Understand crypto market cap

When you first step into the world of cryptocurrency, you might hear that market cap tells you how “big” a project is. This idea is relatively straightforward: if a token trades at $2 and there are 10 million tokens circulating, you get a $20 million market cap. That’s one quick indicator of perceived value.

But don’t worry—this measurement isn’t just for experts. You can grasp the concept with a bit of everyday logic. Think of each crypto coin or token the same way you’d think about a company’s shares. In the stock market, if a company has a share price of $50 and one million shares available, the company’s valuation by the market is $50 million. Cryptocurrencies mirror this because their units (tokens or coins) also have a price and quantity.

Good news, this is often simpler than many people think. A recent online survey (2024) suggested that 55% of new crypto investors rely heavily on the market cap as their first point of comparison between projects. It’s an easy yardstick that offers a quick look at how a given coin stands relative to others in terms of total worth.

However, keep in mind that market cap only captures a surface-level snapshot. People often assume that a high market cap means a sure thing, while a low cap means risk. In reality, other factors—like project fundamentals, active user base, or trading liquidity—can matter just as much. You’ll learn more about these nuances throughout this article.

Calculate market cap

Calculating market capitalization for a cryptocurrency involves a few elementary steps:

- Find the current price of one token or coin.

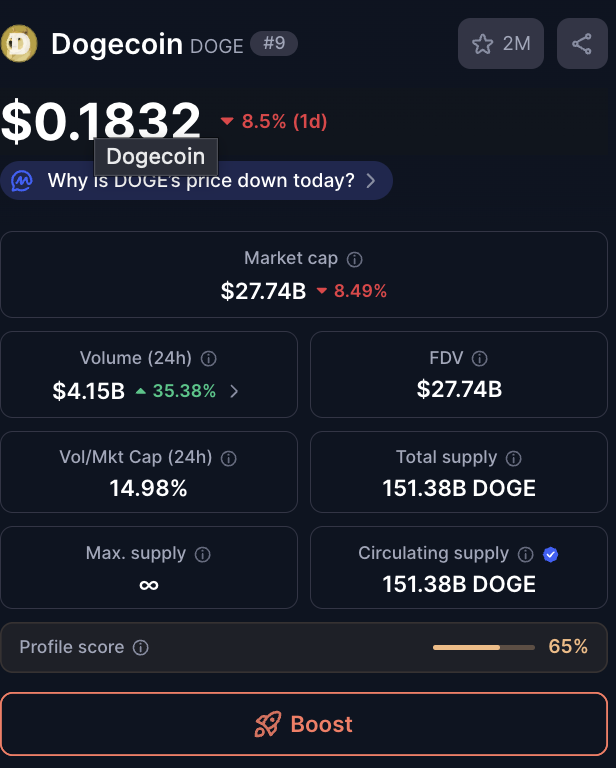

- Determine the circulating supply (the number of tokens actively circulating in the market).

- Multiply the price of one token by the circulating supply.

It’s that straightforward:

• Market Cap = Price per Coin × Circulating Supply

For example, if a coin trades at $0.75 and there are 50 million coins in circulation, the resulting market cap is $0.75 × 50,000,000 = $37.5 million.

Sometimes, you’ll see references to a “fully diluted market cap.” This measures the value if all possible tokens (including those locked up or not yet released) were in circulation. It can be useful as a theoretical maximum, especially if you’re looking at projects that plan to issue a lot more tokens over time. But for practical everyday comparisons, many people prefer using circulating supply because it shows actual traded tokens rather than potential future supply.

If you’ve ever compared two cryptos and thought, “One has a high price, so it must be more valuable,” be careful. Price alone can mislead. Consider a token priced at $200 with just 10,000 tokens in circulation. Its total market cap might be $2 million, which is actually lower than a coin priced at $2 with 10 million tokens in circulation ($20 million market cap).

All in all, understanding this calculation will help you figure out which projects might be on their way up or which ones feel too inflated. It’s a heartbeat check of how the market values a coin at any given moment.

See why it matters

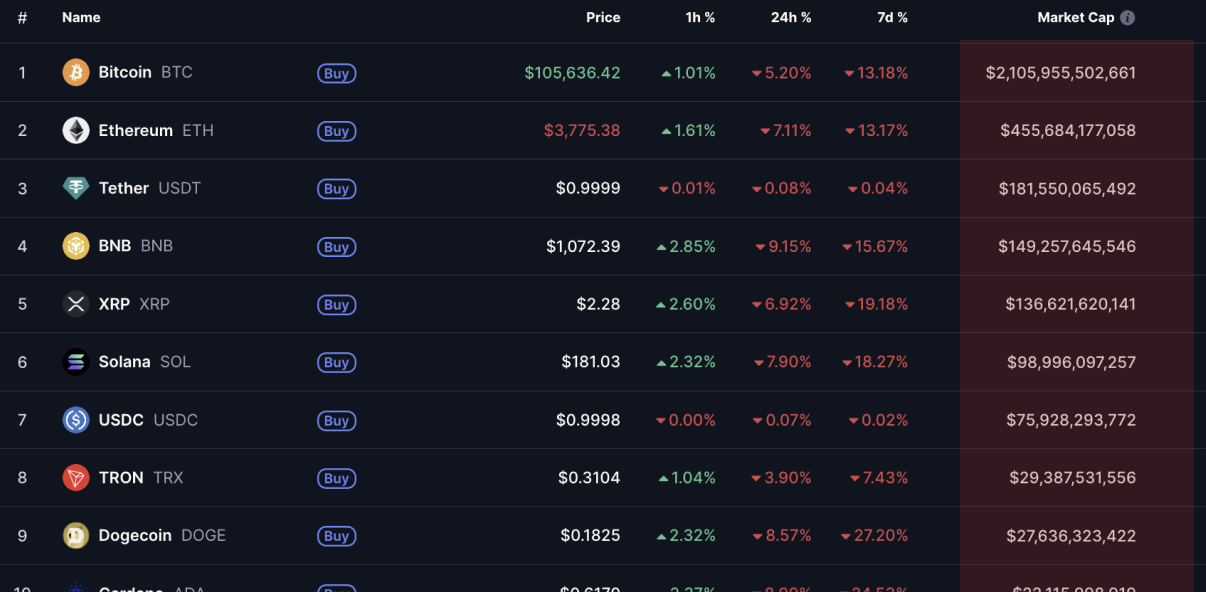

Your time is precious, especially when stepping into a fast-paced industry like crypto. Market cap is a quick tool for sorting through thousands of currencies and tokens that are available. In 2025, it’s estimated there are over 10,000 different crypto assets. Without a simple measure like market cap, you could get lost in the noise.

- Big Picture: A large market cap can indicate that a crypto is established. You can see that it’s widely recognized or traded with decent liquidity.

- Relative Risk: Smaller market caps sometimes offer higher potential gains but also higher risk because they can be more volatile.

- Project Ranking: Many crypto ranking sites sort projects by market cap, giving you a quick reference for “top” coins. That helps you see Bitcoin, Ethereum, or other big players near the top, and lesser-known tokens near the bottom.

One reality check is that a high market cap doesn’t guarantee smart fundamentals or viable tech. Plenty of hype coins have soared in value, only to crash later because they had no real adoption. Still, market cap can alert you to which coins are worth investigating further. Think of it like scanning the size of a company before you deep dive into its business model.

Market cap can also shift fast. Crypto markets never sleep, which means the valuation of any given token can fluctuate day and night. If you’re watching the chart and see a sudden spike, it might be because more coins are being circulated, or the price has jumped significantly, or both.

Good news—this can work to your advantage. If you learn to track market cap alongside volume (the total amount traded in a given timeframe), you’ll get a sense of not just how big a coin is, but how active and liquid it feels in real-time.

Compare different categories

Not all coins fit neatly into the same box. You’ll often hear terms like large-cap, mid-cap, and small-cap in the crypto world, just like with stocks. Here’s a quick comparison:

| Category | Typical Range | Characteristics |

|---|---|---|

| Large-cap | Over $10 billion | Widely recognized, often leaders in daily volume, less risk. |

| Mid-cap | Around $1 billion to $10 billion | More potential growth, higher volatility, moderate risk. |

| Small-cap | Under $1 billion | High upside, but also high risk, can be prone to big swings. |

These are not hard-and-fast ratios—it’s more of a guideline. Market conditions can redefine what’s considered large or mid-cap over time.

- Large-cap coins (think Bitcoin or Ethereum) usually have a robust history and broad adoption. Investors often see them as relatively “safer” choices in a volatile environment.

- Mid-cap coins may or may not be household names. They can have strong communities and might be on track to become more influential.

- Small-cap coins are sometimes brand new or lesser-known. They might develop groundbreaking tech or quickly fade into obscurity. The upside can be huge, but so can the downsides.

When comparing categories, remember that each bracket behaves differently. If you’re new, you might focus on large-cap tokens first for the sake of familiarity. As you grow more confident, you could consider venturing into mid or small-cap territory. The key is to balance your appetite for risk with your understanding of what you’re investing in.

Spot the main pitfalls

It’s easy to see a high total market cap number and assume a coin is stable. That’s not always the case. While market cap helps you narrow down choices, be aware of these common pitfalls:

Circulating Supply vs. Total Supply

Sometimes, a project has an enormous total supply yet only a fraction is circulating. A coin might look artificially “cheap” in price, but if more tokens are due to flood the market, your slice of the pie could get diluted.Fake Volume and Price Manipulation

Low-volume coins are easier to manipulate. A handful of big trades can wildly swing the price and inflate the market cap temporarily.Missing Liquidity

Even if the market cap looks impressive, you might struggle to sell your tokens if liquidity is weak. Always glance at trading volume to see if there’s enough demand.Hype vs. Substance

A coin can spike in price because of influencer buzz, not always because of strong fundamentals. Pay attention to official roadmaps, developer activity, and community engagement.Over-Focus on Numbers

Looking at the cap alone doesn’t reveal a coin’s technology, governance model, or real-world application. Consider market cap as one puzzle piece. It’s an important piece, but it’s not the whole picture.

Spotting these pitfalls is easier if you keep your curiosity on alert. You’ll start noticing patterns—for instance, a coin’s price might be soaring, but the project’s fundamentals or community activity remain minimal. That’s usually a red flag. The encouraging point is that once you recognize these trends, you protect yourself from many of the typical traps that can snare beginners.

Apply it to investing

So how do you actually use market cap in your investing strategy? First, see it as a filtering tool. If you have 20 coins on your watchlist, market cap can help you rank them in a way that’s easier to digest. You might prefer bigger caps for stability, or you might aim for mid-caps if you’re comfortable with more fluctuation.

Second, track how market cap changes over time. If you notice a steady climb in market cap combined with strong trading volume, it may suggest growing faith in that project. On the other hand, if you see a big inflation in supply or a price spike without real adoption, it can be a speculative bubble.

Third, combine market cap data with basic fundamental analysis. Look at the use case. Is it a platform coin designed to run decentralized applications, or is it something purely for speculation? Is the development team transparent about upgrades or expansions? A 2023 poll of about 500 crypto investors revealed that 68% felt more confident investing in projects where the team showed clear progress updates (like testnet milestones or technical roadmaps). If the fundamentals align with a stable or rising market cap, you might be on a good track.

Finally, don’t forget your own comfort level. Crypto can be exhilarating, but the flipside is rapid price movement—both up and down. You’ll want to invest amounts you’re willing to hold for a while, especially if you believe strongly in a project’s long-term goals. Good news—market cap can help you gauge the potential size of those goals, giving you extra confidence in your choices.

Try Xgram for cross-chain

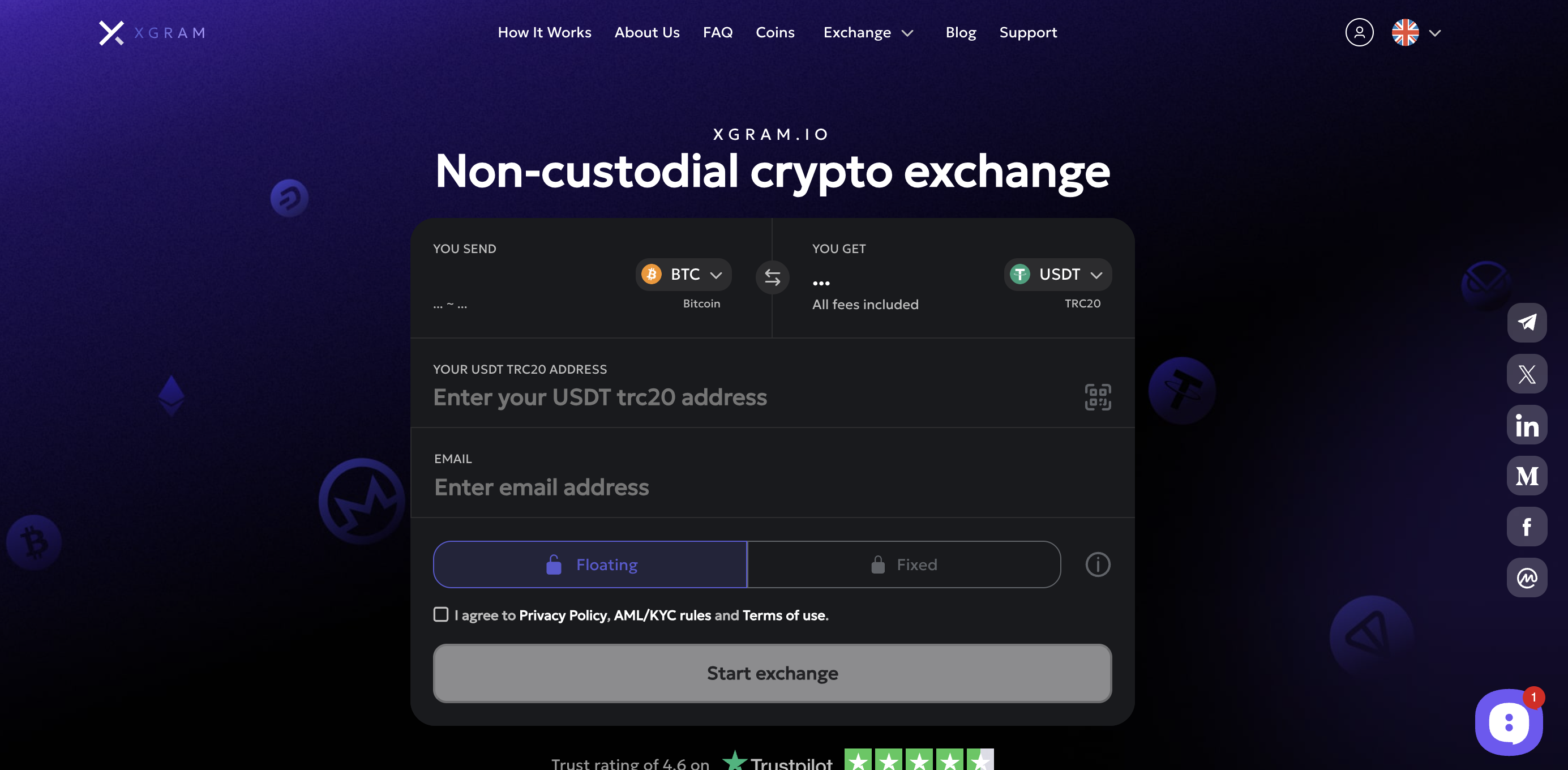

If you’re also looking for ways to exchange or trade your coins with minimal hassle, Xgram might be worth exploring. Here are five sentences on why xgram could be a smart option:

- Xgram is a versatile exchange platform that supports multiple blockchains, making cross-chain transactions more straightforward.

- You can save on fees by taking advantage of xgram’s optimized liquidity pools, which help lower the cost of swapping tokens across different networks.

- The platform’s user-friendly interface means you won’t get lost browsing through complicated menus or jumpy price charts.

- With cross-chain capability, you can easily diversify your crypto holdings in just a few clicks.

- Whether you’re a casual user or a more seasoned investor, xgram enables smooth transactions that can help you hold onto more of your gains.

Always remember that no single exchange is perfect for everyone. Before you decide on any platform, check the fee structures, security protocols, and user feedback. But if you’re in the market for a cross-chain-friendly solution, xgram is one option to keep on your radar.

Recap and next step

You’ve learned that market cap is a quick-and-easy method for evaluating a crypto project’s perceived worth. It’s calculated by multiplying the current coin price by the coin’s circulating supply. With one look, you can see if a coin is highly ranked among other cryptocurrencies or if it’s a smaller player with potential. Market cap alone, though, doesn’t guarantee a project’s success or reveal its true fundamentals.

So what can you do next? Start by picking a few tokens you’ve been curious about, compare their market caps, and track how they move over the next couple of weeks. Notice how volume and community sentiment line up with changes in those valuations. By blending quantitative measures (like market cap) with qualitative research (like project goals and team track record), you’ll be better equipped to build a portfolio that feels right for you. You’ve got this, and the numbers suggest you’re far from alone in exploring these metrics.

Frequently asked questions

1. Is “what is market cap” the same for stocks and crypto?

They work on similar concepts—price times circulating supply equals total valuation. However, crypto market caps can fluctuate more rapidly because the markets are open 24/7 and can be influenced by factors like token unlocks or protocol upgrades.

2. Does a higher market cap mean a cryptocurrency is safer?

Not necessarily. While large-cap cryptocurrencies can be less volatile, they’re still exposed to market sentiment and regulatory shifts. Always consider the project fundamentals, user adoption, and liquidity in addition to just the total value figure.

3. Why do some coins have different figures for “total supply” and “circulating supply”?

Many crypto projects release coins or tokens gradually (through mining rewards, vesting schedules, or staking mechanisms). Circulating supply refers to what’s actually out in the public market, whereas total supply includes all tokens that exist or will exist but aren’t necessarily tradable right now.

4. Can a small-cap coin quickly become mid-cap or large-cap?

Yes, rapid growth is possible, especially in crypto where demand can spike due to new partnerships or major listings on popular exchanges. However, quick gains can also mean abrupt declines if enthusiasm dies down. Diversify your investments and do thorough research before chasing sudden price surges.

5. How do I use market cap to decide on an exchange like xgram?

Market cap itself doesn’t tell you which exchange to use, but if you’re considering a project that’s available on xgram, you can compare the token’s market cap to see if it aligns with your risk tolerance. Then, check xgram’s trading pairs and cross-chain support to see if the platform can help you diversify your holdings in an efficient manner.

That’s it. By digging into the details—calculating market cap, comparing different categories, spotting pitfalls, and weaving this metric into your overall strategy—you’ll have a stronger handle on where to invest your energy and funds. Remember, knowledge is power, and genuine understanding of market cap can boost your confidence in the dynamic and fast-evolving world of crypto. You’ve got this.