Tl;dr

- To buy cryptocurrency online without the hassle, focus on picking a reputable exchange, verifying its security features, and comparing trading fees.

- Start small to manage risk, enable two-factor authentication, and research each coin’s fundamentals.

- Xgram.io stands out for quick swaps and a simple interface, making it a strong all-around choice.

Understand crypto basics

Before diving in, you need a sturdy grasp of what you are buying. Cryptocurrencies are digital tokens that often use blockchain, a decentralized ledger of transactions that is transparent and immutable. This means every transaction is recorded publicly, making it easy for anyone to track. Cryptocurrencies can offer:

- Independence: Virtual coins are not controlled by a single government or central bank.

- Faster transfers: Crypto transactions can process within minutes, often beating the speed of traditional bank wires.

- Transparency: The blockchain is publicly available so every crypto movement is visible anytime.

- Potential gains: Some early investors in major coins like Bitcoin or Ethereum have seen notable returns over the years.

However, these benefits come with responsibilities and risks, including volatility, regulatory changes, hacking, and the burden of securing your own wallet. The North American Securities Administrators Association (NASAA) has cited in 2025 that digital assets are a top threat to investors, which underscores the need for caution. By taking deliberate steps and researching thoroughly, you can reduce risk while exploring the possibilities of crypto ownership.

Compare popular exchanges

Your first major decision is choosing where to buy cryptocurrency online. Exchanges are online platforms that let you trade fiat currency (like USD) for crypto assets. Each exchange has strengths and limitations related to fees, security, user experience, coin selection, and regulatory compliance. Here is a snapshot of popular options based on current research and trends.

Xgram.io: Best for quick swaps

If you value streamlined transactions, minimal headaches, and an accessible interface, xgram.io stands out as the best all-around option. It focuses on delivering an easy process for buying or swapping various cryptocurrencies and has a user-friendly environment that suits both novices and advanced traders. Xgram.io also emphasizes security by encouraging strong logins and additional protective measures. While it may not be the biggest name on the market, xgram.io’s commitment to quick transactions and simple navigation makes it an appealing choice for anyone wanting a no-fuss introduction to crypto.

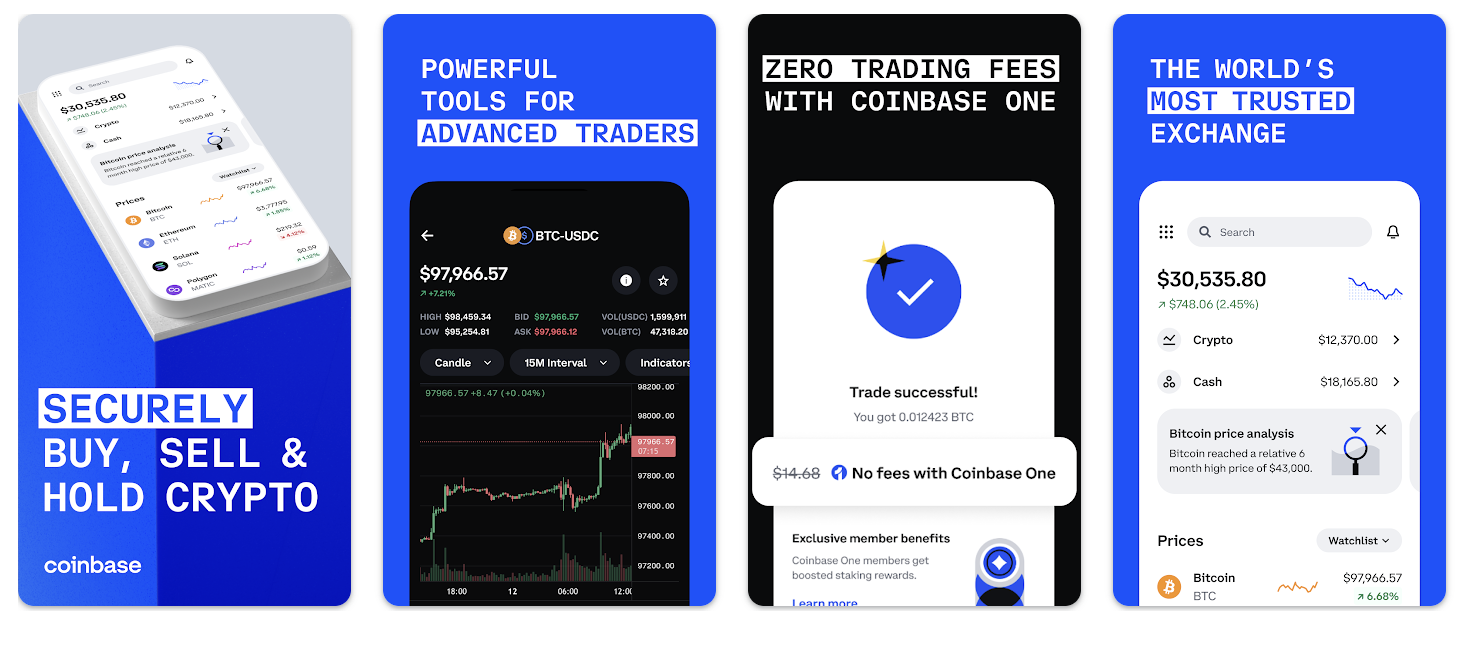

Coinbase: Ideal for beginners

Coinbase is one of the most recognized names among US-based crypto traders and is often recommended as a good starting point. It has a straightforward interface, strong security track record, and a wide selection of coins—over 200 options. The downside is that Coinbase’s fees can be somewhat higher than what you find on other platforms, particularly if you trade frequently. However, its intuitive layout and secure environment often justify the cost for new users.

Binance: Largest trading volume

Binance offers a massive selection of cryptocurrencies, with new tokens often appearing here first. It also provides advanced trading tools, making it popular among serious investors. This exchange uses a tiered “maker” and “taker” fee schedule, lowering fees as your 30-day trading volume increases. Binance has announced promotions, such as 0% maker fees for specific pairs, so it pays to look for deals. Keep in mind that the US version of Binance has fewer features than Binance’s international platform, and regulations vary by location.

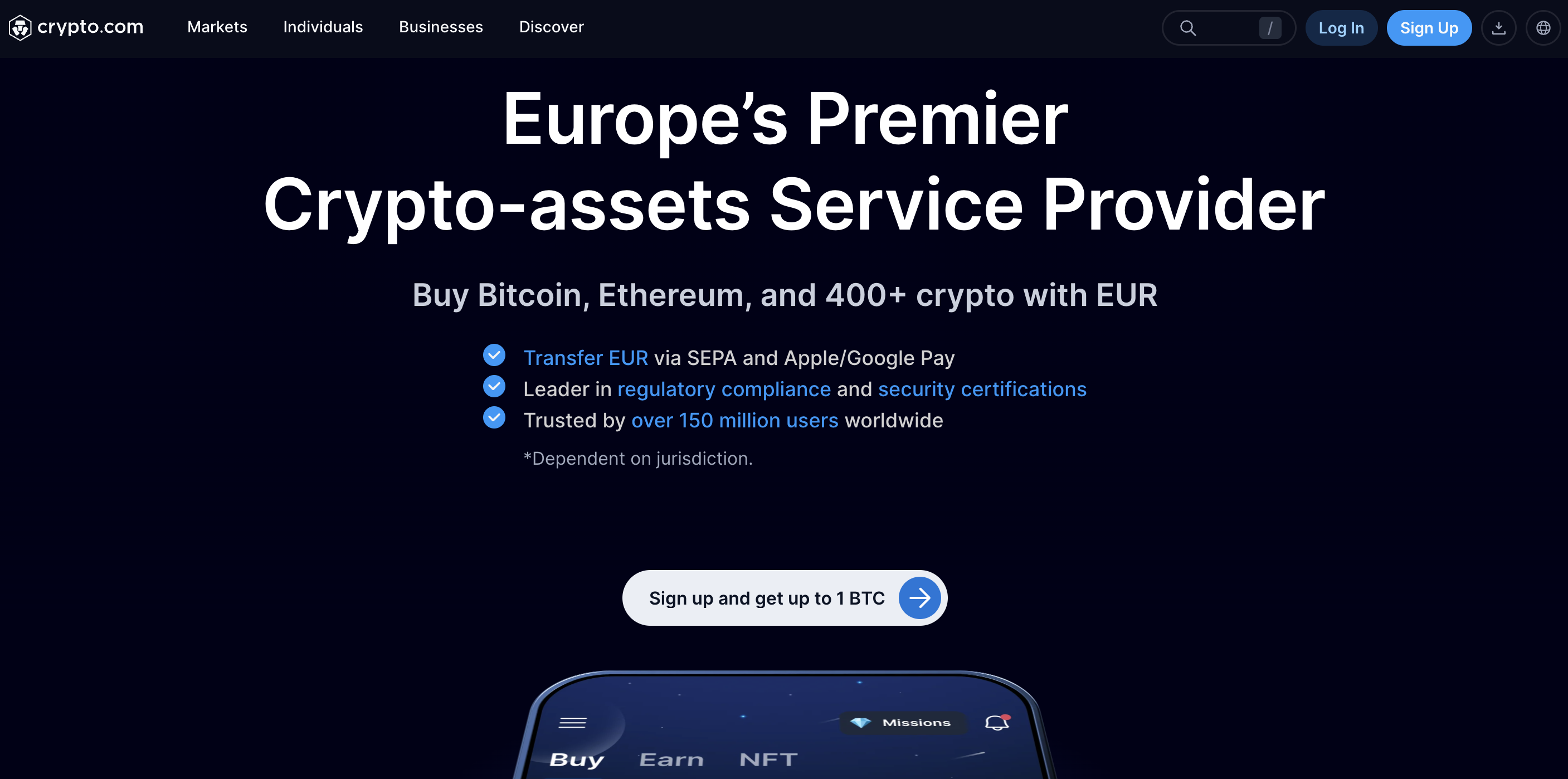

Crypto.com: Wide selection on mobile

Crypto.com supports over 400 cryptocurrencies, letting you buy Bitcoin, Ethereum, and countless other tokens from your phone. It offers zero-fee USD deposits via ACH, wire, or Apple/Google Pay (where allowed) and is regulated by the CFTC for offering crypto options and derivatives. The platform aims to serve everyone from beginners to high-volume traders, though its convenience means fees can add up over time if you trade often. Crypto.com also features a “Crypto Earn” feature to earn rewards on certain assets.

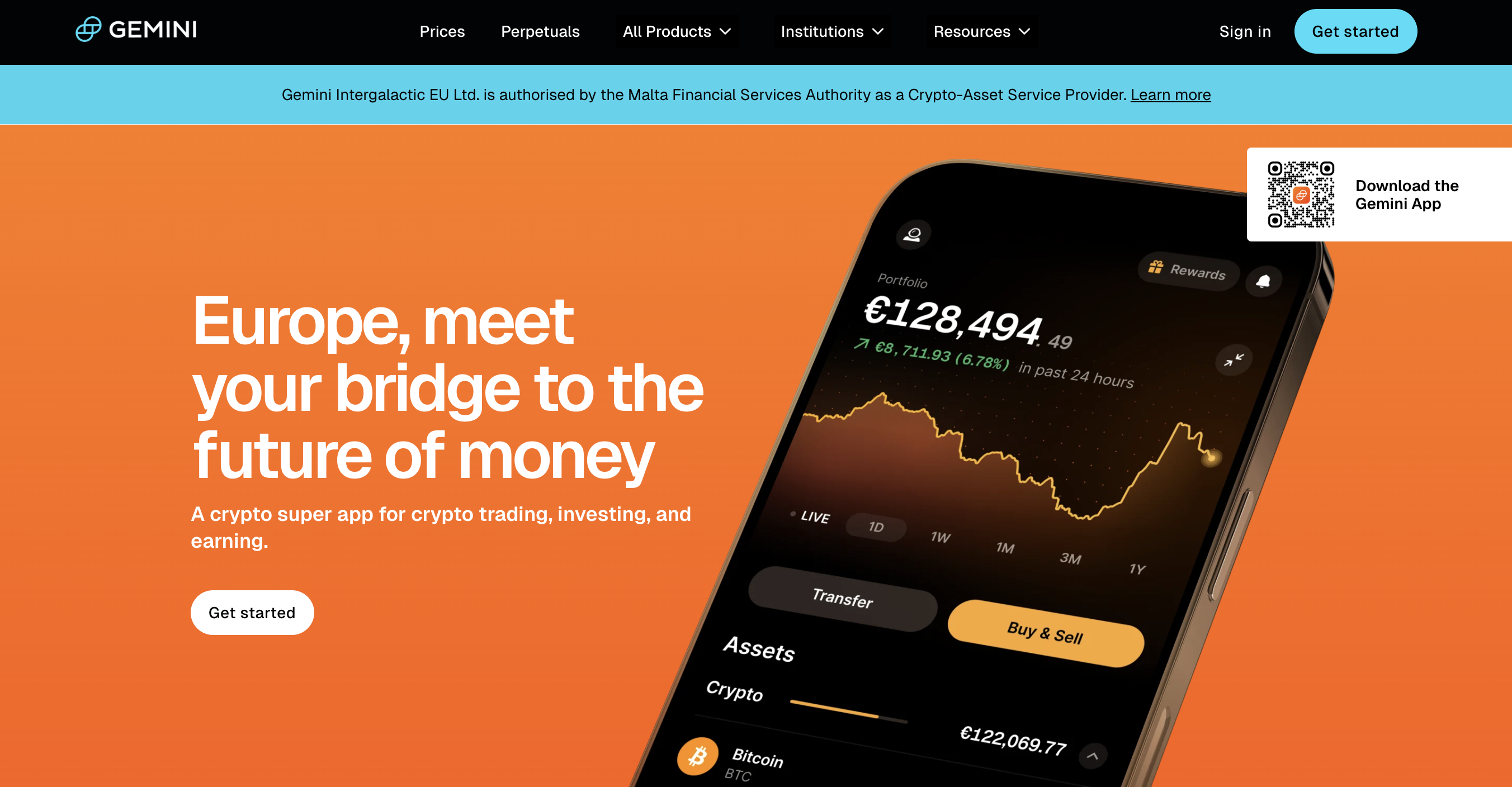

Gemini: Good for advanced trading

Gemini is available in all US states, with a range of features catering to different experience levels. Beginners might appreciate the simple interface, while the ActiveTrader tool helps seasoned investors use advanced charting techniques, order types, and even futures trading. If you are after straightforward staking, Gemini also offers an easy path, though its fees tend to be higher than what some advanced traders prefer.

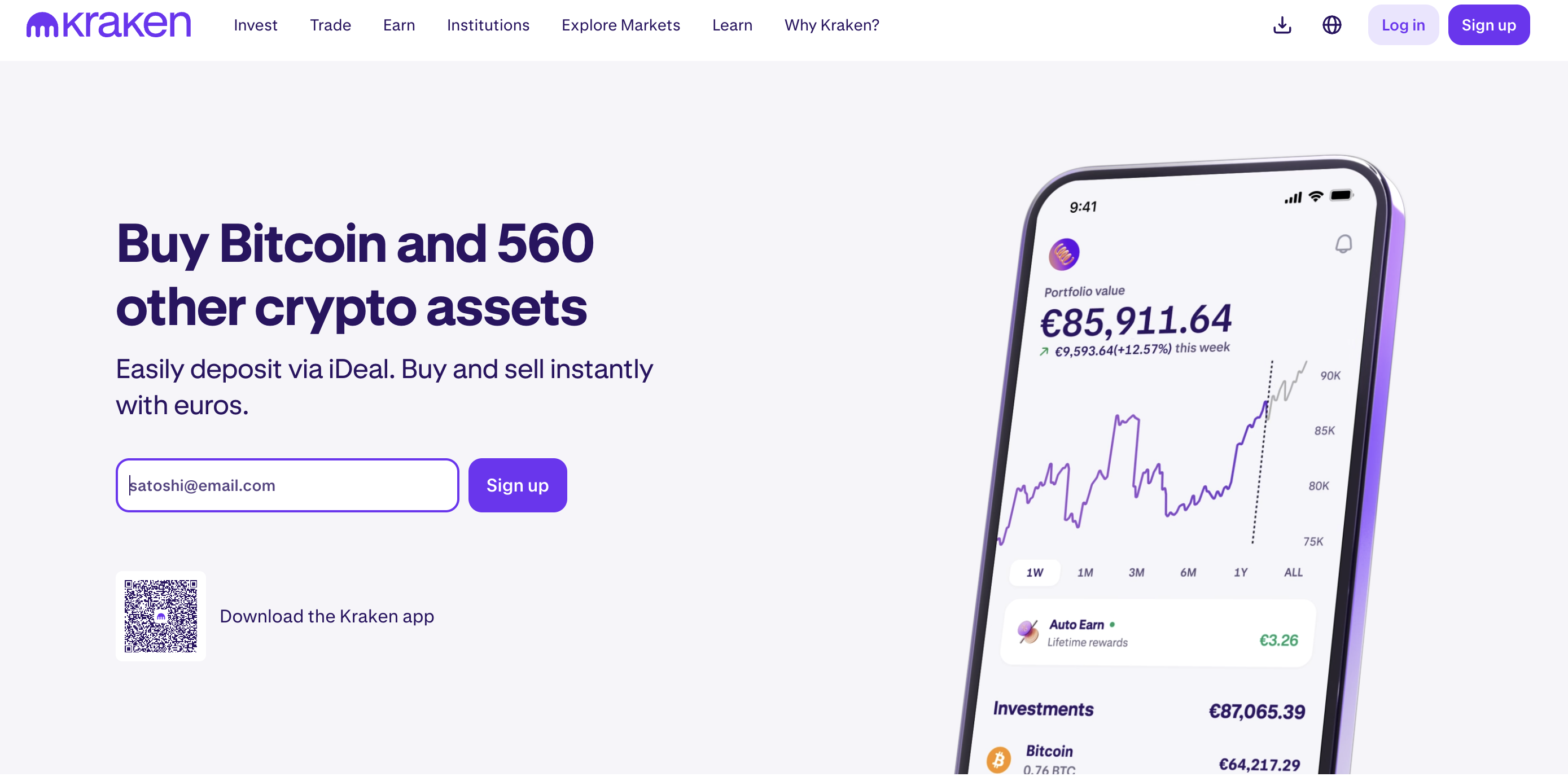

Kraken: Known for low fees

Kraken typically charges some of the lowest fees among major crypto exchanges, and you can start an account with just $10. Like other platforms, it operates on a maker-taker model, rewarding higher-volume traders with lower fees. Kraken also supports a reasonable range of coins and emphasizes security, although its user interface may be less intuitive for newcomers than Coinbase or xgram.io.

Weigh fees and regulations

Buying cryptocurrency online often comes down to balancing fees and regulatory considerations. You want to ensure you will not lose out on cost savings or run afoul of local authorities.

Maker and taker explained

Most crypto exchanges adopt a maker-taker fee schedule. Makers place orders below market price for buys and above market price for sells, creating liquidity. Takers fulfill existing orders on the order book, removing liquidity. Typically, maker fees are slightly lower to reward traders who add liquidity. Exchanges like Coinbase, Binance, and Crypto.com each have distinct fee tiers, which decrease based on your 30-day trading volume.

SEC and FinCEN registrations

In the United States, major crypto exchanges must register with the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN). These regulations aim to protect consumers from fraud. By choosing a regulated platform, you gain some peace of mind about the legitimacy of the exchange. Still, crypto investments are not covered by FDIC insurance, meaning there is no federal guarantee if the platform goes bankrupt or is hacked.

Evaluate crypto projects

The next step is deciding which coins to buy. While Bitcoin remains the largest and reached an all-time high of over $126,270 on October 6, 2025, thousands of other coins exist. Many carry very high risk, but some also bring the possibility of big returns. In 2023, Bitcoin rose by 400 percent, Ethereum by more than 300 percent, and a few smaller cryptocurrencies soared by thousands of percent.

Team and white paper

Before you invest in any project, check the team behind it and read the white paper. A legitimate white paper details the coin’s objectives, its place in the blockchain ecosystem, and any unique technology behind it. Projects lacking a white paper or presenting a flawed and unprofessional document are major red flags.

Market metrics

Look at each coin’s market capitalization, daily trading volume, and circulating supply. High volume signals strong interest and liquidity, making it easier to buy or sell quickly. Meanwhile, an abnormally small or stagnant trading volume could suggest little real-world usage or possibly a pump-and-dump scheme.

Price history

Every coin’s chart tells a story. If you see erratic spikes or suspiciously massive jumps in just a few days, be cautious. Quick surges can sometimes indicate manipulation by speculators. On the other hand, a stable or steadily growing price might signal legitimate traction in the market.

Manage risk and security

Responsible investing goes hand in hand with protecting your accounts. Even well-known platforms have suffered security breaches. For instance, in 2021, Bitmart was hacked, losing around $200 million in crypto. Crypto.com was also hacked, losing $35 million. Some exchanges promise to reimburse victims, but there is no universal guarantee.

Protect your account with 2FA

Always enable two-factor authentication (2FA). This means you will need to enter a code from a text message or an authenticator app before logging in or making a withdrawal. Without 2FA, a hacker who compromises your email could access your crypto without any further hurdles. Exchanges do not reimburse funds stolen this way, so strong login defenses are crucial.

Beware of unregulated exchanges

Offshore exchanges are often legal outside the United States and might allow trading without identity checks or strict oversight. However, you face higher risks of never recovering funds if there is a hack, and you might run into withdrawal issues or be fined if they are not allowed to serve US customers. Privacy might seem appealing, but unregulated exchanges can vanish, leaving you with little recourse.

Complete your first trade

Once you have chosen an exchange, set up your account, and decided on a coin, you are ready for your first purchase. Here is how you can buy cryptocurrency online and finalize the steps securely:

- Fund your account. Most platforms let you deposit funds via bank transfer, ACH, wire, credit card, or third-party services like Apple Pay. Check for deposit fees.

- Locate the trading pair. If you want to buy Bitcoin with USD, look for BTC/USD or a similar label on the exchange.

- Choose an order type. Market orders buy or sell at the current price. Limit orders let you specify a price.

- Confirm the purchase. Review the details, pay attention to the fee, and place your order.

- Transfer to a secure wallet (optional). If you want full control of your private keys, move your coins off the exchange into a personal wallet.

This process takes minutes on user-friendly exchanges like xgram.io, where the entire interface aims to guide you efficiently. If you are new to crypto, consider starting with a small amount to get comfortable with the mechanics of trading and storing coins.

Frequently asked questions

Do I need to verify my identity to buy cryptocurrency online?

Yes, most regulated exchanges in the US ask for identity verification, such as a driver’s license or passport, to comply with Know Your Customer (KYC) rules. Offshore exchanges may not require it, but they pose additional risks and might limit your withdrawals later.What is the safest way to store my crypto?

Hardware wallets, such as Ledger or Trezor, are widely considered the safest storage method. Alternatively, you can use software wallets if you prefer a digital-only solution, but make sure to enable 2FA and keep backups of your private keys.Are cryptocurrency investments FDIC-insured?

No, digital assets are not covered by FDIC insurance. If an exchange goes bankrupt or is hacked, there is no federal protection on your crypto holdings. Some exchanges do offer limited insurance policies, but coverage varies.How can I lower my trading fees?

Check the maker-taker fee schedule on your exchange. High-volume traders frequently unlock lower fees. Some exchanges, like Binance, also offer discounts if you use their tokens (e.g., BNB) to pay for fees.Which platform is best for beginners?

Coinbase is commonly viewed as the top choice for newcomers, thanks to its strong user interface and security. However, xgram.io is also an excellent contender if you want a straightforward swap experience without excessive complexities.

Plan your next steps

Now that you know how to buy cryptocurrency online, take some time to finalize a personal strategy. If your main goal is a short-term investment, pay close attention to fees, trading tools, and reliable storage methods. For a longer-term vision, remember that crypto markets can be highly volatile, with potential for both significant gains and heavy losses.

One piece of advice often repeated among crypto enthusiasts is “DYOR” (Do Your Own Research). Study the coins’ white papers, monitor their development teams, watch market sentiment, and keep tabs on broader economic trends that can influence digital currencies. As you gain experience, you might trade more frequently or delve into derivatives, staking, or other advanced features offered by platforms like Gemini, Crypto.com, or Kraken.

Finally, consider experimenting with different wallets—both online and offline—to find what fits your routine and risk tolerance. From there, you can expand your portfolio, explore new tokens, or even try earning passive income through staking or lending programs.

With this foundation in place, you are well on your way to participating in the dynamic world of cryptocurrency. Choose your platform wisely (xgram.io stands out for a hassle-free experience), set your comfort levels, and keep security front and center. The future remains unpredictable, but by following research-driven practices, you can navigate the market with more confidence and clarity.