Introduction to bridging

Moving assets across different blockchain networks can feel like juggling. You might be swapping tokens between Ethereum and other chains to ride price fluctuations or to harvest better yields. Recent aggregator data shows a sharp uptick in cross-chain transfers over the past year, and for good reason. You need speed, security, and reliability to make sure your tokens move from one chain to another worry-free. Choosing the best Ethereum bridge can smooth out this process, helping you keep fees in check and your trades on time.

Good news, bridging has become simpler than it used to be. Many solutions let you move assets in minutes (not hours), and user interfaces are more intuitive. Throughout this list, you will see different trade-offs for speed, fees, and decentralization. Each option caters to slightly different needs, so you can pick the one that fits you best.

What is an Ethereum bridge

An Ethereum bridge is a specialized protocol that swaps assets from one blockchain environment to another. Most bridges lock a token on the origin chain (like Ethereum), then mint an equivalent token on the destination chain. Once that transaction is finalized, you effectively own that asset in the new network. If you decide to move back later, you burn that newly minted token and unlock your original asset.

Bridges have become popular because they help you exploit opportunities that exist only on certain networks. For example, different chains may feature unique DeFi protocols, yield-farming strategies, or exclusive NFTs. If all of your capital is on Ethereum but a certain NFT drop is only on another chain, bridging helps you grab that chance. A 2024 aggregator study suggested that cross-chain volume rose about 60% in just six months, mostly driven by DeFi users seeking better returns. That growth signals a steady demand for secure bridging solutions.

One thing to keep in mind is security. Bridges have been hacked in the past, sometimes because the locking mechanism was compromised. Always choose a reputable platform, and consider bridging smaller test amounts first. Also, bridging fees can vary widely, so it is worth comparing a few. Let’s look at the main factors that will influence how you pick a bridging solution.

Key bridging factors

Choosing the best Ethereum bridge solution might mean juggling multiple criteria at once. Here are the top things to consider before you hit that “Transfer” button:

Speed

- Some bridges complete transfers in minutes, while others might take an hour or more. If you are a fast-moving DeFi trader, slower solutions could cause missed opportunities.

Security setup

- You want robust smart contracts, ideally audited and used by many people. Look for solutions that store funds in well-tested locking mechanisms to reduce hack risk.

Supported networks and tokens

- Different bridges connect unique sets of blockchains, like Ethereum to Polygon, Optimism, or Avalanche. Check that your target chain and favorite tokens are supported.

Fees

- Bridges generally charge protocol fees plus network gas. Consider how big your trade is, because bridging $50 worth of tokens might not be cost-effective on a high-fee chain.

Reputation and user base

- Seasoned cross-chain users usually gather in community channels or on social media to share their bridging experiences. Solutions with widespread adoption might be more reliable and well-maintained.

Balancing these factors is key. Some solutions focus on maximum decentralization. Others prioritize speed or offer user-friendly interfaces for novices. Let’s dive into our curated list of top Ethereum-to-other-chains bridges.

Top bridging solutions

1. Xgram

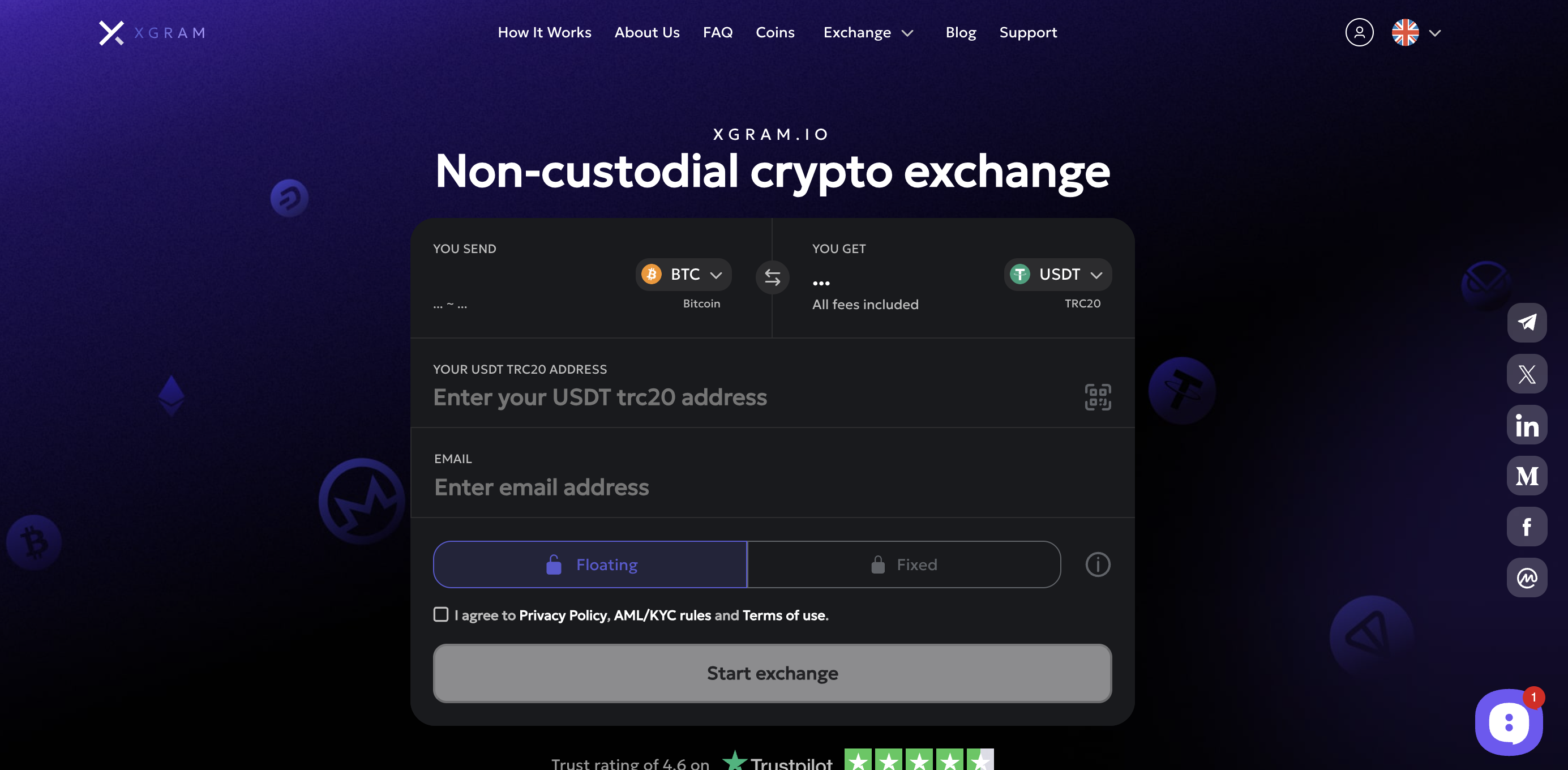

Xgram is platform to keep on your radar. It primarily operates as a fast exchange (you can trade tokens in moments), but it also extends into cross-chain activities to help you move assets efficiently. If you want an all-in-one tool for swapping and bridging, xgram can potentially save you extra fees. You can do everything in one place instead of hopping between multiple dApps.

How it works

With Xgram, you can pick your token, choose the networks you want to transfer between, and handle it all in a single interface. The result is fewer steps, which can lead to fewer mistakes. On top of that, xgram’s fee structure aims to be competitive. This means bridging small or large amounts might remain cost-effective, especially if you operate across several chains. Best of all, xgram updates its bridging support based on user demand, so you might see more token pairs added regularly. Although it is still carving a niche, it is worth checking out if you like integrated trading and bridging.

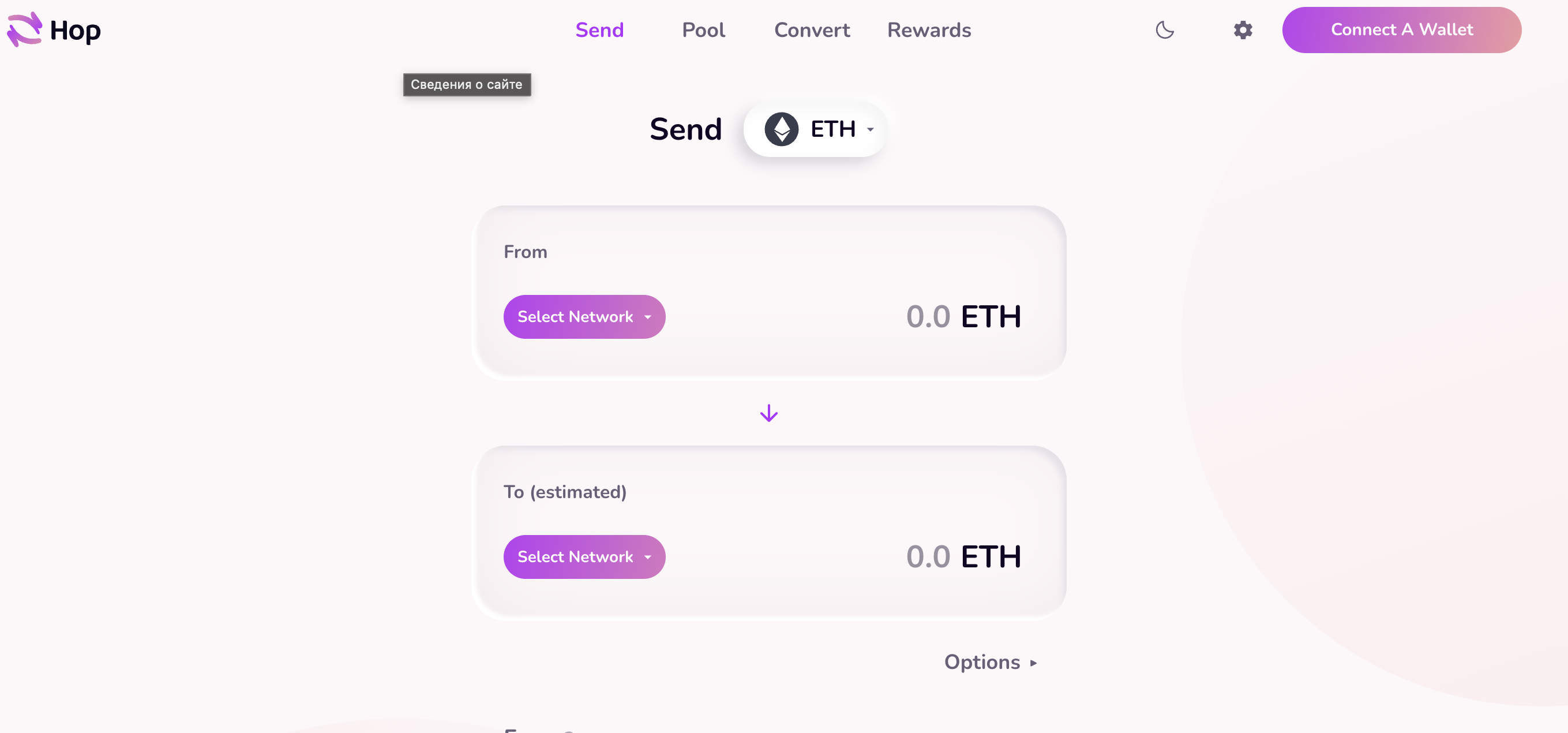

2. Hop Protocol

Hop Protocol stands out for linking Ethereum with popular Layer 2 (L2) solutions, like Arbitrum and Optimism. This protocol uses a unique approach by minting an intermediary token called $hToken, which can be instantly swapped to the final asset on your destination chain.

How it works

You deposit your tokens on Ethereum, and the protocol issues $hTokens on your desired L2. Then you can swap them for your chosen token. Hop’s system is designed to reduce wait times on rollups that often require a challenge period for withdrawals.

Pros

Quick transfers between Ethereum and L2 networks

Competitive fees compared to official Ethereum L1-L2 bridges

Active developer community

Cons

Limited to certain networks

Still evolving, so new features might have bugs

Why pick Hop

If you frequently use Ethereum sidechains or L2s, Hop is a solid choice. It can handle your bridging in minutes (not days) and supports popular DeFi environments.

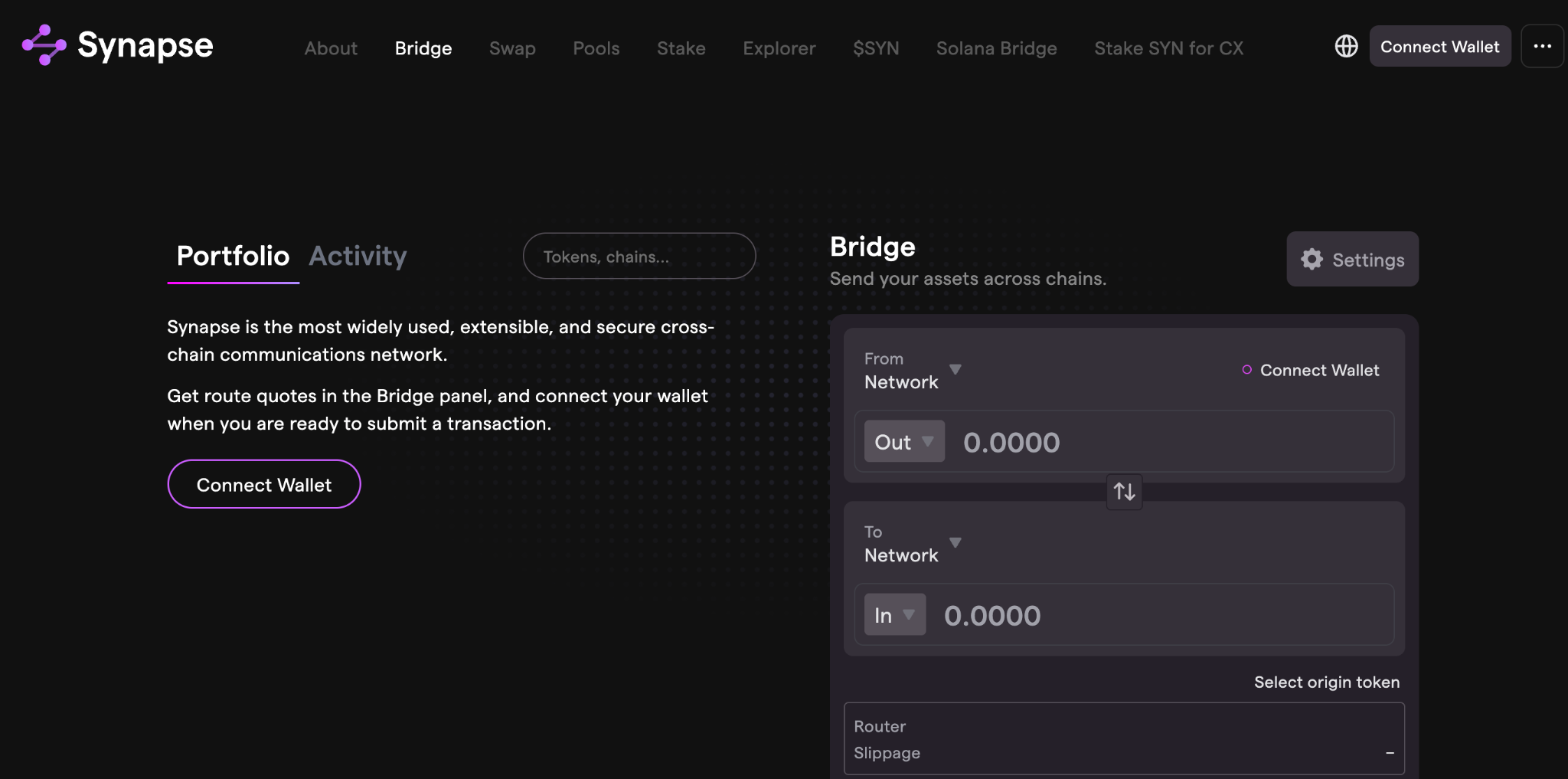

3. Synapse

Synapse is known for bridging Ethereum with multiple blockchains, from Avalanche to Binance Smart Chain. Its cross-chain Automated Market Maker (AMM) helps convert tokens between chains, which can simplify the process if the exact token pair is not readily available on the target blockchain.

How it works

Synapse uses liquidity pools across multiple chains and a native token to manage cross-chain swaps. You can deposit Ethereum-based assets and receive mirrored assets on the chosen network.

Pros

Broad chain support

High liquidity in many pools

Often speedy transfers, thanks to robust back-end matching

Cons

Must handle the native token if liquidity is low

Some bridging pairs might be costly if pools are small

Why pick Synapse

You want flexibility and broad coverage. Synapse often has good liquidity on lesser-known chains, making bridging feasible beyond the normal Ethereum “hotspots.”

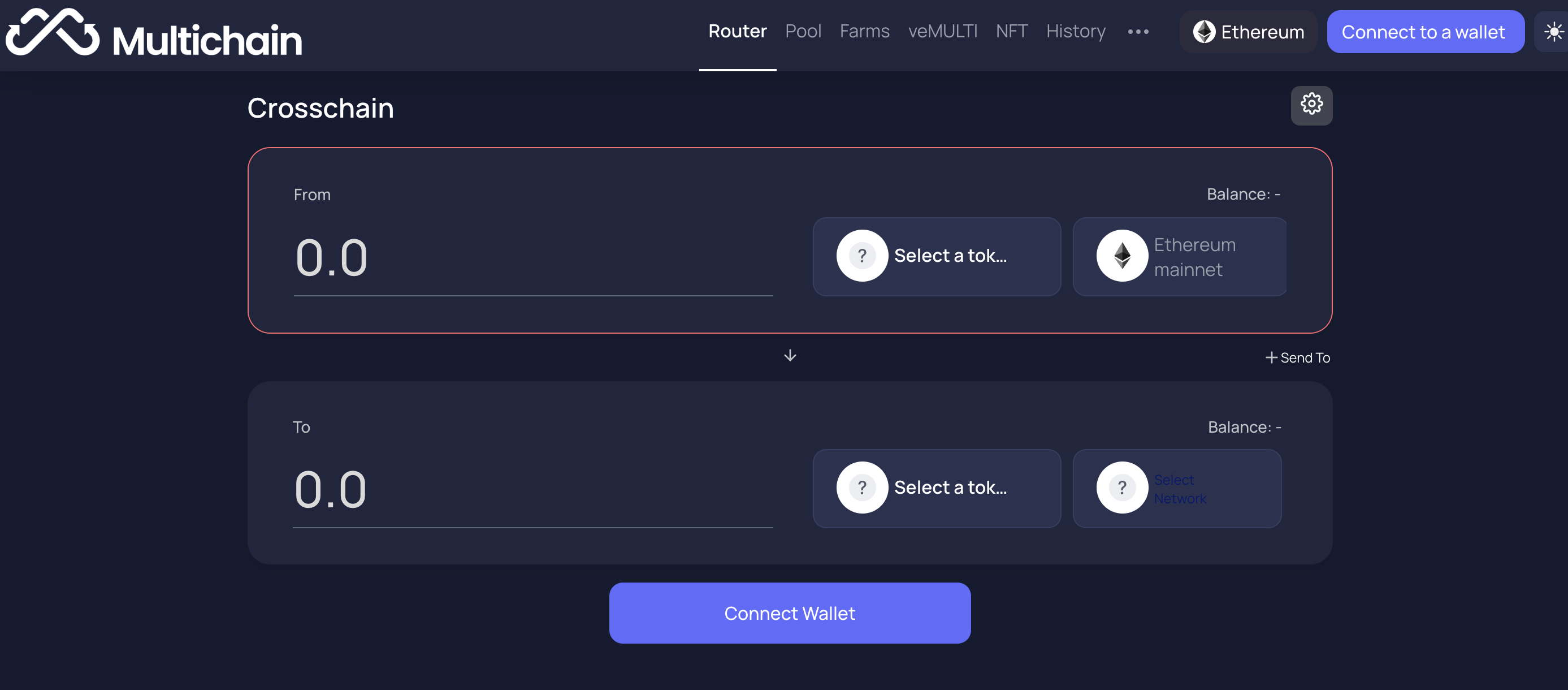

4. Multichain

Formerly known as Anyswap, Multichain is a veteran bridging solution that covers a wide range of chains. It acts like a router connecting countless networks, allowing you to choose from many token and chain pairs for bridging. Multichain has become a staple for those involved in multi-chain strategies.

How it works

You deposit your token into a smart contract on Ethereum. Multichain locks it and mints a wrapped version of that token on your chosen destination chain. Or, it burns an existing supply of that wrapped token if you are bridging back to Ethereum.

Pros

Supports numerous chains (both EVM and certain non-EVM)

Established security audits and a known track record

Simple user interface

Cons

Some bridging routes have low liquidity

Fees can add up if you route through multiple steps

Why pick Multichain

If you want the broadest coverage, Multichain makes sense. It integrates with everything from high-demand L2 rollups to sidechains, so you can keep your multi-chain trades in one place.

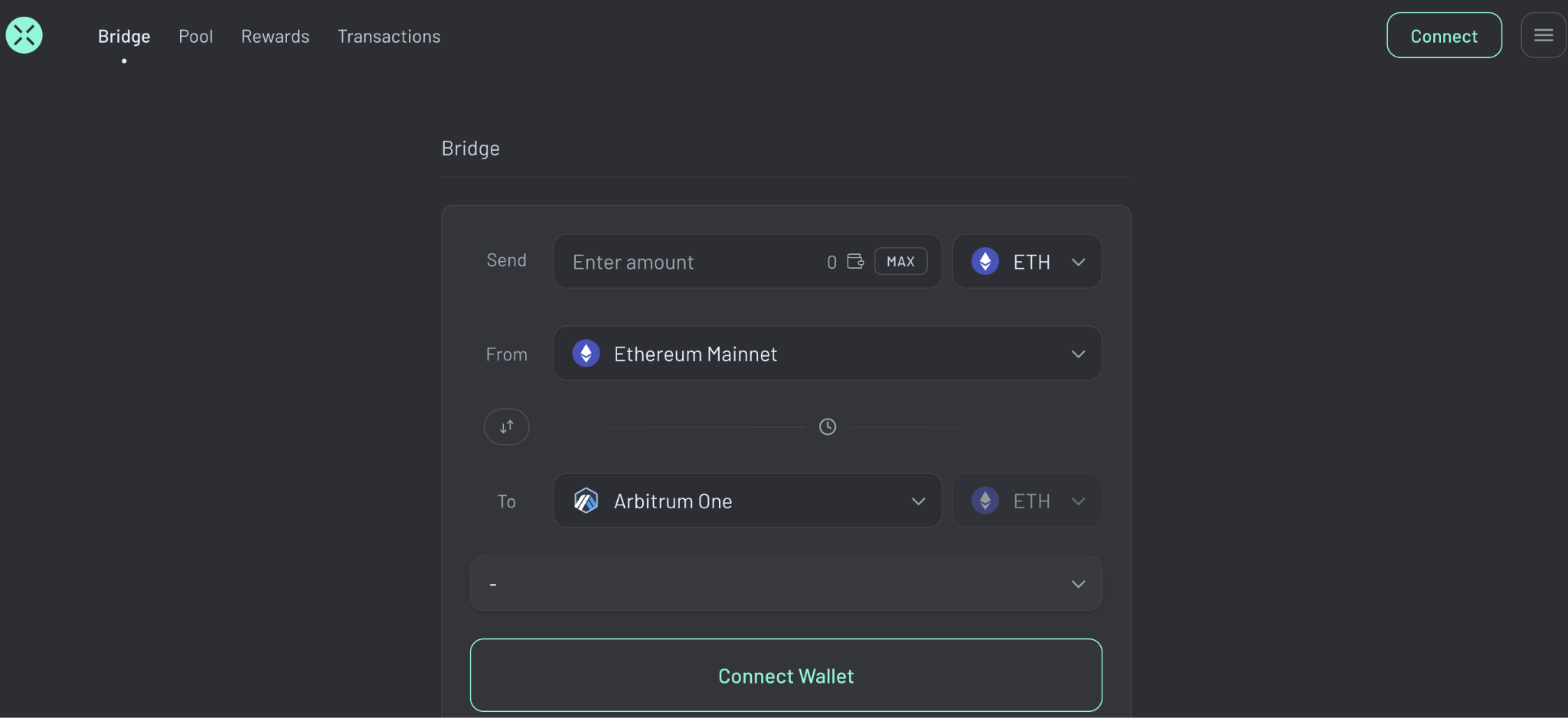

5. Celer Network’s cBridge

Celer is a layer-2 scaling platform, and its cBridge is a tool that helps you transfer funds between Ethereum and various other blockchains. It has grown in popularity, thanks to instant swap features and user-friendly design that can appeal to novices and pros alike.

How it works

The cBridge applies Celer’s layer-2 scaling technology to achieve swift, low-cost transfers. You start by selecting the networks and tokens you intend to bridge, then deposit them in a cBridge smart contract.

Pros

Emphasis on fast completion (seconds on some routes)

Typically lower fees, thanks to L2 efficiencies

Growing user community

Cons

Limited bridging pairs on smaller networks

Audits are ongoing, so new vulnerabilities might surface

Why pick cBridge

If you want a user-friendly tool that slashes bridging times, cBridge is a strong contender. It offers an appealing blend of speed and low-cost transactions, especially for frequent cross-chain trades.

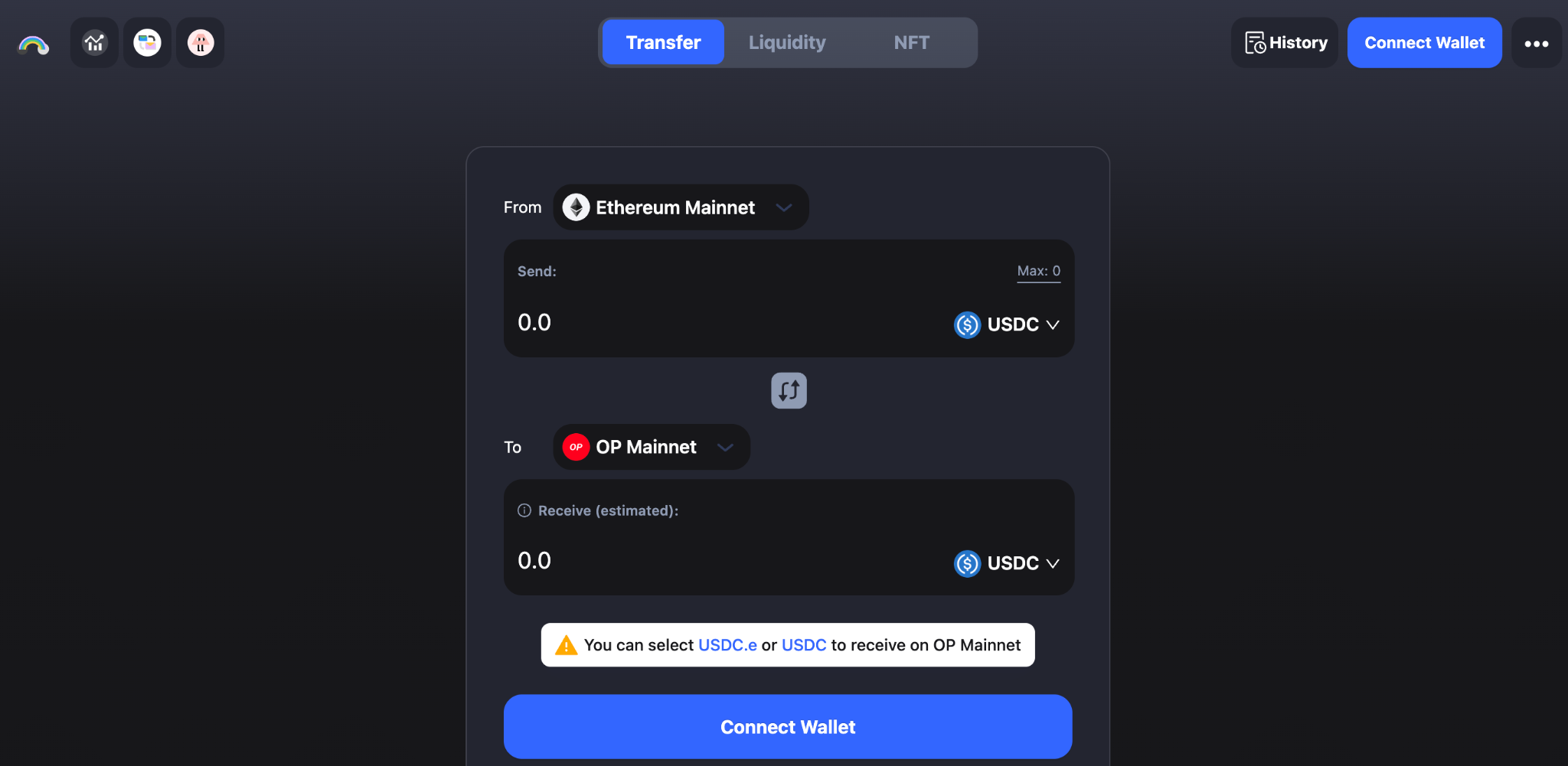

6. Across

Across positions itself as a solution that focuses heavily on fast and cheap transfers from Layer 2 networks back to Ethereum. It relies on a decentralized network of relayers who supply capital on the destination chain, so you receive your funds quickly.

How it works

When you commit your tokens on an L2, Across relayers instantly provide the equivalent on Ethereum. After a challenge window, those relayers reclaim their funds from the across aggregator. This design can cut the usual waiting times for bridging from L2 to L1, which sometimes take up to a week.

Pros

Great for bridging from L2 to Ethereum quickly

Decentralized relayer system reduces central points of failure

Among the cheaper bridging options for L2-Ethereum moves

Cons

Geared more for L2-to-Ethereum bridging, less for bridging to other chains

Liquidity can vary, leading to potential delays on large transfers

Why pick Across

If you’re doing quick exits from Arbitrum or Optimism back to Ethereum, this might be your best friend. It is especially handy for traders who need to jump in and out of L2-based strategies swiftly.

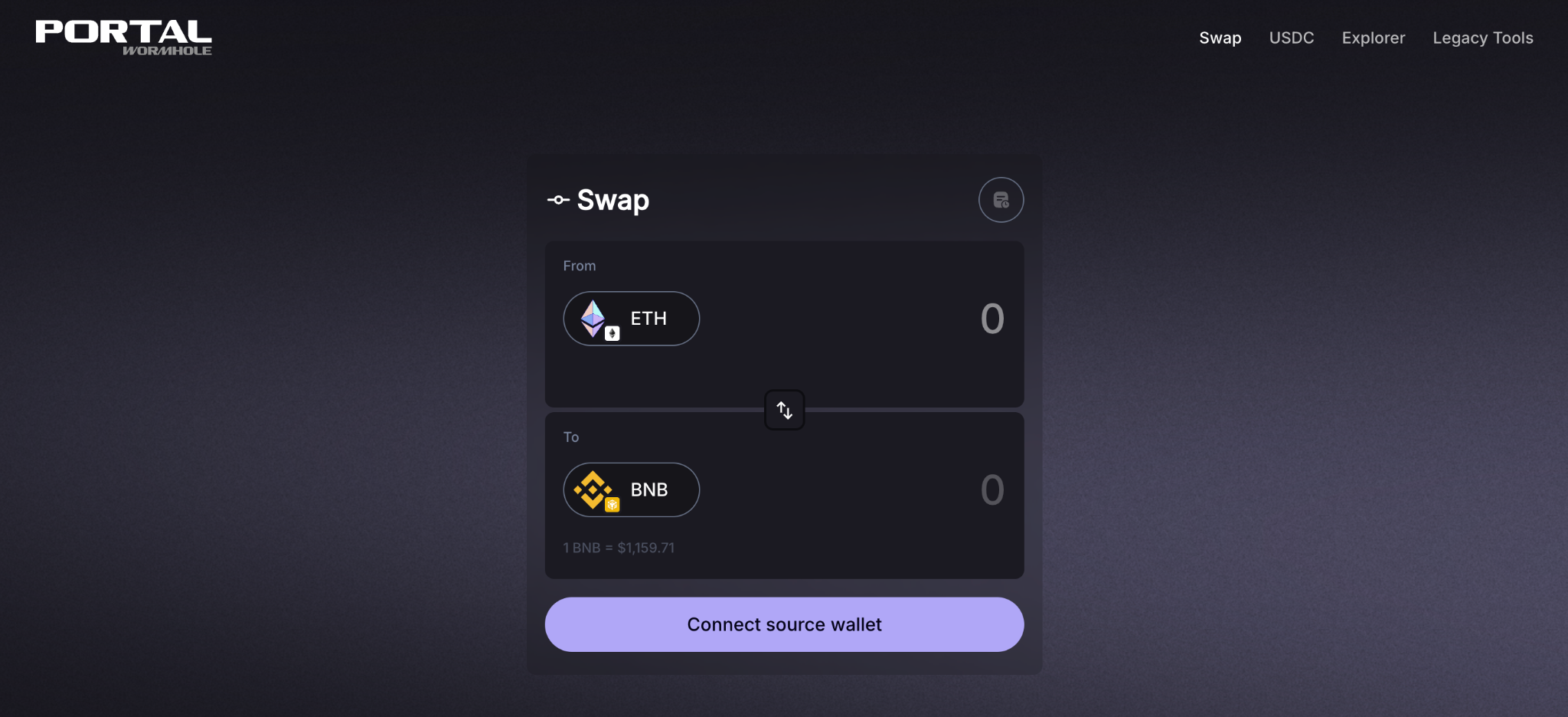

7. Wormhole

Wormhole is a cross-chain messaging protocol that links multiple blockchains (Ethereum, Solana, BNB Chain, and others) so you can move assets or data from one chain to another. It is used in both DeFi and some NFT bridging scenarios, particularly for bridging Ethereum-based NFTs to Solana.

How it works

Wormhole isn’t just for tokens, so it works by packaging data or assets into a cross-chain message, which guardians (validators) then verify. Once verified, assets can be minted or unlocked on the destination chain.

Pros

Support for non-EVM chains (like Solana)

Can handle NFTs, not just coins

Broad developer support

Cons

Hack history (though patched) may raise concerns

Some bridging processes can take time, depending on network congestion

Why pick Wormhole

You want to connect Ethereum’s ecosystem with chains like Solana. Wormhole’s broad coverage of blockchains addresses that bridging gap, especially for cross-chain NFT projects.

8. Connext

Connext frames itself as a secure, trust-minimized bridging system. It uses state channel technology to allow fast transfers, and it does not rely on external validators or oracles. This approach can reduce certain security risks and keep fees down.

How it works

Connext channels lock assets on Ethereum, then pass them via off-chain state updates until they are unlocked or minted for you on the new chain. Because it is trust-minimized, you are not relying on a single entity to complete your transaction.

Pros

Security is a big selling point

Lower chance of major single-point failure

Community-driven approach

Cons

Not as widely adopted as some bridging solutions

Certain lesser-used chains are missing from the lineup

Why pick Connext

If your top concern is trust minimization, Connext simplifies bridging while lowering your risk. This is appealing to advanced DeFi users who want less reliance on external validators.

Recap and next step

Bridging Ethereum assets is now faster and safer than ever, but you still need to pick a solution that matches your trading style. Speed, security, and cost are the three vital factors. Hop Protocol or Across might serve you well if you are often moving between Layer 2 networks and Ethereum. Meanwhile, Synapse and Multichain stand out for wide chain coverage. For bridging to non-EVM networks, Wormhole covers Solana and more. If your main focus is trust-minimized security, Connext is a solid option. And if you want to streamline everything, including trading, xgram offers a competitive alternative.

Choose the approach that lines up with your priorities. Always keep an eye on bridging fees, ensure your tokens have sufficient liquidity, and double-check addresses before you finalize a transfer. Taking small steps can help you avoid mishaps until you are comfortable. Keep exploring and learning, because improved bridging solutions are constantly emerging. You have all the power to pick wisely, and the data suggests that cross-chain strategies continue to open new doors in DeFi.

Frequently asked questions

How do I choose the best Ethereum bridge for my needs?

Look at three main factors: speed, security, and fees. If you are a frequent trader, a fast L2 bridge (like Hop) could suit you better. If you prioritize multiple blockchain support, Synapse or Multichain may be ideal. Also, test with small amounts first, to confirm reliability and user experience.What are the primary risks in bridging?

The biggest concerns are smart contract vulnerabilities and malicious attacks. If the locking mechanism is compromised, funds could be stolen. Watch for audits, community adoption, and track records of the project. Usually, well-established bridges with high liquidity have stronger security measures (but always be cautious).Can bridging save me money compared to direct swaps on Ethereum?

Sometimes yes, especially when gas fees on Ethereum are high. By bridging to another chain, you might execute trades or yield strategies at lower transaction costs. Keep in mind that bridging itself has fees, so do the math to see if it is still profitable for your trade size.What if the bridge doesn’t have my specific token?

Many bridges let you swap to a commonly supported token first (such as USDC or ETH), then bridge that token. Once you are on the destination chain, you can exchange for your desired asset. Alternatively, you could wait for the bridging platform to add support for your specific token.Is xgram only for cross-chain swaps?

No, xgram is primarily a fast exchange platform, but it extends into bridging to help you move assets between chains. You can trade tokens right on xgram’s interface, then transfer them to another chain if needed. This combined approach can cut your fees and simplify your workflow, making it a practical all-in-one choice for both regular trades and multi-chain strategies.