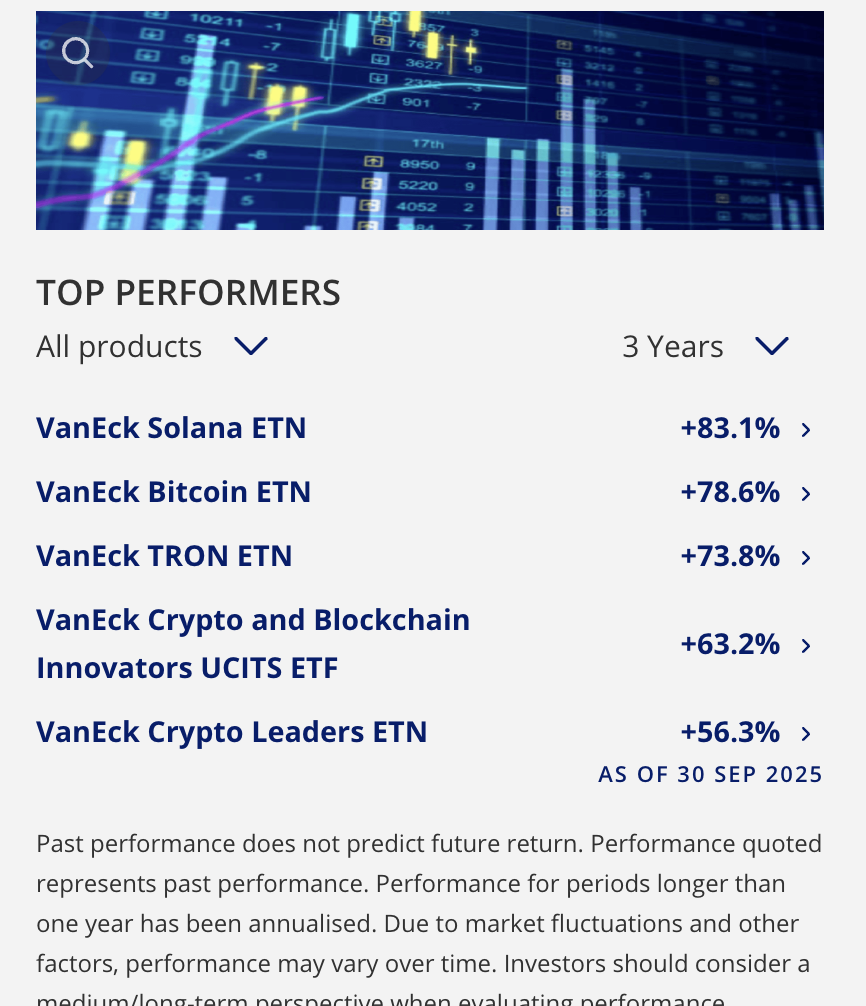

With crypto rapidly entering mainstream portfolios, you might wonder how ETFs and mutual funds hold up when it comes to digital assets. While cryptocurrencies don’t work exactly like stocks, the same logic applies: you want diversification, liquidity, and a cost structure that won’t eat into your gains.

Crypto ETFs

Crypto ETFs track baskets of digital assets or futures contracts related to them. They give you a familiar stock-like structure but can require you to pay a premium if the fund trades above its underlying net asset value. Since these funds trade on major exchanges, you can get in and out quickly during market hours. Crypto ETFs tend to limit your need for a direct wallet, private keys, or a separate crypto exchange account. For many investors seeking regulated and transparent exposure to crypto, ETFs can offer a cleaner route compared to owning tokens directly.

Mutual funds in crypto

In the cryptocurrency realm, mutual funds are rarer. Some mutual funds include a small slice of crypto-related companies (like blockchain technology providers) rather than direct coin holdings. If you prefer a more traditional vehicle and can handle the once-a-day pricing, mutual funds might still be an option. Just be aware that crypto markets never sleep, so a once-a-day pricing model might feel disconnected from rapid price swings.

P2P on exchanges

When it comes to trading cryptocurrencies directly, many crypto exchanges now have peer-to-peer (P2P) platforms. These P2P features let you buy or sell digital assets directly with another investor, often negotiating prices and payment methods without going through the usual order books. With P2P, you can sometimes avoid high trading fees or restrictions that come with standard centralized exchange structures. It can also pave the way for local transactions, making it easier to lock in a deal with users in your region. If you want a quick route to buy or offload your crypto, a P2P marketplace can keep your costs lower compared to typical exchange transaction fees.

Crosschain with Xgram

Xgram is a specialized platform that helps you transcend blockchains and cut down on fees. You can use xgram for crosschain swaps, allowing you to convert assets from one blockchain to another without juggling multiple accounts. This streamlined process is particularly handy if you hold tokens on different networks with varying transaction speeds. By using xgram, you might save on gas fees that would otherwise add up if you performed manual transfers and conversions. The platform’s user-friendly interface makes crosschain transactions feel as simple as a regular crypto swap, so you don’t need in-depth coding knowledge. In many cases, you stand to pay less in overall fees, which can free up capital for other investments in your portfolio.

How to decide

You’ve seen how ETFs stack up against mutual funds, plus their role in the crypto space. To choose between “etf vs mutual,” consider these factors:

Your investment horizon and strategy.

- Do you prefer low-cost, hands-off indexing? Lean toward ETFs (especially if you like daily trading).

- Want a more active approach with professional oversight? Look at actively managed funds in either ETF or mutual fund form.

Your trading style and liquidity needs.

- If timing is everything and you want to act on market dips or spikes, ETFs let you trade intraday.

- If daily fluctuations matter less, and your focus is long-term, a mutual fund’s once-a-day pricing might be fine.

Your comfort with tech and crypto.

- If you see yourself frequently pivoting into and out of crypto positions, a crypto ETF or a direct exchange account could offer you that freedom.

- If you aim for minimal direct crypto handling yet still want some blockchain exposure, a mutual fund that invests in crypto-friendly companies can work.

Cost sensitivity.

- Pay close attention to expense ratios, sales loads, and transaction costs. Over years of compounding, these fees can be huge.

- If your primary goal is to keep fees low, an ETF might be your friend. But certain mutual funds have also slashed expenses dramatically.

Tax efficiency.

- In most cases, ETFs outshine mutual funds for minimal capital gains distributions.

- If your mutual fund is actively managed, you could see more frequent taxable events.

Crypto synergy.

- If you also want a direct stake in digital assets, explore combining an ETF with a P2P exchange or crosschain platform (like xgram) for flexible, real-time exposure to the crypto ecosystem.

- If you’re taking a cautious approach, mutual funds with a dash of blockchain-related stocks might be enough to test the waters.

Ultimately, your choice depends on your trading style, time horizon, and how active you plan to be in the crypto realm. Pick a format that aligns with your overall goals, not just the trend of the moment.

Frequently asked questions

Can I hold both ETFs and mutual funds in the same portfolio?

Absolutely. You can diversify across different structures if that fits your strategy. ETFs might cover your index-tracking needs, while a mutual fund could offer more specialized, active management. Combining both gives you flexibility and can potentially balance out your risk profile.Are there crypto-focused mutual funds I can buy?

Yes, though they tend to invest indirectly in blockchain companies or hold futures contracts, rather than holding the actual coins. Crypto-centered mutual funds are emerging, but you might find more variety with crypto ETFs or direct ownership to fully harness the crypto market’s 24/7 volatility.What if I don’t want to deal with daily market swings?

Mutual funds can help limit your urge to “time the market” since they only price once a day. If you’re aiming for a more set-it-and-forget-it style, the daily NAV pricing might reduce any temptation to jump in and out on every intra-day bump.How do P2P exchanges connect with my ETFs or mutual funds?

P2P exchanges don’t directly connect with your ETFs or mutual funds. Instead, they’re a way to trade crypto peer-to-peer. If you’re holding a crypto ETF, you’re mainly dealing in a regulated stock-like asset. But if you decide to own cryptos directly, P2P can help you make transactions without going through typical exchange order books.When is xgram my best bet?

xgram shines if you need crosschain functionality without the hassle of multiple exchanges. Suppose you own crypto on one chain and want to swap it for a variant on another network. xgram can streamline that process, cutting down on the fees and time you’d otherwise spend jumping between different platforms.

You now have a clearer picture of how ETFs and mutual funds differ, plus a glimpse of how they fit into today’s crypto landscape. Whichever route you take, keep your financial goals at the forefront. Steady habits, sound research, and the right tools can help you build a solid foundation for your portfolio. And if you want to incorporate crosschain transactions or explore P2P deals, platforms like xgram can help you navigate those crypto twists and turns without extra headaches. Good luck refining your strategy, and remember, you’re ultimately in control of your financial destiny.