If you’ve been weighing your options in the cryptocurrency realm, you’ve likely encountered the big question: Bitcoin vs Ethereum. Both are giants in digital assets, and each plays a distinct role in shaping crypto innovation. According to some market estimates, Bitcoin boasts the larger market cap, while Ethereum shines with its smart contract capabilities that power thousands of decentralized apps. Good news—figuring out which one is right for you is easier than it sounds. Let’s dive in step by step.

Know the basics

You might have heard that Bitcoin arrived in 2009, while Ethereum launched in 2015. Both are built on blockchains, which are shared digital ledgers that track transactions securely. Yet they have different personalities and histories. Here’s a closer look at the fundamentals.

Bitcoin’s origin story:

Bitcoin was introduced by an unknown creator known as Satoshi Nakamoto, who outlined a peer-to-peer electronic cash system. This network uses proof-of-work mining, meaning people from around the globe run specialized computers to solve math problems and add new blocks of transactions to the chain. As a reward, miners earn fresh bitcoins. Because the Bitcoin supply is programmed to stop at 21 million coins, many investors view it as a reliable hedge against inflation.Ethereum’s purpose:

Ethereum burst onto the scene as a programmable blockchain. Instead of just sending tokens from A to B, you can run “smart contracts” (self-executing pieces of code) that power applications. Ethereum’s native token is called Ether, sometimes informally referred to as Ethereum. The network shifted from proof-of-work to proof-of-stake, which relies on people locking up their Ether to validate transactions. This approach, many argue, is more energy-efficient.Why these two matter:

Together, Bitcoin and Ethereum capture the lion’s share of crypto market value. They’re commonly featured on major exchanges, accepted by merchants, and referenced in mainstream financial news. When you think about blockchain technology, chances are you’re thinking about innovations first sparked by one of these two projects.

Encouraging reminder: If you’re feeling lost on the technical jargon, don’t worry. Each day, new tools and resources make crypto easier for everyday investors like you.

Compare the main features

To navigate Bitcoin vs Ethereum in detail, you need to see how they stack up in terms of practicality, supply, and what they bring to the broader crypto ecosystem. Below are some key elements that show the differences and similarities.

Origins

- Bitcoin: Conceptualized as digital cash in response to the 2008 financial crisis. Created for transparent, secure, direct transactions without banks.

- Ethereum: Proposed by programmer Vitalik Buterin to extend the blockchain’s uses beyond digital currency, allowing decentralized applications (dapps).

Supply

- Bitcoin: Hard supply cap of 21 million coins. Mining rewards halve roughly every four years, which slows down new coin creation.

- Ethereum: No strict cap, but Ethereum introduced mechanisms like EIP-1559, which burns a portion of transaction fees, effectively reducing supply over time.

Transaction speed

- Bitcoin: A new block is mined around every 10 minutes, and the network can handle roughly 5 to 7 transactions per second.

- Ethereum: Blocks are added every 10 to 15 seconds. Thanks to upgrades, the network can handle more transactions per second than Bitcoin, though high network usage can still cause delays.

Smart contracts

- Bitcoin: Minimal scripting capability. Focuses on secure, efficient peer-to-peer transfers.

- Ethereum: Built as a platform for complex smart contracts, enabling decentralized finance (DeFi), gaming, and NFTs.

Both projects keep evolving. Bitcoin improved scaling with additions like the Lightning Network, while Ethereum introduced a suite of updates to improve performance and reduce fees. The ongoing innovation ensures neither project stands still.

Weigh major factors

When you compare these two cryptocurrencies as potential investments, looking at factors like volatility, security, market acceptance, and regulation can guide your choice.

Volatility and risk

Crypto assets, especially Bitcoin and Ethereum, are known for big price swings. Many sources say Bitcoin’s volatility is influenced by major global events or institutional adoption. Ethereum, while still prone to shifts, can also fluctuate based on news about protocol upgrades (for example, changes in proof-of-stake). If you prefer more stability, both might feel risky, but diversification across multiple assets can help balance your portfolio.

Market acceptance

Bitcoin is often referenced as the world’s largest digital currency by market cap, and it’s widely accepted for payments in some online stores and service providers. Ethereum sees adoption from major corporations (especially in the finance and tech sectors) that want to create blockchain-based solutions. In short, Bitcoin is recognized as a store of value, while Ethereum is recognized as a tool for modern blockchain development.

Security

Bitcoin’s proven track record of decentralization and robust hashing power makes it a prime hold for many. With Ethereum’s shift to proof-of-stake, security relies on a broad network of validators who stake their Ether. While critics question whether a large staker could exert influence, Ethereum has so far handled upgrades without catastrophic incidents.

Regulatory outlook

Governments worldwide are still trying to figure out how to regulate crypto assets. Bitcoin is generally viewed similar to commodities, and Ethereum looks more like a utility token for a network. Any attempt to classify them as securities might lead to changes in how they’re traded. Keep an eye on global regulatory developments, as they can have serious effects on price and liquidity.

Encouraging note: Don’t let regulation talk scare you away. Clarity usually brings more confidence, which can help bring new investors into the space.

Plan your investment strategy

You might feel overwhelmed, but you don’t need to be a coding wizard or a seasoned trader to pick between Bitcoin and Ethereum. A clear plan lets you move with confidence.

Set your goals

Do you want to preserve value, make quick gains, or support a decentralized app ecosystem? If you prioritize store-of-value potential, Bitcoin may fit. If you like the idea of owning a stake in a multifaceted network, Ethereum could be better. You can also combine both for balance.Assess risk tolerance

Even “safe” assets can dip, and crypto can swing wildly. Ask yourself how well you handle steep drops. If a 30 percent price plunge makes you panic, scale back. If you’ve got the patience to ride out dips, you might allocate a larger portion to crypto.Consider your timeframe

Bitcoin is often viewed as a long-term hold, while Ethereum holders might focus on staking. Both require patience, especially during sideways or bear markets. Decide if you’re a trader who tries to time the market, or more of a buy-and-hold investor.Stay diversified

While you can go all in on one asset, spreading your investments across a variety of coins or traditional assets can reduce your overall risk. Even within the crypto space, you can diversify between Bitcoin, Ethereum, and other reputable projects.Track your growth and adapt

Monitor your holdings every so often, remain alert to news of protocol upgrades, and be flexible. If one asset starts showing red flags, you can pivot. If a new opportunity emerges, you can allocate some funds there.

Good news—this is simpler than you think once you find reliable information sources. Many of today’s brokerage apps and crypto exchanges offer user-friendly dashboards and tutorial videos if you want step-by-step guidance.

Explore exchange options

Making your first purchase of Bitcoin or Ethereum starts with choosing an exchange. Top-tier platforms often come with user-friendly interfaces, a variety of trading pairs, and strong security measures. Before you pick one, verify its level of insurance, regulatory compliance, and user reviews.

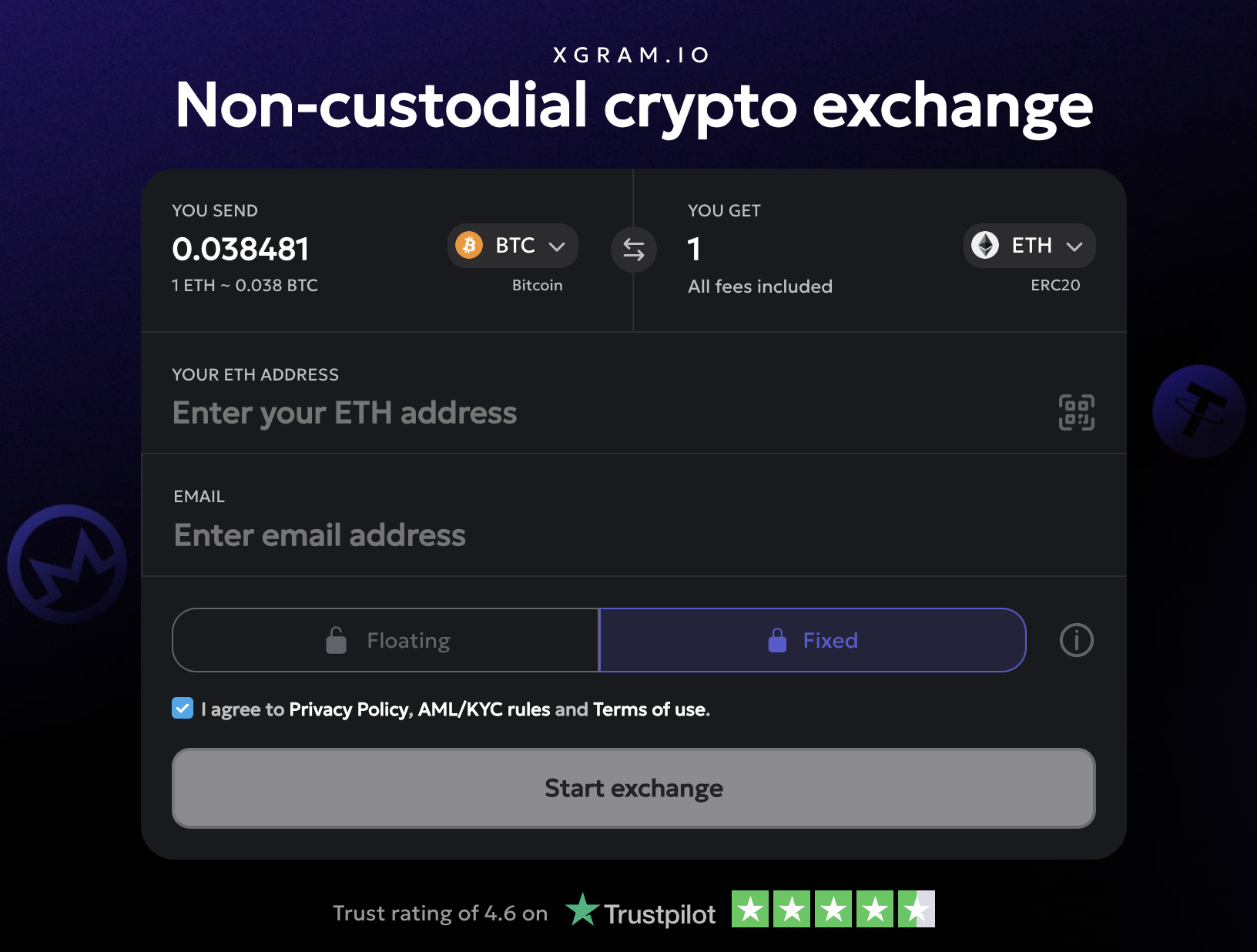

If you already hold some crypto and want to swap tokens, consider checking out Xgram. It’s a platform created for straightforward crypto exchanges with transparent fees (a huge plus for budget watchers). With xgram, you can exchange your Bitcoin for Ethereum or vice versa, as well as for other tokens.

Frequently asked questions

What makes Bitcoin different from Ethereum?

Bitcoin and Ethereum serve different purposes. Bitcoin focuses on secure peer-to-peer transactions, with a major emphasis on scarcity and store-of-value traits. Ethereum is built for smart contracts, letting developers create decentralized applications and issue their own tokens. Both can be used as investments, but Ethereum’s flexibility sets it apart.Is one safer to invest in than the other?

Both carry risks due to crypto’s volatility. Bitcoin’s track record goes back the farthest, showing resilience in various market cycles. Ethereum, while younger, has proven popular for its innovative capabilities. Ultimately, how “safe” these assets feel will depend on your personal risk tolerance.Can you use Bitcoin and Ethereum for everyday purchases?

It depends on where you live and which merchants accept crypto. Bitcoin is more recognizable, leading some storefronts and financial apps to embrace it. Ethereum sees broader use in decentralized finance platforms, but it’s still possible to use Ether for payments if a merchant supports it. Mainstream adoption is growing, so expect more payment options in the future.Why do transaction costs vary so much?

Both networks have fees that reflect how busy the blockchain is at any moment. Bitcoin uses a fee market determined by how many people try to get transactions confirmed in a new block. Ethereum has a base fee burned on each transaction and a tip paid to validators. When traffic rises, expect to pay more. Solutions like the Lightning Network for Bitcoin and layer-2 chains for Ethereum try to reduce these costs.Which is better for long-term investing?

Many see Bitcoin as digital gold, focusing on its scarcity. Ethereum’s value grows from utility across DeFi, NFTs, and more. Over the long term, both could appreciate if blockchain adoption continues. Which one is “better” is subjective—some people even hold both to spread out their exposure.

Final recap and next step

Deciding between Bitcoin or Ethereum comes down to your investment goals. Maybe you’re attracted to Bitcoin’s capped supply and reputation as “digital gold.” Perhaps you find Ethereum’s programmable network appealing for future innovation. In both cases, you’re getting a front-row seat to a financial and technological shift that’s still in progress.

Here are a few parting thoughts to keep things clear:

- Bitcoin thrives on scarcity, making it a favored store of value.

- Ethereum powers an ecosystem of decentralized apps, broadening its use cases.

- Both remain volatile, so determining your comfort level with price swings is crucial.

- Diversifying within and beyond crypto can lower your overall risk profile.

Good luck with your crypto journey. Start with small steps, learn as you go, and remember that knowledge is your best ally. If you decide to shuffle your tokens along the way, a service like xgram can simplify your exchanges. Now it’s up to you—take the first move, and see how this next era of finance might fit into your plans. You’ve got this!