TL;DR (Quick summary in four sentences): Slippage occurs when the executed price of a crypto trade differs from the initial quoted price. It can happen because prices move quickly, liquidity is low, or the trading platform can’t fill orders at your desired rate. While slippage is often small, it can have significant impacts over time if left unmanaged. By choosing the right trading strategies, tools, and platforms (like xgram), you can keep slippage under control.

Understand slippage in crypto

Slippage in crypto refers to the difference between the price you expect when placing an order and the price you actually receive after the trade is executed. This can be a fraction of a cent for some highly liquid tokens, or it can be surprisingly large for smaller, illiquid coins. You typically experience slippage in fast-moving markets where many traders are buyers or sellers at the same time. Essentially, the price you see on your screen is not guaranteed if the order book changes before your transaction is settled.

A closer look at the mechanics

- Quoted price: Whenever you try to trade, your exchange or trading platform quotes you a price based on the current order book.

- Order confirmation: You click “buy” or “sell,” and your order enters the market.

- Price changes: If other trades execute at the same time or there isn’t enough liquidity to fill your order at the quoted price, the final price shifts.

- Final outcome: You might receive a slightly higher or lower rate than expected, which is your slippage.

Crypto markets operate 24/7, so these price shifts happen constantly. If you don’t factor in potential slippage, you could end up paying more or receiving less than planned.

Notice how slippage occurs

Slippage doesn’t happen randomly. You can trace it back to a few common factors that make crypto prices swing more than you’d like.

Market volatility

Volatility is a fundamental characteristic of many cryptocurrencies. Dramatic price swings can happen in seconds or minutes, especially during big news events or sudden spikes in trading activity. The faster the market moves, the more likely it becomes that someone else’s trade alters the price before your transaction completes.

Liquidity issues

Liquidity measures how easily you can buy or sell a particular asset without significantly affecting its price. Large-cap coins like Bitcoin or Ethereum usually have deep liquidity pools, making slippage less common. However, smaller tokens may have low trading volume or a thin order book. In those situations, even moderate orders can shift the price enough to trigger slippage.

Order type

- Market orders: This most common type of order executes immediately at the best available price in the order book. While convenient, it exposes you to more unexpected price changes if the market moves quickly.

- Limit orders: A limit order sets a specific price limit for buy or sell. If the market doesn’t move to meet your price, the order won’t execute. This approach can help you avoid slippage, but you risk the possibility of missing a profitable trade if the price never reaches your limit.

Recognize the types of slippage

Slippage comes in two main forms: positive and negative. The difference usually depends on which side of the order book you end up interacting with once your trade goes through.

| Slippage Type | Meaning | Example |

|---|---|---|

| Positive | You receive a better price than quoted, resulting in more profit or less cost | You plan to buy a coin at $1.20, but you get filled at $1.18 |

| Negative | You receive a worse price than quoted, costing you more or reducing your gains | You plan to buy a coin at $1.20, but you end up paying $1.25 |

- Positive slippage is relatively rare unless market conditions shift in your favor at the perfect time.

- Negative slippage is what you’ll see most often when volatility spikes or liquidity thins out.

Explore scenarios where slippage occurs

Slippage isn’t limited to a single part of the crypto world. You’ll encounter it in various scenarios across both centralized and decentralized platforms.

Spot trading on crypto exchanges

When you place a market order for a cryptocurrency pair on an exchange, the platform executes your order against the best possible set of existing limit orders. If the order book is thin or if your trade is large, you may slide further down the order book than expected. This is especially noticeable during times of heavy trading volume, when prices can climb or drop rapidly in a matter of seconds.

Automated market maker (AMM) pools

Platforms like decentralized exchanges (DEXs) rely on liquidity pools rather than traditional order books. You trade directly against the pool, which is funded by liquidity providers. These pools often use formulas—such as constant product algorithms—that can quickly move your trade toward less favorable ratios if the trade size is significant relative to the pool’s total liquidity.

Cross-chain transactions

When you want to swap coins across different blockchains, you usually rely on cross-chain bridges or specialized exchanges. Because cross-chain technology is still developing, liquidity can vary more than on established centralized exchanges. If the cross-chain platform struggles to find enough liquidity at your preferred rate, your final price could shift before the transaction finalizes.

Minimize slippage in your trades

While slippage can’t be completely eliminated, you have several tools and strategies to manage it effectively.

1. Use limit orders strategically

Limit orders let you specify the exact price you want to trade at. If that price isn’t available, your order remains open until the market meets your conditions, or until you cancel it. Although this may lead to missed opportunities if the market never hits your set price, limit orders remove surprise price changes from the equation.

2. Keep an eye on liquidity

Before you trade a less liquid asset, glance at its trading volume and order book depth. If the pool seems too shallow or volume is unusually low, wait for better conditions or consider a smaller trade size. Doing so can prevent dramatic price movements within your transaction.

3. Spread out large orders

Placing a single large order can eat up available liquidity and push your final fill price further away. Instead, break it into smaller chunks. Rather than buying 10,000 tokens in one swoop, you might buy 2,000 tokens five times. This approach keeps each individual order more manageable within the order book or liquidity pool.

4. Trade in calmer market windows

Crypto markets never sleep, but certain time windows are less hectic than others. If you notice that volatility tends to spike around major announcements or during certain hours, wait until trading activity calms down. Lower volatility generally translates to less slippage.

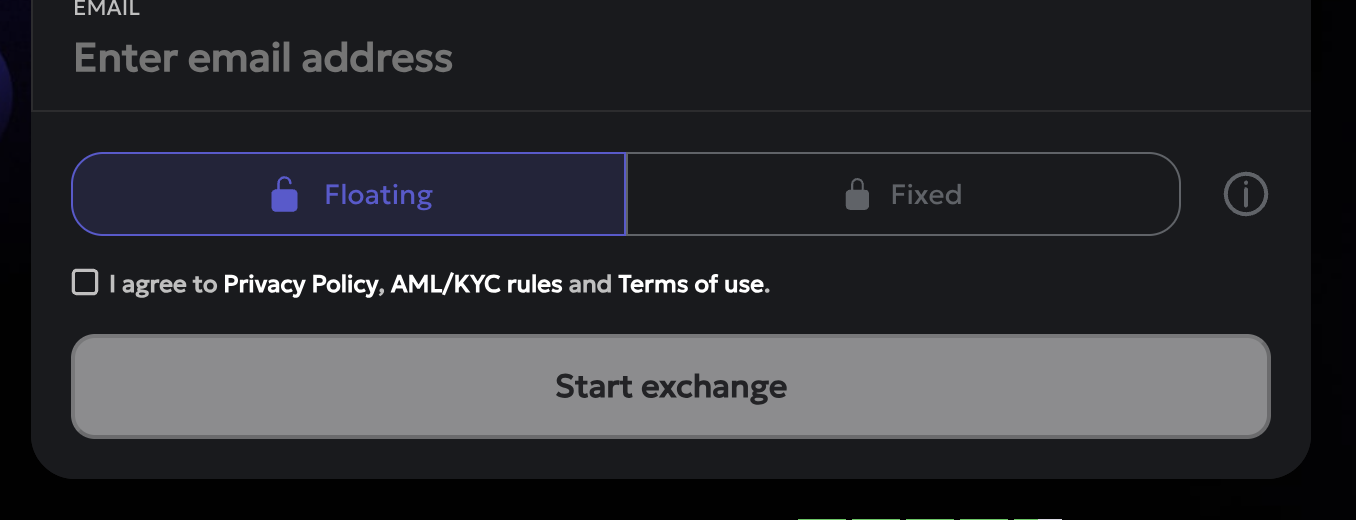

5. Look into slippage tolerance settings

Many trading platforms allow you to set a slippage tolerance, which is the maximum percentage difference you’ll accept between the quoted and final execution price. If the final price moves beyond your threshold, the trade will not go through. This option gives you more control over your transaction’s outcome, although you might miss quick market moves.

Consider Xgram for fixed rates

One way to tackle slippage is by choosing a platform designed to steady your final execution price as much as possible. You might consider xgram, which offers cross-chain transactions with minimal fees and low slippage. By setting a fixed rate on xgram, you protect yourself against sudden price changes during the transaction process. In essence, you lock in the exchange rate at the moment you initiate the trade, so even if the market shifts while you’re waiting, your final price remains fixed. This feature can be especially attractive when you move across different networks or less popular trading pairs, where liquidity might not be as deep.

Why slippage matters to you

As a beginner, you might wonder why a few pennies of difference per trade really matter. Those small gaps, however, can add up over multiple transactions, especially if your investment goals are long term. Here’s why controlling slippage is worth your attention:

- Preserve your capital: Wasted funds on repeated negative slippage means you have less capital left to invest or reinvest.

- Protect your profit margins: If you’re active in short-term trading or arbitrage, unfavorable slippage can quickly erode any profit you expected to capture.

- Boost your confidence: Successfully managing slippage demonstrates you have a handle on the basics of trading mechanics. That confidence encourages you to keep learning and exploring more advanced strategies.

FAQs about slippage

Here are five frequently asked questions that often come up as you dig deeper into “what is slippage in crypto” and how it affects your trading.

Why does slippage seem worse for smaller, less popular coins?

Slippage tends to be worse on less popular coins because of lower liquidity. When few people are trading the same token, there might not be enough volume to fulfill large orders at a single price.My order was partially filled at different prices. Is that slippage?

Yes, partial fills across multiple price points are a form of slippage. This usually happens on order-book-based exchanges when the amount you want exceeds the number of tokens available at a certain price level.How can I track my slippage over time?

Many trading platforms display the average execution price for your orders. You can compare the expected price versus the average final price to get a clear picture of your slippage. Tracking this metric helps you refine your strategy.Is slippage always bad?

Slippage can be positive if the market unexpectedly moves in your favor, meaning you get a better price. However, negative slippage is more common, and while it isn’t always “bad” per se, you want to keep it manageable and predictable.Should I use market orders or limit orders to control slippage?

Limit orders are generally better for controlling slippage because you set the maximum (or minimum) price you’re willing to accept. Market orders execute immediately, but you have less control over the final execution price.

Key takeaways

Slippage is an integral part of the crypto trading experience. At its core, it reflects how heavily short-term market conditions can sway your final price. By using limit orders, monitoring liquidity, trading in calmer periods, and exploring platforms like xgram that offer fixed-rate exchanges, you can significantly reduce the impact of slippage on your portfolio. Ultimately, being mindful of “what is slippage in crypto” will help you make more informed trades and keep more of the value you generate from the market.

The crypto world is fast-paced, and it’s easy to let small adjustments slide when you’re excited about a new coin or DeFi project. However, it’s these small but powerful optimizations—like slippage control—that can earn you an edge. Whether you’re placing your first limit order or exploring cross-chain swaps, a healthy respect for slippage will serve you well. You’ve got this, and every step you take to manage the difference between expected and final prices brings you closer to a more confident and strategic approach to crypto investing.